Printable Vehicle Repayment Agreement Template

The Vehicle Repayment Agreement form plays a crucial role in the process of financing a vehicle. This document outlines the terms and conditions under which a borrower agrees to repay a loan taken out to purchase a vehicle. It typically includes essential details such as the total amount financed, the interest rate, and the repayment schedule. Additionally, the form specifies the consequences of defaulting on payments, providing clarity on what actions may be taken by the lender. Both parties must understand their rights and responsibilities as outlined in the agreement. By clearly stating the terms, the Vehicle Repayment Agreement helps to protect the interests of both the borrower and the lender, ensuring a smoother transaction and minimizing potential disputes. Understanding this form is essential for anyone entering into a vehicle financing arrangement, as it sets the groundwork for a responsible borrowing experience.

Similar forms

The Loan Agreement is a document that outlines the terms under which a borrower agrees to repay a loan. Similar to the Vehicle Repayment Agreement, it specifies the loan amount, interest rate, repayment schedule, and consequences of default. Both documents serve to protect the interests of the lender while providing clear expectations for the borrower regarding their financial obligations.

The Promissory Note is another document that shares similarities with the Vehicle Repayment Agreement. It is a written promise from the borrower to pay a specific amount to the lender under agreed-upon terms. Like the Vehicle Repayment Agreement, it includes details such as the repayment timeline and interest rates, ensuring both parties understand their responsibilities and rights.

In the context of vehicle ownership, ensuring proper documentation is crucial, especially when it comes to transactions like sales or transfers. The Arizona Motorcycle Bill of Sale form stands out as a vital tool for motorcycle transactions, serving as a reliable record of the sale that protects both the buyer and the seller. For those interested in learning more, you can find a free version of this important document here: https://motorcyclebillofsale.com/free-arizona-motorcycle-bill-of-sale/.

The Lease Agreement is comparable to the Vehicle Repayment Agreement in that it outlines the terms of use for a vehicle. While a Vehicle Repayment Agreement focuses on ownership and repayment, a Lease Agreement details rental terms, including duration, payment amounts, and conditions for returning the vehicle. Both documents aim to protect the rights of the parties involved and clarify their obligations.

The Security Agreement is another relevant document. It establishes a legal claim over collateral—in this case, the vehicle—until the debt is repaid. Like the Vehicle Repayment Agreement, it outlines the terms of the loan and the consequences if the borrower fails to meet their obligations. Both documents ensure that the lender has a means of recourse should the borrower default.

The Installment Sale Agreement also bears resemblance to the Vehicle Repayment Agreement. This document allows a buyer to purchase a vehicle by making regular payments over time, similar to how a Vehicle Repayment Agreement functions. It details the purchase price, payment schedule, and any penalties for late payments, ensuring that both the buyer and seller have a clear understanding of the transaction.

Document Overview

| Fact Name | Description |

|---|---|

| Purpose | The Vehicle Repayment Agreement form outlines the terms under which a borrower agrees to repay a loan for a vehicle. |

| Borrower Information | The form requires the borrower's personal details, including name, address, and contact information. |

| Lender Information | It includes information about the lender, such as the name and address of the financial institution or individual providing the loan. |

| Payment Terms | The agreement specifies the repayment schedule, including the amount due, frequency of payments, and total loan amount. |

| Governing Law | The form may be governed by state-specific laws, such as the Uniform Commercial Code (UCC) in the state where the agreement is executed. |

| Signatures | Both the borrower and lender must sign the form to validate the agreement and confirm their acceptance of the terms. |

More Templates:

Family Law Financial Affidavit Short Form Florida - The document is designed to facilitate transparency in financial matters during legal proceedings.

Obtaining a Georgia General Power of Attorney form is essential for anyone looking to designate someone to manage their affairs, offering peace of mind that personal and financial responsibilities are in trusted hands; you can find these forms conveniently at Georgia PDF Forms, ensuring you have the proper documentation ready for any situation where you might need assistance.

Parking Space Rental Agreement Template - Specifies the notice period required for lease termination by either party.

House Purchase Agreement - May outline the terms for any seller financing options available to the buyer.

Sample - Vehicle Repayment Agreement Form

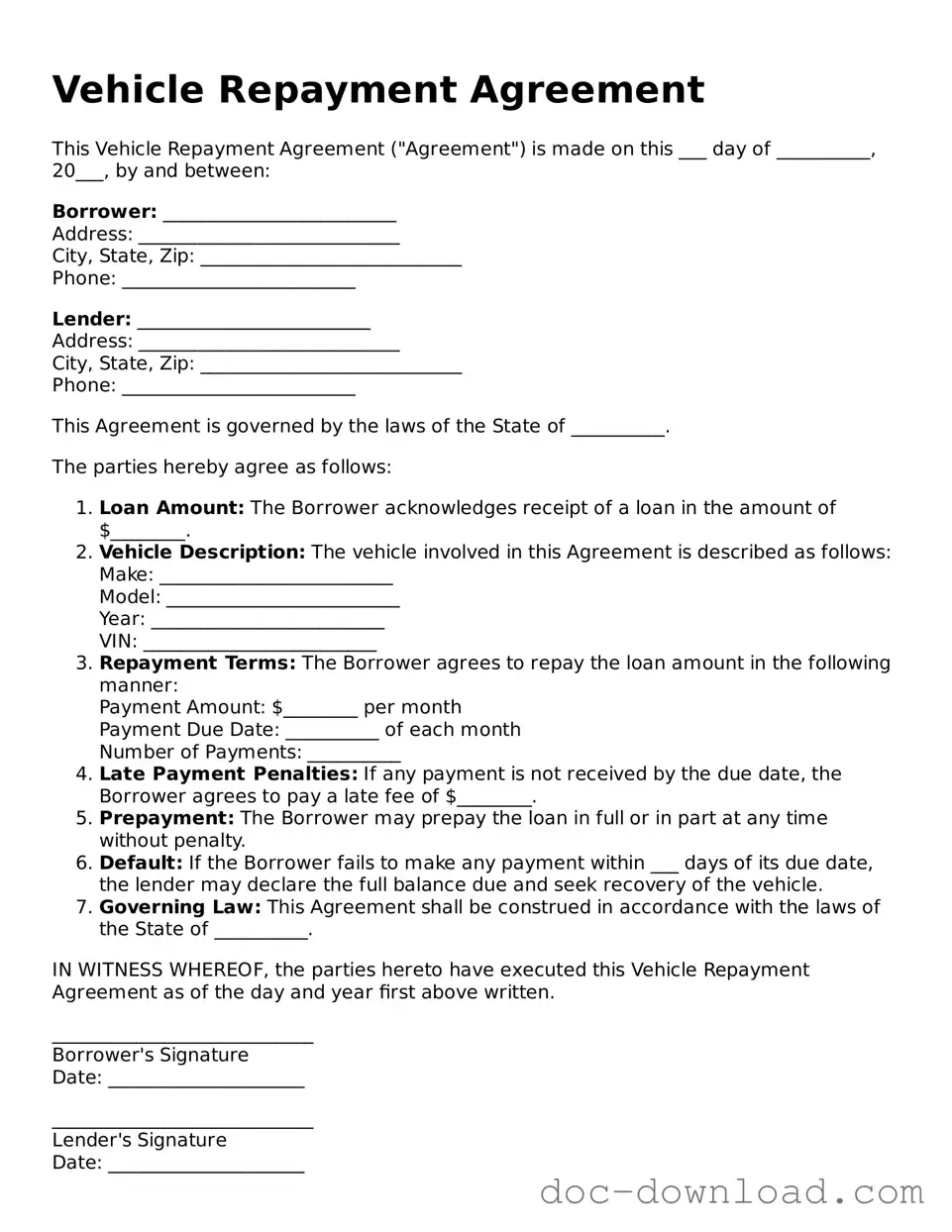

Vehicle Repayment Agreement

This Vehicle Repayment Agreement ("Agreement") is made on this ___ day of __________, 20___, by and between:

Borrower: _________________________

Address: ____________________________

City, State, Zip: ____________________________

Phone: _________________________

Lender: _________________________

Address: ____________________________

City, State, Zip: ____________________________

Phone: _________________________

This Agreement is governed by the laws of the State of __________.

The parties hereby agree as follows:

- Loan Amount: The Borrower acknowledges receipt of a loan in the amount of $________.

- Vehicle Description: The vehicle involved in this Agreement is described as follows:

Make: _________________________

Model: _________________________

Year: _________________________

VIN: _________________________ - Repayment Terms: The Borrower agrees to repay the loan amount in the following manner:

Payment Amount: $________ per month

Payment Due Date: __________ of each month

Number of Payments: __________ - Late Payment Penalties: If any payment is not received by the due date, the Borrower agrees to pay a late fee of $________.

- Prepayment: The Borrower may prepay the loan in full or in part at any time without penalty.

- Default: If the Borrower fails to make any payment within ___ days of its due date, the lender may declare the full balance due and seek recovery of the vehicle.

- Governing Law: This Agreement shall be construed in accordance with the laws of the State of __________.

IN WITNESS WHEREOF, the parties hereto have executed this Vehicle Repayment Agreement as of the day and year first above written.

____________________________

Borrower's Signature

Date: _____________________

____________________________

Lender's Signature

Date: _____________________