Blank Transfer-on-Death Deed Document for Indiana

The Indiana Transfer-on-Death Deed form offers a straightforward and effective method for property owners to transfer their real estate to designated beneficiaries upon their passing, without the need for probate. This legal tool allows individuals to maintain control over their property during their lifetime while ensuring a seamless transition of ownership after death. One of the key features of this form is its ability to be revoked or modified at any time, providing flexibility to the property owner as their circumstances or wishes change. Additionally, it requires the signature of the property owner and must be recorded with the county recorder’s office to be valid. The form can be used for various types of real estate, making it a versatile option for many homeowners. Understanding the nuances of the Transfer-on-Death Deed is essential for anyone considering this option, as it can significantly simplify the estate planning process and reduce the financial burden on loved ones. By utilizing this deed, individuals can ensure that their property is transferred according to their wishes, providing peace of mind for both themselves and their beneficiaries.

Similar forms

The Indiana Transfer-on-Death Deed (TOD) allows property owners to designate beneficiaries who will receive their real estate upon their death, bypassing the probate process. This document is similar to a Revocable Living Trust. Both instruments provide a way to transfer assets outside of probate, ensuring a smoother transition of property to beneficiaries. A Revocable Living Trust can hold various types of assets and can be altered during the grantor's lifetime, while the TOD deed specifically pertains to real estate. This flexibility makes trusts a popular choice for comprehensive estate planning.

Understanding the various legal documents related to property transfer is essential for effective estate planning. Among these, the Georgia Durable Power of Attorney form plays a significant role, enabling one person to manage another’s affairs, particularly in financial or health matters, and it remains valid even through incapacitation. For those in Georgia looking to navigate these complexities, resources such as Georgia PDF Forms can provide valuable assistance.

Another document comparable to the TOD deed is the Beneficiary Designation form. This form is often used for financial accounts, such as bank accounts or retirement plans, allowing account holders to name beneficiaries who will inherit those assets upon their death. Like the TOD deed, this form avoids probate and ensures a direct transfer to the named individuals. However, it is limited to financial accounts rather than real estate, which is the focus of the TOD deed.

The Last Will and Testament is also similar to the Indiana Transfer-on-Death Deed. Both documents are essential in estate planning and serve to distribute assets after death. A will, however, must go through the probate process, which can be time-consuming and costly. In contrast, the TOD deed allows for immediate transfer of property without court involvement, making it a more efficient option for real estate transfers.

A Life Estate Deed shares similarities with the TOD deed as well. This document allows a property owner to transfer their property to a beneficiary while retaining the right to use the property during their lifetime. Upon the owner’s death, the property automatically transfers to the beneficiary. While both documents facilitate the transfer of property outside of probate, a Life Estate Deed grants the current owner rights until death, whereas the TOD deed transfers ownership entirely upon death.

The Joint Tenancy with Right of Survivorship is another legal arrangement akin to the TOD deed. In this setup, two or more individuals hold property together, and upon the death of one owner, the remaining owners automatically inherit the deceased's share. This method avoids probate, similar to the TOD deed. However, joint tenancy can complicate ownership rights during the lifetime of the owners, whereas the TOD deed allows for more straightforward control over the property until death.

The Transfer-on-Death Account (TOD Account) is also relevant. This financial instrument allows individuals to designate beneficiaries for their bank or investment accounts, ensuring that the funds transfer directly to the named beneficiaries upon death. Like the TOD deed, it avoids probate and provides a seamless transfer of assets. However, the TOD Account is limited to financial assets, while the TOD deed specifically addresses real estate.

Lastly, a Durable Power of Attorney can be seen as similar in that it allows individuals to designate someone to manage their financial matters, including real estate, while they are alive. This document does not directly transfer property upon death but empowers the designated agent to act on behalf of the property owner. While both the Durable Power of Attorney and the TOD deed involve the management of property, they serve different purposes and timelines within estate planning.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | The Indiana Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by Indiana Code § 32-17-14. |

| Eligibility | Only individuals who own real estate in Indiana can create a Transfer-on-Death Deed. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries to receive the property. |

| Revocation | The deed can be revoked at any time by the property owner, provided they follow the proper legal procedures. |

| Recording Requirement | The Transfer-on-Death Deed must be recorded in the county where the property is located to be effective. |

| No Immediate Transfer | Ownership does not transfer to the beneficiary until the death of the property owner. |

Additional State-specific Transfer-on-Death Deed Forms

Transfer on Death Deed Tennessee Form - This form provides peace of mind by ensuring that the property owner’s wishes are honored after their passing.

To ensure your estate is handled according to your wishes, utilizing a well-crafted Last Will and Testament document template is vital. This form simplifies the process of outlining your final desires, making it a key component in effective estate planning.

Arizona Beneficiary Deed Form - Completing this deed can significantly ease the burden on surviving family members during an emotionally challenging time.

Sample - Indiana Transfer-on-Death Deed Form

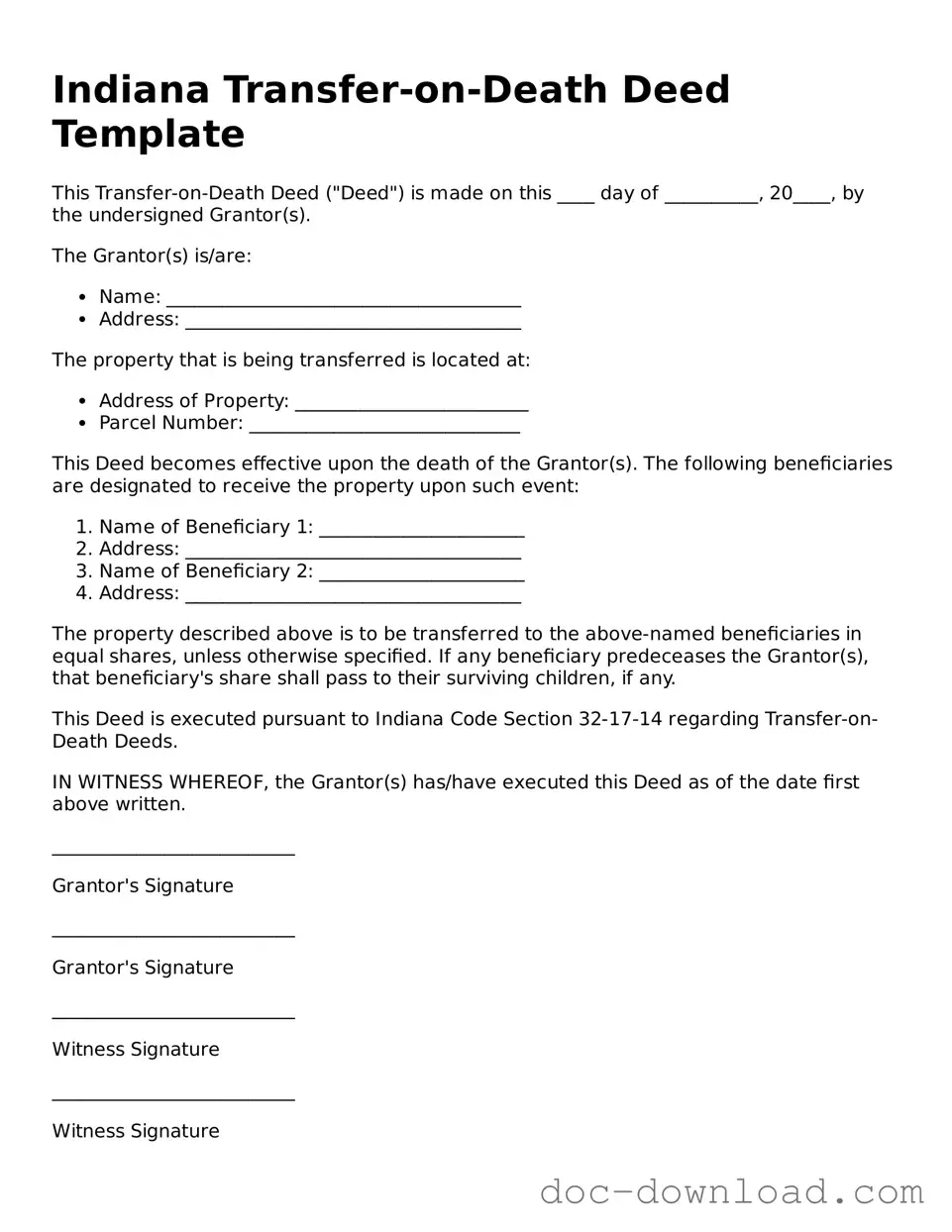

Indiana Transfer-on-Death Deed Template

This Transfer-on-Death Deed ("Deed") is made on this ____ day of __________, 20____, by the undersigned Grantor(s).

The Grantor(s) is/are:

- Name: ______________________________________

- Address: ____________________________________

The property that is being transferred is located at:

- Address of Property: _________________________

- Parcel Number: _____________________________

This Deed becomes effective upon the death of the Grantor(s). The following beneficiaries are designated to receive the property upon such event:

- Name of Beneficiary 1: ______________________

- Address: ____________________________________

- Name of Beneficiary 2: ______________________

- Address: ____________________________________

The property described above is to be transferred to the above-named beneficiaries in equal shares, unless otherwise specified. If any beneficiary predeceases the Grantor(s), that beneficiary's share shall pass to their surviving children, if any.

This Deed is executed pursuant to Indiana Code Section 32-17-14 regarding Transfer-on-Death Deeds.

IN WITNESS WHEREOF, the Grantor(s) has/have executed this Deed as of the date first above written.

__________________________

Grantor's Signature

__________________________

Grantor's Signature

__________________________

Witness Signature

__________________________

Witness Signature

This document should be filed with the appropriate county recorder's office in Indiana to ensure that the property transfer occurs according to your wishes.