Blank Promissory Note Document for Texas

The Texas Promissory Note form serves as a crucial financial instrument for individuals and businesses alike, facilitating the borrowing and lending of money while ensuring clear terms and conditions are established. This form outlines the borrower's promise to repay a specified amount of money to the lender, along with any applicable interest. Key components of the note include the principal amount, interest rate, repayment schedule, and any provisions for late payments or default. Additionally, the form typically includes the names and addresses of both the borrower and lender, ensuring that all parties are clearly identified. Understanding the nuances of this document is essential for both lenders and borrowers, as it not only protects the rights of the parties involved but also provides a legal framework for addressing any disputes that may arise. By utilizing the Texas Promissory Note, individuals can navigate the lending process with greater confidence, knowing that their agreement is documented and enforceable under Texas law.

Similar forms

The Texas Promissory Note is similar to a Loan Agreement in that both documents outline the terms of a loan between a borrower and a lender. A Loan Agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Both documents serve to protect the interests of the lender while providing the borrower with clear guidelines on their obligations. While a Loan Agreement may cover more extensive terms and conditions, the core purpose of both documents is to formalize the borrowing process and ensure that both parties understand their rights and responsibilities.

Another document similar to the Texas Promissory Note is the Mortgage. A Mortgage secures a loan with real property, giving the lender a claim to the property if the borrower defaults. While the Promissory Note focuses primarily on the promise to repay the loan, the Mortgage establishes the collateral backing that promise. Both documents work together in real estate transactions, as the Promissory Note outlines the terms of the loan while the Mortgage provides security for that loan. This combination helps mitigate risk for the lender and clarifies the borrower's obligations.

The Texas Promissory Note also bears resemblance to an Installment Agreement. An Installment Agreement allows a borrower to pay back a debt in scheduled payments over time, much like the repayment terms specified in a Promissory Note. Both documents detail the payment structure, including the amount due and frequency of payments. However, an Installment Agreement may apply to various types of debts, such as personal loans or service agreements, while a Promissory Note is more specifically tied to a loan transaction. Despite these differences, both documents aim to facilitate manageable repayment plans for borrowers.

A further document that shares similarities with the Texas Promissory Note is a Personal Guarantee. A Personal Guarantee is often used in business loans, where an individual agrees to be personally liable for the debt if the business defaults. While the Promissory Note outlines the terms of the loan itself, the Personal Guarantee adds an additional layer of accountability for the borrower. Both documents emphasize the borrower's commitment to repaying the loan, but the Personal Guarantee shifts some of the risk to the individual, providing the lender with greater assurance of repayment.

For those looking to navigate the complexities of California business formation, understanding the various forms like the LLC 12 is essential. This particular form can be easily obtained through resources such as californiapdffoms.com, where you can access the fillable document to streamline the filing process, ensuring compliance and maintaining your LLC's active status.

Finally, a Secured Loan Agreement is akin to the Texas Promissory Note, as both involve borrowing money with a promise to repay. A Secured Loan Agreement specifies the collateral backing the loan, which provides security for the lender. The Promissory Note, while it may not explicitly mention collateral, is often used in conjunction with such agreements to formalize the borrower's commitment to repay. Both documents serve to protect the lender's interests and ensure that the borrower understands their financial obligations, creating a clear framework for the lending relationship.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Texas Promissory Note is a written promise to pay a specific amount of money to a designated person or entity. |

| Governing Law | This form is governed by the Texas Business and Commerce Code, specifically Chapter 3, which outlines the Uniform Commercial Code provisions. |

| Parties Involved | The note typically involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, and it should be clearly stated in the document. |

| Payment Terms | Payment terms, including the due date and frequency of payments, must be explicitly defined. |

| Signature Requirement | The note must be signed by the borrower to be legally binding. |

| Default Provisions | Provisions regarding default, including potential penalties or remedies, should be included to protect the lender's interests. |

Additional State-specific Promissory Note Forms

Can I Get My Mortgage Note Online - It legally binds the borrower to repay the loan as agreed.

Having a well-crafted Operating Agreement is essential for any LLC in Colorado, as it provides clarity on the roles of its members and the procedures for day-to-day operations. For those seeking to create or refine their agreement, resources like Colorado PDF Forms can be invaluable in ensuring that the document meets all legal requirements and reflects the specific needs of the business.

Promissory Note Template Missouri - Electronic signatures can be used on promissory notes, depending on state laws.

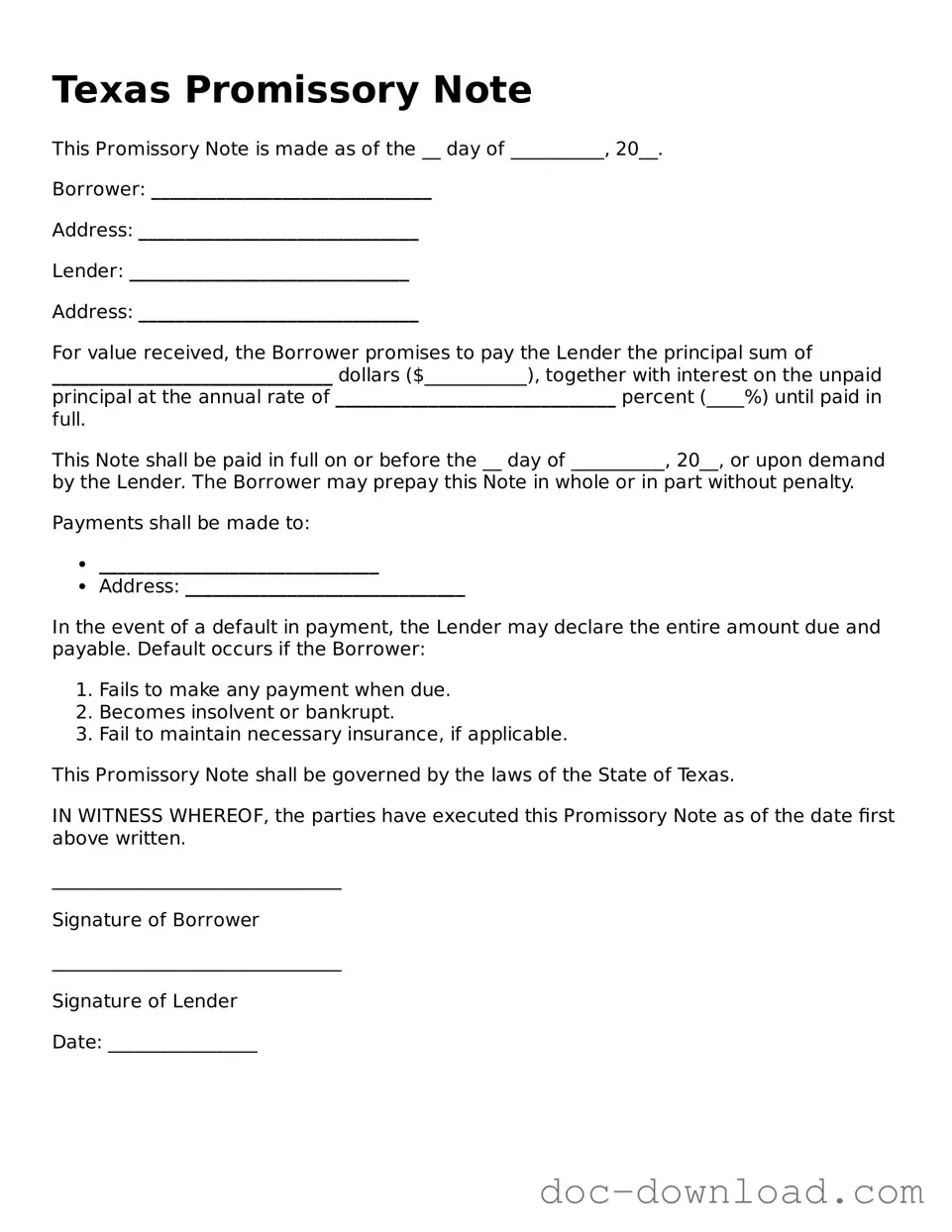

Sample - Texas Promissory Note Form

Texas Promissory Note

This Promissory Note is made as of the __ day of __________, 20__.

Borrower: ______________________________

Address: ______________________________

Lender: ______________________________

Address: ______________________________

For value received, the Borrower promises to pay the Lender the principal sum of ______________________________ dollars ($___________), together with interest on the unpaid principal at the annual rate of ______________________________ percent (____%) until paid in full.

This Note shall be paid in full on or before the __ day of __________, 20__, or upon demand by the Lender. The Borrower may prepay this Note in whole or in part without penalty.

Payments shall be made to:

- ______________________________

- Address: ______________________________

In the event of a default in payment, the Lender may declare the entire amount due and payable. Default occurs if the Borrower:

- Fails to make any payment when due.

- Becomes insolvent or bankrupt.

- Fail to maintain necessary insurance, if applicable.

This Promissory Note shall be governed by the laws of the State of Texas.

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the date first above written.

_______________________________

Signature of Borrower

_______________________________

Signature of Lender

Date: ________________