Fill Out Your Louisiana act of donation Template

The Louisiana Act of Donation Form serves as a vital tool for individuals looking to transfer ownership of property without the complexities often associated with traditional sales. This form is particularly significant in the context of gifting real estate or personal property, allowing donors to express their intent clearly and legally. It outlines essential details such as the identities of both the donor and the recipient, a description of the property being donated, and any conditions or restrictions that may apply to the donation. By providing a structured format, the Act of Donation ensures that both parties understand their rights and responsibilities, minimizing potential disputes in the future. Additionally, the form often requires notarization, which adds an extra layer of authenticity and protection for both the donor and the recipient. Understanding the nuances of this form can help individuals navigate the donation process smoothly, making it easier to share assets with loved ones or charitable organizations.

Similar forms

The Louisiana act of donation form is similar to a gift deed. A gift deed is a legal document that transfers property from one person to another without any exchange of money. Like the act of donation, it requires the donor's intent to give the property as a gift. Both documents must be executed in writing and often need to be notarized to ensure validity. The primary purpose of both forms is to clearly outline the transfer of ownership without any financial compensation involved.

The process of property transfer can often seem daunting, but having the correct documentation can make it manageable. For those in Colorado, utilizing a Quitclaim Deed form is a key part of transferring ownership without guaranteeing title validity. This option is particularly useful for family transactions or title clarifications. For further guidance on filling out this legal document, visit https://quitclaimdeedtemplate.com/colorado-quitclaim-deed-template.

An estate planning document, such as a will, shares similarities with the Louisiana act of donation form. Both documents facilitate the transfer of assets upon death or during the donor's lifetime. While a will takes effect after the individual's passing, the act of donation allows for immediate transfer of ownership. Both documents must be executed according to specific legal requirements to ensure they are enforceable, often requiring witnesses or notarization.

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | The Louisiana Act of Donation is a legal document used to transfer ownership of property from one person to another without any compensation. |

| Governing Law | This act is governed by the Louisiana Civil Code, specifically under Articles 1468 to 1471. |

| Types of Donations | Donations can be inter vivos (between living persons) or mortis causa (effective upon death). |

| Requirements | The act must be in writing and, for certain property types, may need to be notarized. |

| Revocation | Donations can be revoked under specific circumstances, such as if the donor becomes incapacitated or if the donee fails to fulfill conditions. |

| Tax Implications | Donations may have tax consequences, and both parties should consider consulting a tax professional. |

Different PDF Templates

Bill of Lading Forms - It plays a vital role in preventing fraud within the shipping industry.

Owner Operator Lease Agreement Pdf - The agreement clarifies that any loss or damage to goods is the Owner Operator's responsibility.

Filing the Colorado Homeschool Letter of Intent form not only initiates the homeschooling journey but also emphasizes the importance of adhering to state regulations. To facilitate this process, parents can access various resources, including those provided by Colorado PDF Forms, which offer the necessary documentation needed for compliance.

Roof Condition Certification Form - Proper documentation helps prevent misunderstandings after purchase.

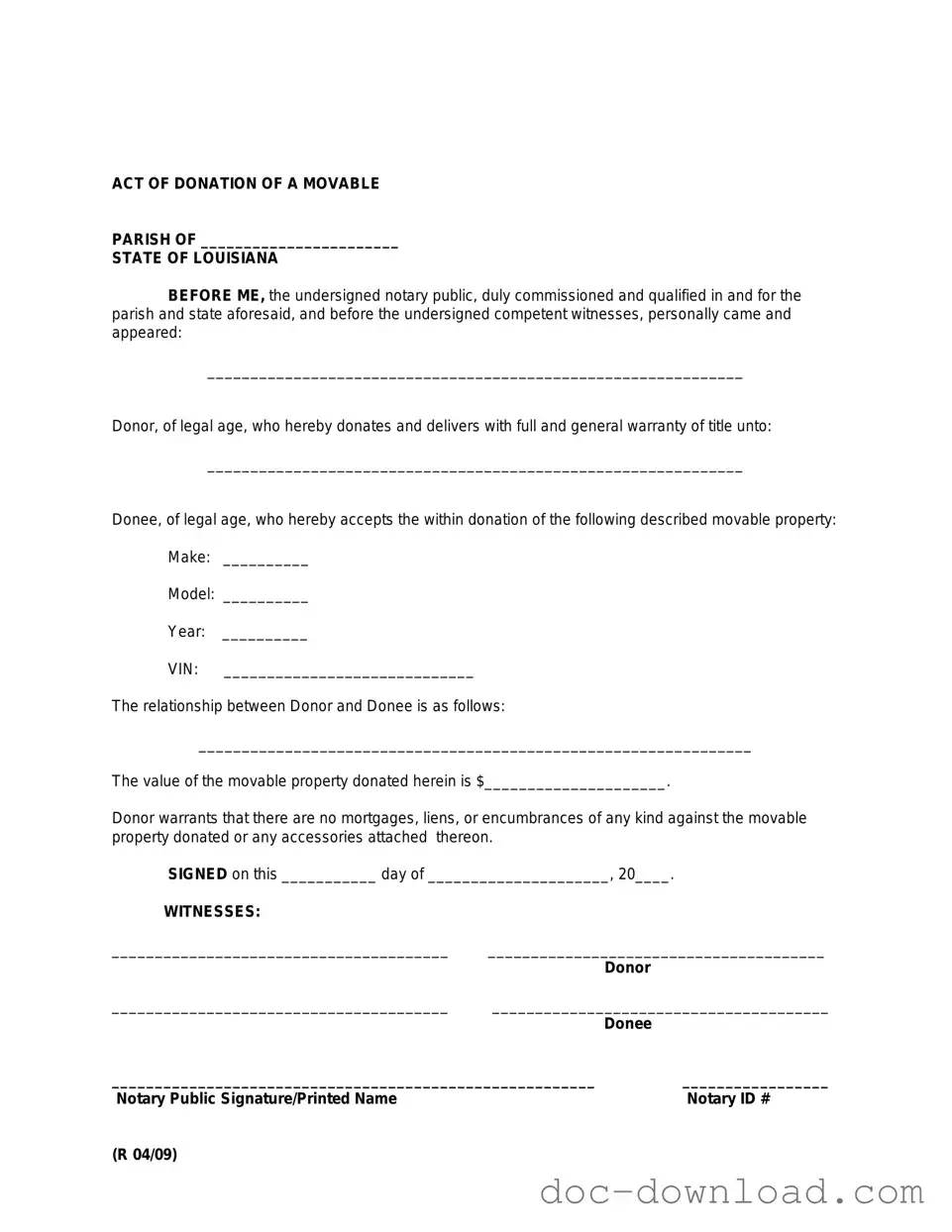

Sample - Louisiana act of donation Form

ACT OF DONATION OF A MOVABLE

PARISH OF _______________________

STATE OF LOUISIANA

BEFORE ME, the undersigned notary public, duly commissioned and qualified in and for the parish and state aforesaid, and before the undersigned competent witnesses, personally came and appeared:

______________________________________________________________

Donor, of legal age, who hereby donates and delivers with full and general warranty of title unto:

______________________________________________________________

Donee, of legal age, who hereby accepts the within donation of the following described movable property:

Make: __________

Model: __________

Year: __________

VIN: _____________________________

The relationship between Donor and Donee is as follows:

________________________________________________________________

The value of the movable property donated herein is $_____________________.

Donor warrants that there are no mortgages, liens, or encumbrances of any kind against the movable property donated or any accessories attached thereon.

SIGNED on this ___________ day of _____________________, 20____. |

|

|

WITNESSES: |

|

|

_______________________________________ |

_______________________________________ |

|

|

Donor |

|

_______________________________________ |

_______________________________________ |

|

|

Donee |

|

________________________________________________________ |

_________________ |

|

Notary Public Signature/Printed Name |

|

Notary ID # |

(R 04/09)