Printable Loan Agreement Template

When engaging in a loan transaction, a well-structured Loan Agreement form serves as a critical document that outlines the terms and conditions of the loan. This form typically includes essential elements such as the names of the borrower and lender, the principal amount being borrowed, and the interest rate applicable to the loan. Additionally, it specifies the repayment schedule, detailing when payments are due and the total duration of the loan. Provisions regarding late fees, collateral, and default conditions are also commonly included to protect the interests of both parties. Furthermore, the agreement may address prepayment options, ensuring that borrowers understand their rights and responsibilities. By clearly delineating these aspects, the Loan Agreement form not only fosters transparency but also helps to mitigate potential disputes that may arise during the life of the loan.

State-specific Guidelines for Loan Agreement Forms

Loan Agreement Document Subtypes

Similar forms

A promissory note is a financial document that outlines a borrower's promise to repay a loan under specified terms. Similar to a Loan Agreement, it includes details such as the amount borrowed, interest rate, and repayment schedule. However, a promissory note is generally simpler and may not contain the extensive terms and conditions found in a Loan Agreement. It serves as a straightforward acknowledgment of debt, while the Loan Agreement provides a more comprehensive framework for the lender and borrower relationship.

A mortgage agreement is another document closely related to a Loan Agreement, particularly in real estate transactions. This document secures the loan with the property itself, meaning if the borrower defaults, the lender can claim the property. While a Loan Agreement outlines the terms of the loan, a mortgage agreement specifies the collateral involved and the legal rights of both parties concerning the property. Both documents work together to protect the lender's interests while detailing the borrower's obligations.

A lease agreement shares similarities with a Loan Agreement in that both involve a contractual arrangement between two parties. In a lease agreement, one party (the lessor) allows another party (the lessee) to use property for a specified period in exchange for payment. Like a Loan Agreement, it outlines payment terms, duration, and responsibilities of both parties. However, while a Loan Agreement pertains to borrowing money, a lease agreement focuses on the rental of property, making it essential for different contexts.

An installment agreement is akin to a Loan Agreement in that it allows borrowers to repay a debt over time through scheduled payments. This type of agreement is often used for larger purchases, like vehicles or appliances. Both documents detail the payment amounts and schedule, but an installment agreement may not cover as many legal protections or stipulations as a Loan Agreement. Nevertheless, they both facilitate structured repayment plans for borrowers.

A credit agreement, often used in credit card or line of credit situations, shares common ground with a Loan Agreement. Both documents define the terms of borrowing, including interest rates, repayment terms, and fees. However, a credit agreement typically allows for more flexible borrowing and repayment options, as borrowers can draw on their credit line as needed. While a Loan Agreement usually pertains to a specific loan amount, a credit agreement provides ongoing access to funds, creating a different financial relationship.

When navigating the complexities of divorce filings, it's crucial to understand the importance of the various forms required by the court. In Georgia, for instance, the Georgia PDF Forms provide essential guidance for individuals preparing to address their marital dissolution, ensuring that they submit all necessary documentation in a format that meets legal standards.

A personal guarantee is another document that complements a Loan Agreement, especially in business loans. This document involves an individual agreeing to be responsible for repaying a loan if the borrowing entity defaults. While the Loan Agreement outlines the terms of the loan, the personal guarantee adds a layer of security for the lender. It ensures that a personal asset may be at stake, reinforcing the commitment of the borrower and providing additional assurance to the lender.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Loan Agreement is a legal document outlining the terms under which one party borrows money from another. |

| Parties Involved | The agreement typically involves a lender and a borrower, each with defined rights and obligations. |

| Interest Rate | The document specifies the interest rate, which can be fixed or variable, affecting the total repayment amount. |

| Repayment Terms | Repayment schedules, including the frequency and amount of payments, are detailed in the agreement. |

| Governing Law | The agreement is governed by the laws of the state in which it is executed, such as California or New York. |

| Default Clauses | Conditions under which the borrower may be considered in default are outlined, including potential penalties. |

| Collateral | In some cases, the agreement may require collateral, which secures the loan against default. |

| Amendments | Any changes to the agreement must be documented in writing and agreed upon by both parties. |

More Templates:

Tattoo Waiver App - A Tattoo Release form can help establish trust between clients and tattoo artists.

Ensuring a seamless transfer of ownership for your mobile home in Illinois is vital, and utilizing the Mobile Home Bill of Sale form can streamline this process by providing all necessary details required for the transaction.

Animal Bill of Sale - The form contains essential details about the livestock, including breed and age.

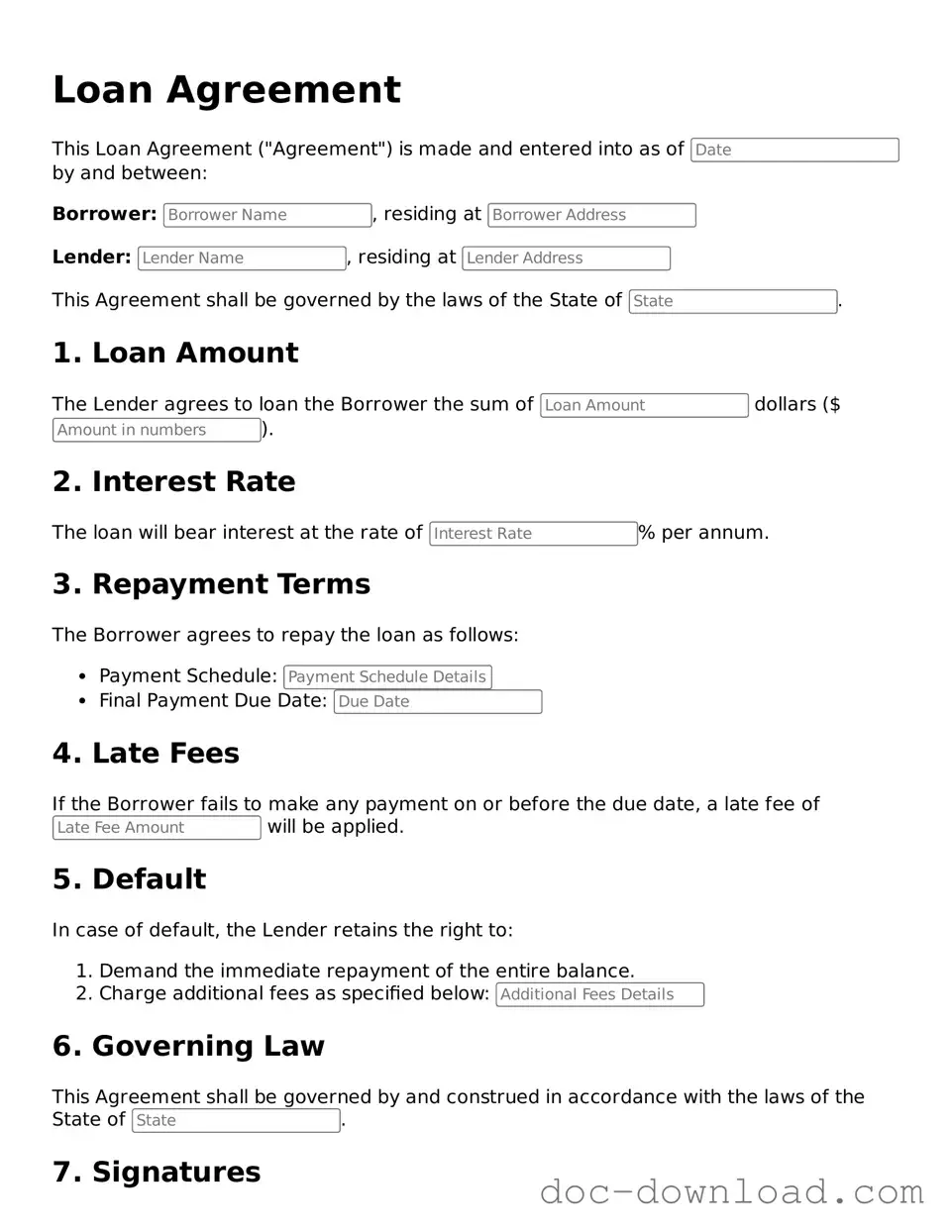

Sample - Loan Agreement Form

Loan Agreement

This Loan Agreement ("Agreement") is made and entered into as of by and between:

Borrower: , residing at

Lender: , residing at

This Agreement shall be governed by the laws of the State of .

1. Loan Amount

The Lender agrees to loan the Borrower the sum of dollars ($).

2. Interest Rate

The loan will bear interest at the rate of % per annum.

3. Repayment Terms

The Borrower agrees to repay the loan as follows:

- Payment Schedule:

- Final Payment Due Date:

4. Late Fees

If the Borrower fails to make any payment on or before the due date, a late fee of will be applied.

5. Default

In case of default, the Lender retains the right to:

- Demand the immediate repayment of the entire balance.

- Charge additional fees as specified below:

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of .

7. Signatures

By signing below, both parties agree to the terms and conditions outlined in this Agreement.

Borrower Signature: ______________________ Date:

Lender Signature: ______________________ Date: