Printable Investment Letter of Intent Template

When entering the world of investments, clarity and intention are crucial. The Investment Letter of Intent (LOI) serves as a foundational document in this process, outlining the key terms and conditions that will guide the investment relationship between parties. It typically includes essential details such as the amount of investment, the purpose of the funds, and the timeline for the investment. Additionally, the LOI often highlights any conditions that must be met before the investment is finalized, as well as the expectations of both the investor and the recipient. This document not only helps to set the stage for future negotiations but also demonstrates a serious commitment to moving forward. By clearly stating intentions, the Investment Letter of Intent can pave the way for a smoother and more transparent investment process, fostering trust and understanding between all parties involved.

Similar forms

The Investment Letter of Intent (LOI) shares similarities with a Memorandum of Understanding (MOU). Both documents serve as preliminary agreements outlining the intentions of parties involved in a transaction. An MOU, however, is typically less formal than an LOI and may not include specific terms of a deal. While an LOI often signifies a commitment to move forward, an MOU can serve as a framework for negotiation, detailing the general principles that will guide future agreements.

Another document akin to the Investment LOI is the Term Sheet. A Term Sheet outlines the basic terms and conditions of an investment or financing arrangement. Like the LOI, it provides a summary of key points but is generally more detailed regarding financial terms, valuation, and structure. Both documents are used to guide negotiations, but the Term Sheet often serves as a precursor to a more formal agreement, while the LOI can indicate a stronger intent to finalize the deal.

The Non-Binding Agreement is also comparable to the Investment LOI. This document establishes a mutual understanding between parties without creating enforceable obligations. While an LOI may contain binding provisions regarding confidentiality or exclusivity, a Non-Binding Agreement typically focuses on the intention to negotiate without committing to specific terms. Both documents aim to facilitate discussions and clarify the parties’ intentions, but the Non-Binding Agreement emphasizes a lack of enforceability.

In addition, the Letter of Intent for Real Estate Transactions bears resemblance to the Investment LOI. This document outlines the key terms and conditions for a potential real estate deal, such as purchase price and contingencies. Similar to the Investment LOI, it serves as a starting point for negotiations and expresses the parties' interest in moving forward. However, the real estate LOI often includes more specific details about property conditions and financing arrangements.

The Purchase Agreement is another document that shares characteristics with the Investment LOI. A Purchase Agreement is a formal contract that finalizes the sale of goods or services. While the Investment LOI expresses intent to invest, the Purchase Agreement solidifies the terms of that investment. Both documents reflect the parties' commitment to a transaction, but the Purchase Agreement is legally binding and includes comprehensive details about the transaction, including payment terms and obligations.

The Confidentiality Agreement, or Non-Disclosure Agreement (NDA), is also relevant when discussing the Investment LOI. This document protects sensitive information shared during negotiations. While the LOI may include confidentiality provisions, an NDA is specifically designed to safeguard proprietary information. Both documents are essential in maintaining trust between parties as they explore potential investments, but the NDA focuses solely on confidentiality rather than outlining the terms of the investment itself.

Lastly, the Joint Venture Agreement has similarities to the Investment LOI. This document formalizes the partnership between two or more parties to undertake a specific business venture. While the Investment LOI expresses interest in investing, the Joint Venture Agreement establishes the operational and financial structure of the partnership. Both documents reflect a commitment to collaboration, but the Joint Venture Agreement is more comprehensive, detailing responsibilities, profit-sharing, and management roles.

Document Overview

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent form outlines the preliminary terms of an investment agreement between parties. |

| Non-Binding Nature | This form is typically non-binding, meaning it expresses intent but does not create a legally enforceable obligation. |

| Governing Law | For state-specific forms, the governing law usually corresponds to the state where the investment is made, such as California or New York. |

| Key Components | It often includes details like investment amount, timeline, and any conditions that must be met before finalizing the deal. |

| Importance in Negotiations | The form serves as a foundation for negotiations, helping to clarify expectations and responsibilities for both parties. |

Other Investment Letter of Intent Templates:

Letter of Intent for Business Purchase - This document can help identify key personnel that may be retained post-sale.

Sample Letter of Intent to Purchase Property - It often addresses potential next steps, including further due diligence processes.

Sample - Investment Letter of Intent Form

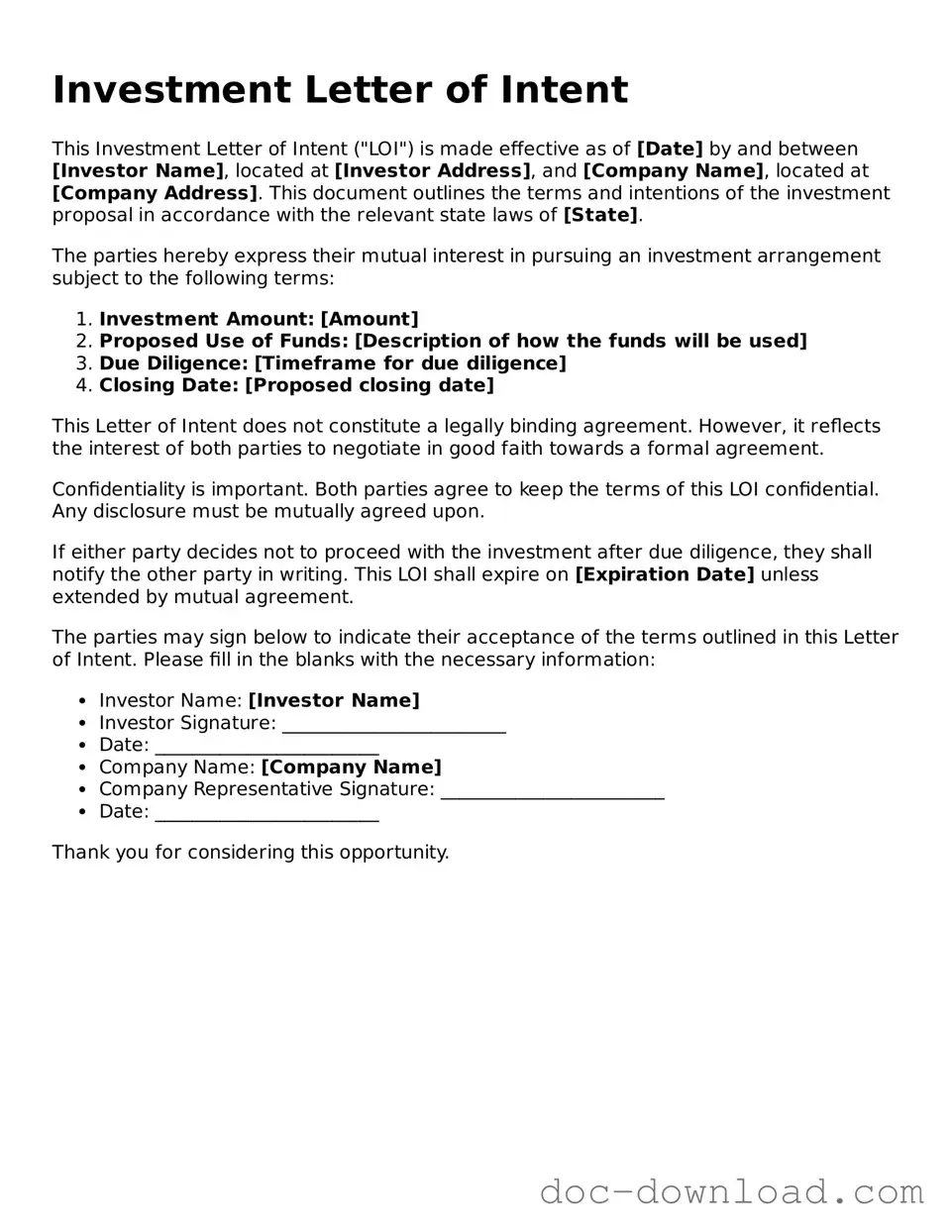

Investment Letter of Intent

This Investment Letter of Intent ("LOI") is made effective as of [Date] by and between [Investor Name], located at [Investor Address], and [Company Name], located at [Company Address]. This document outlines the terms and intentions of the investment proposal in accordance with the relevant state laws of [State].

The parties hereby express their mutual interest in pursuing an investment arrangement subject to the following terms:

- Investment Amount: [Amount]

- Proposed Use of Funds: [Description of how the funds will be used]

- Due Diligence: [Timeframe for due diligence]

- Closing Date: [Proposed closing date]

This Letter of Intent does not constitute a legally binding agreement. However, it reflects the interest of both parties to negotiate in good faith towards a formal agreement.

Confidentiality is important. Both parties agree to keep the terms of this LOI confidential. Any disclosure must be mutually agreed upon.

If either party decides not to proceed with the investment after due diligence, they shall notify the other party in writing. This LOI shall expire on [Expiration Date] unless extended by mutual agreement.

The parties may sign below to indicate their acceptance of the terms outlined in this Letter of Intent. Please fill in the blanks with the necessary information:

- Investor Name: [Investor Name]

- Investor Signature: ________________________

- Date: ________________________

- Company Name: [Company Name]

- Company Representative Signature: ________________________

- Date: ________________________

Thank you for considering this opportunity.