Printable Promissory Note for a Car Template

When purchasing a car, whether new or used, a Promissory Note for a Car serves as a crucial document in the financing process. This form outlines the agreement between the buyer and the seller, detailing the terms of the loan, including the amount financed, the interest rate, and the repayment schedule. It provides clarity on the obligations of both parties, ensuring that the buyer understands their commitment to repay the borrowed amount over a specified period. Additionally, the Promissory Note includes provisions for late payments and default, which protect the seller's interests while also informing the buyer of potential consequences. By clearly stating the terms of the agreement, this document helps to prevent misunderstandings and disputes down the line, making it an essential part of the car-buying experience. Whether you are financing through a dealership or an individual seller, having a well-drafted Promissory Note can offer peace of mind and a clear framework for the transaction.

Similar forms

A Loan Agreement is a document that outlines the terms and conditions under which a borrower receives funds from a lender. Similar to a Promissory Note for a Car, it specifies the amount borrowed, the interest rate, and the repayment schedule. Both documents serve as a legal commitment, ensuring that the borrower understands their obligation to repay the borrowed amount. The Loan Agreement, however, may cover a broader range of loans and can include additional terms such as collateral, default clauses, and any fees associated with the loan.

A Mortgage is another document that shares similarities with a Promissory Note for a Car. While a Promissory Note typically pertains to personal property like a vehicle, a Mortgage is specifically related to real estate. Both documents require the borrower to repay a specified amount over time, often with interest. In the case of a Mortgage, the property itself serves as collateral, which means that if the borrower fails to repay, the lender can take possession of the property. This creates a stronger security interest for the lender compared to the car note.

A Lease Agreement is also comparable to a Promissory Note for a Car. This document outlines the terms under which one party can use property owned by another party, often for a specific period. Like a car note, a Lease Agreement details payment terms, including monthly payments and duration. However, while the Promissory Note signifies a loan for purchasing a vehicle, a Lease Agreement usually pertains to renting a vehicle without ownership transfer. Both documents require adherence to the agreed-upon terms to avoid penalties.

For individuals seeking to outline their financial obligations, a simple Promissory Note template can provide clarity and structure in detailing repayment terms and conditions. This form simplifies the process of borrowing and lending, ensuring a mutual understanding between parties.

A Credit Agreement is another document that bears resemblance to a Promissory Note for a Car. This agreement sets forth the terms under which a borrower can access credit from a lender. Similar to a car note, it includes details about the loan amount, interest rate, and repayment schedule. However, a Credit Agreement often encompasses a broader range of financial products, such as lines of credit or credit cards, and may include terms related to fees and penalties for late payments. Both documents establish a formal relationship between borrower and lender.

A Personal Loan Agreement is yet another document that aligns closely with a Promissory Note for a Car. This agreement outlines the terms for a loan that an individual borrows from a lender, which can be used for various purposes, including purchasing a vehicle. Both documents detail the loan amount, interest rate, and repayment terms. However, a Personal Loan Agreement may not be secured by collateral, meaning it relies more heavily on the borrower's creditworthiness. This makes the risk for the lender different compared to a secured Promissory Note.

Finally, an Installment Agreement shares characteristics with a Promissory Note for a Car. This type of document is used when a borrower agrees to pay for a product or service in fixed amounts over a specified period. Like a car note, it outlines the payment schedule and total amount due. The key difference lies in the nature of the transaction; an Installment Agreement may apply to various purchases beyond vehicles, such as furniture or appliances. Both agreements require timely payments to maintain good standing with the lender or seller.

Document Overview

| Fact Name | Details |

|---|---|

| Definition | A promissory note for a car is a written promise to pay a specified amount for the purchase of a vehicle. |

| Parties Involved | The note typically involves the borrower (buyer) and the lender (seller or financial institution). |

| Governing Law | In the United States, the laws governing promissory notes vary by state, often following the Uniform Commercial Code (UCC). |

| Payment Terms | The note outlines the payment schedule, including due dates and amounts. |

| Interest Rate | Interest rates may be fixed or variable, depending on the agreement between the parties. |

| Default Consequences | If the borrower defaults, the lender may have the right to repossess the vehicle. |

| Notarization | Some states require notarization of the promissory note for it to be legally binding. |

| Amendments | Any changes to the terms must be documented and agreed upon by both parties. |

Other Promissory Note for a Car Templates:

Satisfaction and Release Form - Must include necessary signatures to be effective.

For individuals looking to streamline their lending processes, a well-crafted Pennsylvania Promissory Note template can be invaluable. This document lays out all necessary terms, ensuring both parties understand their obligations clearly. For a useful resource, check out the resourceful Pennsylvania Promissory Note that can help guide you through the creation of this essential agreement.

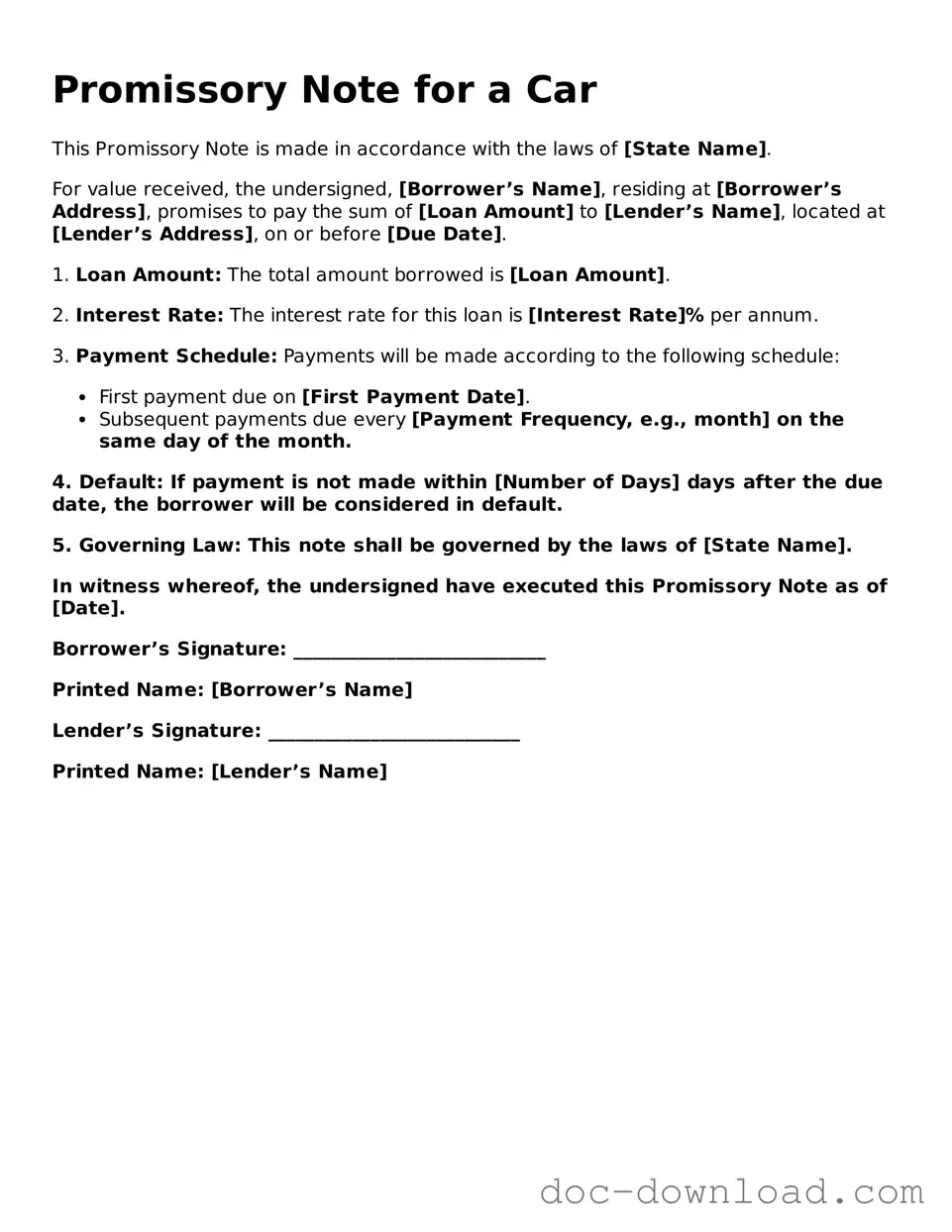

Sample - Promissory Note for a Car Form

Promissory Note for a Car

This Promissory Note is made in accordance with the laws of [State Name].

For value received, the undersigned, [Borrower’s Name], residing at [Borrower’s Address], promises to pay the sum of [Loan Amount] to [Lender’s Name], located at [Lender’s Address], on or before [Due Date].

1. Loan Amount: The total amount borrowed is [Loan Amount].

2. Interest Rate: The interest rate for this loan is [Interest Rate]% per annum.

3. Payment Schedule: Payments will be made according to the following schedule:

- First payment due on [First Payment Date].

- Subsequent payments due every [Payment Frequency, e.g., month] on the same day of the month.

4. Default: If payment is not made within [Number of Days] days after the due date, the borrower will be considered in default.

5. Governing Law: This note shall be governed by the laws of [State Name].

In witness whereof, the undersigned have executed this Promissory Note as of [Date].

Borrower’s Signature: ___________________________

Printed Name: [Borrower’s Name]

Lender’s Signature: ___________________________

Printed Name: [Lender’s Name]