Blank Quitclaim Deed Document for Texas

When it comes to transferring property ownership in Texas, understanding the Quitclaim Deed form is essential for both buyers and sellers. This straightforward legal document allows one party to relinquish any claim they may have on a property, effectively transferring their interest to another person or entity. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property; instead, it simply conveys whatever rights they may possess. This makes it particularly useful in situations such as divorces, estate settlements, or when a property is gifted among family members. By utilizing this form, individuals can streamline the process of property transfer, but it’s crucial to understand the implications of using a Quitclaim Deed, especially regarding potential risks and liabilities. As we delve deeper into the specifics of the Texas Quitclaim Deed, you’ll discover how to properly fill out the form, the necessary information it should contain, and the steps to ensure that the transfer is legally recognized and binding.

Similar forms

A Warranty Deed provides a guarantee that the seller has clear title to the property and the right to sell it. Unlike a Quitclaim Deed, which offers no such assurances, a Warranty Deed protects the buyer from future claims against the property. This makes it a safer option for buyers who want peace of mind regarding their ownership. If any issues arise, the seller is responsible for resolving them, which adds an extra layer of security to the transaction.

A Grant Deed is another type of property transfer document that includes some assurances about the title. When using a Grant Deed, the seller guarantees that they have not sold the property to anyone else and that there are no undisclosed liens. This makes it more reliable than a Quitclaim Deed, which offers no such guarantees. Buyers often prefer Grant Deeds for their added protection, as they ensure that the seller is providing a clear title.

When entering into property transactions, it's essential to understand the various types of deeds available, including warranty and special warranty deeds, which provide different levels of assurance regarding ownership. For those interested in leasing residential properties, utilizing a clear lease agreement is crucial; resources like All Templates PDF can guide landlords and tenants in drafting a comprehensive lease that outlines their rights and responsibilities effectively.

A Bargain and Sale Deed is similar to a Quitclaim Deed in that it transfers ownership without warranties, but it usually implies that the seller holds title to the property. This type of deed is often used in foreclosure sales or tax lien sales, where the seller may not be able to provide full assurances about the property. While it offers more than a Quitclaim Deed, it still lacks the protections that come with a Warranty Deed.

A Special Warranty Deed is a hybrid between a Warranty Deed and a Quitclaim Deed. It guarantees that the seller has not caused any title issues during their ownership but does not protect against problems that existed before the seller acquired the property. This type of deed is often used in commercial transactions, where the seller is willing to take some responsibility for the title while still limiting their liability.

An Executor’s Deed is used when a property is transferred as part of an estate settlement. This deed allows the executor to convey property owned by a deceased person to the heirs or beneficiaries. While it is similar to a Quitclaim Deed in that it does not provide warranties, it is specifically tied to the probate process and reflects the authority of the executor to act on behalf of the estate.

A Deed of Trust is a document used in real estate transactions to secure a loan. It involves three parties: the borrower, the lender, and a trustee. While it serves a different purpose than a Quitclaim Deed, both documents facilitate the transfer of property rights. The Deed of Trust allows the lender to take possession of the property if the borrower defaults, making it a critical tool in financing real estate transactions.

A Leasehold Deed is a document that grants a tenant the right to use a property for a specified period. While it does not transfer ownership like a Quitclaim Deed, it does convey certain rights associated with the property. This type of deed can be used in commercial real estate to establish long-term leases, providing tenants with a degree of security in their occupancy without transferring ownership rights.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Texas Quitclaim Deed transfers ownership of property without guaranteeing the title's validity. |

| Governing Law | The Texas Quitclaim Deed is governed by the Texas Property Code, specifically Section 5.022. |

| Usage | This deed is often used among family members or in situations where the grantor does not want to make any warranties. |

| Title Assurance | Unlike warranty deeds, a quitclaim deed offers no assurances regarding the title's condition. |

| Consideration | While consideration is often required, it can be nominal or even $0 in some cases. |

| Filing Requirements | The completed quitclaim deed must be filed with the county clerk in the county where the property is located. |

| Signature Requirements | The deed must be signed by the grantor, and notarization is typically required for it to be valid. |

| Effect on Property Rights | A quitclaim deed immediately transfers the grantor's interest in the property to the grantee. |

| Potential Risks | Buyers should be cautious, as they assume the risk of any title issues when using a quitclaim deed. |

| Common Scenarios | Commonly used in divorce settlements, estate transfers, or to clear up title issues. |

Additional State-specific Quitclaim Deed Forms

Quick Claim Deed Form Arizona - Proper identification of property and parties involved is crucial in the deed.

Massachusetts Quitclaim Deed Form - The lack of warranties means that the grantee accepts any risks associated with the title.

For those seeking to streamline their hiring practices, a thorough understanding of the Employment Verification process is essential. This vital document ensures employers can accurately assess the qualifications and work history of potential employees, thereby fostering a trustworthy recruitment environment.

Indiana Quit Claim Deed Pdf - The grantor may remain liable for existing obligations tied to the property after the transfer.

Quitclaim Deed Missouri - It is often preferred for its speed and ease in property transfers.

Sample - Texas Quitclaim Deed Form

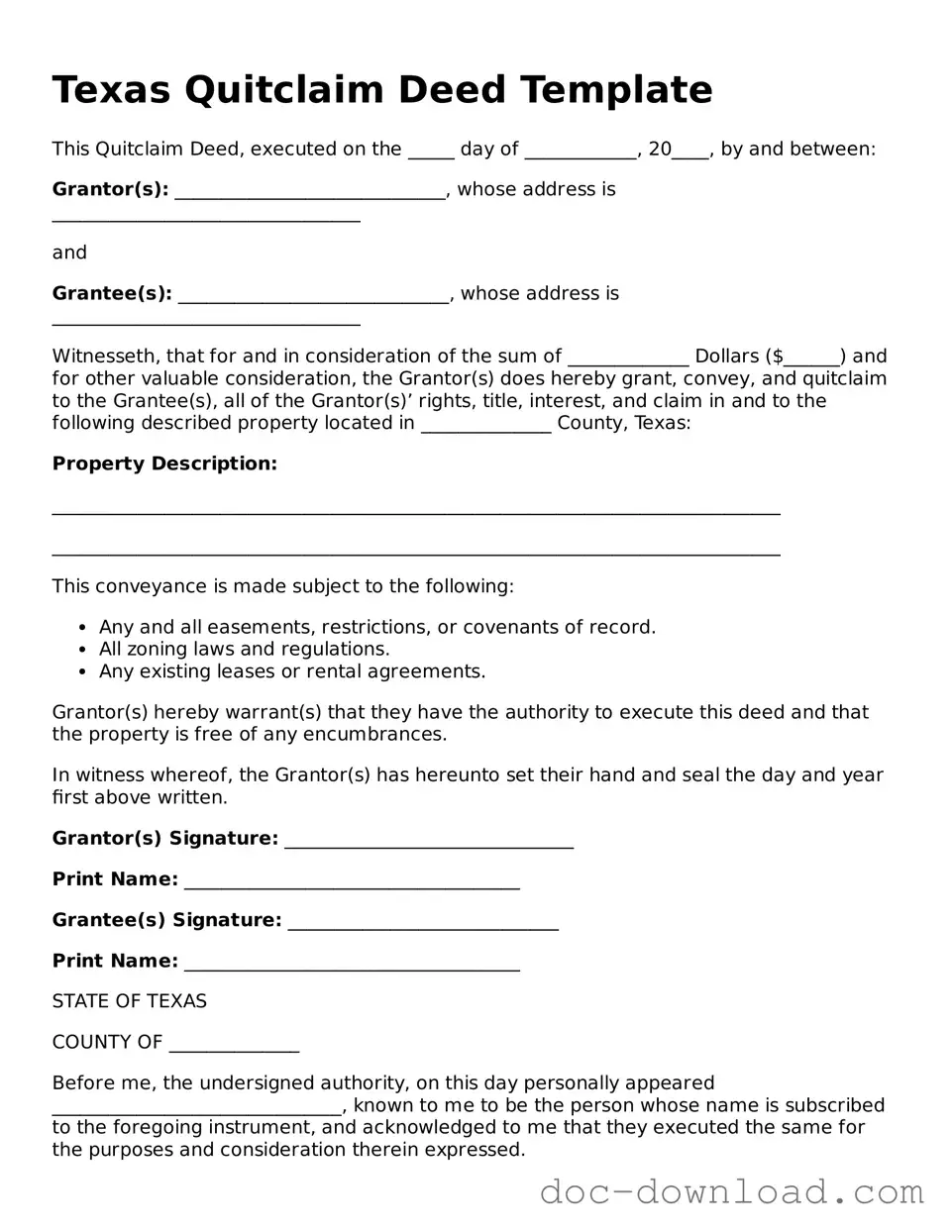

Texas Quitclaim Deed Template

This Quitclaim Deed, executed on the _____ day of ____________, 20____, by and between:

Grantor(s): _____________________________, whose address is _________________________________

and

Grantee(s): _____________________________, whose address is _________________________________

Witnesseth, that for and in consideration of the sum of _____________ Dollars ($______) and for other valuable consideration, the Grantor(s) does hereby grant, convey, and quitclaim to the Grantee(s), all of the Grantor(s)’ rights, title, interest, and claim in and to the following described property located in ______________ County, Texas:

Property Description:

______________________________________________________________________________

______________________________________________________________________________

This conveyance is made subject to the following:

- Any and all easements, restrictions, or covenants of record.

- All zoning laws and regulations.

- Any existing leases or rental agreements.

Grantor(s) hereby warrant(s) that they have the authority to execute this deed and that the property is free of any encumbrances.

In witness whereof, the Grantor(s) has hereunto set their hand and seal the day and year first above written.

Grantor(s) Signature: _______________________________

Print Name: ____________________________________

Grantee(s) Signature: _____________________________

Print Name: ____________________________________

STATE OF TEXAS

COUNTY OF ______________

Before me, the undersigned authority, on this day personally appeared _______________________________, known to me to be the person whose name is subscribed to the foregoing instrument, and acknowledged to me that they executed the same for the purposes and consideration therein expressed.

Given under my hand and seal this _____ day of ____________, 20____.

Notary Public Signature: _____________________________

My Commission Expires: _______________