Printable Transfer-on-Death Deed Template

The Transfer-on-Death Deed (TODD) serves as a valuable estate planning tool that allows property owners to designate beneficiaries who will inherit real estate upon their death, bypassing the often lengthy and costly probate process. This form provides a straightforward method for transferring ownership, ensuring that the property seamlessly transitions to the intended heirs without the complications that can arise from traditional wills. Notably, the TODD remains revocable during the property owner’s lifetime, allowing them to change beneficiaries or even cancel the deed altogether if circumstances change. It is important for property owners to understand the specific requirements and limitations associated with this deed, including the necessity of proper execution and recording to ensure its validity. Additionally, while the TODD simplifies the transfer process, it does not address issues such as debts or taxes that may impact the estate, making it essential for individuals to consider their overall estate planning strategy. By utilizing the Transfer-on-Death Deed, property owners can provide clarity and peace of mind for their loved ones, facilitating a smoother transition of assets after their passing.

State-specific Guidelines for Transfer-on-Death Deed Forms

Similar forms

The Transfer-on-Death Deed (TODD) shares similarities with a Will. Both documents serve the purpose of directing how a person's assets will be distributed upon their passing. A Will requires probate, a legal process that validates the document and oversees the distribution of assets. In contrast, a TODD allows for a more streamlined transfer of property without the need for probate, making it a simpler and often quicker option for asset distribution. However, both documents necessitate careful consideration of beneficiaries and the specific assets involved.

In the realm of property transfer methods, it's crucial to understand the purpose and nuances of various legal documents, including the Quitclaim Deed, which serves as a pivotal option for transferring ownership. This form is particularly useful for those looking to convey property without warranties, often between family members or in situations where title issues need resolution. For further information and resources on this, you can visit quitclaimdeedtemplate.com/illinois-quitclaim-deed-template.

Document Overview

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows an individual to transfer real estate to a beneficiary upon their death without going through probate. |

| State-Specific Laws | In the United States, laws governing TOD Deeds vary by state. For example, California's law can be found in the California Probate Code, while Texas has its own regulations under the Texas Estates Code. |

| Revocation | The property owner can revoke the TOD Deed at any time before their death, ensuring flexibility in estate planning. |

| Beneficiary Rights | Beneficiaries do not have any rights to the property until the owner's death, which means they cannot sell or manage the property during the owner's lifetime. |

| Tax Implications | Transfer-on-Death Deeds may have implications for estate taxes, and it is advisable to consult a tax professional to understand potential impacts. |

Other Transfer-on-Death Deed Templates:

How to File a Quitclaim Deed in California - A Quitclaim Deed can resolve disputes over property ownership quickly.

How to File a Lady Bird Deed in Michigan - It provides a way to keep property within the family while still allowing the original owner to retain control during their lifetime.

When engaging in a vehicle transaction, it is crucial to utilize the Colorado Motor Vehicle Bill of Sale form, which serves as legal proof of the sale or purchase. This document must include vital details such as the price, vehicle information, and the identities of both the buyer and seller. Not only is this form required by law, but it also promotes transparency in the transaction process, making it easier to address any potential disputes. For those looking to obtain the necessary documentation, you can find a reliable source at Colorado PDF Forms.

Corrective Deed California - A Corrective Deed does not transfer ownership but rather amends the existing deed.

Sample - Transfer-on-Death Deed Form

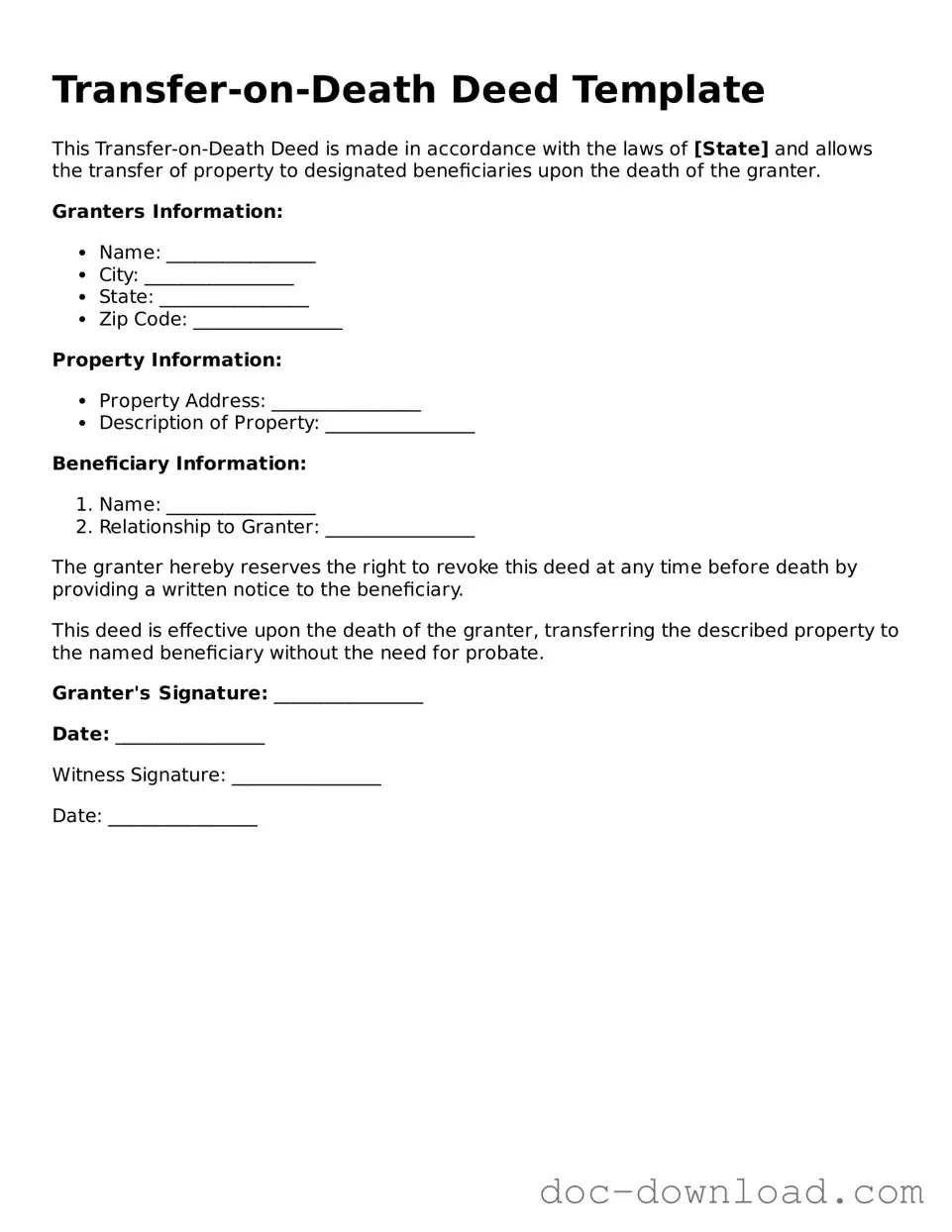

Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made in accordance with the laws of [State] and allows the transfer of property to designated beneficiaries upon the death of the granter.

Granters Information:

- Name: ________________

- City: ________________

- State: ________________

- Zip Code: ________________

Property Information:

- Property Address: ________________

- Description of Property: ________________

Beneficiary Information:

- Name: ________________

- Relationship to Granter: ________________

The granter hereby reserves the right to revoke this deed at any time before death by providing a written notice to the beneficiary.

This deed is effective upon the death of the granter, transferring the described property to the named beneficiary without the need for probate.

Granter's Signature: ________________

Date: ________________

Witness Signature: ________________

Date: ________________