Blank Transfer-on-Death Deed Document for Tennessee

In Tennessee, the Transfer-on-Death Deed (TOD) offers a straightforward way for property owners to ensure their real estate passes directly to their chosen beneficiaries upon their death, without the need for probate. This legal tool allows individuals to retain full control over their property during their lifetime, while also simplifying the transfer process for loved ones. By filling out a TOD deed, property owners can specify who will inherit their property, making it an essential part of estate planning. Importantly, this deed must be properly executed and recorded to be effective, and it can be revoked or altered at any time before the owner's passing. Understanding the nuances of the Transfer-on-Death Deed form can empower individuals to make informed decisions about their estate, ultimately providing peace of mind for both themselves and their beneficiaries.

Similar forms

The Tennessee Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without the need for probate. Similar to this deed is the Revocable Living Trust. A revocable living trust enables individuals to place their assets into a trust during their lifetime, allowing for a seamless transfer of those assets to beneficiaries after death. Both documents serve to avoid probate, but a trust may require more management and formalities during the grantor's lifetime.

Another document akin to the Transfer-on-Death Deed is the Beneficiary Designation Form. Commonly used for bank accounts, retirement accounts, and life insurance policies, this form allows individuals to designate a beneficiary to receive the asset upon the account holder's death. Like the Transfer-on-Death Deed, it bypasses the probate process, ensuring that the designated beneficiary receives the asset directly.

The Life Estate Deed is also comparable. This deed allows an individual to retain the right to use and occupy a property during their lifetime while designating a remainder beneficiary who will receive the property after their death. While both documents facilitate a transfer of property outside of probate, a life estate deed involves a retained interest, which can complicate ownership and use during the grantor's life.

The Joint Tenancy with Right of Survivorship is another similar document. This form of ownership allows two or more people to hold title to a property together. Upon the death of one owner, the surviving owner automatically receives full ownership of the property. Like the Transfer-on-Death Deed, this arrangement avoids probate, but it also requires that all joint tenants agree to any decisions regarding the property while all are alive.

The Will is a fundamental document that shares similarities with the Transfer-on-Death Deed. A will specifies how a person's assets should be distributed upon their death. Unlike the Transfer-on-Death Deed, which transfers property directly to beneficiaries without going through probate, a will typically must go through the probate process, making it a less efficient option for transferring property.

The Durable Power of Attorney is another important document. This legal instrument allows an individual to designate someone else to manage their financial affairs if they become incapacitated. While it does not directly transfer property upon death, it can work in tandem with a Transfer-on-Death Deed to ensure that the individual's wishes regarding property management and transfer are respected while they are alive and after their death.

In the realm of estate planning, it's essential to have a variety of tools at your disposal to ensure your assets are managed according to your wishes. One significant option is the Colorado PDF Forms which can help in creating a Last Will and Testament, providing clarity and legal support in the distribution of your estate after death.

The Assignment of Beneficial Interest in a Trust is similar as well. This document allows an individual to assign their beneficial interest in a trust to another party. Upon the original holder's death, the assigned beneficiary receives the interest without going through probate. Both the Assignment and the Transfer-on-Death Deed aim to simplify the transfer process and provide clarity regarding asset distribution.

Lastly, the Affidavit of Heirship is a document that can be used to establish the heirs of a deceased individual. This document is often used in situations where there is no will or formal estate plan. While it does not transfer property directly, it can help clarify ownership and facilitate the transfer of property outside of probate, similar to the intent behind a Transfer-on-Death Deed.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | The Tennessee Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The use of the Transfer-on-Death Deed in Tennessee is governed by Tennessee Code Annotated § 66-4-201 to § 66-4-207. |

| Eligibility | Only individuals who own real estate can create a Transfer-on-Death Deed; it cannot be used for personal property. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property after their death. |

| No Immediate Transfer | The deed does not transfer ownership until the property owner passes away, allowing the owner to retain full control during their lifetime. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner, ensuring flexibility in estate planning. |

| Filing Requirements | The deed must be recorded with the county register of deeds where the property is located to be effective. |

| Impact on Taxes | Since the property does not transfer until death, it generally does not affect the property owner's tax situation during their lifetime. |

| Legal Assistance | While individuals can create a Transfer-on-Death Deed without legal help, consulting an attorney is advisable to ensure compliance with state laws. |

| Limitations | Transfer-on-Death Deeds cannot be used to transfer property subject to a mortgage or other encumbrances without proper planning. |

Additional State-specific Transfer-on-Death Deed Forms

Transfer on Death Deed Florida Form - Requires clear identification of the property to be transferred.

For further information and resources on how to complete the necessary documentation for your transaction, you can visit https://californiapdffoms.com, ensuring you have all the tools to facilitate a compliant and efficient process.

Transfer on Death Deed Missouri Pdf - It is important for property owners to review their Transfer-on-Death Deed periodically to ensure it reflects their current wishes.

Arizona Beneficiary Deed Form - Choosing to use this deed reflects proactive management of one’s real estate to protect family interests.

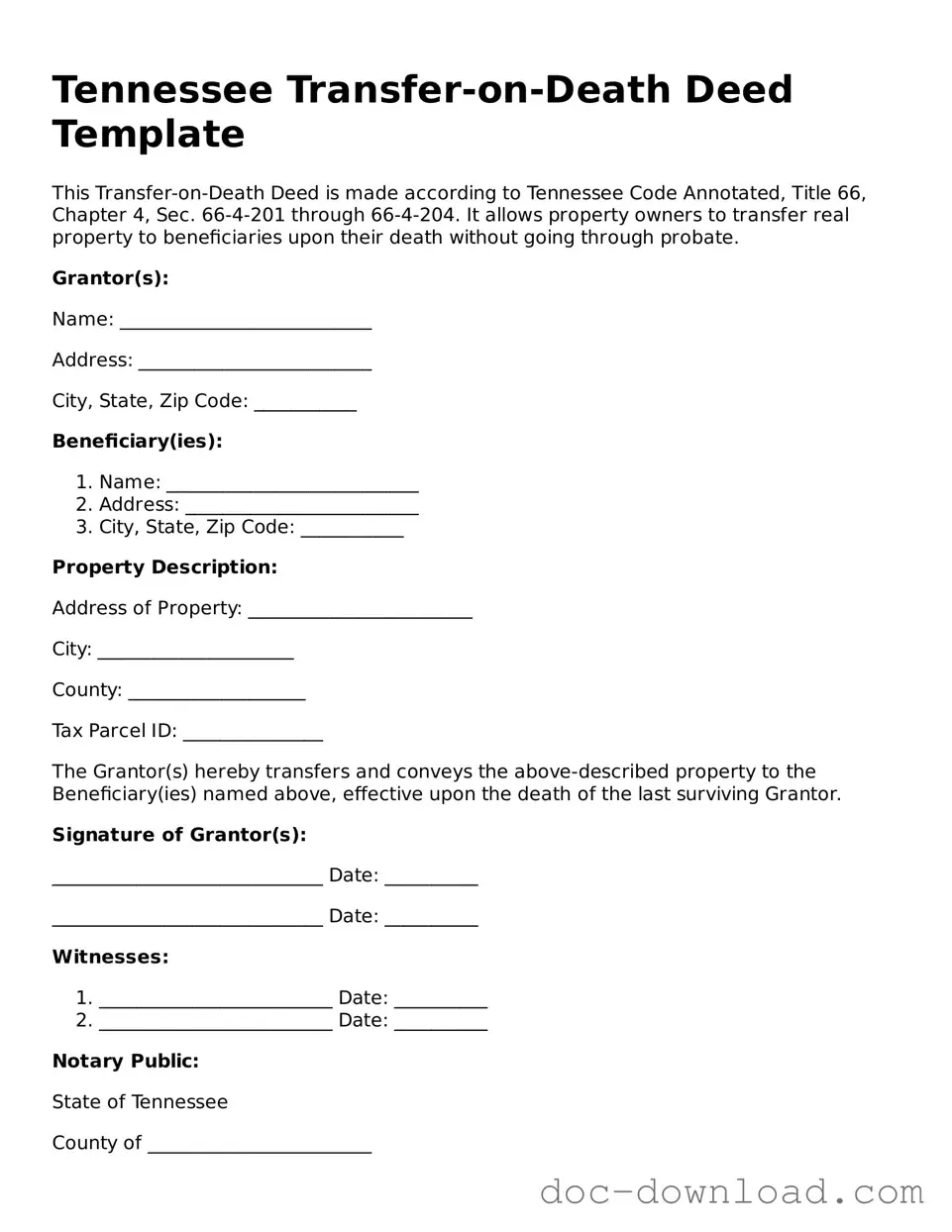

Sample - Tennessee Transfer-on-Death Deed Form

Tennessee Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made according to Tennessee Code Annotated, Title 66, Chapter 4, Sec. 66-4-201 through 66-4-204. It allows property owners to transfer real property to beneficiaries upon their death without going through probate.

Grantor(s):

Name: ___________________________

Address: _________________________

City, State, Zip Code: ___________

Beneficiary(ies):

- Name: ___________________________

- Address: _________________________

- City, State, Zip Code: ___________

Property Description:

Address of Property: ________________________

City: _____________________

County: ___________________

Tax Parcel ID: _______________

The Grantor(s) hereby transfers and conveys the above-described property to the Beneficiary(ies) named above, effective upon the death of the last surviving Grantor.

Signature of Grantor(s):

_____________________________ Date: __________

_____________________________ Date: __________

Witnesses:

- _________________________ Date: __________

- _________________________ Date: __________

Notary Public:

State of Tennessee

County of ________________________

Subscribed and sworn to before me on this ____ day of __________, 20___.

_______________________________

Notary Public Signature

My commission expires: _______________