Fill Out Your Netspend Dispute Template

The Netspend Dispute Notification Form serves as a crucial tool for cardholders seeking to address unauthorized credit or debit transactions. This form must be filled out and submitted to Netspend promptly, ideally within 60 days of the disputed transaction. Upon receipt of the completed form, Netspend commits to reviewing the claim and making a decision regarding the potential credit of disputed funds within 10 business days. To support the investigation, cardholders are encouraged to provide relevant documentation, such as receipts or police reports, alongside the form. It is important to note that if a card is lost or stolen, cardholders may bear some liability for unauthorized transactions unless they have reported the loss and requested to block the card. The form requires personal details, including the cardholder's name, contact information, and specific transaction details for up to five disputes. Additionally, it prompts users to disclose whether they have contacted the merchant involved and to provide a detailed explanation of the circumstances surrounding the dispute. This comprehensive approach aims to streamline the dispute resolution process while ensuring that cardholders are informed of their rights and responsibilities.

Similar forms

The Netspend Dispute Notification Form shares similarities with a Chargeback Request Form. Both documents serve the purpose of disputing unauthorized transactions. They require the cardholder to provide specific details about the disputed charges, including transaction dates and amounts. The Chargeback Request Form typically also requires the cardholder to indicate whether they have contacted the merchant, mirroring the inquiry present in the Netspend form. Both forms emphasize the importance of submitting supporting documentation to strengthen the case for a refund.

Another comparable document is the Fraud Report Form. This form is used to report instances of fraud involving a financial account, similar to how the Netspend Dispute Notification Form addresses unauthorized transactions. Both forms require the account holder to detail the nature of the incident, including the dates and amounts involved. Additionally, the Fraud Report Form may ask for information on whether the cardholder has taken steps to secure their account, such as changing their PIN, which aligns with the recommendations found in the Netspend form.

In the realm of financial documentation, one may find the need to utilize various forms to address discrepancies, such as the Georgia Divorce Form. This form not only initiates the dissolution of marriage process but also ensures that all parties clearly understand their rights and obligations. For those navigating similar complex situations, pertinent forms like the Georgia PDF Forms can provide essential guidance and support through the process of handling legal matters effectively.

The Identity Theft Report is also similar in function and purpose. It allows individuals to document instances where their personal information has been misused, often leading to unauthorized transactions. Like the Netspend Dispute Notification Form, the Identity Theft Report requires detailed information about the fraudulent activities. Both documents stress the importance of filing a police report and submitting supporting evidence to substantiate the claims made by the victim.

A Consumer Complaint Form can also be compared to the Netspend Dispute Notification Form. This document is often used to address grievances regarding financial transactions or services. Both forms require the consumer to provide details about the issue at hand, including transaction specifics. The Consumer Complaint Form may also ask for the steps the consumer has taken to resolve the issue directly with the merchant, paralleling the inquiries made in the Netspend form.

Lastly, the Account Verification Form is similar, as it is used to confirm the legitimacy of transactions on an account. This form may be utilized when there are discrepancies or concerns regarding unauthorized charges. Like the Netspend Dispute Notification Form, it often requires the account holder to provide personal information and transaction details. Both forms aim to protect the consumer by ensuring that only authorized transactions are processed, and they typically require the submission of additional documentation to validate the claims made.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | This form is used to dispute unauthorized credit or debit transactions on a Netspend card. |

| Submission Deadline | Complete and submit the form within 60 days of the transaction date. |

| Response Time | Netspend will respond within 10 business days after receiving the completed form. |

| Supporting Documentation | Providing supporting documents can help in the dispute resolution process. |

| Liability | If your card was lost or stolen, you may be liable for unauthorized transactions until you report it. |

| Blocking Activity | You can block activity on your card by indicating it was lost or stolen on the form. |

| PIN Reset | It is advisable to reset your PIN after reporting a lost or stolen card. |

| Police Report | Filing a police report is recommended and should be submitted with the form. |

| Transaction Details | You can dispute up to five transactions on one form. |

| Contacting Merchant | The form asks whether you have contacted the merchant regarding the disputed transaction. |

Different PDF Templates

Advanced Beneficiary Notice - This form is a proactive step in financial planning for healthcare services.

For those looking to secure a formal agreement, utilizing a well-drafted Loan Agreement form can simplify the borrowing process. This document lays out the necessary details between the lender and borrower, ensuring clarity in terms of repayment and obligations. You can access a comprehensive Loan Agreement template to meet your needs by visiting the following link: customizable Loan Agreement form options.

Aia Document A305 - The A305 outlines essential metrics like project size and complexity.

Sample - Netspend Dispute Form

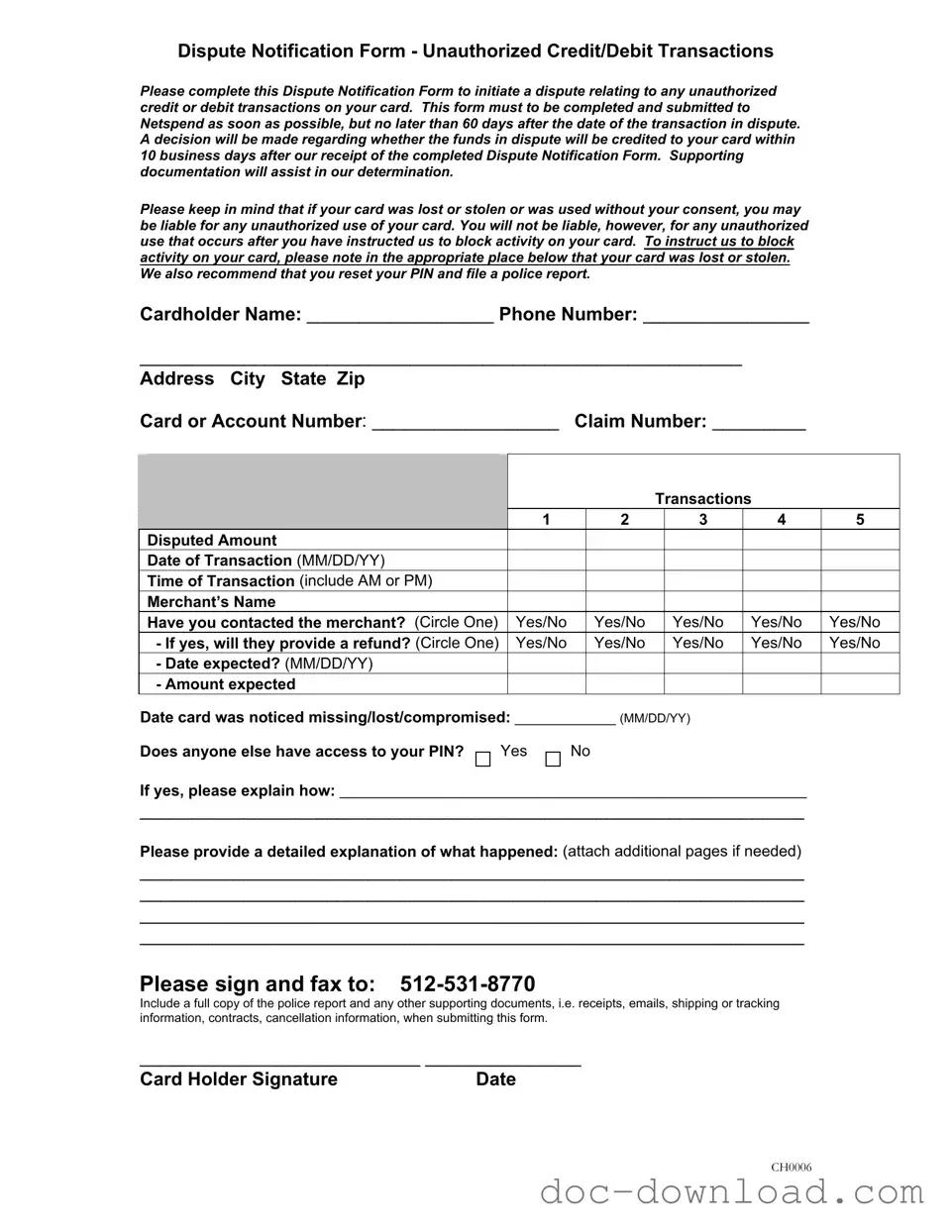

Dispute Notification Form - Unauthorized Credit/Debit Transactions

Please complete this Dispute Notification Form to initiate a dispute relating to any unauthorized credit or debit transactions on your card. This form must to be completed and submitted to Netspend as soon as possible, but no later than 60 days after the date of the transaction in dispute. A decision will be made regarding whether the funds in dispute will be credited to your card within 10 business days after our receipt of the completed Dispute Notification Form. Supporting documentation will assist in our determination.

Please keep in mind that if your card was lost or stolen or was used without your consent, you may be liable for any unauthorized use of your card. You will not be liable, however, for any unauthorized use that occurs after you have instructed us to block activity on your card. To instruct us to block activity on your card, please note in the appropriate place below that your card was lost or stolen. We also recommend that you reset your PIN and file a police report.

Cardholder Name: __________________ Phone Number: ________________ |

|

||||||||

__________________________________________________________ |

|

|

|||||||

Address City State Zip |

|

|

|

|

|

|

|

||

Card or Account Number: __________________ |

Claim Number: _________ |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

Please provide information for each |

|

|

|

|

|

|

|

|

|

transaction you are disputing (submit up to 5 |

|

|

|

|

|

|

|

|

|

on one form) |

|

|

|

|

Transactions |

|

||

|

|

|

1 |

|

2 |

|

3 |

4 |

5 |

Disputed Amount |

|

|

|

|

|

|

|

||

Date of Transaction (MM/DD/YY) |

|

|

|

|

|

|

|

||

Time of Transaction (include AM or PM) |

|

|

|

|

|

|

|

||

Merchant’s Name |

|

|

|

|

|

|

|

||

Have you contacted the merchant? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

||

|

- If yes, will they provide a refund? (Circle One) |

Yes/No |

|

Yes/No |

|

Yes/No |

Yes/No |

Yes/No |

|

|

- Date expected? (MM/DD/YY) |

|

|

|

|

|

|

|

|

|

- Amount expected |

|

|

|

|

|

|

|

|

Date card was noticed missing/lost/compromised: _____________ (MM/DD/YY)

Does anyone else have access to your PIN?

Yes

No

If yes, please explain how: ______________________________________________________

________________________________________________________________

Please provide a detailed explanation of what happened: (attach additional pages if needed)

________________________________________________________________

________________________________________________________________

________________________________________________________________

________________________________________________________________

Please sign and fax to:

Include a full copy of the police report and any other supporting documents, i.e. receipts, emails, shipping or tracking information, contracts, cancellation information, when submitting this form.

___________________________ _______________

Card Holder Signature |

Date |

CH0006