Blank Loan Agreement Document for Texas

In the vast landscape of financial transactions, the Texas Loan Agreement form stands out as a crucial document for both lenders and borrowers. This form serves as a written contract that outlines the terms and conditions under which a loan is extended, ensuring that all parties involved have a clear understanding of their rights and obligations. Key elements of the agreement typically include the loan amount, interest rate, repayment schedule, and any collateral involved. Additionally, the form addresses default conditions, which outline what happens if the borrower fails to meet their repayment obligations. By establishing these parameters, the Texas Loan Agreement not only protects the lender's investment but also provides the borrower with a structured framework for repayment. As such, understanding this form is essential for anyone looking to navigate the lending landscape in Texas, whether they are seeking to borrow funds or extend a loan to someone else.

Similar forms

The Texas Loan Agreement form shares similarities with a Promissory Note. A Promissory Note is a written promise to pay a specified amount of money to a designated party at a predetermined time or on demand. Like the Loan Agreement, it outlines the terms of the loan, including the interest rate, payment schedule, and consequences for default. Both documents establish a clear understanding between the lender and borrower regarding the financial transaction, ensuring that both parties are aware of their rights and obligations.

Another document that resembles the Texas Loan Agreement is the Mortgage Agreement. A Mortgage Agreement secures a loan by using real property as collateral. Similar to the Loan Agreement, it specifies the loan amount, interest rate, and repayment terms. However, the Mortgage Agreement also includes details about the property being used as collateral and the lender's rights in case of default. Both documents work together to protect the lender’s investment while providing the borrower with necessary funds.

When considering property transactions in Illinois, it is essential to understand how legal documents like the Quitclaim Deed operate, as they facilitate the transfer of ownership without warranties. For those ready to embark on this process, the necessary template can be found at https://quitclaimdeedtemplate.com/illinois-quitclaim-deed-template/, providing a straightforward solution for your documentation needs.

The Texas Loan Agreement is also akin to a Security Agreement. A Security Agreement is used when a borrower pledges personal property as collateral for a loan. This document outlines the collateral, the terms of the loan, and the rights of the lender if the borrower defaults. Like the Loan Agreement, it establishes a legal framework for the financial transaction, ensuring that both parties understand their responsibilities and the potential consequences of non-compliance.

A Credit Agreement can also be compared to the Texas Loan Agreement. A Credit Agreement outlines the terms under which a lender provides credit to a borrower. This document typically includes information about credit limits, interest rates, and repayment terms. Both agreements serve to formalize the lender-borrower relationship, detailing the expectations and obligations of each party. While a Loan Agreement usually pertains to a specific loan amount, a Credit Agreement may cover a revolving line of credit, providing more flexibility for the borrower.

Lastly, the Texas Loan Agreement is similar to a Lease Agreement, particularly when it comes to equipment financing. A Lease Agreement allows one party to use property owned by another in exchange for periodic payments. Like a Loan Agreement, it specifies the terms of payment, duration, and responsibilities of both parties. While a Loan Agreement typically involves a direct transfer of funds, a Lease Agreement focuses on the use of property, yet both documents aim to create a clear understanding of the financial arrangement between the parties involved.

Document Overview

| Fact Name | Details |

|---|---|

| Definition | The Texas Loan Agreement form is a legal document that outlines the terms and conditions of a loan between a lender and a borrower in Texas. |

| Governing Law | The agreement is governed by the laws of the State of Texas, specifically under the Texas Business and Commerce Code. |

| Parties Involved | The form identifies the lender and the borrower, ensuring that both parties are clearly defined and understood. |

| Loan Amount | The document specifies the principal amount of the loan, which is the sum of money being borrowed. |

| Interest Rate | The agreement outlines the interest rate applicable to the loan, detailing how interest will be calculated and applied. |

| Repayment Terms | It includes the repayment schedule, indicating when payments are due and the total duration of the loan. |

| Default Conditions | The form describes the conditions under which the borrower would be considered in default, along with the potential consequences. |

Additional State-specific Loan Agreement Forms

Free Promissory Note Template Florida - It may state whether the loan can be transferred or assigned.

To navigate the complexities of the legal system effectively, it is important to utilize resources that simplify the process, such as the California Judicial Council form. This form not only helps maintain consistency in court filings but also ensures that essential information is presented clearly. For more details on how to fill out this form, visit californiapdffoms.com/ and take the necessary steps toward clarity in your legal proceedings.

Sample Promissory Note California - Indicates if insurance is necessary for the loan terms.

Sample - Texas Loan Agreement Form

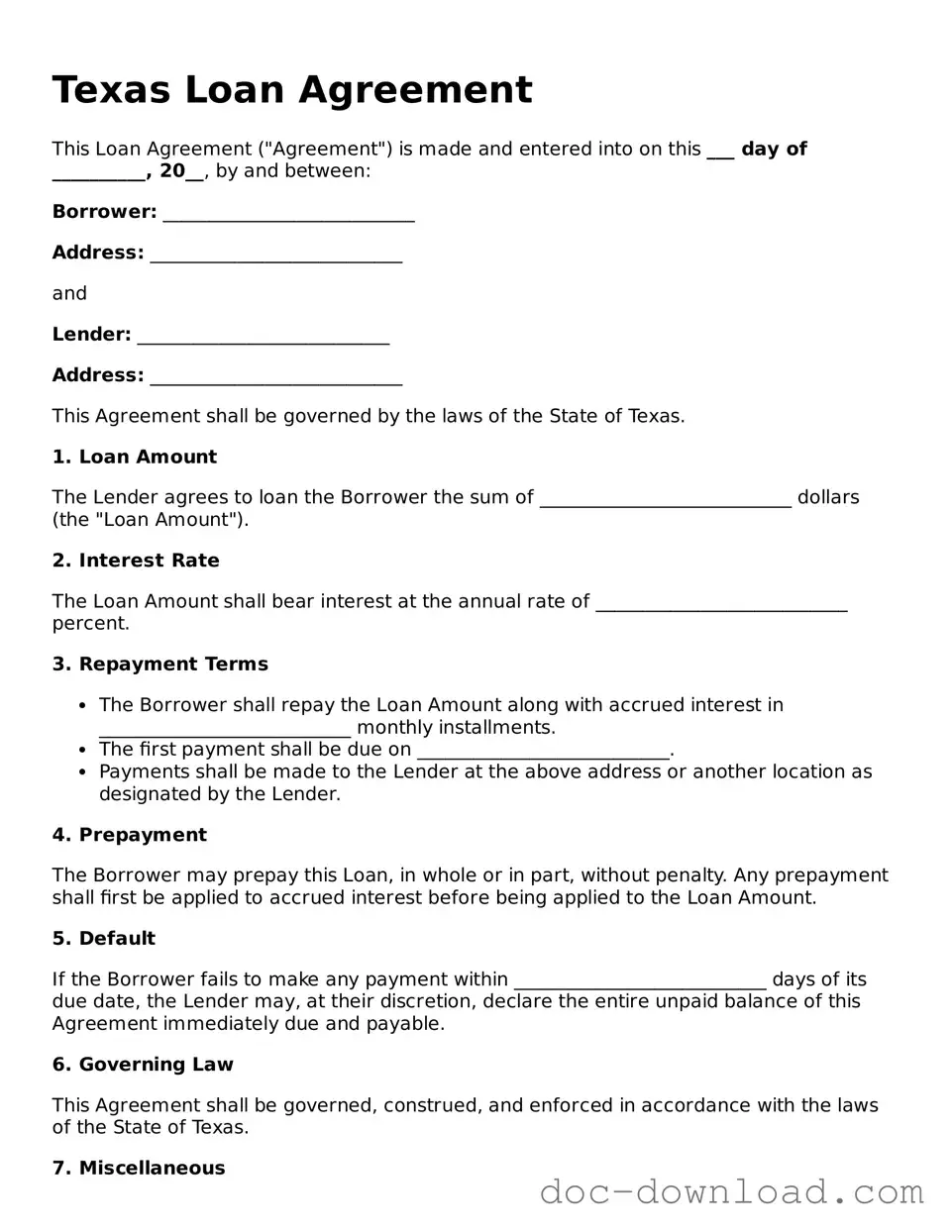

Texas Loan Agreement

This Loan Agreement ("Agreement") is made and entered into on this ___ day of __________, 20__, by and between:

Borrower: ___________________________

Address: ___________________________

and

Lender: ___________________________

Address: ___________________________

This Agreement shall be governed by the laws of the State of Texas.

1. Loan Amount

The Lender agrees to loan the Borrower the sum of ___________________________ dollars (the "Loan Amount").

2. Interest Rate

The Loan Amount shall bear interest at the annual rate of ___________________________ percent.

3. Repayment Terms

- The Borrower shall repay the Loan Amount along with accrued interest in ___________________________ monthly installments.

- The first payment shall be due on ___________________________.

- Payments shall be made to the Lender at the above address or another location as designated by the Lender.

4. Prepayment

The Borrower may prepay this Loan, in whole or in part, without penalty. Any prepayment shall first be applied to accrued interest before being applied to the Loan Amount.

5. Default

If the Borrower fails to make any payment within ___________________________ days of its due date, the Lender may, at their discretion, declare the entire unpaid balance of this Agreement immediately due and payable.

6. Governing Law

This Agreement shall be governed, construed, and enforced in accordance with the laws of the State of Texas.

7. Miscellaneous

- This Agreement may only be amended in writing signed by both parties.

- If any provision of this Agreement is found to be unenforceable, the remaining provisions will continue in full force.

- This Agreement constitutes the entire understanding between the parties.

In witness whereof, the parties have executed this Loan Agreement as of the date first above written.

_____________________________

Borrower: ____________________________

_____________________________

Lender: ____________________________