Fill Out Your Payroll Check Template

The Payroll Check form plays a crucial role in the financial operations of any business, ensuring that employees are compensated accurately and on time. This document typically includes essential information such as the employee's name, identification number, and the pay period covered by the check. Additionally, it outlines the gross pay, deductions for taxes and benefits, and the net pay that the employee will receive. Understanding the components of the Payroll Check form is vital for both employers and employees, as it not only facilitates the payment process but also serves as a record for tax purposes. Furthermore, this form often requires signatures or approvals to validate the transaction, reinforcing its importance in maintaining compliance with labor laws and regulations. Familiarity with the Payroll Check form can help prevent errors and disputes, ensuring a smoother payroll process for everyone involved.

Similar forms

The Payroll Check form is similar to the Direct Deposit Authorization form. Both documents serve the purpose of facilitating employee compensation, but they differ in how payments are processed. While the Payroll Check form is used for issuing physical checks to employees, the Direct Deposit Authorization form allows for funds to be electronically deposited into an employee's bank account. This can streamline the payment process and reduce the need for paper checks.

Another document that shares similarities with the Payroll Check form is the Wage Garnishment Order. This legal document instructs an employer to withhold a portion of an employee's wages to satisfy a debt. Like the Payroll Check form, it involves the calculation of earnings and requires accurate record-keeping to ensure compliance with legal requirements. Both documents must be handled with care to protect the employee's rights and ensure proper payment distribution.

When dealing with property transactions, it's essential to understand the various forms involved, one of which is the North Carolina Quitclaim Deed. This legal document facilitates the transfer of real estate ownership without ensuring that the title is clear, making it a practical choice for family members or acquaintances. To learn more about this form and access a template, visit https://quitclaimdeedtemplate.com/north-carolina-quitclaim-deed-template/.

The Employee Pay Stub is also akin to the Payroll Check form. While the Payroll Check form is used to issue payment, the Pay Stub provides a detailed breakdown of that payment. It outlines gross pay, deductions, and net pay, allowing employees to understand how their compensation is calculated. Both documents are essential for transparency and help employees keep track of their earnings and deductions.

The Time Sheet is another related document. It records the hours worked by an employee, which directly influences the amount paid on the Payroll Check form. Accurate timekeeping is crucial, as discrepancies can lead to incorrect payments. Both documents rely on precise information to ensure employees are compensated fairly for their work.

The Employment Contract is similar in that it outlines the terms of employment, including salary and payment frequency. While the Payroll Check form is a mechanism for payment, the Employment Contract serves as a foundational agreement that specifies how and when employees will be compensated. Both documents play a critical role in the employer-employee relationship.

The Tax Withholding Form, often referred to as the W-4, is another document that interacts closely with the Payroll Check form. This form determines how much federal income tax is withheld from an employee's paycheck. The Payroll Check form reflects these withholdings, making it essential for both compliance and accurate payroll processing. Employees must complete this form to ensure the correct amount is deducted from their earnings.

The Benefits Enrollment Form is also relevant. While it does not directly relate to the payment process, it impacts the overall compensation package an employee receives. The Payroll Check form may reflect deductions for benefits such as health insurance or retirement contributions. Both documents work together to provide a comprehensive view of an employee's financial compensation and benefits.

The Bonus Payment Request form is similar in that it involves additional compensation outside of regular wages. This document outlines requests for bonus payments, which may be reflected on a separate Payroll Check form. Both documents require clear communication between employees and employers to ensure that bonuses are processed accurately and in a timely manner.

Lastly, the Expense Reimbursement Form is another document that can be linked to the Payroll Check form. Employees use this form to request reimbursement for business-related expenses incurred during their work. Once approved, these reimbursements may be included in the next Payroll Check, highlighting the interconnectedness of various payroll-related documents in ensuring employees receive all entitled compensation.

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Payroll Check form is used to issue payments to employees for their work. |

| Frequency | Employers typically issue payroll checks on a regular schedule, such as weekly, bi-weekly, or monthly. |

| Information Included | The form includes employee name, pay period, hours worked, rate of pay, and total earnings. |

| Deductions | Employers must list any deductions, such as taxes, health insurance, or retirement contributions. |

| State-Specific Requirements | Each state may have specific laws governing payroll checks, including minimum wage and overtime regulations. |

| Governing Law Example | In California, the governing law is the California Labor Code, which sets forth requirements for payroll checks. |

| Record Keeping | Employers must keep records of payroll checks issued for a certain period, usually three to seven years. |

| Electronic Payroll | Many employers now use electronic payroll systems, allowing for direct deposit and online access to pay stubs. |

Different PDF Templates

Vtr-40 Odometer Disclosure Statement - Odometer readings must be provided without tenths for accuracy.

When navigating the complexities of ending a marriage, it is essential to utilize the proper legal documentation to streamline the process. The Georgia Divorce Form is one such document that facilitates this, as it provides a structured approach tailored to Georgia's legal requirements. For individuals seeking guidance on how to fill out these forms correctly, resources such as Georgia PDF Forms are invaluable, offering easy access to the necessary templates and information needed to ensure all critical aspects of the divorce are comprehensively addressed.

Free Editable Utility Bill Template - Used to report utility bill discrepancies.

Sample - Payroll Check Form

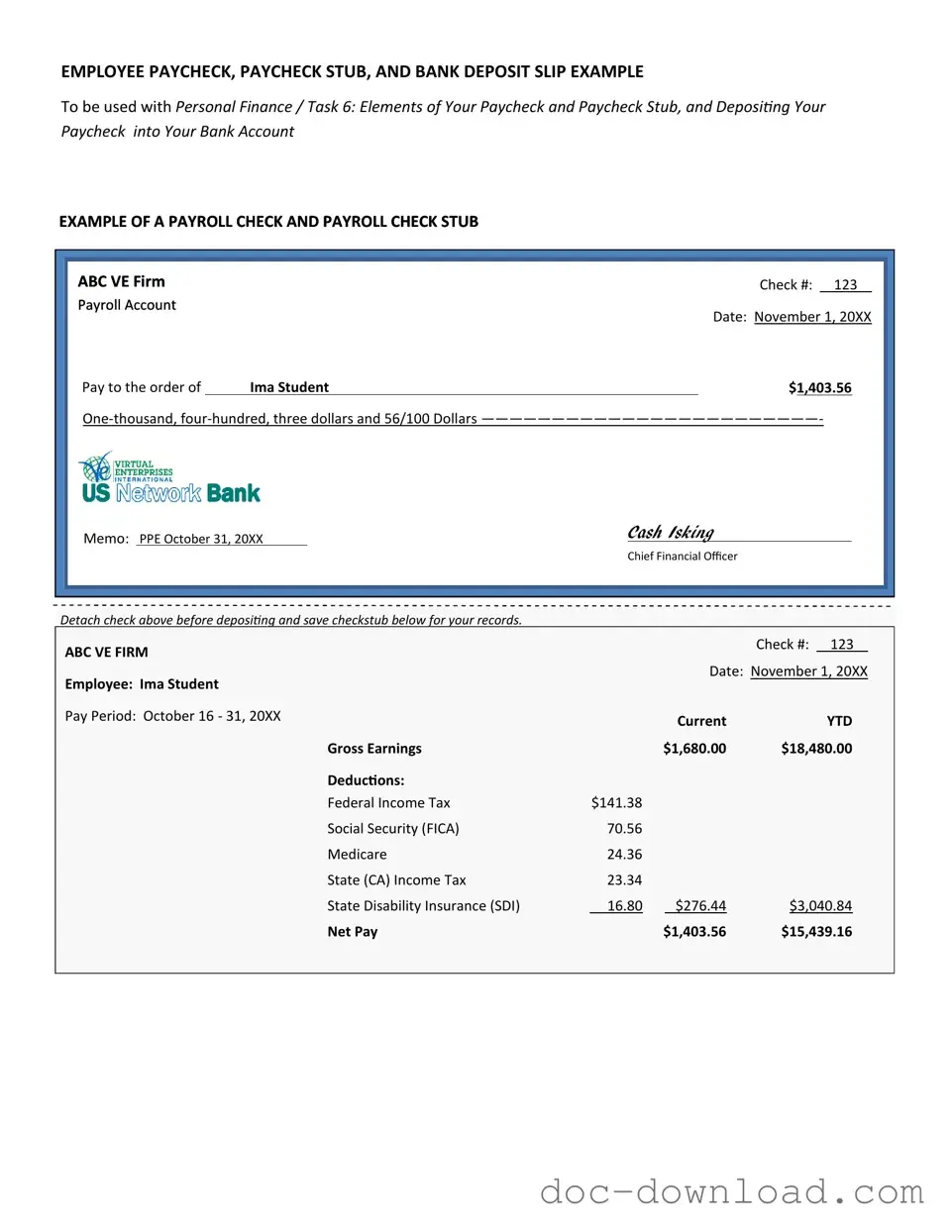

EMPLOYEE PAYCHECK, PAYCHECK STUB, AND BANK DEPOSIT SLIP EXAMPLE

To be used with Personal Finance / Task 6: Elements of Your Paycheck and Paycheck Stub, and Depositing Your Paycheck into Your Bank Account

EXAMPLE OF A PAYROLL CHECK AND PAYROLL CHECK STUB

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ABC VE Firm |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

Payroll Account |

|

|

|

|

|

|

Date: November 1, 20XX |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Pay to the order of |

|

Ima Student |

|

|

|

|

|

|

$1,403.56 |

|

|

|

||||||

|

|

|

|

|

|

||||||||||||||

|

Memo: PPE October 31, 20XX |

|

Cash Isking |

|

|

|

|

|

|

|

|

||||||||

|

|

Chief Financial Officer |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Detach check above before depositing and save checkstub below for your records. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

ABC VE FIRM |

|

|

|

|

|

|

|

|

Check #: |

|

123 |

|

|

|

||||

|

|

|

|

|

|

|

Date: November 1, 20XX |

||||||||||||

|

Employee: Ima Student |

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Pay Period: October 16 - 31, 20XX |

|

|

|

Current |

|

|

|

YTD |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

Gross Earnings |

|

|

$1,680.00 |

|

$18,480.00 |

|

|

|

||||||

|

|

|

|

|

Deductions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Federal Income Tax |

$141.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Social Security (FICA) |

70.56 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Medicare |

24.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State (CA) Income Tax |

23.34 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State Disability Insurance (SDI) |

16.80 |

|

$276.44 |

|

$3,040.84 |

|

|

|

||||||

|

|

|

|

|

Net Pay |

|

|

$1,403.56 |

|

$15,439.16 |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

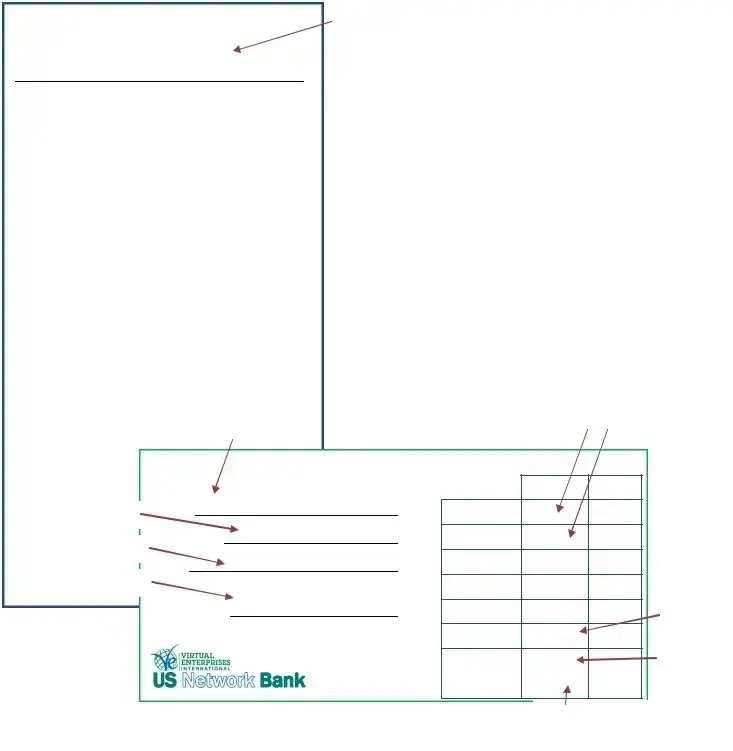

BACK OF PAYCHECK |

|

|

|

|

|

ENDORSE HERE |

|

Recipient’s signature |

|

|

|

DO NOT WRITE, STAMP OR SIGN BELOW THIS LINE |

|

|

|

|

|

|

|

|

List amount of each item that |

||

|

|

|

is being depositing. Checks |

||

|

|

BANK DEPOSIT SLIP |

are entered separately; do |

||

|

|

not combine. |

|

||

|

|

|

|

||

|

Customer’s name |

|

|

|

|

|

|

DEPOSIT SLIP |

|

|

|

|

|

|

dollars |

cents |

|

Customer’s account # |

NAME |

CASH |

|

. |

|

|

|

|

|||

Current date |

ACCOUNT # |

CHECKS |

|

. |

|

|

|

|

|

|

|

|

DATE |

|

|

. |

|

|

|

|

|

|

|

Customer’s Signature |

|

|

|

. |

|

|

|

|

|

|

|

|

SIGNATURE: |

|

|

. |

Sum of items to |

|

|

Subtotal |

|

. |

be deposited |

|

|

|

|

||

Less Cash |

. |

Cash that you |

|

|

|

want back |

|

TOTAL |

. |

||

|

Total amount being deposited into your account