Blank Durable Power of Attorney Document for Missouri

In Missouri, the Durable Power of Attorney form serves as a crucial legal tool that empowers individuals to designate someone they trust to make decisions on their behalf when they are unable to do so. This form is particularly significant in situations involving health care, financial matters, or any other personal affairs. By executing this document, individuals can ensure that their wishes are respected, even if they become incapacitated due to illness or injury. The form allows for a broad range of powers, which can be tailored to meet specific needs, from managing bank accounts and investments to making medical decisions. It is essential to understand the implications of granting these powers, as the appointed agent will have the authority to act in the principal's best interest. Additionally, the Durable Power of Attorney remains effective even if the principal becomes incapacitated, distinguishing it from other types of power of attorney forms. Understanding how to properly complete and execute this form is vital for anyone looking to safeguard their future and ensure that their affairs are handled according to their preferences.

Similar forms

The Missouri Durable Power of Attorney (DPOA) form shares similarities with the General Power of Attorney (GPOA). Both documents allow an individual, known as the principal, to appoint someone else, referred to as the agent, to make decisions on their behalf. However, the GPOA typically becomes void if the principal becomes incapacitated, whereas the DPOA remains effective even in such situations. This distinction makes the DPOA a more reliable option for long-term planning, ensuring that the agent can continue to act in the principal's best interests during times of need.

Another document akin to the DPOA is the Healthcare Power of Attorney (HPOA). This specific form empowers an agent to make medical decisions for the principal when they are unable to do so. While the DPOA can cover a broad range of financial and legal matters, the HPOA is focused solely on health-related decisions. Both documents emphasize the importance of appointing a trusted individual to act on one's behalf, but they serve different purposes in terms of the types of decisions that can be made.

The Living Will is another important document that complements the DPOA. While the DPOA allows an agent to make decisions, a Living Will explicitly outlines an individual's wishes regarding medical treatment in end-of-life situations. This document is crucial for guiding healthcare providers and family members when tough choices must be made. In essence, the Living Will provides clarity on the principal's preferences, while the DPOA designates someone to carry out those wishes if the individual cannot communicate them directly.

For those interested in formalizing a lending agreement, utilizing a detailed Loan Agreement template can greatly streamline the process. To access a comprehensive Loan Agreement form, click here: detailed Loan Agreement form.

A Revocable Trust shares some characteristics with the DPOA, particularly in the realm of estate planning. Both documents enable individuals to manage their assets and designate someone to handle their affairs. However, a Revocable Trust allows for the transfer of assets into a trust, which can avoid probate upon death. In contrast, the DPOA is primarily about appointing an agent to manage decisions while the principal is alive. While they serve different functions, both can be vital components of a comprehensive estate plan.

Lastly, the Financial Power of Attorney (FPOA) is closely related to the DPOA, focusing specifically on financial matters. Like the DPOA, the FPOA allows the principal to appoint an agent to handle financial transactions, such as paying bills, managing investments, and filing taxes. The key difference lies in the scope of authority; the DPOA can encompass a wider range of decisions beyond just financial matters. Both documents aim to ensure that someone trustworthy is in place to manage affairs when the principal cannot do so themselves.

Document Overview

| Fact Name | Details |

|---|---|

| Definition | A Missouri Durable Power of Attorney allows an individual to appoint someone to make decisions on their behalf, even if they become incapacitated. |

| Governing Law | The Missouri Durable Power of Attorney is governed by Chapter 404 of the Revised Statutes of Missouri. |

| Durability | This document remains effective even if the principal becomes incapacitated, ensuring continuous authority for the agent. |

| Agent Selection | The principal can choose any competent adult as their agent, allowing for personal trust and familiarity. |

| Scope of Authority | The powers granted can be broad or limited, depending on the principal’s wishes, and should be clearly outlined in the document. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, provided they are mentally competent to do so. |

| Witness Requirements | In Missouri, the signing of the Durable Power of Attorney must be witnessed by at least one person or notarized. |

| Agent's Responsibilities | Agents must act in the best interest of the principal and follow the instructions outlined in the document. |

| Legal Advice | While it is not required, consulting with an attorney is recommended to ensure the document meets all legal requirements and reflects the principal's intentions. |

Additional State-specific Durable Power of Attorney Forms

Indiana Durable Power of Attorney Form - A Durable Power of Attorney is not just for the elderly—everyone can benefit from having one in place.

For a smooth property transfer process in North Carolina, utilizing a North Carolina Quitclaim Deed is essential, particularly for those familiar with each other, such as family members. To assist you in drafting this important document, you can find a template at quitclaimdeedtemplate.com/north-carolina-quitclaim-deed-template, ensuring that you cover all necessary details accurately.

California Durable Power of Attorney Form - Filling out a Durable Power of Attorney form is an important step in responsible financial planning.

Massachusetts Power of Attorney Requirements - The form designates a person, often called an agent, to act on your behalf, covering various matters like finances and healthcare.

Sample - Missouri Durable Power of Attorney Form

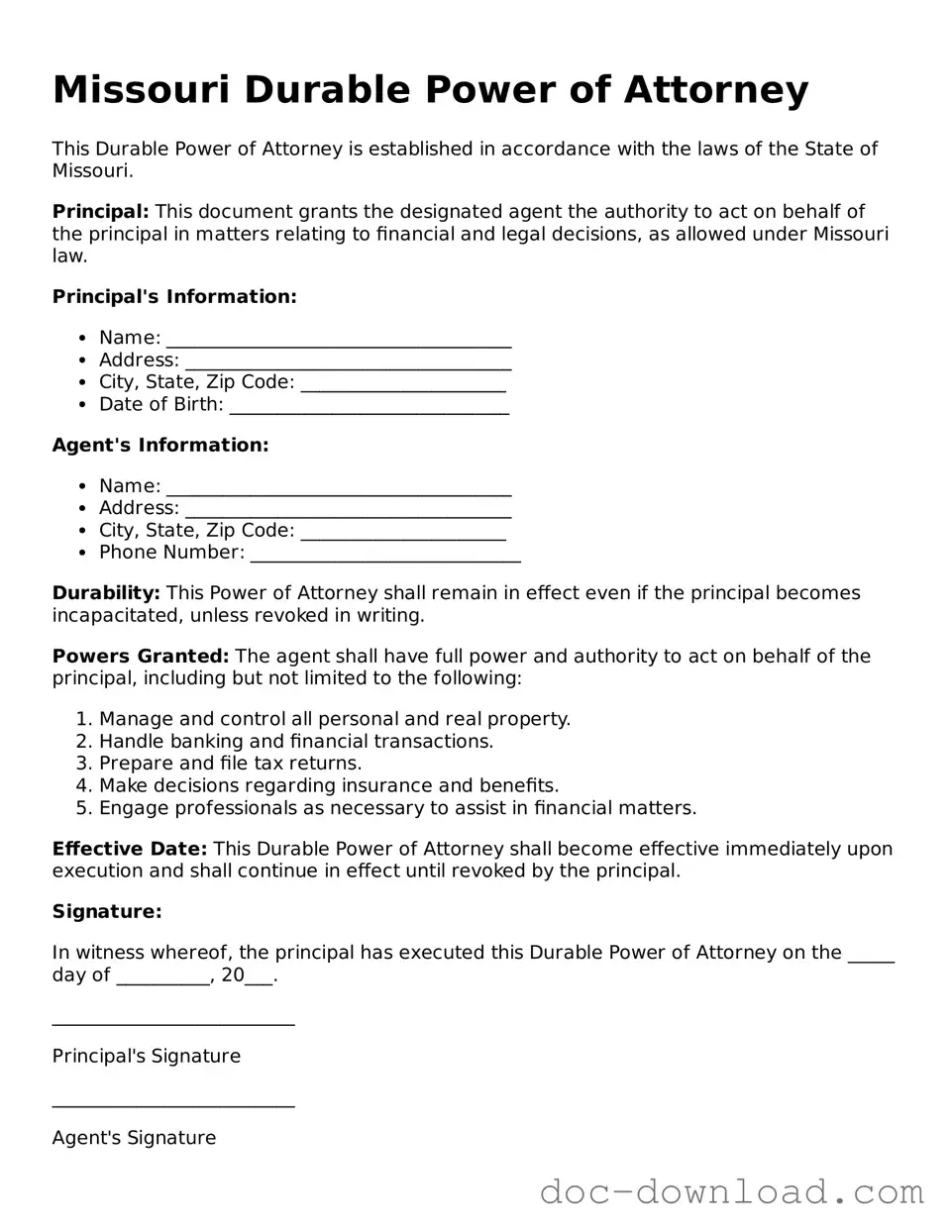

Missouri Durable Power of Attorney

This Durable Power of Attorney is established in accordance with the laws of the State of Missouri.

Principal: This document grants the designated agent the authority to act on behalf of the principal in matters relating to financial and legal decisions, as allowed under Missouri law.

Principal's Information:

- Name: _____________________________________

- Address: ___________________________________

- City, State, Zip Code: ______________________

- Date of Birth: ______________________________

Agent's Information:

- Name: _____________________________________

- Address: ___________________________________

- City, State, Zip Code: ______________________

- Phone Number: _____________________________

Durability: This Power of Attorney shall remain in effect even if the principal becomes incapacitated, unless revoked in writing.

Powers Granted: The agent shall have full power and authority to act on behalf of the principal, including but not limited to the following:

- Manage and control all personal and real property.

- Handle banking and financial transactions.

- Prepare and file tax returns.

- Make decisions regarding insurance and benefits.

- Engage professionals as necessary to assist in financial matters.

Effective Date: This Durable Power of Attorney shall become effective immediately upon execution and shall continue in effect until revoked by the principal.

Signature:

In witness whereof, the principal has executed this Durable Power of Attorney on the _____ day of __________, 20___.

__________________________

Principal's Signature

__________________________

Agent's Signature

__________________________

Witness Signature

__________________________

Witness Signature