Blank Promissory Note Document for Massachusetts

The Massachusetts Promissory Note form serves as a crucial financial instrument, enabling individuals or businesses to formalize a loan agreement. This document outlines the terms under which one party promises to pay a specified sum of money to another party, often including details such as the interest rate, repayment schedule, and any collateral involved. Clarity is essential, as the note must specify the due date and the consequences of default. Additionally, it typically includes provisions for prepayment and any applicable fees. By using this standardized form, parties can ensure that their agreement is legally enforceable, protecting both the lender's and borrower's interests. Understanding the key components of the Massachusetts Promissory Note is vital for anyone entering into a lending arrangement, as it provides a clear framework for the transaction and helps prevent misunderstandings in the future.

Similar forms

The Massachusetts Promissory Note is similar to a Loan Agreement in that both documents outline the terms of a loan between a borrower and a lender. A Loan Agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral securing the loan. Like the Promissory Note, it serves as a binding contract, but it often contains more comprehensive terms and conditions, making it suitable for larger or more complex loans.

Another document akin to the Massachusetts Promissory Note is a Mortgage. While a Promissory Note represents a promise to repay a loan, a Mortgage secures that promise with real property. In essence, the Mortgage provides the lender with a claim to the property if the borrower fails to repay the loan. Both documents work together to create a complete loan transaction, but the Mortgage adds a layer of security for the lender.

A Personal Guarantee is also similar to a Promissory Note. This document involves a third party who agrees to take responsibility for the debt if the primary borrower defaults. It adds a level of assurance for the lender, similar to how a Promissory Note assures repayment from the borrower. However, a Personal Guarantee often lacks the detailed repayment terms found in a Promissory Note.

Next, consider the Secured Note. This document is like a Promissory Note but includes collateral that the borrower pledges to secure the loan. If the borrower defaults, the lender can claim the collateral. The inclusion of security makes the Secured Note a safer option for lenders, much like how a Promissory Note establishes a clear repayment obligation.

In Colorado, when engaging in the sale of a horse, it's crucial to utilize a proper legal document to ensure clarity and protect the interests of both the buyer and seller. This is where a Colorado Horse Bill of Sale form becomes essential, as it records the terms of the transaction in detail. For those looking to access such documentation, resources like Colorado PDF Forms provide a reliable means to obtain the necessary forms to finalize the ownership transfer smoothly.

The Demand Note is another document that shares similarities with the Massachusetts Promissory Note. A Demand Note allows the lender to request repayment at any time, rather than adhering to a fixed schedule. While both documents indicate a borrower's obligation to repay, the Demand Note offers more flexibility for the lender, making it a useful tool in certain financial situations.

A Commercial Note is also comparable to a Promissory Note, particularly when used in business transactions. This type of note is specifically designed for business loans and often includes terms that reflect the unique needs of commercial lending. While both documents serve the same fundamental purpose of outlining a repayment obligation, a Commercial Note may contain additional clauses pertinent to business operations.

Then there's the Installment Note, which is similar in that it details a borrower's promise to repay a loan in regular installments over time. Like the Promissory Note, it specifies the amount, interest rate, and payment schedule. The key difference lies in the structured repayment plan, which can help borrowers manage their finances more predictably.

Lastly, the IOU, or "I Owe You," is a more informal document that acknowledges a debt. While it lacks the legal structure of a Promissory Note, it serves a similar purpose by recognizing the borrower's obligation to repay a certain amount. An IOU can be useful for personal loans among friends or family, but it generally does not carry the same weight in legal settings as a Promissory Note.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Massachusetts Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. |

| Governing Law | This form is governed by the Massachusetts Uniform Commercial Code (UCC), specifically under Chapter 106 of the General Laws of Massachusetts. |

| Essential Elements | To be valid, the note must include the amount owed, the interest rate (if applicable), the payment schedule, and the signatures of the parties involved. |

| Transferability | Promissory notes in Massachusetts can be transferred to third parties, allowing the holder to assign the right to receive payment to another individual or entity. |

| Legal Enforcement | If the borrower fails to repay the amount due, the lender can pursue legal action to enforce the note and recover the owed funds through the courts. |

Additional State-specific Promissory Note Forms

Texas Promissory Note Form - Each promissory note should be tailored to fit the specific financial agreement being made.

Promissory Note Template Arizona - Provides clear communication regarding financial responsibilities.

A Florida Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing the property's title. This type of deed is often utilized in situations such as transferring property between family members or clearing up title issues. For those seeking to simplify this process, more information can be found at https://quitclaimdeedtemplate.com/florida-quitclaim-deed-template. If you're ready to fill out the form, click the button below!

Florida Promissory Note Requirements - Finding legal assistance can be beneficial when drafting a promissory note.

Sample - Massachusetts Promissory Note Form

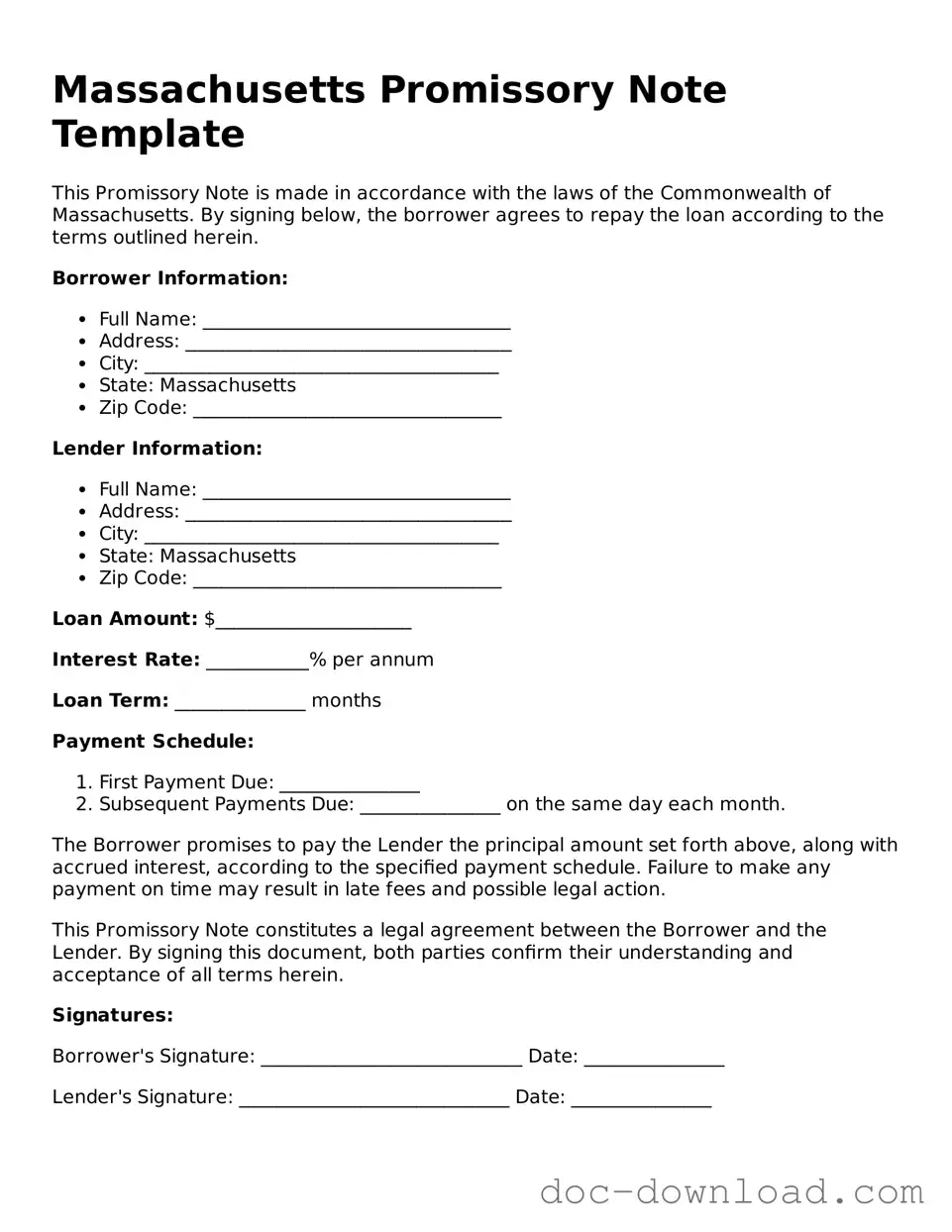

Massachusetts Promissory Note Template

This Promissory Note is made in accordance with the laws of the Commonwealth of Massachusetts. By signing below, the borrower agrees to repay the loan according to the terms outlined herein.

Borrower Information:

- Full Name: _________________________________

- Address: ___________________________________

- City: ______________________________________

- State: Massachusetts

- Zip Code: _________________________________

Lender Information:

- Full Name: _________________________________

- Address: ___________________________________

- City: ______________________________________

- State: Massachusetts

- Zip Code: _________________________________

Loan Amount: $_____________________

Interest Rate: ___________% per annum

Loan Term: ______________ months

Payment Schedule:

- First Payment Due: _______________

- Subsequent Payments Due: _______________ on the same day each month.

The Borrower promises to pay the Lender the principal amount set forth above, along with accrued interest, according to the specified payment schedule. Failure to make any payment on time may result in late fees and possible legal action.

This Promissory Note constitutes a legal agreement between the Borrower and the Lender. By signing this document, both parties confirm their understanding and acceptance of all terms herein.

Signatures:

Borrower's Signature: ____________________________ Date: _______________

Lender's Signature: _____________________________ Date: _______________