Printable Single-Member Operating Agreement Template

When establishing a single-member LLC, having a well-crafted operating agreement is essential. The Single-Member Operating Agreement serves as a foundational document that outlines the management structure, operational procedures, and financial arrangements of the business. This agreement clearly delineates the rights and responsibilities of the sole member, ensuring that personal and business liabilities remain separate. It typically includes key components such as the purpose of the LLC, details on how profits and losses will be handled, and the process for making decisions. Furthermore, it can address the transfer of ownership and outline procedures for dissolution if necessary. By formalizing these aspects, the operating agreement not only enhances the legitimacy of the LLC but also provides a clear roadmap for the business's future, reducing the potential for disputes and misunderstandings.

Similar forms

A Single-Member Operating Agreement is similar to a Partnership Agreement, which outlines the roles, responsibilities, and profit-sharing arrangements between partners in a business. While a Single-Member Operating Agreement focuses on a sole owner, a Partnership Agreement must address multiple parties. Both documents serve to clarify the operational structure and can help prevent misunderstandings among the parties involved. Additionally, they can provide guidelines for decision-making processes and outline procedures for resolving disputes, ensuring that all parties are on the same page regarding the management of the business.

Another document that resembles a Single-Member Operating Agreement is the Bylaws of a Corporation. Bylaws govern the internal management of a corporation and detail how the corporation will operate, including the roles of directors and officers, meeting procedures, and voting rights. Although Bylaws are typically used for corporations with multiple shareholders, they share a common goal with Single-Member Operating Agreements: to provide a clear framework for governance and decision-making. Both documents are essential for maintaining order and clarity in business operations.

In New Jersey, creating a comprehensive Partnership Agreement is essential for ensuring each party's rights and responsibilities are clearly delineated. Much like a Single-Member Operating Agreement, this document establishes crucial terms such as profit-sharing ratios and decision-making processes to avoid misunderstandings. For businesses looking for resources, the NJ PDF Forms can provide valuable templates and guidelines to assist in establishing sound agreements that foster clear communication among partners.

The third document is the LLC Membership Agreement, which is utilized in multi-member limited liability companies. Similar to a Single-Member Operating Agreement, an LLC Membership Agreement outlines the rights and responsibilities of each member. It includes provisions for profit distribution, management duties, and procedures for adding or removing members. While the Single-Member Operating Agreement focuses solely on one owner, the LLC Membership Agreement emphasizes collaboration among multiple members, yet both serve to protect the interests of the owners and establish a clear operational structure.

Lastly, the Sole Proprietorship Agreement is another document that shares similarities with a Single-Member Operating Agreement. This agreement outlines the terms under which a sole proprietor operates their business, including financial arrangements, responsibilities, and business practices. While a Sole Proprietorship Agreement may be less formal than a Single-Member Operating Agreement, both documents emphasize the importance of clarity in business operations. They help define the scope of the business and the owner's role, ensuring that the owner has a solid foundation for managing their enterprise.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Single-Member Operating Agreement outlines the management structure and operational guidelines for a single-member LLC. |

| Purpose | This document helps establish the legal framework for the LLC and protects the owner's personal assets. |

| State Specificity | Operating agreements can vary by state, so it's important to follow the laws of the state where the LLC is formed. |

| Governing Law | Common governing laws include the Delaware Limited Liability Company Act and the California Corporations Code, among others. |

| Flexibility | The agreement allows for flexibility in defining roles, responsibilities, and operational procedures. |

| Not Mandatory | While not required by law in all states, having an operating agreement is highly recommended for clarity and legal protection. |

| Tax Implications | The agreement can influence how the LLC is taxed, particularly in terms of income distribution and deductions. |

| Amendments | Provisions for amendments can be included, allowing the owner to update the agreement as needed. |

Sample - Single-Member Operating Agreement Form

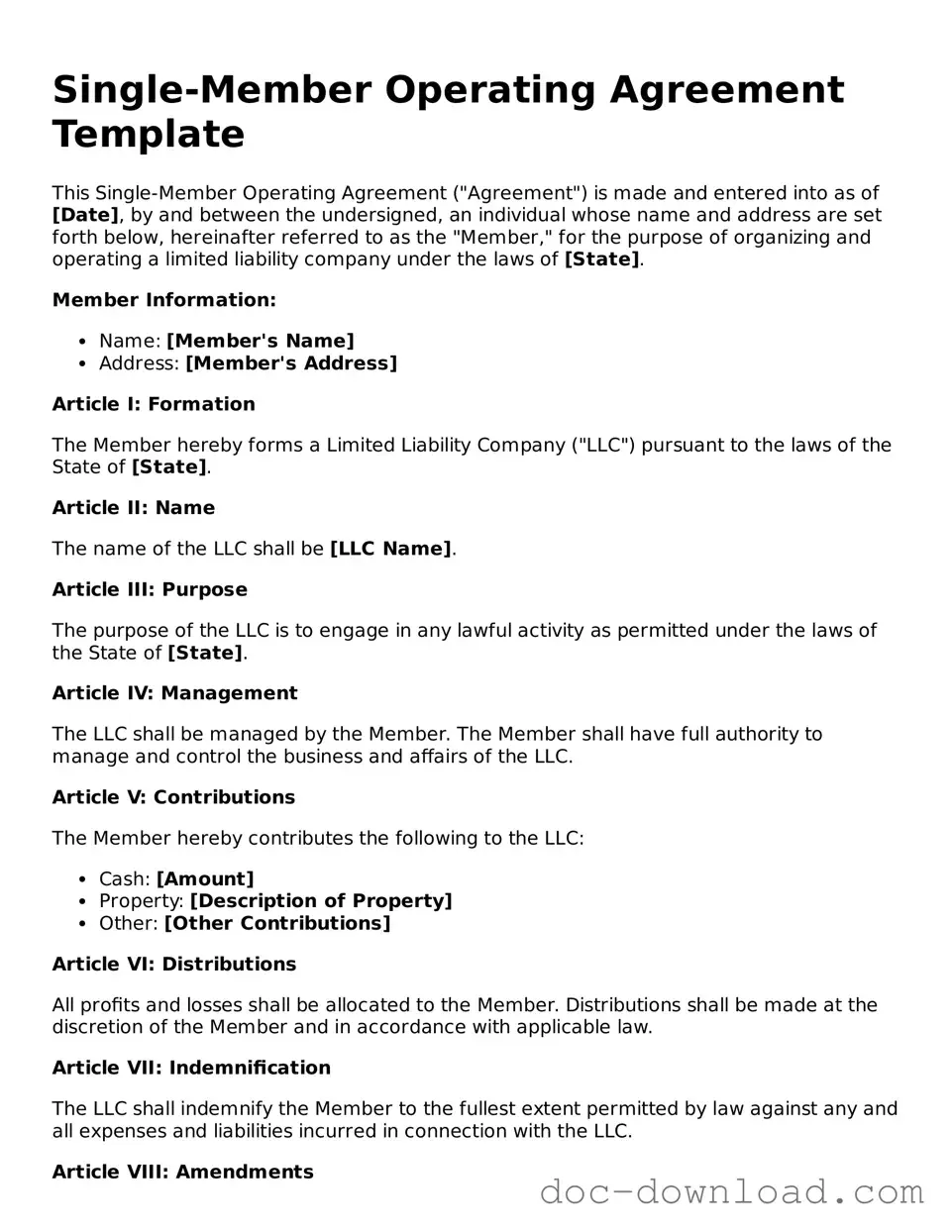

Single-Member Operating Agreement Template

This Single-Member Operating Agreement ("Agreement") is made and entered into as of [Date], by and between the undersigned, an individual whose name and address are set forth below, hereinafter referred to as the "Member," for the purpose of organizing and operating a limited liability company under the laws of [State].

Member Information:

- Name: [Member's Name]

- Address: [Member's Address]

Article I: Formation

The Member hereby forms a Limited Liability Company ("LLC") pursuant to the laws of the State of [State].

Article II: Name

The name of the LLC shall be [LLC Name].

Article III: Purpose

The purpose of the LLC is to engage in any lawful activity as permitted under the laws of the State of [State].

Article IV: Management

The LLC shall be managed by the Member. The Member shall have full authority to manage and control the business and affairs of the LLC.

Article V: Contributions

The Member hereby contributes the following to the LLC:

- Cash: [Amount]

- Property: [Description of Property]

- Other: [Other Contributions]

Article VI: Distributions

All profits and losses shall be allocated to the Member. Distributions shall be made at the discretion of the Member and in accordance with applicable law.

Article VII: Indemnification

The LLC shall indemnify the Member to the fullest extent permitted by law against any and all expenses and liabilities incurred in connection with the LLC.

Article VIII: Amendments

This Agreement may be amended only by a written agreement signed by the Member.

Article IX: Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of [State].

IN WITNESS WHEREOF, the Member has executed this Single-Member Operating Agreement as of the day and year first above written.

Signature: ______________________

Member Name: [Member's Name]