Blank Deed in Lieu of Foreclosure Document for Texas

In Texas, homeowners facing financial difficulties and the possibility of foreclosure may find the Deed in Lieu of Foreclosure form to be a viable alternative. This legal document allows a property owner to voluntarily transfer the title of their home back to the lender, effectively eliminating the need for a lengthy foreclosure process. By executing this form, homeowners can often mitigate the negative impact on their credit scores and avoid the stress associated with foreclosure proceedings. The process typically involves several key steps, including negotiations with the lender, an evaluation of the property's condition, and the potential for the lender to forgive any remaining debt. Importantly, both parties must agree to the terms outlined in the deed, which may include stipulations regarding the property's condition and any potential deficiency judgments. Understanding the implications and requirements of the Deed in Lieu of Foreclosure is crucial for homeowners seeking a resolution to their financial struggles while protecting their future financial stability.

Similar forms

The Texas Deed in Lieu of Foreclosure is similar to a mortgage release. A mortgage release is a document that signifies the lender has relinquished its interest in the property. In both cases, the borrower transfers ownership to the lender to avoid foreclosure. This process can alleviate the borrower's financial burden and expedite the resolution of the loan default. Both documents serve to simplify the transfer of property rights and can help preserve the borrower's credit standing compared to a foreclosure process.

Another document akin to the Texas Deed in Lieu of Foreclosure is a short sale agreement. In a short sale, the lender agrees to accept less than the total amount owed on the mortgage. Like a deed in lieu, a short sale allows the borrower to avoid foreclosure. The key difference lies in the sale process; in a short sale, the property is sold on the open market, while in a deed in lieu, the borrower directly transfers the property to the lender. Both options aim to mitigate financial loss for both parties involved.

The Minnesota Motor Vehicle Bill of Sale form is essential for documenting the transfer of vehicle ownership between the seller and the buyer. It plays a vital role in ensuring that all details of the sale are accurately recorded, providing proof of the transaction that is important for registration and tax purposes. To avoid any ambiguities, it is recommended to open the document for a thorough understanding of its significance and requirements.

A third document is the forbearance agreement. This agreement allows the borrower to temporarily pause or reduce mortgage payments while they regain financial stability. In contrast to a deed in lieu, which involves a complete transfer of ownership, a forbearance keeps the borrower in possession of the property. However, both documents are designed to provide relief to borrowers facing financial hardship and to prevent the more severe consequences of foreclosure.

Finally, the loan modification agreement shares similarities with the Texas Deed in Lieu of Foreclosure. A loan modification alters the terms of the original mortgage to make it more manageable for the borrower. This could involve extending the loan term or reducing the interest rate. While a deed in lieu results in the borrower relinquishing their property, both documents aim to address the borrower's financial difficulties. They offer alternative solutions to foreclosure, allowing borrowers to maintain some level of control over their financial situation.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document where a borrower voluntarily transfers property ownership to the lender to avoid foreclosure. |

| Governing Law | In Texas, the Deed in Lieu of Foreclosure is governed by Texas Property Code § 51.001 et seq. |

| Voluntary Process | The process is voluntary; the borrower must agree to transfer the property to the lender. |

| Credit Impact | While it may have less impact than foreclosure, a Deed in Lieu can still affect the borrower's credit score. |

| Deficiency Judgments | In some cases, lenders may still pursue deficiency judgments if the property value is less than the owed amount. |

| Title Transfer | The deed transfers ownership, allowing the lender to take possession of the property without going through foreclosure. |

| Negotiation | Borrowers can negotiate terms, such as the release of liability for the remaining mortgage balance. |

Additional State-specific Deed in Lieu of Foreclosure Forms

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - In some states, a Deed in Lieu can result in a deficiency waiver, releasing homeowners from outstanding debt.

Completing the California Boat Bill of Sale form not only formalizes the transfer of ownership, but it also ensures that both parties are protected throughout the transaction process. For more information and to access the form, you can visit californiapdffoms.com/, where you will find everything you need to facilitate this important step in boat ownership.

Deed in Lieu of Foreclosure Sample - A Deed in Lieu of Foreclosure transfers property ownership to the lender to avoid foreclosure proceedings.

Sample - Texas Deed in Lieu of Foreclosure Form

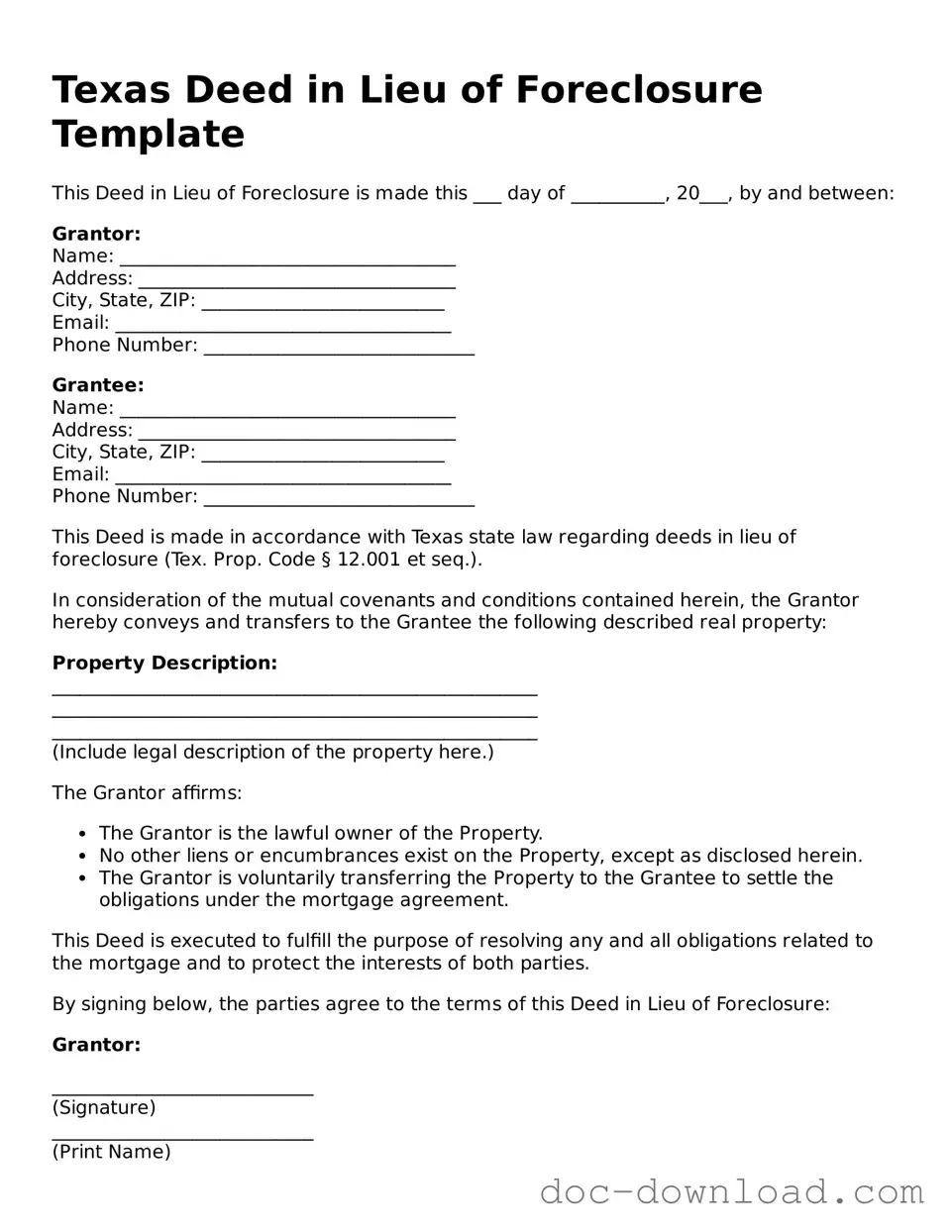

Texas Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is made this ___ day of __________, 20___, by and between:

Grantor:

Name: ____________________________________

Address: __________________________________

City, State, ZIP: __________________________

Email: ____________________________________

Phone Number: _____________________________

Grantee:

Name: ____________________________________

Address: __________________________________

City, State, ZIP: __________________________

Email: ____________________________________

Phone Number: _____________________________

This Deed is made in accordance with Texas state law regarding deeds in lieu of foreclosure (Tex. Prop. Code § 12.001 et seq.).

In consideration of the mutual covenants and conditions contained herein, the Grantor hereby conveys and transfers to the Grantee the following described real property:

Property Description:

____________________________________________________

____________________________________________________

____________________________________________________

(Include legal description of the property here.)

The Grantor affirms:

- The Grantor is the lawful owner of the Property.

- No other liens or encumbrances exist on the Property, except as disclosed herein.

- The Grantor is voluntarily transferring the Property to the Grantee to settle the obligations under the mortgage agreement.

This Deed is executed to fulfill the purpose of resolving any and all obligations related to the mortgage and to protect the interests of both parties.

By signing below, the parties agree to the terms of this Deed in Lieu of Foreclosure:

Grantor:

____________________________(Signature)

____________________________

(Print Name)

Grantee:

____________________________(Signature)

____________________________

(Print Name)

Witnessed by:

____________________________(Signature of Witness)

____________________________

(Print Name of Witness)