Printable Release of Promissory Note Template

The Release of Promissory Note form plays a crucial role in the realm of financial transactions, particularly when it comes to documenting the satisfaction of a debt. This form serves as a formal declaration that a borrower has fulfilled their obligations under a promissory note, effectively releasing them from any further liability associated with that debt. By signing this document, the lender acknowledges that the borrower has repaid the loan in full, which can include the principal amount along with any accrued interest. The form typically includes essential details such as the names of the parties involved, the original loan amount, the date of repayment, and any relevant account numbers. It is important for both parties to retain a copy of this release, as it provides legal protection and clarity in future financial dealings. Furthermore, the document may also specify any conditions or terms that were agreed upon during the repayment process, ensuring that both the lender and borrower are on the same page. Understanding the significance of this form can help individuals navigate their financial responsibilities with confidence.

Similar forms

The Release of Promissory Note form is similar to a Satisfaction of Mortgage document. Both serve to confirm that a financial obligation has been fulfilled. In the case of a Satisfaction of Mortgage, the lender acknowledges that the borrower has paid off their mortgage in full. This document is essential for the borrower to clear the title to their property, just as the Release of Promissory Note indicates that the debt associated with the note has been satisfied.

Another document that parallels the Release of Promissory Note is the Deed of Reconveyance. This document is used in the context of a trust deed and signifies that the lender has relinquished their interest in the property once the borrower has paid off their loan. Similar to the Release of Promissory Note, the Deed of Reconveyance provides the borrower with proof that they have fulfilled their financial obligation, allowing them to regain full ownership without any encumbrances.

The Certificate of Satisfaction also shares similarities with the Release of Promissory Note. This certificate is issued when a borrower has completely paid off a loan. It serves as official documentation that the lender acknowledges the debt has been settled. Like the Release of Promissory Note, this certificate is crucial for the borrower to maintain a clear financial record and avoid any future disputes regarding the status of their debt.

Additionally, it is important to understand that having a clear and formalized agreement in place, such as a Pennsylvania Promissory Note form, is essential in various financial transactions. This ensures that all parties are aware of their rights and obligations, avoiding misunderstandings that could lead to disputes. For those seeking comprehensive resources, you can access All Pennsylvania Forms to find the necessary documentation to support these agreements.

A Release of Lien document can also be compared to the Release of Promissory Note. When a lien is placed on a property due to unpaid debts, the Release of Lien serves to remove that claim once the debt is satisfied. Both documents provide assurance to the borrower that they are no longer bound by the debt, thereby restoring their financial freedom and property rights.

The Loan Payoff Statement is another document that is similar in nature. This statement details the total amount needed to pay off a loan, and once the payment is made, the lender typically issues a release confirming that the loan has been settled. Like the Release of Promissory Note, this document is vital for the borrower to understand their financial standing and to ensure that they are no longer liable for the loan.

Lastly, the Final Payment Receipt is akin to the Release of Promissory Note. This receipt serves as proof that the borrower has made the final payment on their loan. It confirms that the financial obligation has been met, similar to the release provided by the promissory note. Both documents are important for record-keeping and provide peace of mind to the borrower that they have fulfilled their commitments.

Document Overview

| Fact Name | Description |

|---|---|

| Purpose | The Release of Promissory Note form is used to officially acknowledge that a debt has been paid and the note is no longer valid. |

| Parties Involved | This form typically involves the lender and the borrower, confirming the release of the debt obligation. |

| State-Specific Laws | In many states, such as California, the release is governed by the California Civil Code, which outlines the requirements for debt release documentation. |

| Importance of Documentation | Properly completing this form is crucial to protect both parties and prevent future disputes regarding the debt. |

Other Release of Promissory Note Templates:

Promissary Note Template - Encourages responsible management of car loans among borrowers.

When dealing with financial agreements, a reliable resource for understanding the New Jersey Promissory Note is indispensable. Explore our in-depth guide to the invaluable New Jersey Promissory Note essentials to ensure you are well-informed about this important document.

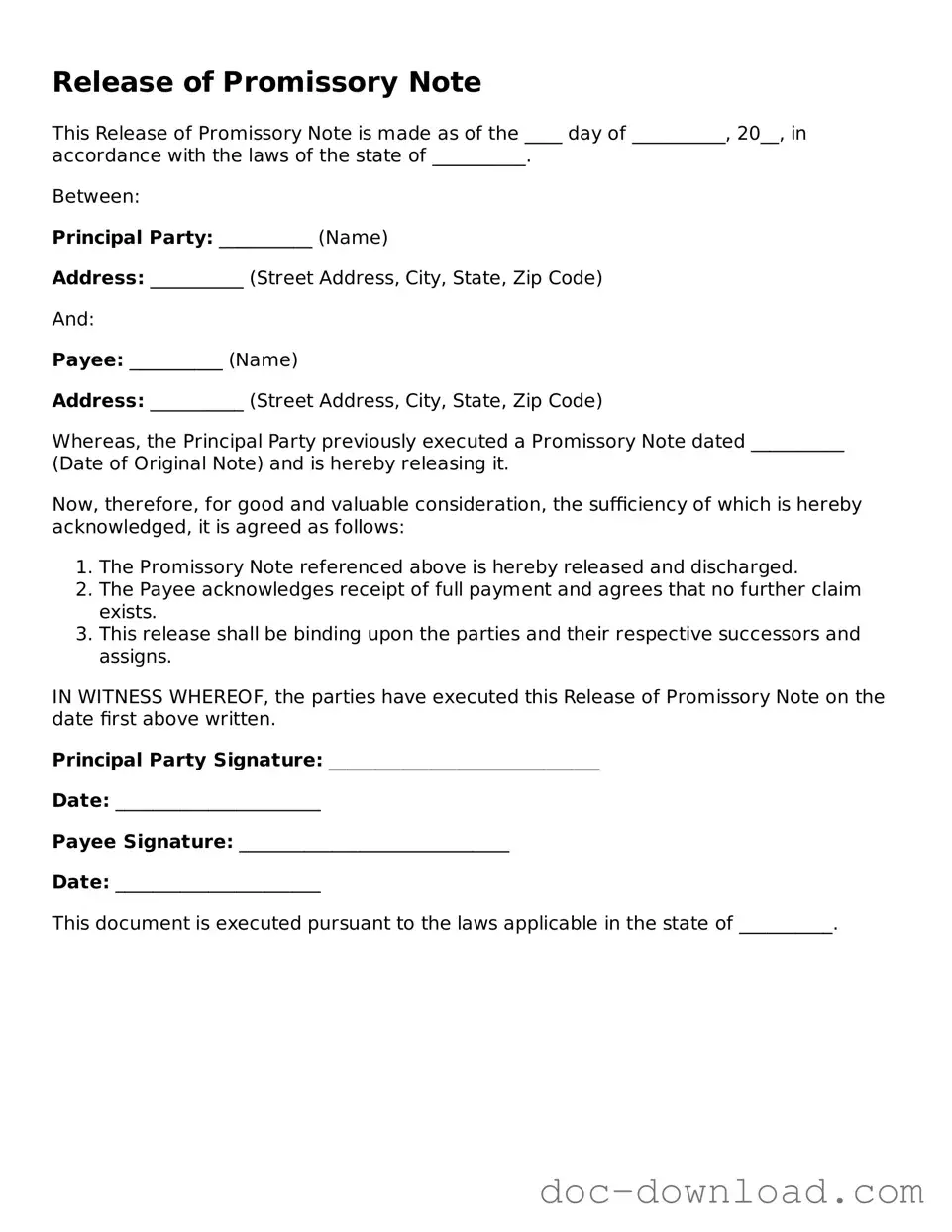

Sample - Release of Promissory Note Form

Release of Promissory Note

This Release of Promissory Note is made as of the ____ day of __________, 20__, in accordance with the laws of the state of __________.

Between:

Principal Party: __________ (Name)

Address: __________ (Street Address, City, State, Zip Code)

And:

Payee: __________ (Name)

Address: __________ (Street Address, City, State, Zip Code)

Whereas, the Principal Party previously executed a Promissory Note dated __________ (Date of Original Note) and is hereby releasing it.

Now, therefore, for good and valuable consideration, the sufficiency of which is hereby acknowledged, it is agreed as follows:

- The Promissory Note referenced above is hereby released and discharged.

- The Payee acknowledges receipt of full payment and agrees that no further claim exists.

- This release shall be binding upon the parties and their respective successors and assigns.

IN WITNESS WHEREOF, the parties have executed this Release of Promissory Note on the date first above written.

Principal Party Signature: _____________________________

Date: ______________________

Payee Signature: _____________________________

Date: ______________________

This document is executed pursuant to the laws applicable in the state of __________.