Blank Quitclaim Deed Document for Missouri

When it comes to transferring property in Missouri, understanding the Quitclaim Deed form is essential for both buyers and sellers. This straightforward legal document allows an individual, known as the grantor, to transfer any interest they may have in a property to another person, known as the grantee. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor holds clear title to the property; instead, it simply conveys whatever interest they possess, if any. This makes it a popular choice for certain transactions, such as transferring property between family members or in divorce settlements, where the parties are already familiar with the property’s history. The form typically requires basic information, including the names of the parties involved, a description of the property, and the signatures of the grantor and a notary public. Understanding how this form works can empower individuals to navigate property transactions with greater confidence and clarity.

Similar forms

The Warranty Deed is a common document used in real estate transactions, similar to the Quitclaim Deed. Unlike the Quitclaim Deed, which transfers ownership without any guarantees about the property’s title, the Warranty Deed provides a strong assurance. When a seller uses a Warranty Deed, they guarantee that they hold clear title to the property and have the right to sell it. This means that if any issues arise regarding the title, the seller is legally responsible for resolving them. This added layer of protection makes the Warranty Deed a preferred choice for many buyers.

An Operating Agreement form is a foundational document that outlines the ownership and operating procedures of a limited liability company (LLC) in Colorado. This critical agreement allows business owners to structure their financial and working relationships in a way that suits their company's needs. When a Colorado LLC does not have an Operating Agreement, its operations may be governed by default state laws, which might not be suitable for every business. For more information on creating this essential document, visit Colorado PDF Forms.

The Special Warranty Deed offers a middle ground between the Quitclaim Deed and the Warranty Deed. Like the Warranty Deed, it provides some assurances about the title, but only for the time the seller owned the property. The seller is not responsible for any issues that arose before their ownership. This type of deed is often used in commercial real estate transactions, where the seller wants to limit their liability while still providing some assurance to the buyer.

The Bargain and Sale Deed resembles the Quitclaim Deed in that it transfers ownership without warranties. However, it implies that the seller has some interest in the property, even if it does not guarantee a clear title. This type of deed is often used in situations where the seller is not certain about the property's title status. Buyers should approach this deed with caution, as it does not provide the same level of protection as a Warranty Deed.

The Grant Deed is another document similar to the Quitclaim Deed. It conveys ownership of property but includes some implied warranties. Specifically, the Grant Deed assures that the seller has not transferred the property to anyone else and that the property is free from undisclosed encumbrances. This makes it a more secure option than a Quitclaim Deed, while still being less comprehensive than a Warranty Deed.

The Deed of Trust is a slightly different document, often used in financing transactions. It involves three parties: the borrower, the lender, and a trustee. The borrower conveys the property to the trustee as security for a loan. If the borrower defaults, the trustee can sell the property to pay off the debt. While not directly a conveyance of ownership like the Quitclaim Deed, it serves a similar purpose in transferring interests in property and is an important document in real estate transactions.

Finally, the Affidavit of Title serves as a declaration by the seller regarding the status of the property’s title. While it does not transfer ownership like the Quitclaim Deed, it provides important information about the title and can be used in conjunction with other deeds. Buyers often request this affidavit to ensure there are no undisclosed liens or claims against the property. It adds an extra layer of security and transparency in the transaction process.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Missouri Quitclaim Deed is a legal document used to transfer interest in real property from one party to another without any warranties regarding the title. |

| Governing Law | This deed is governed by the Missouri Revised Statutes, specifically Chapter 442, which outlines the requirements for property transfers. |

| Purpose | It is commonly used to clear up title issues, transfer property between family members, or convey property as part of a divorce settlement. |

| Requirements | The deed must be signed by the grantor and notarized. It is also essential to provide a legal description of the property being transferred. |

| Recording | To ensure the transfer is public and enforceable, the quitclaim deed must be recorded with the local county recorder of deeds. |

| Limitations | Because it offers no guarantees, the grantee assumes all risks associated with the property, including any existing liens or claims. |

Additional State-specific Quitclaim Deed Forms

How to Get a Quit Claim Deed - The Quitclaim Deed is particularly common in states with simplified property transfer laws.

Using a Quitclaim Deed in Indiana can simplify the transfer of property interests, especially when the parties involved are familiar with each other. For those looking to obtain the necessary legal documentation to facilitate this process, you can find useful resources such as the one at quitclaimdeedtemplate.com/indiana-quitclaim-deed-template, which provides guidance and templates for your Quitclaim Deed needs.

Massachusetts Quitclaim Deed Form - The deed allows the granter to transfer their rights to the property, but not necessarily any ownership claims.

Tennessee Quitclaim Deed Form - A Quitclaim Deed has fewer requirements than other types of property transfers.

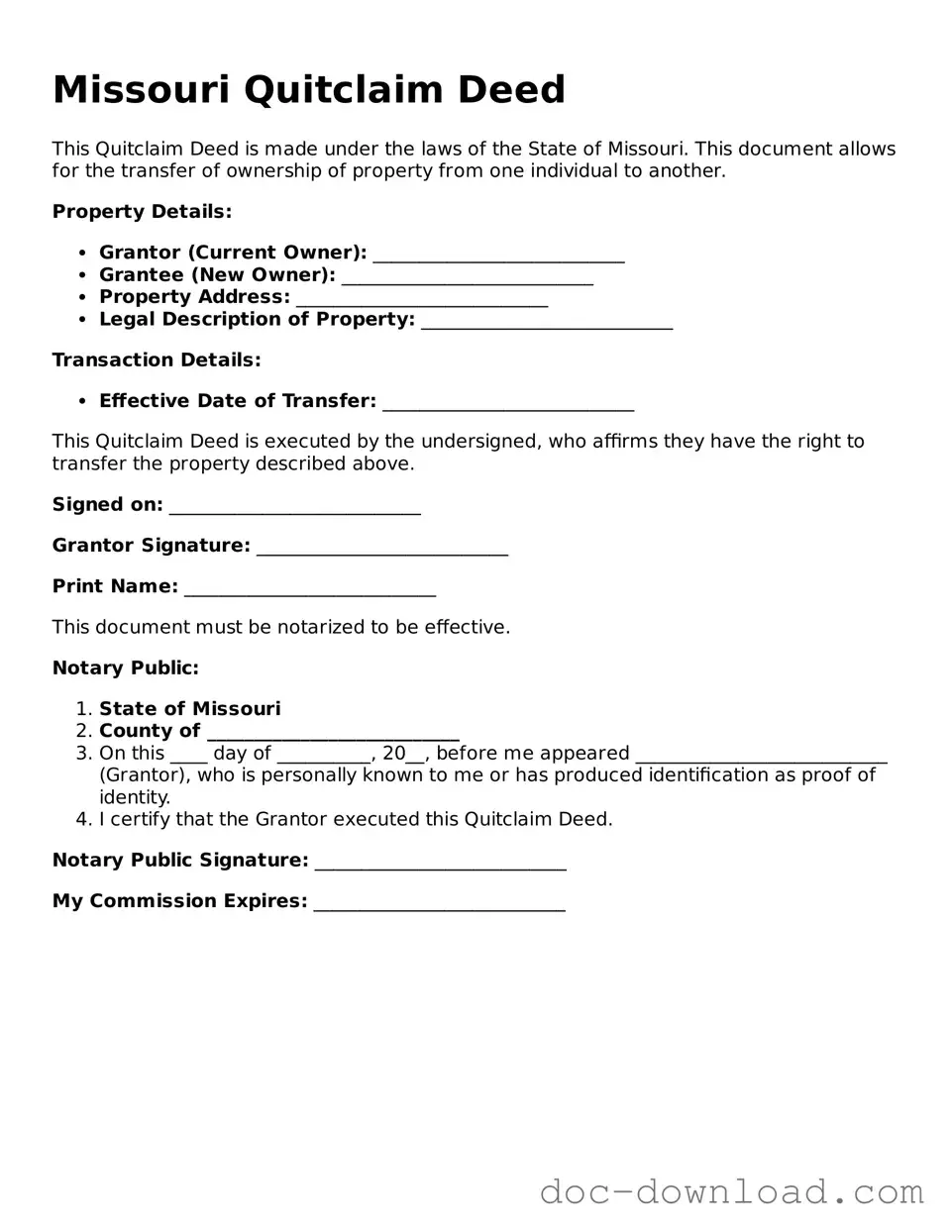

Sample - Missouri Quitclaim Deed Form

Missouri Quitclaim Deed

This Quitclaim Deed is made under the laws of the State of Missouri. This document allows for the transfer of ownership of property from one individual to another.

Property Details:

- Grantor (Current Owner): ___________________________

- Grantee (New Owner): ___________________________

- Property Address: ___________________________

- Legal Description of Property: ___________________________

Transaction Details:

- Effective Date of Transfer: ___________________________

This Quitclaim Deed is executed by the undersigned, who affirms they have the right to transfer the property described above.

Signed on: ___________________________

Grantor Signature: ___________________________

Print Name: ___________________________

This document must be notarized to be effective.

Notary Public:

- State of Missouri

- County of ___________________________

- On this ____ day of __________, 20__, before me appeared ___________________________ (Grantor), who is personally known to me or has produced identification as proof of identity.

- I certify that the Grantor executed this Quitclaim Deed.

Notary Public Signature: ___________________________

My Commission Expires: ___________________________