Blank Transfer-on-Death Deed Document for Missouri

In Missouri, the Transfer-on-Death Deed (TODD) serves as a valuable tool for property owners looking to streamline the transfer of real estate upon their passing. This legal document allows individuals to designate beneficiaries who will inherit their property without the need for probate, simplifying the process for loved ones during a difficult time. By completing a TODD, property owners can retain full control over their assets while they are alive, ensuring that the transfer occurs automatically upon their death. This form is particularly advantageous for those who wish to avoid the complexities and costs associated with probate proceedings. It is important to note that the deed must be properly executed and recorded to be effective, and it can be revoked or modified at any time before the owner's death. Understanding the nuances of the Transfer-on-Death Deed is crucial for anyone considering this option, as it provides peace of mind and clarity regarding the future of their property.

Similar forms

The Missouri Transfer-on-Death Deed (TOD) allows property owners to transfer their real estate to beneficiaries without going through probate. This document is similar to a Living Trust, which also facilitates the transfer of assets upon death. A Living Trust holds property during the owner's lifetime and specifies how it should be distributed after death, avoiding the lengthy probate process. Both documents ensure that the property passes directly to the chosen beneficiaries without court intervention.

An Affidavit of Heirship is another document comparable to the TOD. This affidavit is used to establish the heirs of a deceased person when there is no will. It provides a way for heirs to claim property without going through probate. While the TOD deed specifies beneficiaries in advance, the Affidavit of Heirship clarifies who inherits after the owner has passed away.

The Power of Attorney (POA) is another relevant document. A POA allows an individual to designate someone to make decisions on their behalf while they are alive, particularly in financial or medical matters. Although it does not deal with property transfer after death, it can work in conjunction with a TOD deed by ensuring that the property owner’s wishes are respected while they are still alive.

A Beneficiary Designation is similar to a TOD in that it allows individuals to name beneficiaries for specific assets, such as life insurance policies or retirement accounts. These designations take precedence over a will, meaning the named beneficiaries receive the assets directly upon the owner's death. Both the TOD and beneficiary designations streamline the transfer process, bypassing probate.

For individuals interested in documenting their transactions, a well-prepared form can be invaluable. Completing a detailed bill of sale for equipment sales not only records the transfer of ownership but also serves as critical evidence of the agreement between buyer and seller.

The Quitclaim Deed is another document that shares similarities with the TOD deed. A Quitclaim Deed transfers ownership of property without warranties, often used between family members. While a Quitclaim Deed can be used during the owner's lifetime, the TOD deed specifically facilitates the transfer of property upon death, ensuring a smoother transition to the beneficiaries.

A Revocable Living Trust is closely related to the TOD deed. Like the TOD, a Revocable Living Trust allows for the transfer of property outside of probate. The property is held in trust during the owner's lifetime and can be altered or revoked at any time. Upon the owner's death, the trust assets are distributed according to the terms of the trust, similar to how a TOD deed operates.

The Deed of Gift is another document that can function similarly to a TOD deed. A Deed of Gift transfers property as a gift during the owner's lifetime. While a TOD deed transfers property upon death, a Deed of Gift allows for immediate transfer. Both documents can help avoid probate, but the timing of the transfer is the primary difference.

Finally, the Life Estate Deed creates a life estate in property, allowing the current owner to live in the property for their lifetime while designating a remainder beneficiary. Upon the owner’s death, the property automatically transfers to the designated beneficiary, similar to the function of a TOD deed. Both documents provide a way to transfer property without going through probate, ensuring a seamless transition of ownership.

Document Overview

| Fact Name | Details |

|---|---|

| Definition | A Transfer-on-Death (TOD) Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The TOD Deed is governed by Missouri Revised Statutes, Chapter 461. |

| Eligibility | Any individual who owns real estate in Missouri can create a TOD Deed. |

| Beneficiaries | Multiple beneficiaries can be named, and they can be individuals or entities. |

| Revocation | The property owner can revoke the TOD Deed at any time before their death. |

| Execution Requirements | The deed must be signed by the property owner and notarized to be valid. |

| Recording | The TOD Deed must be recorded with the county recorder of deeds in the county where the property is located. |

| Tax Implications | There are no immediate tax implications for the beneficiaries until they sell the property. |

Additional State-specific Transfer-on-Death Deed Forms

Transfer on Death Deed Florida Form - Free from the usual complexities of wills and trusts.

In understanding the legal implications of tenancy in Colorado, it is essential to recognize the importance of proper documentation, such as the Colorado Notice to Quit form, which landlords utilize to notify tenants of lease violations. For additional resources and templates, you may refer to Colorado PDF Forms, which provide valuable assistance in managing these critical processes effectively.

Transfer on Death Deed Tennessee Form - Transfer-on-Death Deeds encourage property owners to consider their long-term intentions regarding their real estate holdings.

Sample - Missouri Transfer-on-Death Deed Form

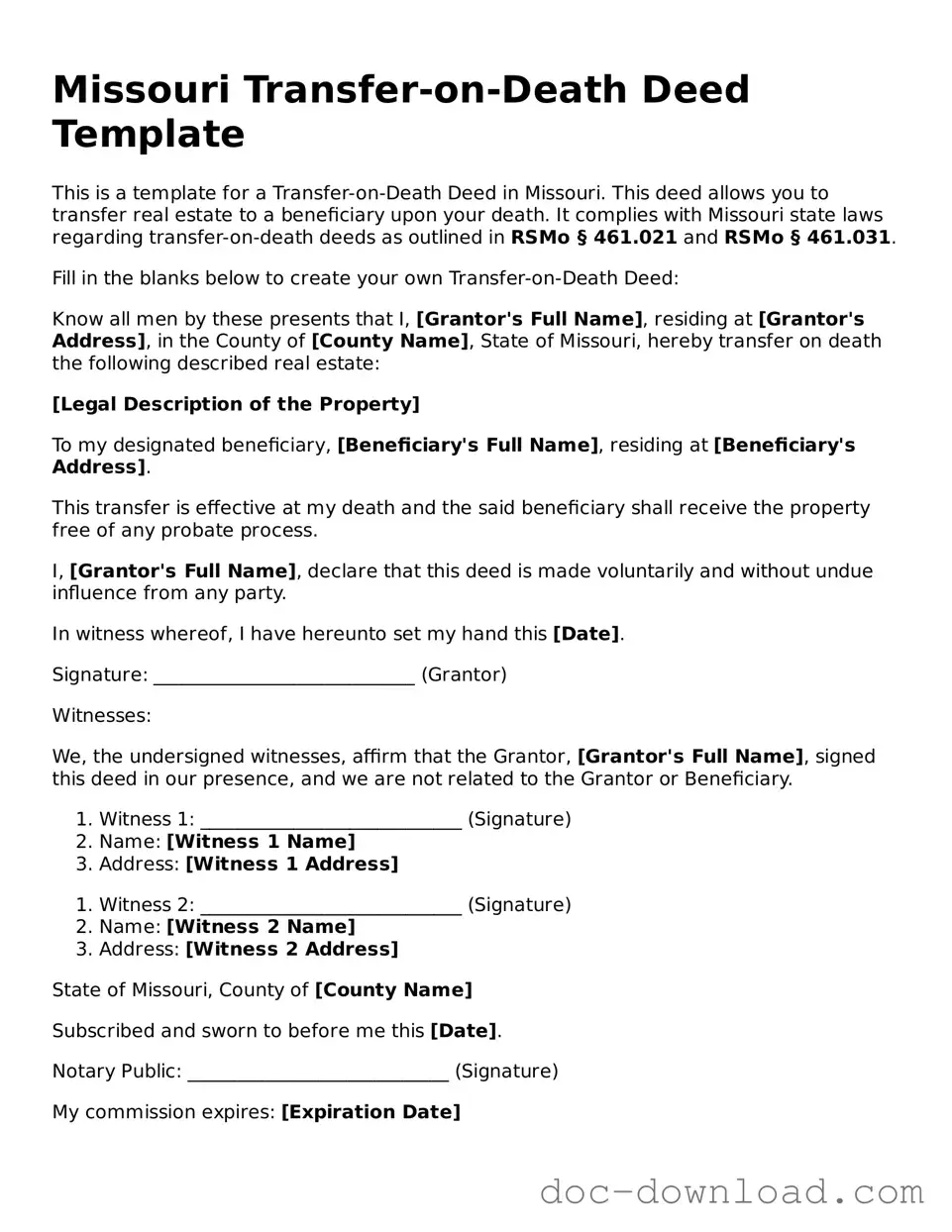

Missouri Transfer-on-Death Deed Template

This is a template for a Transfer-on-Death Deed in Missouri. This deed allows you to transfer real estate to a beneficiary upon your death. It complies with Missouri state laws regarding transfer-on-death deeds as outlined in RSMo § 461.021 and RSMo § 461.031.

Fill in the blanks below to create your own Transfer-on-Death Deed:

Know all men by these presents that I, [Grantor's Full Name], residing at [Grantor's Address], in the County of [County Name], State of Missouri, hereby transfer on death the following described real estate:

[Legal Description of the Property]

To my designated beneficiary, [Beneficiary's Full Name], residing at [Beneficiary's Address].

This transfer is effective at my death and the said beneficiary shall receive the property free of any probate process.

I, [Grantor's Full Name], declare that this deed is made voluntarily and without undue influence from any party.

In witness whereof, I have hereunto set my hand this [Date].

Signature: ____________________________ (Grantor)

Witnesses:

We, the undersigned witnesses, affirm that the Grantor, [Grantor's Full Name], signed this deed in our presence, and we are not related to the Grantor or Beneficiary.

- Witness 1: ____________________________ (Signature)

- Name: [Witness 1 Name]

- Address: [Witness 1 Address]

- Witness 2: ____________________________ (Signature)

- Name: [Witness 2 Name]

- Address: [Witness 2 Address]

State of Missouri, County of [County Name]

Subscribed and sworn to before me this [Date].

Notary Public: ____________________________ (Signature)

My commission expires: [Expiration Date]