Blank Promissory Note Document for Tennessee

The Tennessee Promissory Note form serves as a crucial document in the realm of personal and business finance. This form outlines the agreement between a borrower and a lender, detailing the amount borrowed, the interest rate, and the repayment schedule. It clearly specifies the obligations of both parties, ensuring that the lender is protected while providing the borrower with a clear understanding of their commitments. Additionally, the form can include provisions for late fees, prepayment options, and default terms, which further define the relationship between the parties involved. By using this standardized form, individuals and businesses can avoid misunderstandings and establish a solid foundation for their financial transactions. Understanding the key components of the Tennessee Promissory Note can empower both borrowers and lenders, making the lending process smoother and more transparent.

Similar forms

A loan agreement is a document that outlines the terms of a loan between a lender and a borrower. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement typically includes more detailed terms regarding the obligations of both parties and may address what happens in case of default. This additional detail can provide clarity and protection for both the lender and borrower.

A mortgage is another document that shares similarities with a promissory note. It secures a loan for purchasing real estate. The borrower promises to repay the loan, and the property serves as collateral. While a promissory note is a standalone promise to pay, a mortgage ties that promise to a specific asset, allowing the lender to take possession of the property if the borrower fails to repay.

A deed of trust functions similarly to a mortgage but involves three parties: the borrower, the lender, and a trustee. The borrower gives the trustee the right to hold the title to the property until the loan is repaid. Like a promissory note, it outlines the borrower’s obligation to repay the loan, but it also provides a method for the lender to foreclose on the property if necessary.

An IOU is a less formal document than a promissory note but serves a similar purpose. It acknowledges a debt and indicates that one party owes money to another. While an IOU may lack the detailed terms found in a promissory note, it still serves as evidence of a debt and can be enforceable in court, depending on the circumstances.

Understanding the nuances of various financial documents is essential for both borrowers and lenders. For instance, the Texas Transfer-on-Death Deed, which allows property owners to designate beneficiaries without probate complications, is an important legal tool. To learn more about how to fill out the form, visit https://todform.com/blank-texas-transfer-on-death-deed/ for detailed information.

A personal guarantee is a document that can accompany a promissory note, especially in business transactions. It involves a third party agreeing to be responsible for the debt if the primary borrower defaults. This adds an extra layer of security for the lender, similar to how a promissory note guarantees repayment from the borrower.

A security agreement is used when a borrower pledges collateral to secure a loan. It details the specific assets that will serve as collateral. Like a promissory note, it outlines the borrower’s obligations. However, the security agreement emphasizes the rights of the lender to seize the collateral if the borrower fails to meet their obligations.

A lease agreement can also resemble a promissory note in that it involves a promise to pay. In a lease, a tenant agrees to pay rent to a landlord over a specified period. While it primarily focuses on the rental terms, the underlying promise to pay is similar to the commitments made in a promissory note.

A credit agreement is a comprehensive document that governs the terms of credit extended to a borrower. Like a promissory note, it outlines repayment terms and interest rates. However, it often includes additional provisions regarding the borrower’s financial covenants and the lender’s rights in case of default, offering a more detailed framework for the borrowing relationship.

A bond is a formal debt instrument used by corporations or governments to raise funds. Investors purchase bonds, effectively lending money in exchange for periodic interest payments and the return of principal at maturity. Similar to a promissory note, a bond represents a promise to repay, but it typically involves larger sums and a more complex structure, including various terms and conditions.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note in Tennessee is a written promise to pay a specific amount of money to a designated person or bearer at a specified time. |

| Governing Law | The Tennessee Uniform Commercial Code (UCC) governs promissory notes, specifically under Title 47, Chapter 3. |

| Parties Involved | Typically, a promissory note involves two parties: the maker (the borrower) and the payee (the lender). |

| Interest Rate | The note can specify an interest rate, which must comply with Tennessee's usury laws to avoid excessive charges. |

| Payment Terms | Payment terms can vary, including options for installment payments or a lump sum at maturity. |

| Transferability | Promissory notes in Tennessee are generally transferable, allowing the payee to sell or assign the note to another party. |

| Enforceability | A properly executed promissory note is legally enforceable, provided it meets all necessary legal requirements. |

Additional State-specific Promissory Note Forms

Florida Promissory Note Requirements - A promissory note does not replace a formal contract but complements it.

The Colorado Hold Harmless Agreement form is a legal document used to ensure that one party is not held liable for the risks assumed by another party. It serves as a risk transfer mechanism, providing protection from claims, liabilities, or losses. This critical form is commonly used in various business arrangements and construction projects across Colorado, highlighting its importance in managing potential legal issues. For more information, you can refer to Colorado PDF Forms.

Promissory Note Template Arizona - Provides a framework for financial transactions without needing a bank.

Should a Promissory Note Be Notarized - It serves as proof of debt and can be used in legal proceedings if needed.

Promissory Note Template California Word - Legal protections vary by state, so understanding local regulations is important for both parties.

Sample - Tennessee Promissory Note Form

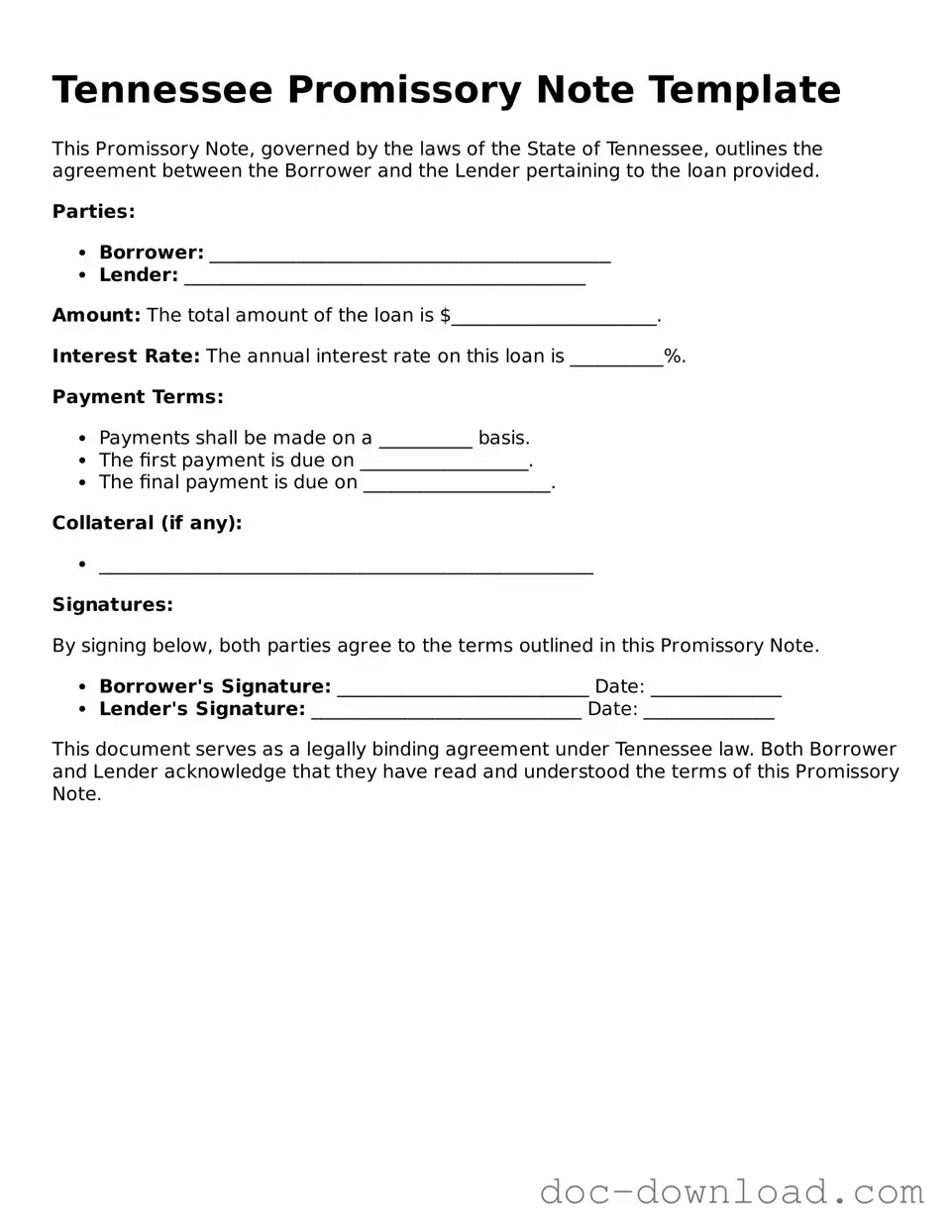

Tennessee Promissory Note Template

This Promissory Note, governed by the laws of the State of Tennessee, outlines the agreement between the Borrower and the Lender pertaining to the loan provided.

Parties:

- Borrower: ___________________________________________

- Lender: ___________________________________________

Amount: The total amount of the loan is $______________________.

Interest Rate: The annual interest rate on this loan is __________%.

Payment Terms:

- Payments shall be made on a __________ basis.

- The first payment is due on __________________.

- The final payment is due on ____________________.

Collateral (if any):

- _____________________________________________________

Signatures:

By signing below, both parties agree to the terms outlined in this Promissory Note.

- Borrower's Signature: ___________________________ Date: ______________

- Lender's Signature: _____________________________ Date: ______________

This document serves as a legally binding agreement under Tennessee law. Both Borrower and Lender acknowledge that they have read and understood the terms of this Promissory Note.