Blank Durable Power of Attorney Document for Tennessee

In Tennessee, a Durable Power of Attorney (DPOA) is a crucial legal document that allows individuals to appoint someone they trust to make decisions on their behalf, particularly in financial and healthcare matters. This form remains effective even if the person who created it becomes incapacitated, ensuring that their wishes are honored when they can no longer communicate them. The DPOA can cover a wide range of powers, from managing bank accounts and real estate to making medical decisions. It's essential to choose an agent wisely, as this person will have significant authority over your affairs. Additionally, the form must be signed and notarized to be legally binding, and it is advisable to discuss your choices with your agent beforehand. Understanding the implications of a Durable Power of Attorney is vital for anyone considering this option, as it can significantly impact your future and the management of your assets.

Similar forms

The Tennessee Durable Power of Attorney (DPOA) form shares similarities with the General Power of Attorney (GPOA). Both documents allow individuals to appoint someone else to manage their financial and legal affairs. However, the key difference lies in the durability aspect. A GPOA becomes ineffective if the principal becomes incapacitated, while a DPOA remains in effect even if the principal can no longer make decisions for themselves. This feature makes the DPOA particularly useful for long-term planning and ensuring that one’s affairs are handled continuously, regardless of health changes.

Another document that resembles the DPOA is the Healthcare Power of Attorney (HPOA). Like the DPOA, the HPOA enables individuals to designate someone to make decisions on their behalf. However, the HPOA specifically pertains to medical and healthcare-related decisions. In contrast, the DPOA focuses on financial and legal matters. Both documents empower trusted individuals to act in the best interest of the principal, ensuring that their wishes are respected when they are unable to communicate them directly.

The Living Will is also similar to the DPOA in that it addresses the principal’s wishes regarding medical treatment and end-of-life care. While the DPOA allows someone to make decisions for the principal, the Living Will outlines the principal’s own preferences regarding life-sustaining treatment. This document serves as a guide for healthcare providers and family members, ensuring that the principal's desires are honored when they cannot express them. Together, these documents create a comprehensive approach to managing both health and financial matters.

For anyone needing to finalize ownership transfers, understanding the implications of a properly executed bill of sale is vital. You can find more information on the process in this guide to the comprehensive bill of sale form, which outlines necessary considerations and steps to follow.

Lastly, the Revocable Trust shares some characteristics with the DPOA, especially in terms of managing assets. A Revocable Trust allows individuals to place their assets into a trust, which can be managed by a trustee. The principal retains control over the trust while they are alive and can make changes as needed. Similar to the DPOA, a Revocable Trust can help ensure that assets are managed according to the principal’s wishes, particularly if they become incapacitated. Both documents facilitate the smooth handling of affairs, but the Revocable Trust also provides a mechanism for asset distribution after death.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney in Tennessee allows an individual to designate another person to make financial and legal decisions on their behalf. |

| Durability | This type of power of attorney remains effective even if the principal becomes incapacitated. |

| Governing Law | The Tennessee Durable Power of Attorney is governed by Tennessee Code Annotated, Title 34, Chapter 6. |

| Principal | The person who creates the Durable Power of Attorney is referred to as the principal. |

| Agent | The individual designated to act on behalf of the principal is known as the agent or attorney-in-fact. |

| Limitations | While the agent has broad authority, certain limitations can be specified in the document itself. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are competent. |

| Notarization | Although notarization is not required, it is recommended to ensure the document's validity and to prevent disputes. |

Additional State-specific Durable Power of Attorney Forms

Mo Poa - A Durable Power of Attorney helps to ensure continuity in management of your affairs.

A Colorado Non-disclosure Agreement form serves as a legally binding document between two parties, designed to protect confidential information from being disclosed. This form is specifically tailored to meet the legal requirements of the state of Colorado, ensuring that sensitive details, shared during business transactions or partnerships, remain secure. For those looking for templates or additional resources, Colorado PDF Forms can be a valuable source, helping to safeguard the integrity of proprietary information.

Florida Durable Power of Attorney Form 2023 - Prior to executing the form, a discussion between the principal and agent is often beneficial.

Massachusetts Power of Attorney Requirements - It is advisable to discuss your wishes with your appointed agent to ensure they understand your preferences and intentions.

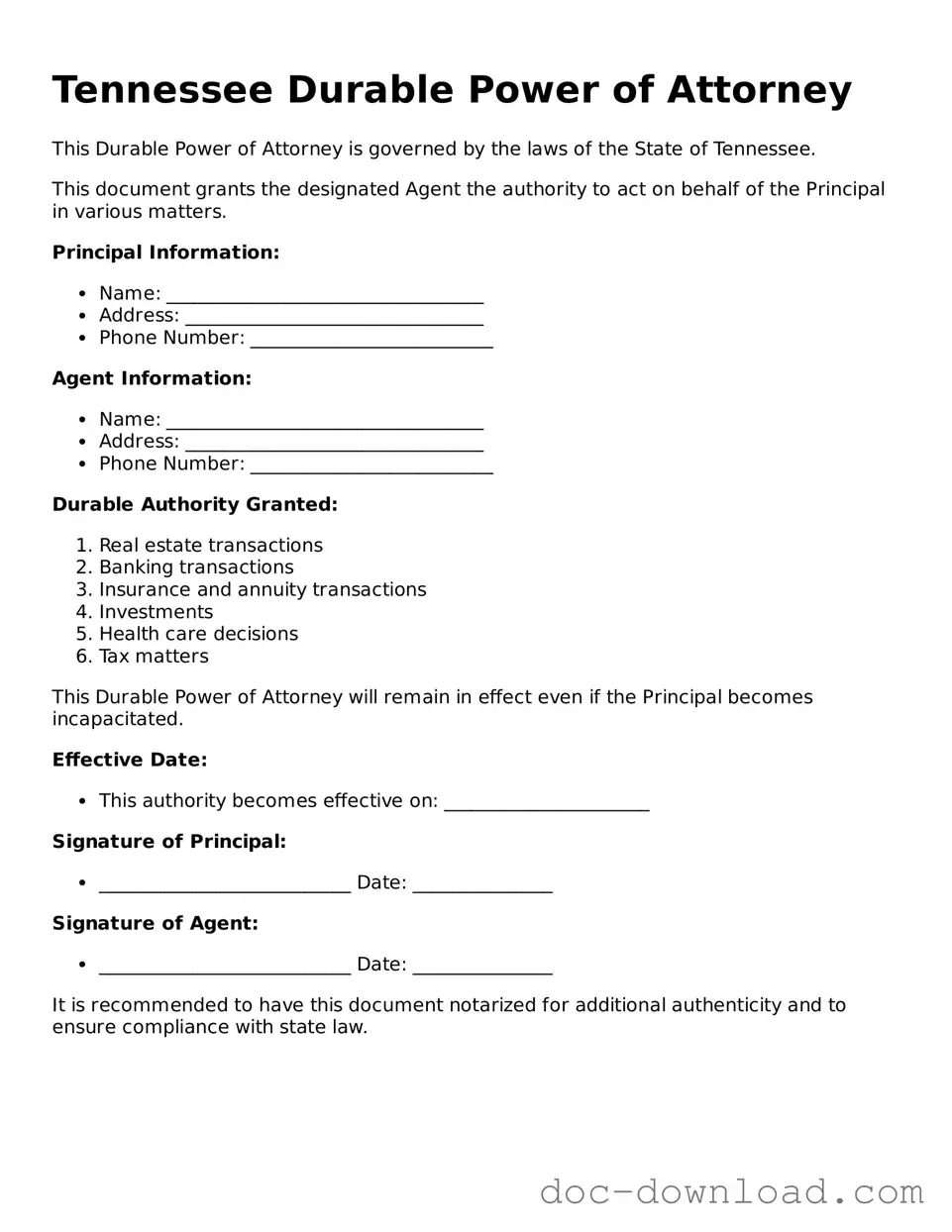

Sample - Tennessee Durable Power of Attorney Form

Tennessee Durable Power of Attorney

This Durable Power of Attorney is governed by the laws of the State of Tennessee.

This document grants the designated Agent the authority to act on behalf of the Principal in various matters.

Principal Information:

- Name: __________________________________

- Address: ________________________________

- Phone Number: __________________________

Agent Information:

- Name: __________________________________

- Address: ________________________________

- Phone Number: __________________________

Durable Authority Granted:

- Real estate transactions

- Banking transactions

- Insurance and annuity transactions

- Investments

- Health care decisions

- Tax matters

This Durable Power of Attorney will remain in effect even if the Principal becomes incapacitated.

Effective Date:

- This authority becomes effective on: ______________________

Signature of Principal:

- ___________________________ Date: _______________

Signature of Agent:

- ___________________________ Date: _______________

It is recommended to have this document notarized for additional authenticity and to ensure compliance with state law.