Blank Operating Agreement Document for Tennessee

When forming a limited liability company (LLC) in Tennessee, one crucial document comes into play: the Operating Agreement. This form serves as the backbone of the business structure, outlining the rights, responsibilities, and obligations of each member involved. It details how the company will be managed, how profits and losses will be distributed, and the procedures for adding or removing members. Additionally, the Operating Agreement helps to clarify decision-making processes, ensuring that all members are on the same page regarding the direction of the business. While Tennessee law does not mandate an Operating Agreement, having one in place can protect personal assets and provide a clear framework for resolving disputes. By addressing key aspects such as management structure, financial arrangements, and member roles, this document fosters transparency and stability within the LLC. Understanding the importance of the Tennessee Operating Agreement form is essential for anyone looking to establish a successful business venture in the Volunteer State.

Similar forms

The Tennessee Operating Agreement form is quite similar to the LLC Operating Agreement, which is a foundational document for Limited Liability Companies. Both documents outline the management structure and operational procedures of the business. They serve to clarify the roles and responsibilities of members, ensuring that everyone is on the same page regarding how the company will be run. This agreement helps to protect the interests of the members and can be crucial in preventing disputes down the line.

Another document that shares similarities is the Partnership Agreement. Like the Operating Agreement, this document outlines the terms of the partnership, including the contributions of each partner, profit-sharing arrangements, and management responsibilities. Both agreements emphasize the importance of clear communication and expectations among members or partners, fostering a cooperative environment for business operations.

The Colorado Notice to Quit form is a pivotal legal document utilized by landlords to notify tenants of lease violations, such as non-payment of rent, while demanding necessary corrections or vacating the premises. This form plays a crucial role in the landlord-tenant relationship by providing tenants an opportunity to address grievances before legal actions are taken. For those seeking more information about similar forms, the Colorado PDF Forms can serve as a valuable resource.

The Corporate Bylaws are also comparable to the Tennessee Operating Agreement. While Bylaws are specific to corporations, they serve a similar purpose in defining the governance structure and operational guidelines. Both documents detail how decisions are made, the roles of officers or managers, and the procedures for meetings. This ensures that all members understand the rules that govern their business entity.

The Shareholders’ Agreement has parallels with the Operating Agreement as well. This document is used primarily in corporations and outlines the rights and obligations of shareholders. Similar to an Operating Agreement, it addresses issues such as the transfer of shares, voting rights, and how disputes will be resolved. Both documents aim to protect the interests of their respective members or shareholders.

The Joint Venture Agreement is another document that resembles the Tennessee Operating Agreement. This agreement is formed when two or more parties collaborate on a specific project or business activity. Like the Operating Agreement, it defines the roles, contributions, and profit-sharing arrangements of each party involved. Both documents are essential for establishing clear expectations and responsibilities to avoid misunderstandings.

The Non-Disclosure Agreement (NDA) may not seem directly related, but it shares the goal of protecting interests. While the Operating Agreement focuses on operational procedures, an NDA safeguards confidential information shared between parties. Both documents help to establish trust and security in business relationships, ensuring that sensitive information remains protected.

The Employment Agreement is similar in that it outlines the terms and conditions of employment, much like how an Operating Agreement outlines the roles of members. Both documents define expectations, responsibilities, and the rights of the parties involved. They are essential for ensuring that everyone understands their role and what is expected of them within the organization.

The Franchise Agreement also bears resemblance to the Tennessee Operating Agreement. This document outlines the terms under which a franchisee can operate a business under the franchisor's brand. Like the Operating Agreement, it details the rights and responsibilities of both parties, including operational guidelines and financial arrangements. Both agreements are crucial for maintaining consistency and clarity in business operations.

Lastly, the Memorandum of Understanding (MOU) is somewhat akin to the Operating Agreement. An MOU outlines the intentions and expectations of parties entering into a collaborative arrangement. While it may not be as binding as an Operating Agreement, it serves a similar purpose in establishing a clear framework for cooperation and collaboration. Both documents emphasize the importance of mutual understanding and cooperation in achieving common goals.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | The Tennessee Operating Agreement outlines the management and operational procedures of a limited liability company (LLC) in Tennessee. |

| Governing Law | The agreement is governed by the Tennessee Limited Liability Company Act, codified in Title 48, Chapter 249 of the Tennessee Code Annotated. |

| Membership Structure | It specifies the rights and responsibilities of members, including voting rights and profit distribution. |

| Flexibility | The agreement allows for customization, enabling members to tailor the provisions to fit their specific needs and business goals. |

| Legal Protection | Having an operating agreement can provide legal protection for members by clearly outlining the operational framework and reducing potential disputes. |

| Not Mandatory | While not required by law, it is highly recommended for all LLCs in Tennessee to have an operating agreement to ensure clarity and structure. |

Additional State-specific Operating Agreement Forms

Form Llc Indiana - The agreement may detail how profits and losses are distributed.

To efficiently transfer ownership of property, it's essential to understand the requirements and implications of using a Colorado Quitclaim Deed. This form is particularly beneficial in scenarios involving familiar parties, such as family members or during divorce settlements. To facilitate the process, you can find a fillable version of the form at https://quitclaimdocs.com/fillable-colorado-quitclaim-deed/, which will help ensure all necessary information is accurately completed.

Missouri Llc Operating Agreement - It acts as a reference for members to understand their rights and duties.

Operating Agreement Llc Texas Template - It can include non-compete clauses for members or key employees.

Sample - Tennessee Operating Agreement Form

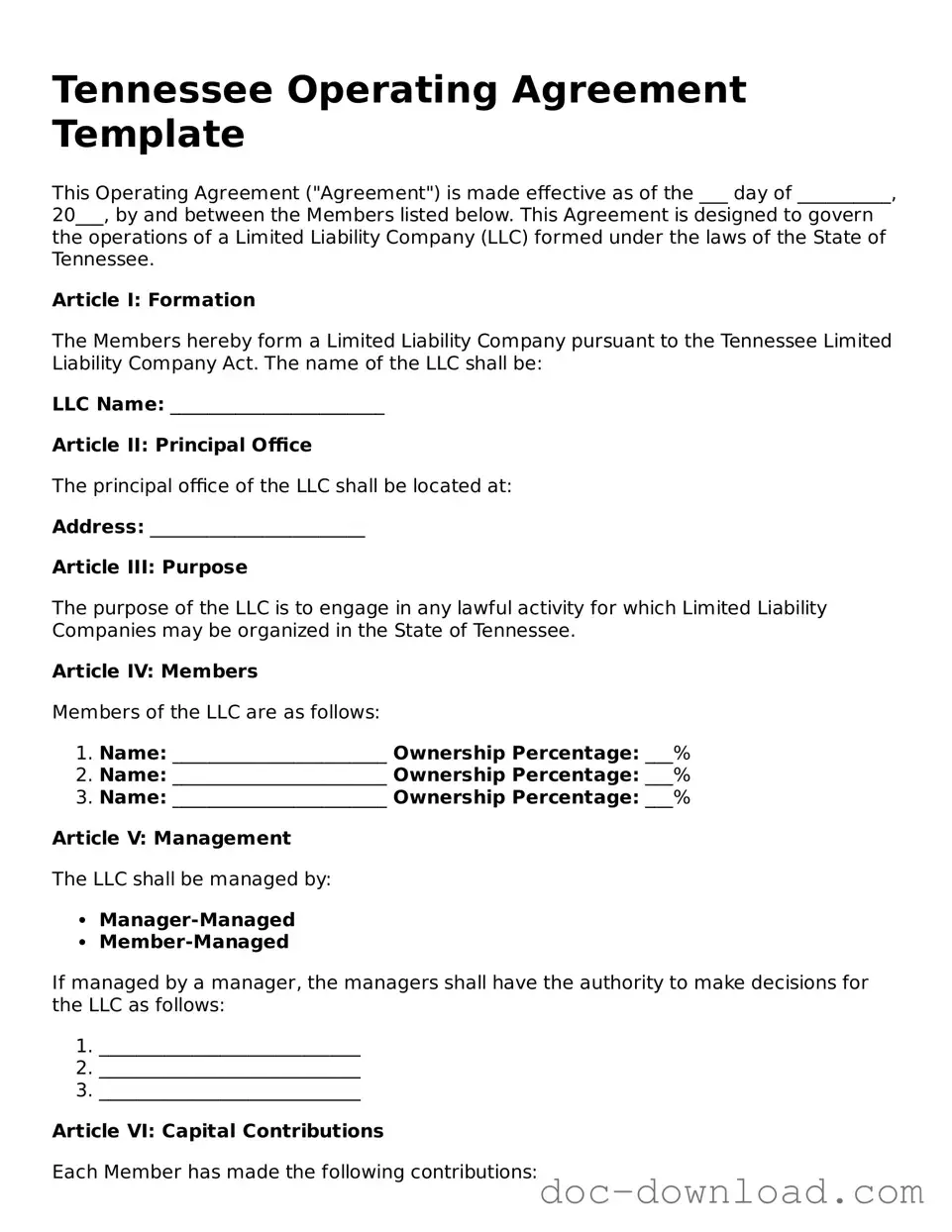

Tennessee Operating Agreement Template

This Operating Agreement ("Agreement") is made effective as of the ___ day of __________, 20___, by and between the Members listed below. This Agreement is designed to govern the operations of a Limited Liability Company (LLC) formed under the laws of the State of Tennessee.

Article I: Formation

The Members hereby form a Limited Liability Company pursuant to the Tennessee Limited Liability Company Act. The name of the LLC shall be:

LLC Name: _______________________

Article II: Principal Office

The principal office of the LLC shall be located at:

Address: _______________________

Article III: Purpose

The purpose of the LLC is to engage in any lawful activity for which Limited Liability Companies may be organized in the State of Tennessee.

Article IV: Members

Members of the LLC are as follows:

- Name: _______________________ Ownership Percentage: ___%

- Name: _______________________ Ownership Percentage: ___%

- Name: _______________________ Ownership Percentage: ___%

Article V: Management

The LLC shall be managed by:

- Manager-Managed

- Member-Managed

If managed by a manager, the managers shall have the authority to make decisions for the LLC as follows:

- ____________________________

- ____________________________

- ____________________________

Article VI: Capital Contributions

Each Member has made the following contributions:

- Name: _______________________ Contribution Amount: $__________

- Name: _______________________ Contribution Amount: $__________

- Name: _______________________ Contribution Amount: $__________

Article VII: Profit and Loss Allocation

Profits and losses of the LLC shall be allocated to the Members in proportion to their ownership percentages as follows:

Allocation Method: _______________________

Article VIII: Dissolution

The LLC may be dissolved upon:

- The written consent of all Members.

- The sale of substantially all LLC assets.

- The entry of a decree of judicial dissolution.

Upon dissolution, the assets of the LLC will be distributed as follows:

Distribution Method: _______________________

Article IX: Amendments

This Agreement may be amended only by a written agreement signed by all Members.

IN WITNESS WHEREOF, the Members have executed this Operating Agreement as of the date first above written.

Member Signatures:

_______________________________

_______________________________

_______________________________