Blank Transfer-on-Death Deed Document for Massachusetts

In Massachusetts, the Transfer-on-Death Deed (TODD) form offers a unique way for property owners to transfer their real estate to beneficiaries without the need for probate. This innovative legal tool allows individuals to retain full control of their property during their lifetime while ensuring that their chosen heirs receive the property automatically upon their passing. By completing a TODD, property owners can simplify the estate planning process, reduce potential disputes among heirs, and provide clarity regarding the transfer of assets. It is important to understand that this deed does not take effect until the owner has passed away, meaning the property remains part of the owner's estate until that time. The form must be properly executed and recorded to be valid, and it can be revoked or modified at any point prior to the owner's death. Understanding the nuances of the TODD form can empower property owners to make informed decisions about their estate planning, ensuring their wishes are honored and their loved ones are cared for after they are gone.

Similar forms

The Massachusetts Transfer-on-Death Deed form shares similarities with a Last Will and Testament. Both documents serve the purpose of transferring property upon the death of the owner. A Last Will outlines the distribution of assets according to the decedent's wishes, while the Transfer-on-Death Deed allows for the direct transfer of real estate without going through probate. This can simplify the process for beneficiaries and reduce the time and costs associated with estate administration.

Another document that is comparable is the Revocable Living Trust. Like the Transfer-on-Death Deed, a Revocable Living Trust allows for the transfer of property outside of probate. The property placed in a trust is managed by the grantor during their lifetime and can be distributed to beneficiaries upon death. This method provides flexibility and control over the assets, similar to how the Transfer-on-Death Deed operates for real estate specifically.

The Joint Tenancy with Right of Survivorship is also similar in nature. This legal arrangement allows two or more individuals to own property together, with the right of survivorship ensuring that upon the death of one owner, their share automatically passes to the surviving owner(s). Like the Transfer-on-Death Deed, this arrangement avoids probate, allowing for a seamless transition of property ownership.

A Beneficiary Designation form is another document that bears resemblance. This form is often used for financial accounts, such as bank accounts or retirement plans, allowing the account holder to designate a beneficiary who will receive the assets upon their death. The Transfer-on-Death Deed functions in a similar manner for real estate, ensuring that property passes directly to the designated beneficiary without probate delays.

The Life Estate Deed is also comparable, as it allows a property owner to retain the right to live in the property while designating a beneficiary to receive the property upon their death. This document provides a way to transfer property while still retaining some control, much like the Transfer-on-Death Deed, which allows for the transfer of real estate ownership without immediate relinquishment of rights.

The Power of Attorney document can also be seen as similar, albeit with some differences. A Power of Attorney allows an individual to appoint someone else to manage their financial affairs, including property transactions, while they are alive. While it does not directly transfer property upon death, it can facilitate the management of real estate and other assets, leading up to the eventual transfer that would occur through a Transfer-on-Death Deed.

The Quitclaim Deed is another document that serves to transfer property ownership. This type of deed is often used to transfer property between family members or to clear up title issues. While it does not specifically designate a transfer upon death, it can be used to transfer property during the owner's lifetime, similar to how the Transfer-on-Death Deed operates upon death.

If you require proof of employment, an ideal solution is to utilize a fillable Employment Verification document that can facilitate the process. This form not only confirms an individual's work history but also serves various purposes, including supporting loan applications or new job opportunities.

Lastly, the Declaration of Trust can be likened to the Transfer-on-Death Deed in that it provides a framework for managing and distributing assets. A Declaration of Trust outlines the terms under which a trustee manages the property for the benefit of the beneficiaries. This document, like the Transfer-on-Death Deed, ensures that the intended recipients receive the property without the complications of probate, streamlining the transfer process.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows a property owner to transfer real estate to a beneficiary upon their death without going through probate. |

| Governing Law | Massachusetts General Laws Chapter 191, Section 18 provides the legal framework for Transfer-on-Death Deeds in Massachusetts. |

| Eligibility | Any individual who owns real estate in Massachusetts can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can name one or more beneficiaries to receive the property upon their death. |

| Revocation | The deed can be revoked by the property owner at any time before their death, provided proper procedures are followed. |

| Filing Requirements | The deed must be signed, notarized, and recorded with the local Registry of Deeds to be effective. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes during the property owner's lifetime. |

| Impact on Creditors | Assets transferred via a Transfer-on-Death Deed may still be subject to claims by creditors of the deceased. |

| Survivorship | If multiple beneficiaries are named, the property will transfer to the surviving beneficiaries upon the death of one or more. |

| Limitations | This deed cannot be used for transferring certain types of property, such as property held in a trust or business entities. |

Additional State-specific Transfer-on-Death Deed Forms

Transfer on Death Deed Missouri Pdf - Planning with a Transfer-on-Death Deed can save heirs time and money in the long run.

Transfer on Death Deed Tennessee Form - Property owners in some jurisdictions can enlist the assistance of a notary public when executing their Transfer-on-Death Deed.

Avoiding Probate in California - The deed can include contingencies, allowing for alternative beneficiaries if the primary beneficiary is not available.

A Georgia Deed form is an essential document used to legally transfer property from one person to another. This form serves as evidence that the property owner has conveyed their interest in the property to the new owner. Completing this form correctly ensures that the transfer is recognized by law, securing the new owner's rights to the property. For more information and access to templates, visit Georgia PDF Forms.

Transfer of Death Deed Indiana - Those involved in real estate should familiarize themselves with a Transfer-on-Death Deed for effective estate planning.

Sample - Massachusetts Transfer-on-Death Deed Form

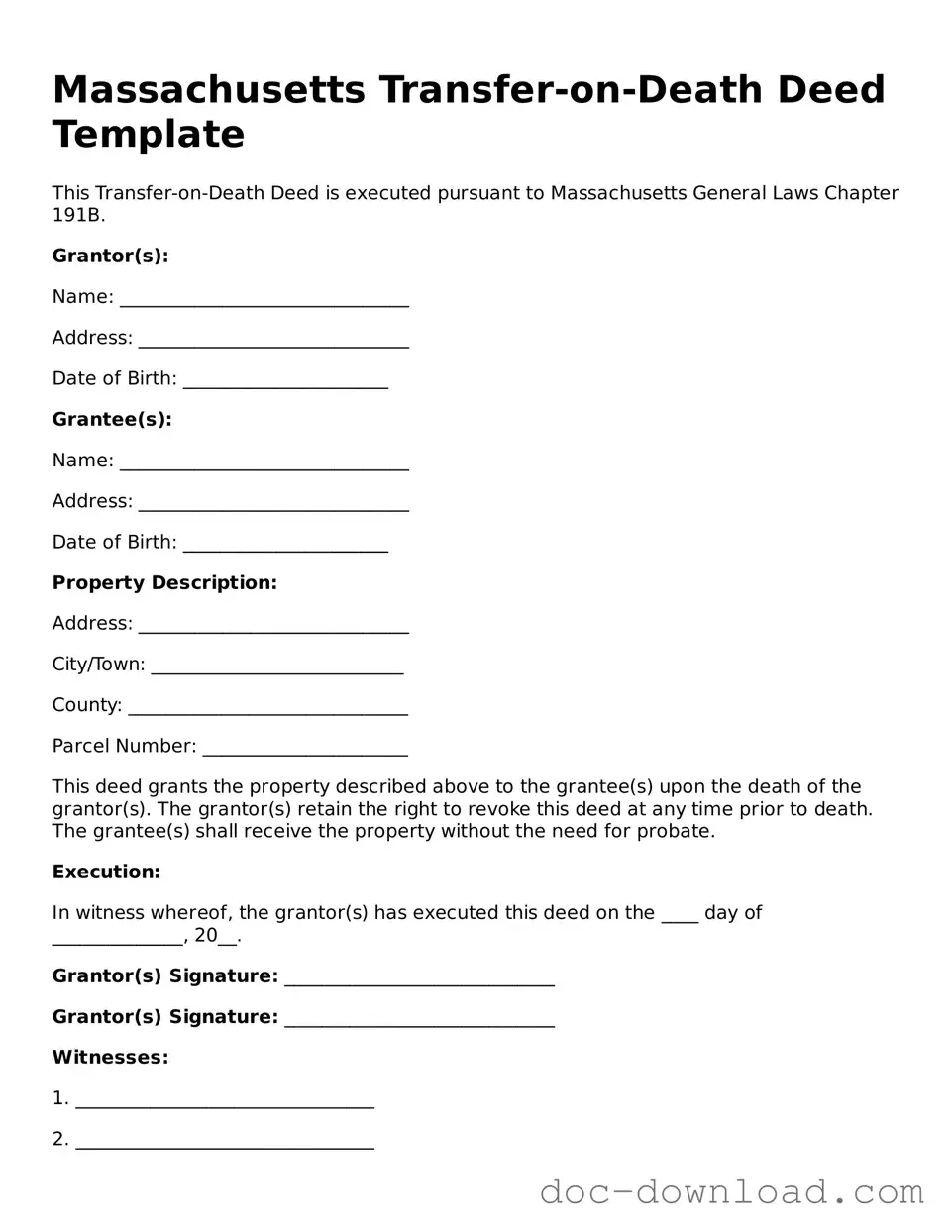

Massachusetts Transfer-on-Death Deed Template

This Transfer-on-Death Deed is executed pursuant to Massachusetts General Laws Chapter 191B.

Grantor(s):

Name: _______________________________

Address: _____________________________

Date of Birth: ______________________

Grantee(s):

Name: _______________________________

Address: _____________________________

Date of Birth: ______________________

Property Description:

Address: _____________________________

City/Town: ___________________________

County: ______________________________

Parcel Number: ______________________

This deed grants the property described above to the grantee(s) upon the death of the grantor(s). The grantor(s) retain the right to revoke this deed at any time prior to death. The grantee(s) shall receive the property without the need for probate.

Execution:

In witness whereof, the grantor(s) has executed this deed on the ____ day of ______________, 20__.

Grantor(s) Signature: _____________________________

Grantor(s) Signature: _____________________________

Witnesses:

1. ________________________________

2. ________________________________

Notarization:

State of Massachusetts, County of ________________

On this ____ day of ______________, 20__, before me, a Notary Public, personally appeared _______________________________ and proved to me through satisfactory evidence of identification to be the person whose name is signed on the preceding or attached document, and acknowledged to me that he/she signed it voluntarily for its stated purpose.

Notary Public Signature: ________________________________

My Commission Expires: _______________________________