Blank Transfer-on-Death Deed Document for Texas

The Texas Transfer-on-Death Deed form is a valuable tool for property owners who wish to ensure a smooth transition of their real estate assets after their passing. This form allows individuals to designate one or more beneficiaries to receive their property without the need for probate, simplifying the process for loved ones during an already challenging time. By filling out this deed, property owners can maintain control over their assets while they are alive, yet provide clear instructions for the transfer of ownership upon their death. The form requires specific information, including the names of the beneficiaries and a legal description of the property. Importantly, it must be signed and recorded with the county clerk to be effective. This deed can be revoked or changed at any time, offering flexibility to the property owner. Understanding the nuances of the Texas Transfer-on-Death Deed form can help individuals make informed decisions about their estate planning, ensuring their wishes are honored and their beneficiaries are protected.

Similar forms

The Texas Transfer-on-Death Deed (TODD) allows property owners to transfer their real estate to beneficiaries upon their death without the need for probate. This document shares similarities with a Last Will and Testament. Both instruments serve to convey a person's wishes regarding the distribution of their assets after they pass away. However, while a will typically requires probate to validate and execute, a TODD allows for a more straightforward transfer, avoiding the often lengthy and costly probate process. This can simplify matters for beneficiaries and provide a quicker path to ownership.

An Affidavit of Heirship is another document that resembles the Transfer-on-Death Deed. This affidavit is used to establish the heirs of a deceased person, particularly when there is no will in place. Like the TODD, it can help streamline the transfer of property ownership. However, the key difference lies in the process: an Affidavit of Heirship does not directly transfer property but instead serves as proof of who is entitled to inherit. This can be particularly useful in situations where a property owner dies intestate, or without a will.

In the realm of property rental, utilizing a well-structured Lease Agreement form is crucial for establishing clear parameters. Potential tenants should ensure they are familiar with the terms that govern their leases. For further guidance, you can refer to a comprehensive lease agreement document that outlines the essential elements. Discover more about this by visiting the useful lease agreement information.

The Joint Tenancy with Right of Survivorship (JTWROS) is another similar legal instrument. Under this arrangement, two or more individuals hold title to a property together, with the understanding that if one owner dies, their share automatically passes to the surviving owner(s). Like the TODD, this arrangement avoids probate, ensuring a seamless transition of ownership. However, the JTWROS requires all parties to be involved in the ownership during their lifetimes, whereas a TODD allows for a more unilateral decision by the property owner.

Finally, a Revocable Living Trust provides a comparable mechanism for transferring property upon death. This trust allows individuals to place their assets into a trust during their lifetime, with instructions for distribution upon their death. Similar to the TODD, a Revocable Living Trust helps avoid probate and can provide greater control over how assets are managed and distributed. The main distinction is that a trust requires more formal setup and management during the grantor's lifetime, while a TODD is a simpler, one-time filing that takes effect upon death.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Texas Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Texas Transfer-on-Death Deed is governed by Chapter 114 of the Texas Estates Code. |

| Eligibility | Any individual who owns real estate in Texas can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can name one or multiple beneficiaries in the deed, allowing flexibility in estate planning. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner, provided the revocation is executed properly. |

| Filing Requirements | The deed must be filed with the county clerk in the county where the property is located to be effective. |

| No Immediate Transfer | The transfer of ownership does not occur until the property owner's death, allowing them to retain full control during their lifetime. |

| Tax Implications | Beneficiaries may receive a step-up in basis for tax purposes, which can minimize capital gains taxes when they sell the property. |

Additional State-specific Transfer-on-Death Deed Forms

Transfer on Death Deed Tennessee Form - Beneficiaries named in a Transfer-on-Death Deed inherit property outside of a will, reducing potential conflicts among heirs.

To ensure clarity and understanding, it is recommended that individuals seeking to establish a Georgia General Power of Attorney form review the available options thoroughly, which can be found on resources like Georgia PDF Forms. This step helps in selecting an agent who aligns with their specific needs and circumstances, enabling effective management of legal and financial decisions.

Avoiding Probate in California - The Transfer-on-Death Deed becomes effective immediately upon signing, but property transfer occurs only after the owner's death.

Sample - Texas Transfer-on-Death Deed Form

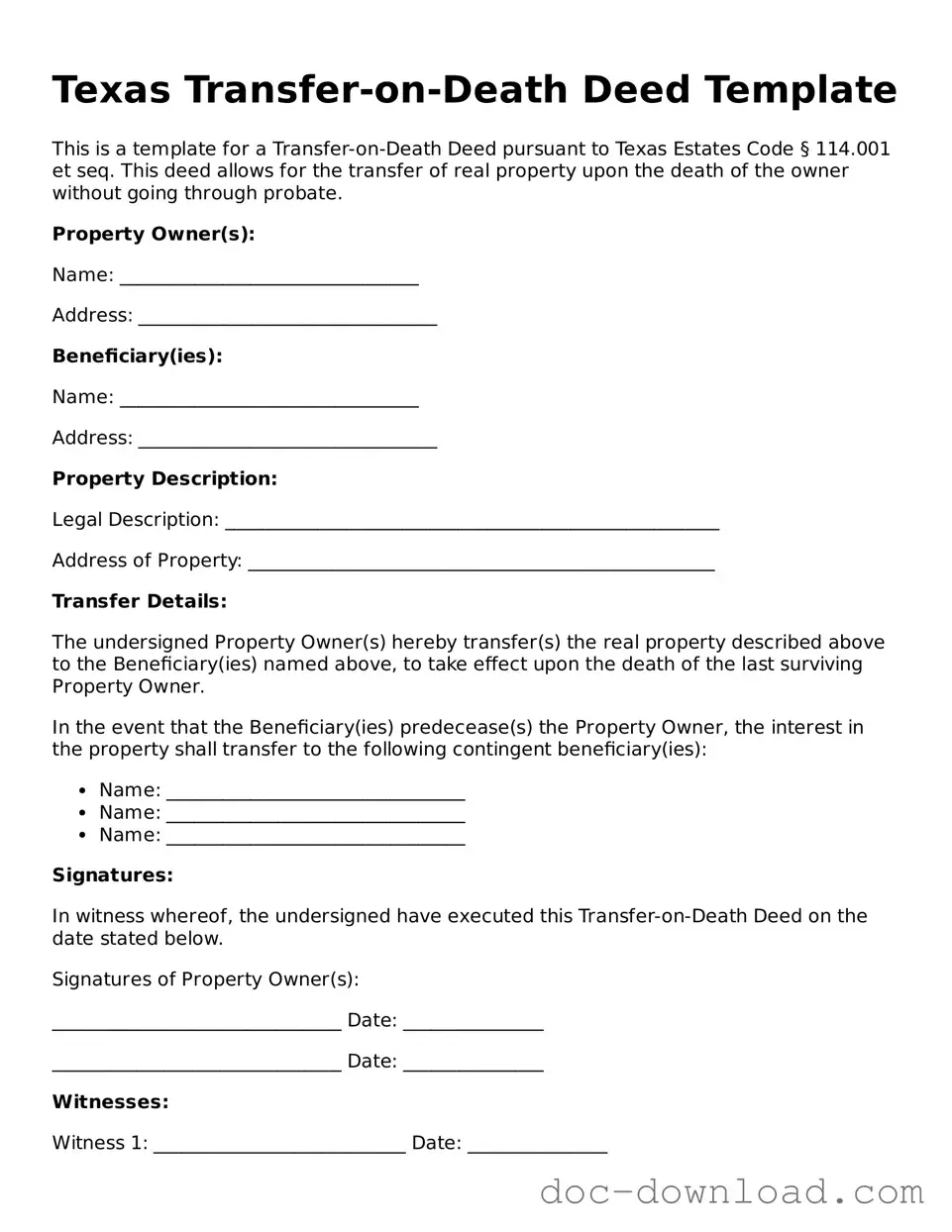

Texas Transfer-on-Death Deed Template

This is a template for a Transfer-on-Death Deed pursuant to Texas Estates Code § 114.001 et seq. This deed allows for the transfer of real property upon the death of the owner without going through probate.

Property Owner(s):

Name: ________________________________

Address: ________________________________

Beneficiary(ies):

Name: ________________________________

Address: ________________________________

Property Description:

Legal Description: _____________________________________________________

Address of Property: __________________________________________________

Transfer Details:

The undersigned Property Owner(s) hereby transfer(s) the real property described above to the Beneficiary(ies) named above, to take effect upon the death of the last surviving Property Owner.

In the event that the Beneficiary(ies) predecease(s) the Property Owner, the interest in the property shall transfer to the following contingent beneficiary(ies):

- Name: ________________________________

- Name: ________________________________

- Name: ________________________________

Signatures:

In witness whereof, the undersigned have executed this Transfer-on-Death Deed on the date stated below.

Signatures of Property Owner(s):

_______________________________ Date: _______________

_______________________________ Date: _______________

Witnesses:

Witness 1: ___________________________ Date: _______________

Witness 2: ___________________________ Date: _______________

Notary Public:

State of Texas, County of _______________

Subscribed and sworn to before me on this ____ day of ___________, 20__.

______________________________

Notary Public, State of Texas