Printable Promissory Note Template

The Promissory Note form serves as a critical document in various financial transactions, acting as a written promise from one party to another to repay a specified sum of money, typically with interest, by a certain date. This form outlines essential details such as the names of the borrower and lender, the amount borrowed, the interest rate, and the repayment schedule. It also includes provisions for late fees and the consequences of defaulting on the loan. While it may seem straightforward, the Promissory Note is an important tool that helps protect the rights of both parties involved. By clearly documenting the terms of the loan, it reduces misunderstandings and provides a reference point should disputes arise. Understanding the components of a Promissory Note is vital for anyone entering into a lending agreement, ensuring that both parties have a clear expectation of their responsibilities and obligations.

State-specific Guidelines for Promissory Note Forms

Promissory Note Document Subtypes

Similar forms

A loan agreement is a document that outlines the terms and conditions under which a borrower agrees to repay borrowed funds. Like a promissory note, it specifies the amount borrowed, the interest rate, and the repayment schedule. However, a loan agreement often includes more detailed provisions regarding collateral, default consequences, and the rights of both parties. This added complexity makes it suitable for larger loans or more formal lending situations.

A mortgage is a specific type of loan agreement that is secured by real property. Similar to a promissory note, it requires the borrower to repay the loan amount, but it also gives the lender a claim to the property if the borrower defaults. The mortgage document details the property being financed, the loan amount, and the terms of repayment, ensuring that both parties understand their rights and obligations regarding the property.

A personal guarantee is a document that holds an individual personally responsible for a debt if the borrowing entity fails to repay. This is similar to a promissory note in that it creates a legal obligation to pay. However, a personal guarantee typically accompanies other agreements, such as business loans, and serves to protect the lender by ensuring that personal assets can be pursued in case of default.

A security agreement is a document that outlines the collateral pledged by a borrower to secure a loan. It is similar to a promissory note in that it establishes a financial obligation, but it focuses on the collateral aspect. The security agreement details what assets are being used to secure the loan, giving the lender a legal claim to those assets in the event of default.

An installment agreement allows a borrower to pay off a debt in regular, scheduled payments. This document shares similarities with a promissory note, as both specify payment amounts and schedules. However, an installment agreement may cover various types of debts, including loans for goods or services, and can include additional terms regarding late fees and penalties.

A lease agreement is a contract between a lessor and a lessee for the rental of property. While it primarily governs the use of property rather than a loan, it shares characteristics with a promissory note in that it establishes payment obligations. Both documents outline the terms of payment, including the amount due and the payment schedule, ensuring clarity for both parties involved.

When managing financial responsibilities, it is crucial to understand the variety of documents available, including a Power of Attorney form that allows someone to act on your behalf in important decisions. For those in Colorado, utilizing resources like Colorado PDF Forms can assist in creating these important legal documents to ensure your choices are respected even when you are unable to make them yourself.

An IOU, or informal acknowledgment of a debt, is a simple document that indicates one party owes money to another. Like a promissory note, an IOU confirms a debt and outlines the amount owed. However, IOUs are typically less formal and may lack detailed terms regarding repayment, making them more suitable for personal loans or informal arrangements between friends or family.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person or entity at a specified time. |

| Parties Involved | The two main parties are the maker (the person who promises to pay) and the payee (the person who receives the payment). |

| Governing Law | Promissory notes are generally governed by the Uniform Commercial Code (UCC) in the United States, specifically Article 3. |

| Key Elements | A valid promissory note must include the principal amount, interest rate, maturity date, and the signatures of the maker and payee. |

| State-Specific Forms | Some states may have specific requirements for promissory notes, so it’s important to check local laws for compliance. |

| Enforceability | If properly executed, a promissory note is legally enforceable in court, allowing the payee to seek repayment if necessary. |

More Templates:

Employer's Quarterly Federal Tax Return - Form 941 helps the IRS and other stakeholders understand employment trends within various industries.

Warranty on Roof - Documentation must be kept in a safe place for future reference regarding the warranty.

When completing a property transfer, it's essential to utilize the correct documentation, and for those in Colorado, a Quitclaim Deed is the preferred choice. This legal document facilitates the transfer of real estate ownership without any warranties regarding the title, making it particularly useful in familiar contexts like transferring property between family members or during divorce settlements. For individuals interested in this process, accessing the appropriate form is vital, and you can find it here: quitclaimdocs.com/fillable-colorado-quitclaim-deed/, which offers a fillable option to streamline your experience.

Sample of Power of Attorney to Sell Property - The agent's authority should be clearly stated to avoid any misunderstandings in the future.

Sample - Promissory Note Form

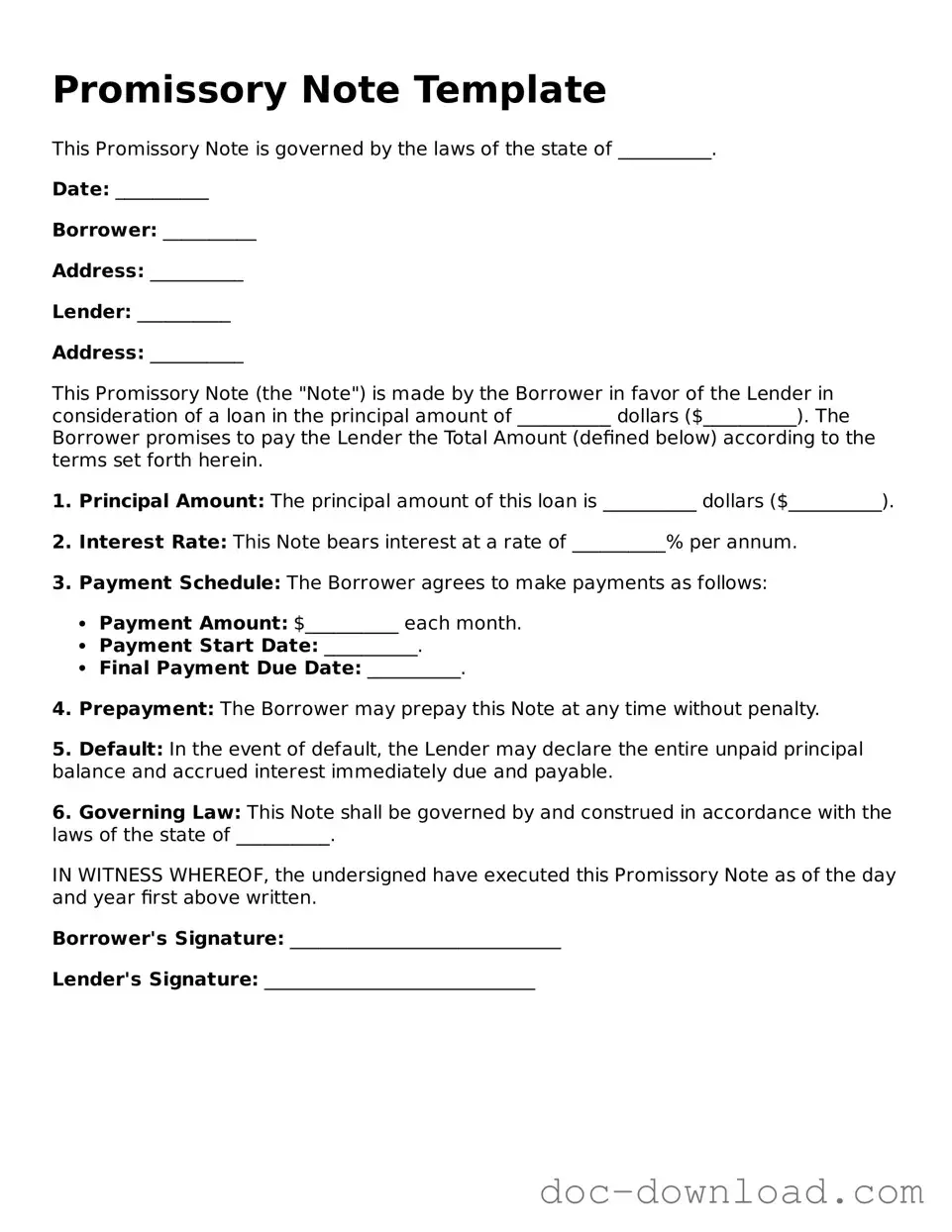

Promissory Note Template

This Promissory Note is governed by the laws of the state of __________.

Date: __________

Borrower: __________

Address: __________

Lender: __________

Address: __________

This Promissory Note (the "Note") is made by the Borrower in favor of the Lender in consideration of a loan in the principal amount of __________ dollars ($__________). The Borrower promises to pay the Lender the Total Amount (defined below) according to the terms set forth herein.

1. Principal Amount: The principal amount of this loan is __________ dollars ($__________).

2. Interest Rate: This Note bears interest at a rate of __________% per annum.

3. Payment Schedule: The Borrower agrees to make payments as follows:

- Payment Amount: $__________ each month.

- Payment Start Date: __________.

- Final Payment Due Date: __________.

4. Prepayment: The Borrower may prepay this Note at any time without penalty.

5. Default: In the event of default, the Lender may declare the entire unpaid principal balance and accrued interest immediately due and payable.

6. Governing Law: This Note shall be governed by and construed in accordance with the laws of the state of __________.

IN WITNESS WHEREOF, the undersigned have executed this Promissory Note as of the day and year first above written.

Borrower's Signature: _____________________________

Lender's Signature: _____________________________