Printable Real Estate Purchase Agreement Template

When embarking on the journey of buying or selling a property, one essential document comes into play: the Real Estate Purchase Agreement. This legally binding contract outlines the terms and conditions agreed upon by both the buyer and the seller, serving as a roadmap for the transaction. Key elements of the agreement include the purchase price, financing details, and contingencies that may affect the sale, such as inspections or appraisals. Additionally, the form specifies important dates, including the closing date, and outlines the responsibilities of each party during the process. By clearly defining the rights and obligations of both the buyer and seller, this agreement helps to minimize misunderstandings and disputes, ensuring a smoother transaction. Understanding the components of the Real Estate Purchase Agreement is crucial for anyone involved in real estate, whether you are a first-time buyer, a seasoned investor, or a seller looking to make a successful sale.

State-specific Guidelines for Real Estate Purchase Agreement Forms

Real Estate Purchase Agreement Document Subtypes

Similar forms

The Real Estate Purchase Agreement (REPA) is similar to a Lease Agreement in that both documents outline the terms of property use. A Lease Agreement specifies the rights and obligations of both the landlord and tenant, detailing the duration of the lease, payment terms, and maintenance responsibilities. Like the REPA, it serves to protect the interests of both parties, ensuring clarity and mutual understanding regarding the use of the property. While the REPA is focused on the sale of property, the Lease Agreement is centered around rental arrangements.

Another document akin to the REPA is the Option to Purchase Agreement. This document grants a potential buyer the right to purchase a property within a specified timeframe, often for a predetermined price. Similar to the REPA, it outlines essential terms, such as the purchase price and the duration of the option. However, it differs in that it does not require the buyer to complete the purchase, providing flexibility for the buyer while still offering the seller a level of security regarding their property.

In addition to the various agreements mentioned, understanding the documentation surrounding workers' compensation is crucial for both employers and employees. The Georgia WC-100 form plays a significant role in this process by facilitating settlement mediation. It serves to streamline communication and establish mutual understanding regarding claims. For further details on related documentation, you can refer to the Georgia PDF Forms.

The Purchase and Sale Agreement (PSA) shares many similarities with the REPA, as both documents are used in the context of real estate transactions. A PSA outlines the terms of the sale, including the purchase price, contingencies, and closing details. The main distinction lies in the terminology and specific provisions, as the PSA may be more comprehensive, addressing additional elements like seller disclosures and title insurance, which can be crucial for both parties in a transaction.

A Buyer’s Agency Agreement is another document that bears resemblance to the REPA. This agreement establishes a relationship between a buyer and a real estate agent, detailing the agent's responsibilities and the buyer's obligations. While the REPA focuses on the transaction itself, the Buyer’s Agency Agreement emphasizes the representation and support the agent provides throughout the purchasing process, ensuring that the buyer’s interests are prioritized.

The Listing Agreement is similar to the REPA in that it involves the sale of real estate, but it is specifically for sellers. This document establishes a relationship between the seller and a real estate agent, granting the agent the authority to market and sell the property. Like the REPA, it includes important details such as the listing price and commission structure, but it is focused on the seller's side of the transaction, outlining the agent's role in facilitating the sale.

The Seller Disclosure Statement is also comparable to the REPA, as it is often a part of the real estate transaction process. This document requires the seller to disclose known issues or defects related to the property. While the REPA formalizes the agreement to buy and sell, the Seller Disclosure Statement ensures that buyers are fully informed about the property's condition, thus fostering transparency and trust in the transaction.

A Joint Venture Agreement can be likened to the REPA in scenarios where two or more parties collaborate to purchase real estate. This document outlines the terms of the partnership, including each party's contributions, responsibilities, and profit-sharing arrangements. Like the REPA, it is designed to protect the interests of all parties involved, ensuring that each member of the joint venture understands their role and the expectations for the investment.

Finally, a Real Estate Investment Trust (REIT) Agreement shares similarities with the REPA in the context of property investment. A REIT Agreement outlines the terms under which investors pool their resources to invest in real estate properties. Both documents focus on the acquisition and management of real estate assets, but the REIT Agreement typically involves a larger group of investors and may include specific provisions related to the management and distribution of profits from the investment.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Real Estate Purchase Agreement is a legal document outlining the terms of a property sale between a buyer and a seller. |

| Parties Involved | The agreement typically involves two main parties: the buyer and the seller of the property. |

| Property Description | The agreement must include a detailed description of the property being sold, including its address and any specific features. |

| Purchase Price | The purchase price is clearly stated in the agreement, along with the payment terms and any deposits required. |

| Contingencies | Common contingencies may include financing, inspections, and the sale of the buyer’s current home. |

| Closing Date | The agreement specifies a closing date, which is when the ownership of the property is officially transferred. |

| Governing Law | Each state has its own laws governing real estate transactions, and the agreement must comply with these laws. |

| Signatures | Both parties must sign the agreement for it to be legally binding, often in the presence of a witness or notary. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties to be enforceable. |

More Templates:

How to Terminate Parental Rights in Sc - Affidavits must be signed in the presence of a notary public for validation.

Landlords seeking to initiate the eviction process must ensure they utilize the correct protocols, and a key component of this is the Notice to Quit form, which formally communicates their intent to the tenant.

Sample Letter of Intent to Purchase Property - It may include contingencies that would need to be addressed in the final agreement.

Short Term Rental Agreement Template - Addresses pet policies and other restrictions for renters.

Sample - Real Estate Purchase Agreement Form

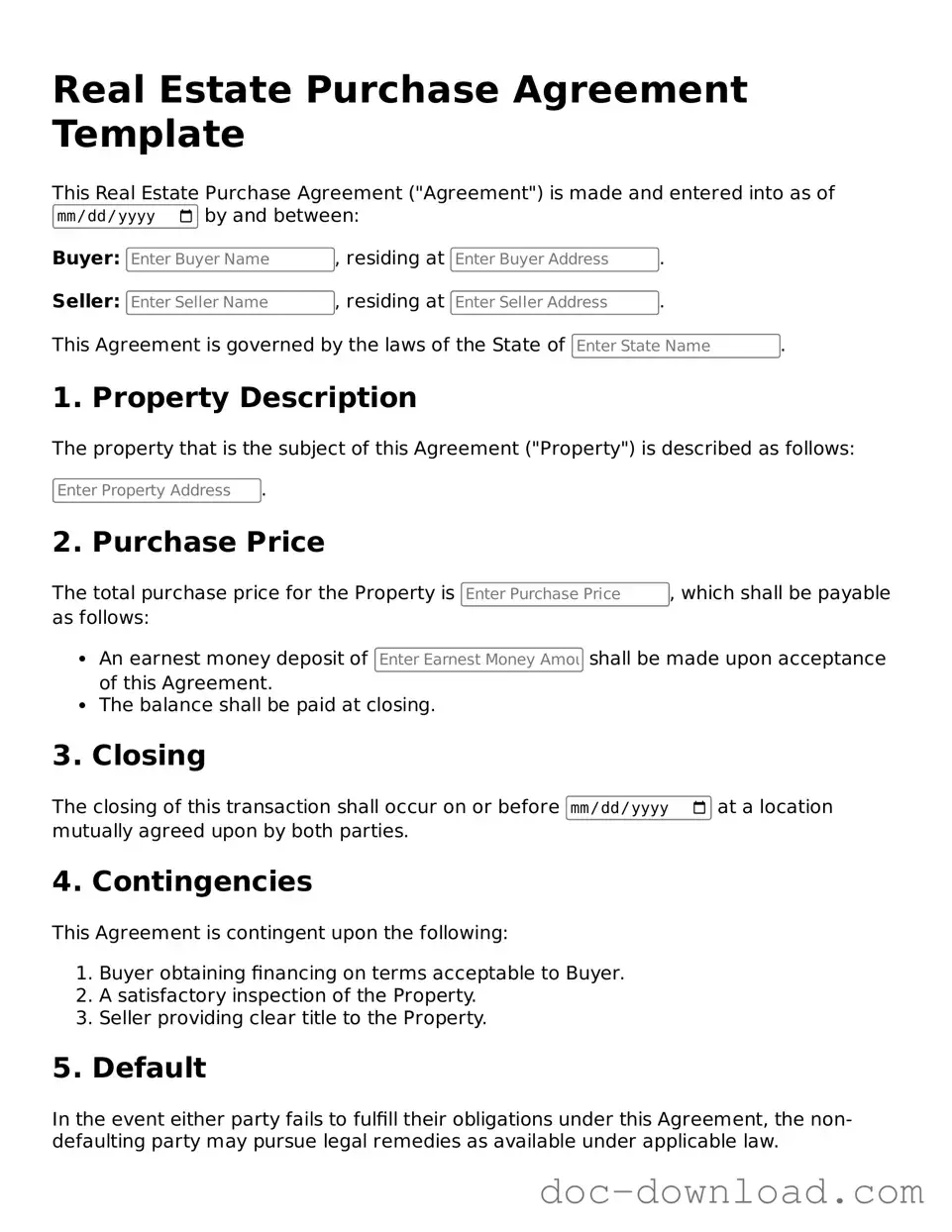

Real Estate Purchase Agreement Template

This Real Estate Purchase Agreement ("Agreement") is made and entered into as of by and between:

Buyer: , residing at .

Seller: , residing at .

This Agreement is governed by the laws of the State of .

1. Property Description

The property that is the subject of this Agreement ("Property") is described as follows:

.

2. Purchase Price

The total purchase price for the Property is , which shall be payable as follows:

- An earnest money deposit of shall be made upon acceptance of this Agreement.

- The balance shall be paid at closing.

3. Closing

The closing of this transaction shall occur on or before at a location mutually agreed upon by both parties.

4. Contingencies

This Agreement is contingent upon the following:

- Buyer obtaining financing on terms acceptable to Buyer.

- A satisfactory inspection of the Property.

- Seller providing clear title to the Property.

5. Default

In the event either party fails to fulfill their obligations under this Agreement, the non-defaulting party may pursue legal remedies as available under applicable law.

6. Governing Law

This Agreement shall be construed in accordance with the laws of the State of .

7. Signatures

IN WITNESS WHEREOF, the parties hereby execute this Real Estate Purchase Agreement as of the date first above written.

Buyer Signature: ______________________________________ Date:

Seller Signature: _____________________________________ Date:

Both parties agree to the terms outlined in this Agreement. Please ensure that all information is filled out correctly before signing.