Blank Power of Attorney Document for Massachusetts

In Massachusetts, the Power of Attorney form serves as a crucial legal document that empowers an individual, known as the "principal," to designate another person, referred to as the "agent" or "attorney-in-fact," to make decisions on their behalf. This form can cover a wide range of financial and legal matters, from managing bank accounts and real estate transactions to making healthcare decisions, depending on how it is structured. One of the significant aspects of this form is its flexibility; the principal can choose to grant broad authority or limit the agent's powers to specific tasks. Additionally, the Massachusetts Power of Attorney can be durable, meaning it remains effective even if the principal becomes incapacitated, or it can be non-durable, terminating upon the principal's incapacity. Understanding the nuances of this document is essential, as it not only facilitates effective management of one’s affairs but also ensures that the principal's wishes are honored when they are unable to communicate them. Proper execution of the form, including signatures and notarization, is vital to its validity, making it essential for individuals to follow the state's requirements closely. This article will explore the key components, advantages, and considerations involved in utilizing the Massachusetts Power of Attorney form.

Similar forms

The Massachusetts Power of Attorney form is similar to a Living Will, which allows individuals to express their preferences regarding medical treatment in situations where they may be unable to communicate their wishes. Both documents empower individuals to make decisions about their health and financial matters, but a Living Will specifically focuses on medical care, while a Power of Attorney covers broader financial and legal responsibilities. In both cases, the intent is to ensure that one’s wishes are respected, even when one cannot voice them directly.

Another document that shares similarities is the Healthcare Proxy. This form designates a specific person to make medical decisions on behalf of someone else if they become incapacitated. Like the Power of Attorney, a Healthcare Proxy allows for the delegation of authority, ensuring that someone trusted can make critical decisions. The key difference lies in the scope; the Healthcare Proxy is limited to health-related decisions, while the Power of Attorney can encompass a wider range of financial and legal matters.

For those seeking to ensure their final wishes are clearly articulated, the importance of understanding the comprehensive Last Will and Testament document cannot be overstated. This form serves as a vital tool in establishing how one's assets will be distributed and who will care for any dependents after passing. By taking the time to fill out this document, individuals can provide peace of mind for themselves and their loved ones, minimizing potential disputes and confusion during difficult times.

The Advance Directive is also akin to the Power of Attorney. This document combines elements of a Living Will and a Healthcare Proxy, allowing individuals to outline their healthcare preferences and appoint someone to make decisions on their behalf. Both documents aim to provide clarity and guidance to loved ones and healthcare providers, ensuring that a person's wishes are honored in medical situations. However, the Power of Attorney is more comprehensive, addressing financial and legal issues beyond healthcare.

A Trust can be compared to the Power of Attorney in that both involve the management of assets and decision-making authority. A Trust allows individuals to place their assets into a legal entity, managed by a trustee for the benefit of designated beneficiaries. While the Power of Attorney grants authority to manage finances and make decisions while the individual is alive, a Trust often comes into play after death, facilitating the distribution of assets according to the individual’s wishes.

The Guardianship document is another related concept. This legal arrangement appoints someone to make decisions for another person, typically when that person is unable to do so due to incapacity. Similar to the Power of Attorney, Guardianship involves the delegation of authority. However, Guardianship is often court-appointed and can be more restrictive, as it may involve oversight and limitations on the guardian’s powers, whereas a Power of Attorney is generally more flexible and based on the individual’s preferences.

The Bill of Sale can also be likened to the Power of Attorney, particularly in terms of asset management. A Bill of Sale serves as a legal document that transfers ownership of personal property from one party to another. In contrast, the Power of Attorney allows an individual to authorize another person to handle transactions, including the sale of assets. Both documents facilitate the transfer of rights and responsibilities, but the Bill of Sale is specifically focused on the exchange of property.

Lastly, the Release of Liability form shares some common ground with the Power of Attorney. This document is used to relinquish claims against another party, often in the context of waiving rights to sue after an accident or injury. Both documents require clear consent and understanding from the individual granting authority or releasing liability. However, the Power of Attorney is broader in scope, allowing for various decisions to be made on behalf of the individual, whereas a Release of Liability is typically limited to specific incidents or agreements.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Power of Attorney (POA) in Massachusetts allows an individual (the principal) to authorize another person (the agent) to act on their behalf in legal and financial matters. |

| Governing Law | The Massachusetts Power of Attorney is governed by Massachusetts General Laws Chapter 201B. |

| Types of POA | Massachusetts recognizes several types of Power of Attorney, including durable, non-durable, and springing POAs, each serving different needs. |

| Durability | A durable Power of Attorney remains effective even if the principal becomes incapacitated, ensuring continued management of their affairs. |

| Revocation | The principal can revoke a Power of Attorney at any time, as long as they are mentally competent to do so. |

| Agent's Responsibilities | Agents must act in the best interest of the principal and adhere to any specific instructions provided in the Power of Attorney document. |

Additional State-specific Power of Attorney Forms

Types of Power of Attorney Indiana - By signing a Power of Attorney, you empower someone to act in your best interests.

Texas Durable Power of Attorney - Power of Attorney forms can often be found online, but ensure they comply with local laws.

The importance of having a well-drafted legal document such as the Georgia Durable Power of Attorney form cannot be emphasized enough, as it permits an individual to act on behalf of another in significant decisions regarding finances and health. For those interested in obtaining this essential form, resources are available, including Georgia PDF Forms, which provide a straightforward way to access the necessary paperwork for effective representation, even during times of incapacitation.

How to Get a Power of Attorney in Florida - This form can help families save time and money during legal or medical emergencies.

Sample - Massachusetts Power of Attorney Form

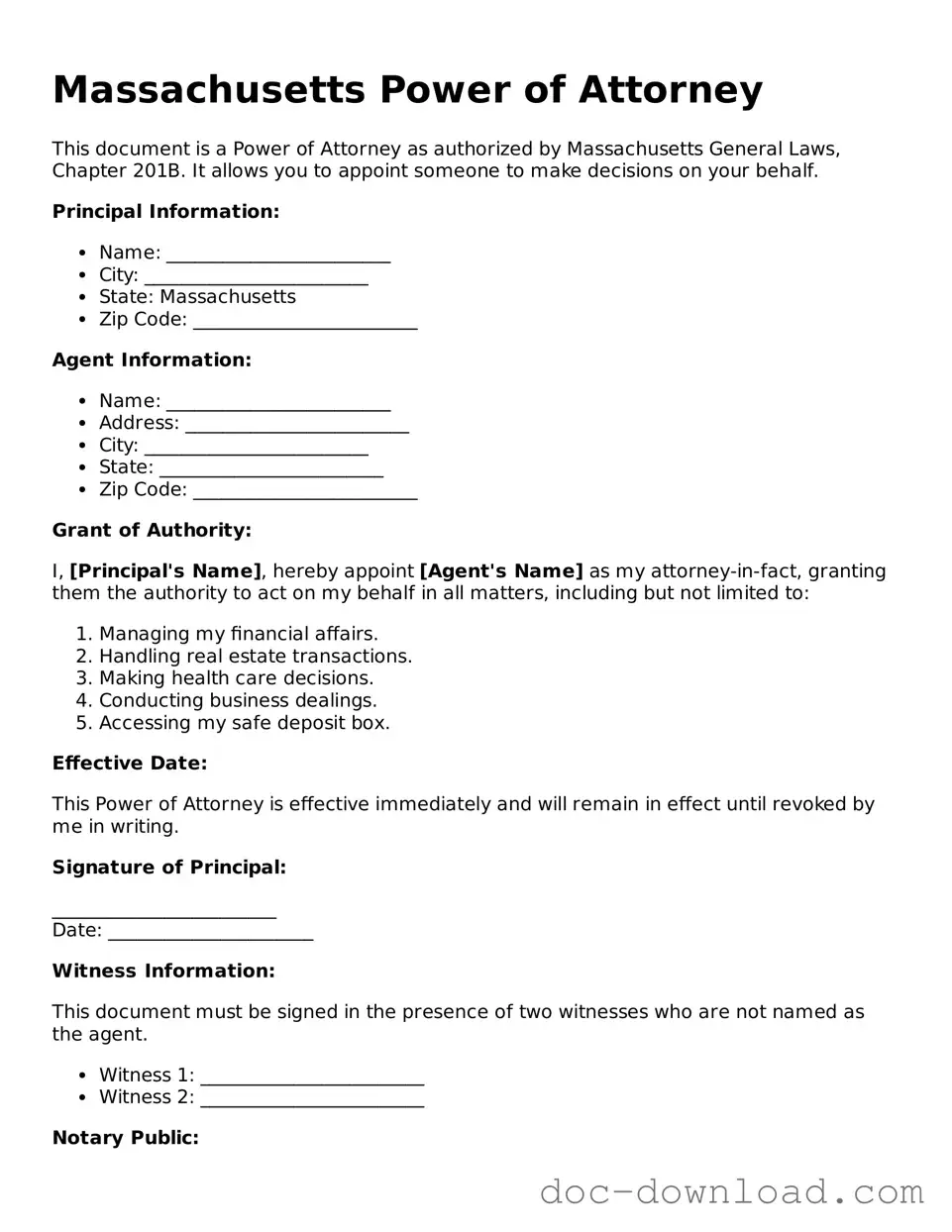

Massachusetts Power of Attorney

This document is a Power of Attorney as authorized by Massachusetts General Laws, Chapter 201B. It allows you to appoint someone to make decisions on your behalf.

Principal Information:

- Name: ________________________

- City: ________________________

- State: Massachusetts

- Zip Code: ________________________

Agent Information:

- Name: ________________________

- Address: ________________________

- City: ________________________

- State: ________________________

- Zip Code: ________________________

Grant of Authority:

I, [Principal's Name], hereby appoint [Agent's Name] as my attorney-in-fact, granting them the authority to act on my behalf in all matters, including but not limited to:

- Managing my financial affairs.

- Handling real estate transactions.

- Making health care decisions.

- Conducting business dealings.

- Accessing my safe deposit box.

Effective Date:

This Power of Attorney is effective immediately and will remain in effect until revoked by me in writing.

Signature of Principal:

________________________

Date: ______________________

Witness Information:

This document must be signed in the presence of two witnesses who are not named as the agent.

- Witness 1: ________________________

- Witness 2: ________________________

Notary Public:

State of Massachusetts

County of ________________

On this ___ day of ___________, 20___, before me, the undersigned notary public, personally appeared ____________________ (Principal Name), proved to me through satisfactory evidence of identification, which were __________________________, to be the person whose name is signed above.

______________________________

Notary Public

My Commission Expires: ___________