Fill Out Your Mortgage Statement Template

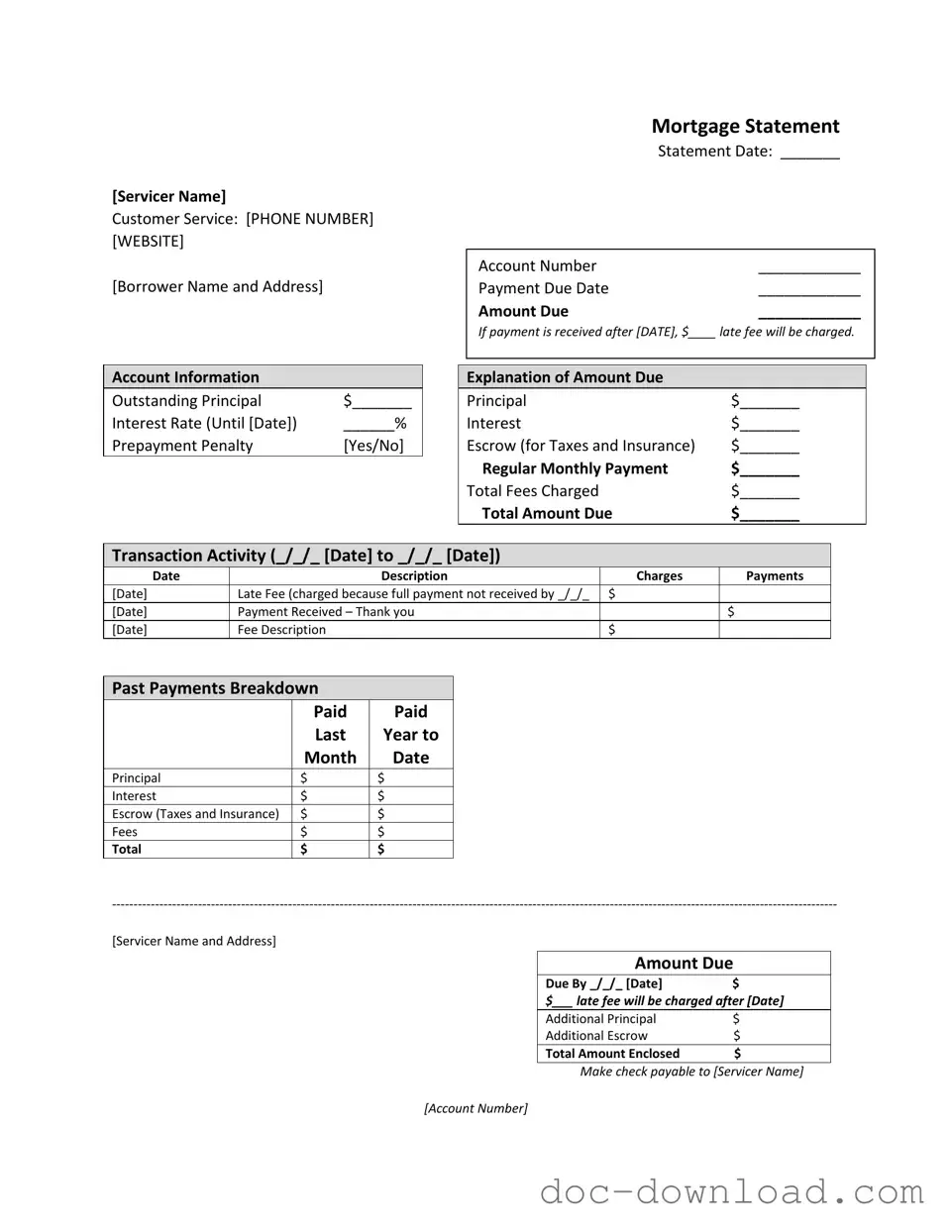

The Mortgage Statement form serves as a critical document for borrowers, providing a detailed snapshot of their mortgage account status. At the top, it prominently displays the servicer's name, customer service contact information, and the borrower's name and address, ensuring clear identification. The statement date, account number, and payment due date follow, creating a structured timeline for payment obligations. Importantly, the amount due is highlighted, along with a warning that late fees will apply if payment is not received by a specified date. The account information section breaks down the outstanding principal, interest rate, and any prepayment penalties, offering transparency about the borrower's financial commitments. A detailed explanation of the amount due lists principal, interest, escrow for taxes and insurance, and total fees charged, allowing borrowers to understand exactly what they owe. Transaction activity is meticulously recorded, showing a history of charges and payments over a specified period, which can help borrowers track their payment patterns. Additionally, the form includes a past payments breakdown, summarizing the amounts paid towards principal, interest, escrow, and fees over the last year. Important messages regarding partial payments and delinquency notices are also included, emphasizing the consequences of missed payments. For those facing financial difficulties, the form directs borrowers to resources for mortgage counseling or assistance, underscoring the servicer's commitment to supporting customers during challenging times.

Similar forms

The first document similar to a Mortgage Statement is the Loan Statement. This document provides a summary of the loan balance, interest rate, and payment history. Like the Mortgage Statement, it details the amount due and any applicable fees. However, a Loan Statement typically focuses on personal loans rather than mortgages, making it essential for borrowers to understand their obligations and payment schedules. Both documents serve as important tools for tracking financial responsibilities and ensuring timely payments.

Another comparable document is the Billing Statement. This statement is commonly used for credit cards and utility bills. It outlines the total amount owed, minimum payment required, and due date. Similar to the Mortgage Statement, it may include late fees if payments are not made on time. The Billing Statement emphasizes the importance of maintaining good standing with creditors, much like the Mortgage Statement does for mortgage lenders.

The Payment Reminder serves a similar purpose as the Mortgage Statement by prompting borrowers to make timely payments. This document is often sent out shortly before a payment is due and includes the amount owed and the due date. While it may not provide as much detail regarding account history or fees, it serves as a crucial reminder for individuals to stay on top of their financial commitments.

A Statement of Account is another document that bears similarities to a Mortgage Statement. It provides a comprehensive overview of all transactions related to an account, including credits and debits. While a Mortgage Statement focuses specifically on mortgage-related transactions, a Statement of Account can apply to various types of accounts, such as bank accounts or business accounts. Both documents help individuals track their financial activities and maintain accurate records.

The Escrow Statement is particularly relevant for homeowners who have an escrow account as part of their mortgage. This document details the funds collected for property taxes and insurance, similar to the escrow information found in a Mortgage Statement. It provides insight into how much is being held in escrow and any adjustments made throughout the year. Understanding the Escrow Statement is crucial for homeowners to ensure they have adequate funds to cover these essential expenses.

The Amortization Schedule is another document closely related to the Mortgage Statement. This schedule outlines each payment over the life of the loan, breaking down how much goes toward principal and interest. While the Mortgage Statement offers a snapshot of the current balance and payment due, the Amortization Schedule provides a detailed view of the loan's progression. Both documents help borrowers understand their mortgage obligations and long-term financial planning.

The Credit Report is also similar in that it reflects the borrower’s overall financial health, including mortgage payment history. While not a direct comparison, both the Mortgage Statement and Credit Report play vital roles in assessing a borrower’s creditworthiness. A Mortgage Statement shows current standing with the mortgage lender, while a Credit Report provides a broader view of all credit accounts, including any missed payments that could affect future lending opportunities.

The Annual Mortgage Statement is a yearly summary that includes information about the total interest paid and the outstanding principal balance for the year. It is similar to the Mortgage Statement but focuses on annual performance rather than monthly details. This document is particularly useful for tax purposes, as homeowners can use the interest paid to potentially reduce their taxable income.

In the realm of property ownership, it is crucial to understand the various legal documents that facilitate transfers, such as the Quitclaim Deed. This form is integral for those looking to transfer real estate without clear title guarantees. For specific templates and guidance regarding a North Carolina Quitclaim Deed, you can visit quitclaimdeedtemplate.com/north-carolina-quitclaim-deed-template/ to ensure a smooth transfer process.

The Loan Modification Agreement is another relevant document. While it is not a statement, it outlines the terms and conditions of any changes made to the original mortgage agreement. This document is essential for borrowers who have negotiated new terms due to financial hardship. Like the Mortgage Statement, it details the new payment amounts and any fees associated with the modification process.

Lastly, the Foreclosure Notice is a document that can arise from the circumstances outlined in a Mortgage Statement. If payments are not made, borrowers may receive this notice, indicating that the lender intends to take legal action. While the Mortgage Statement serves as a reminder to stay current on payments, the Foreclosure Notice highlights the consequences of falling behind. Understanding both documents is crucial for homeowners to avoid the severe repercussions of foreclosure.

Form Specifications

| Fact Name | Description |

|---|---|

| Servicer Contact Information | The mortgage statement includes the servicer's name, customer service phone number, and website for borrower inquiries. |

| Payment Due Date | Each statement specifies the payment due date, which is crucial for avoiding late fees. |

| Outstanding Principal | The statement details the outstanding principal balance, allowing borrowers to understand their remaining debt. |

| Late Fees | If payment is not received by the due date, a late fee will be charged, as indicated on the statement. |

| Delinquency Notice | The statement includes a notice if the borrower is delinquent, outlining potential consequences such as fees and foreclosure. |

Different PDF Templates

Lyft Rideshare Inspection Form - Ensure that all mirrors are present and usable.

What Is Bol - This document is critical for maintaining industry standards in transport.

When seeking a reliable financial agreement, understanding a Loan Agreement that outlines your borrowing terms is vital. You can find a comprehensive resource for this purpose at the fillable Loan Agreement form, which ensures all key details are included for a secure transaction.

Broker Price Opinion Sample - Recommendations for minimal repairs can facilitate easier transactions in competitive markets.

Sample - Mortgage Statement Form

[Servicer Name]

Customer Service: [PHONE NUMBER] [WEBSITE]

[Borrower Name and Address]

Mortgage Statement

Statement Date: _______

Account Number |

____________ |

Payment Due Date |

____________ |

Amount Due |

____________ |

If payment is received after [DATE], $____ late fee will be charged.

Account Information

Outstanding Principal |

$_______ |

Interest Rate (Until [Date]) |

______% |

Prepayment Penalty |

[Yes/No] |

Explanation of Amount Due

Principal |

$_______ |

Interest |

$_______ |

Escrow (for Taxes and Insurance) |

$_______ |

Regular Monthly Payment |

$_______ |

Total Fees Charged |

$_______ |

Total Amount Due |

$_______ |

Transaction Activity (_/_/_ [Date] to _/_/_ [Date])

Date |

Description |

Charges |

Payments |

[Date] |

Late Fee (charged because full payment not received by _/_/_ |

$ |

|

[Date] |

Payment Received – Thank you |

|

$ |

[Date] |

Fee Description |

$ |

|

Past Payments Breakdown

|

Paid |

Paid |

|

Last |

Year to |

|

Month |

Date |

Principal |

$ |

$ |

Interest |

$ |

$ |

Escrow (Taxes and Insurance) |

$ |

$ |

Fees |

$ |

$ |

Total |

$ |

$ |

[Servicer Name and Address]

Amount Due

Due By _/_/_ [Date]$

$___ late fee will be charged after [Date]

Additional Principal |

$ |

Additional Escrow |

$ |

Total Amount Enclosed |

$ |

Make check payable to [Servicer Name]

[Account Number]

[Additional tables to be translated]

Important Messages

*Partial Payments: Any partial payments that you make are not applied to your mortgage, but instead are held in a separate suspense account. If you pay the balance of a partial payment, the funds will then be applied to your mortgage.

**Delinquency Notice**

You are late on your mortgage payments. Failure to bring your loan current may result in fees and foreclosure – the loss of your home. As of [Date], you are __ days delinquent on your mortgage loan.

Recent Account History

·Payment due [Date]: Fully paid on time

·Payment due [Date]: Fully paid on [Date]

·Payment due [Date]: Unpaid balance of $________

·Current payment due [Date]: $_______

·Total: $_______ due. You must pay this amount to bring your loan current.

If you are Experiencing Financial Difficulty: See back for information about mortgage counseling or assistance.