Blank Articles of Incorporation Document for Texas

The Texas Articles of Incorporation form serves as a crucial document for individuals and groups looking to establish a corporation in the state. This form lays the foundation for the legal existence of a corporation, outlining essential details such as the name of the corporation, its purpose, and the duration of its existence. Additionally, it requires the identification of the registered agent, who will act as the corporation's official point of contact. Information regarding the initial board of directors must also be provided, ensuring that governance is clearly defined from the outset. By completing this form, founders can delineate the structure and operational framework of their corporation, setting the stage for future growth and compliance with state regulations. Understanding the significance of each section of the Articles of Incorporation is vital for anyone embarking on this important step in their business journey.

Similar forms

The Texas Articles of Incorporation form shares similarities with the Certificate of Incorporation used in many states. Both documents serve as the foundational legal paperwork required to establish a corporation. They outline essential details such as the corporation's name, purpose, and the address of its registered office. Like the Texas form, the Certificate of Incorporation must be filed with the appropriate state authority to grant the corporation legal status.

Another document that resembles the Texas Articles of Incorporation is the Bylaws. While the Articles of Incorporation provide the basic structure of the corporation, Bylaws detail the internal rules governing the corporation's operations. Both documents are crucial for establishing a corporation, but Bylaws focus more on the management and operational procedures, including the roles of directors and officers.

The Organization Meeting Minutes are also akin to the Texas Articles of Incorporation. After incorporation, the first official meeting of the board of directors is documented in these minutes. This document records the initial decisions made, such as adopting Bylaws and appointing officers. Both documents are foundational, but the minutes capture the actions taken to set up the corporation's governance.

Incorporation in other states often involves a similar document called the Articles of Organization, particularly for Limited Liability Companies (LLCs). Like the Texas Articles of Incorporation, the Articles of Organization establish the entity's legal existence. Both documents require basic information about the business, such as its name and address, but the Articles of Organization cater specifically to LLCs, which have different structures and operational rules.

The Statement of Information is another document that bears resemblance to the Texas Articles of Incorporation. This document is often required after a corporation is formed and provides updated information about the company, including its officers and address. While the Articles of Incorporation set up the corporation, the Statement of Information keeps the state informed about its ongoing operations and structure.

To successfully navigate the complexities of property transactions, understanding various legal documents is crucial, including the Michigan Quitclaim Deed, which is an essential form for transferring real estate ownership without guarantees about the property's title. This intricacy of real estate paperwork forms the foundation for confident dealings, so for those ready to embark on this journey or seeking templates, an excellent resource can be found at quitclaimdeedtemplate.com/michigan-quitclaim-deed-template/, ensuring that you have the right tools at your disposal.

The Partnership Agreement is similar in purpose to the Texas Articles of Incorporation, although it applies to partnerships rather than corporations. This document outlines the terms and conditions under which the partners will operate. Both documents establish a legal framework for the business, defining roles and responsibilities, but the Partnership Agreement is tailored to the unique needs of partnerships.

The Certificate of Good Standing is related to the Texas Articles of Incorporation in that it confirms a corporation's legal existence and compliance with state regulations. While the Articles of Incorporation initiate the corporation's existence, the Certificate of Good Standing serves as proof that the corporation is properly registered and has fulfilled its obligations, such as filing annual reports and paying necessary fees.

Lastly, the Tax Identification Number (TIN) application, while not a formation document, is essential for the operational phase of a corporation. Obtaining a TIN is a necessary step after filing the Texas Articles of Incorporation. Both documents are crucial for legal and tax purposes, as the TIN allows the corporation to conduct business, open bank accounts, and file taxes.

Document Overview

| Fact Name | Details |

|---|---|

| Purpose | The Texas Articles of Incorporation form is used to establish a corporation in Texas. |

| Governing Law | The form is governed by the Texas Business Organizations Code. |

| Filing Requirement | Filing with the Texas Secretary of State is required to legally form the corporation. |

| Information Needed | Key information includes the corporation's name, registered agent, and purpose. |

| Fees | A filing fee is required, which varies based on the corporation type. |

| Approval Time | Processing times can vary, but typically range from a few days to a few weeks. |

| Amendments | Changes to the Articles of Incorporation can be made by filing an amendment form. |

Additional State-specific Articles of Incorporation Forms

Certificate of Formation California - Properly filed Articles allow for easier compliance with regulatory bodies.

Articles of Organization Tn - Details procedures for handling corporate finances.

Understanding the significance of a California Durable Power of Attorney is crucial, as it enables you to designate someone you trust to handle significant decisions for you when you are unable to do so. This assurance allows you to maintain control over your affairs and ensures your preferences are honored. For more information about how to properly fill out this essential document, you can visit californiapdffoms.com/.

Fl Division of Corporations - The document specifies whether the corporation will have stock and its types.

Ma Annual Report - Lists requirements for corporate bookkeeping and accounting practices.

Sample - Texas Articles of Incorporation Form

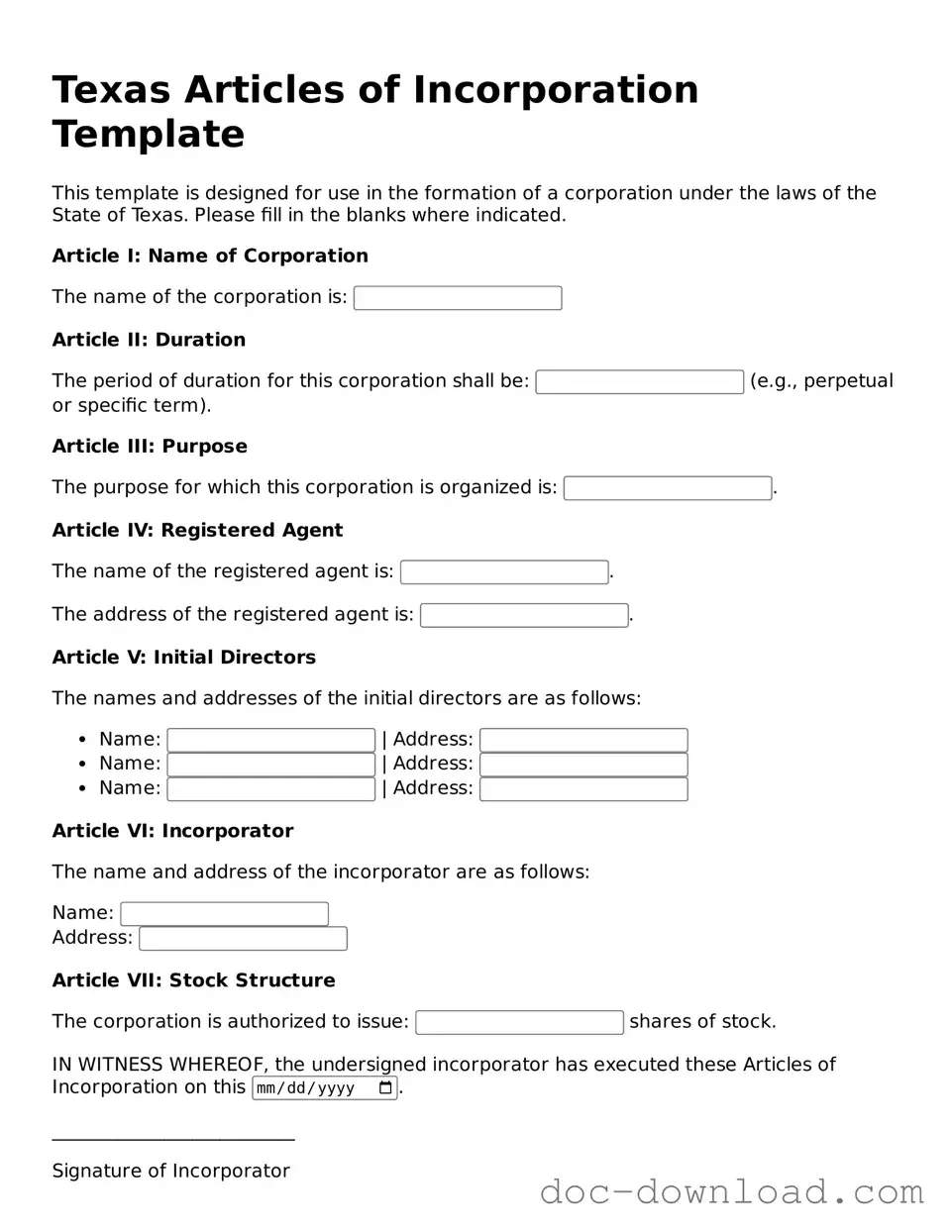

Texas Articles of Incorporation Template

This template is designed for use in the formation of a corporation under the laws of the State of Texas. Please fill in the blanks where indicated.

Article I: Name of Corporation

The name of the corporation is:

Article II: Duration

The period of duration for this corporation shall be: (e.g., perpetual or specific term).

Article III: Purpose

The purpose for which this corporation is organized is: .

Article IV: Registered Agent

The name of the registered agent is: .

The address of the registered agent is: .

Article V: Initial Directors

The names and addresses of the initial directors are as follows:

- Name: | Address:

- Name: | Address:

- Name: | Address:

Article VI: Incorporator

The name and address of the incorporator are as follows:

Name:

Address:

Article VII: Stock Structure

The corporation is authorized to issue: shares of stock.

IN WITNESS WHEREOF, the undersigned incorporator has executed these Articles of Incorporation on this .

__________________________

Signature of Incorporator

______________________________

Printed Name of Incorporator