Blank Promissory Note Document for Missouri

The Missouri Promissory Note form serves as a critical financial instrument for individuals and businesses alike, facilitating the borrowing and lending process by establishing clear terms and obligations. This legally binding document outlines the borrower's commitment to repay a specified amount of money, typically including details such as the principal amount, interest rate, repayment schedule, and any applicable fees. Additionally, it may specify the consequences of default, providing lenders with a framework for recourse should the borrower fail to meet their obligations. By incorporating essential elements like signatures from both parties, the note ensures that all parties are aware of their rights and responsibilities. Understanding this form is vital for anyone involved in lending or borrowing money in Missouri, as it helps to mitigate disputes and fosters trust in financial transactions.

Similar forms

A loan agreement is a document that outlines the terms and conditions under which a borrower receives funds from a lender. Similar to a Missouri Promissory Note, it includes details such as the loan amount, interest rate, repayment schedule, and the consequences of default. Both documents serve to protect the interests of the lender while providing a clear framework for repayment obligations by the borrower.

A mortgage agreement is another document that shares similarities with a promissory note. It secures a loan with real property, allowing the lender to take possession of the property if the borrower fails to repay the loan. Like a promissory note, it details the amount borrowed, interest rates, and repayment terms, but it also includes clauses related to the property itself, which is not typically found in a standard promissory note.

A personal guarantee is a document where an individual agrees to be responsible for a loan or debt if the primary borrower defaults. This is similar to a promissory note in that it establishes an obligation to repay a debt. However, a personal guarantee often involves additional parties and can provide an extra layer of security for the lender.

A business loan agreement is akin to a promissory note but specifically designed for business purposes. It outlines the terms of borrowing for a business entity, including the loan amount, interest rate, and repayment schedule. Both documents serve to formalize the lending process, but a business loan agreement may also include provisions related to business operations and collateral.

A lease agreement can resemble a promissory note when it includes a provision for future payments. In some cases, a lease may require a security deposit or advance rent payments, similar to how a promissory note outlines repayment terms. Both documents establish financial obligations, but a lease agreement typically governs the use of property rather than a direct loan.

An installment agreement is a payment plan that allows a borrower to pay off a debt over time. This is similar to a promissory note, which often specifies a repayment schedule. Both documents detail the amount owed and the payment frequency, but an installment agreement may also include additional terms regarding late fees or penalties for missed payments.

A forbearance agreement is a document that temporarily suspends or reduces payments due on a loan. This is similar to a promissory note in that it addresses the borrower's obligations. However, a forbearance agreement specifically outlines the terms of the temporary relief, including how the borrower will resume payments and any adjustments to the repayment schedule.

When entering into various financial agreements, understanding the associated legal implications is essential. For instance, when navigating the complexities of a Hold Harmless Agreement, it is crucial to ensure that all parties are aware of their responsibilities. This legal framework not only safeguards interests but also delineates risk factors that may arise during transactions. For those looking for standardized forms, the Colorado PDF Forms can provide the necessary documentation to facilitate these agreements effectively.

A debt settlement agreement is a document that outlines the terms under which a borrower agrees to pay a reduced amount to settle a debt. This is similar to a promissory note, as both involve the borrower’s commitment to repay a debt. However, a debt settlement agreement typically includes negotiated terms that differ from the original loan agreement, often reflecting a compromise between the lender and borrower.

An unsecured loan agreement is a document that outlines the terms of a loan that is not backed by collateral. Similar to a promissory note, it specifies the loan amount, interest rate, and repayment terms. Both documents create a legal obligation for the borrower to repay the funds, but an unsecured loan agreement carries a higher risk for the lender, as there is no collateral to claim in case of default.

A credit agreement is a document that defines the terms of a credit arrangement between a lender and a borrower. This is similar to a promissory note, as it specifies the amount of credit extended, interest rates, and repayment terms. Both documents establish a financial relationship, but a credit agreement may also include conditions related to credit limits and fees associated with late payments.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Missouri Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a future date. |

| Governing Law | The Missouri Uniform Commercial Code (UCC) governs promissory notes in Missouri. |

| Parties Involved | The note typically involves two parties: the maker (the person promising to pay) and the payee (the person to whom the payment is owed). |

| Payment Terms | It includes specific terms regarding the amount, interest rate, and payment schedule. |

| Signatures | For the note to be valid, it must be signed by the maker. The payee's signature is not required. |

| Enforceability | If the maker fails to pay, the payee can take legal action to enforce the note and recover the owed amount. |

Additional State-specific Promissory Note Forms

Promissory Note Template California Word - Promissory notes are governed by state laws, which can vary, making local knowledge important.

Promissory Note Template Arizona - Not typically a public record unless entered into a court proceeding.

To assist you in crafting a strong recommendation, utilizing a professional Recommendation Letter template can streamline the process and ensure you highlight key attributes effectively.

Florida Promissory Note Requirements - This document outlines the borrowing terms between the lender and the borrower.

Should a Promissory Note Be Notarized - Borrowers should read and understand all terms before signing the note.

Sample - Missouri Promissory Note Form

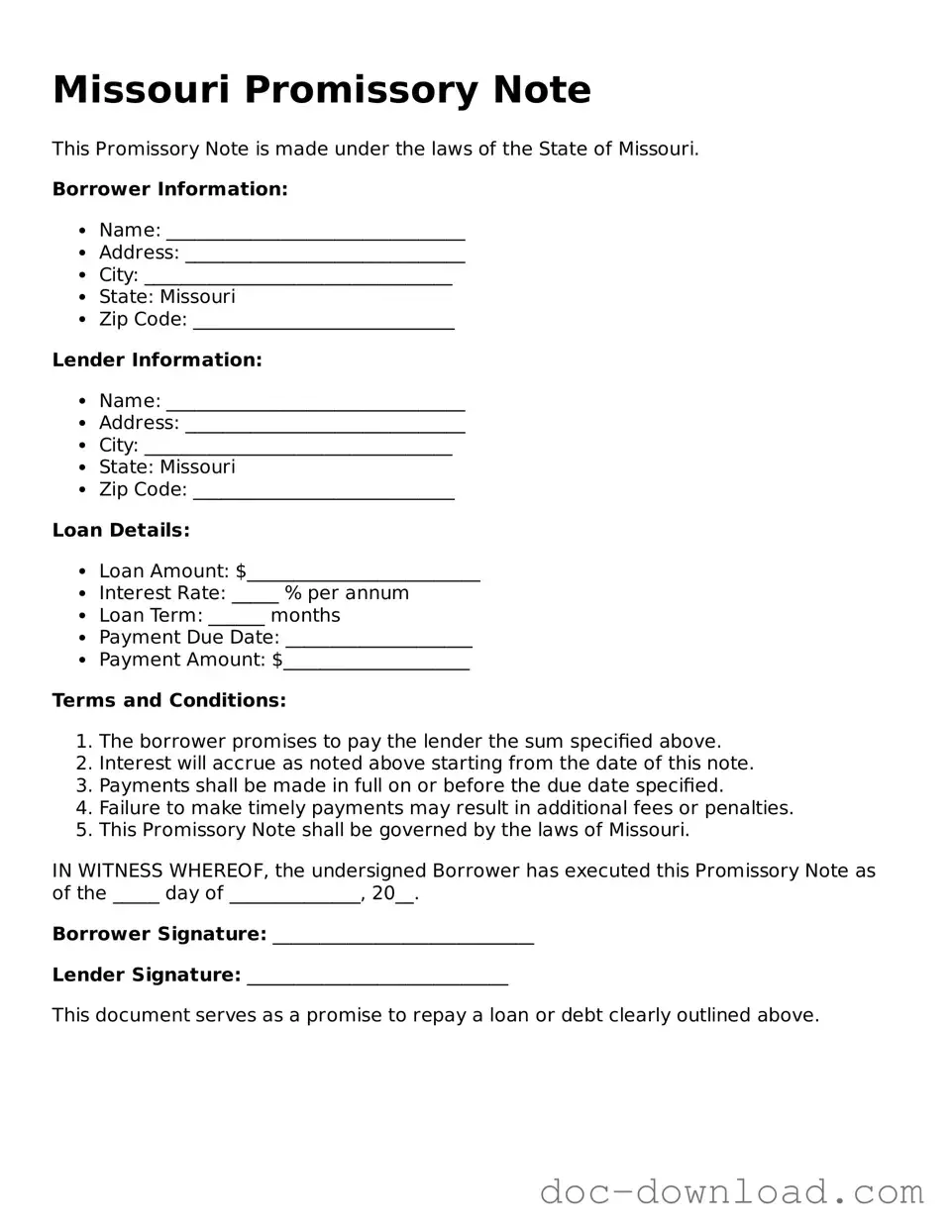

Missouri Promissory Note

This Promissory Note is made under the laws of the State of Missouri.

Borrower Information:

- Name: ________________________________

- Address: ______________________________

- City: _________________________________

- State: Missouri

- Zip Code: ____________________________

Lender Information:

- Name: ________________________________

- Address: ______________________________

- City: _________________________________

- State: Missouri

- Zip Code: ____________________________

Loan Details:

- Loan Amount: $_________________________

- Interest Rate: _____ % per annum

- Loan Term: ______ months

- Payment Due Date: ____________________

- Payment Amount: $____________________

Terms and Conditions:

- The borrower promises to pay the lender the sum specified above.

- Interest will accrue as noted above starting from the date of this note.

- Payments shall be made in full on or before the due date specified.

- Failure to make timely payments may result in additional fees or penalties.

- This Promissory Note shall be governed by the laws of Missouri.

IN WITNESS WHEREOF, the undersigned Borrower has executed this Promissory Note as of the _____ day of ______________, 20__.

Borrower Signature: ____________________________

Lender Signature: ____________________________

This document serves as a promise to repay a loan or debt clearly outlined above.