Blank Promissory Note Document for Indiana

In Indiana, a Promissory Note serves as a crucial financial document that outlines the terms of a loan agreement between a borrower and a lender. This form typically includes key components such as the principal amount, interest rate, repayment schedule, and any applicable fees. It establishes the borrower's commitment to repay the borrowed funds, along with the lender's rights in case of default. Additionally, the Promissory Note may specify whether the loan is secured or unsecured, which can significantly impact the lender's recourse options. Understanding the nuances of this document is essential for both parties, as it not only clarifies the expectations and responsibilities involved but also serves as a legal record of the transaction. By adhering to Indiana's specific requirements for Promissory Notes, individuals can ensure that their agreements are enforceable and protect their financial interests.

Similar forms

The Indiana Promissory Note form bears similarities to a Loan Agreement. Both documents serve as formal contracts between a borrower and a lender, outlining the terms of a loan. A Loan Agreement typically includes details such as the loan amount, interest rate, repayment schedule, and any collateral involved. Like a Promissory Note, it is designed to protect the lender's interests while providing clarity to the borrower about their obligations. However, a Loan Agreement may be more comprehensive, covering additional provisions like default conditions and dispute resolution, which are not always present in a Promissory Note.

Another document akin to the Indiana Promissory Note is the Mortgage Agreement. While a Promissory Note focuses on the borrower's promise to repay the borrowed amount, a Mortgage Agreement secures that promise with real property. In essence, the Mortgage Agreement allows the lender to take possession of the property if the borrower defaults. Both documents work in tandem; the Promissory Note establishes the debt, while the Mortgage Agreement provides collateral to ensure repayment. This relationship underscores the importance of both documents in real estate transactions.

For those seeking proof of their employment, utilizing the Employment Verification form can greatly facilitate the process. This document enables individuals to establish their work history and status with potential employers or financial institutions. For more information on this process, consider visiting a comprehensive Employment Verification resource.

A Credit Agreement is also similar to the Indiana Promissory Note, particularly in its function as a binding contract between a lender and a borrower. While a Promissory Note generally pertains to a single loan, a Credit Agreement may cover multiple loans or a revolving line of credit. Both documents outline repayment terms and conditions, but a Credit Agreement often includes more detailed provisions regarding fees, interest rates, and the borrower's financial obligations. This makes it a more flexible option for borrowers who may require ongoing access to funds.

Lastly, a Personal Guarantee can be compared to the Indiana Promissory Note, especially in situations involving small businesses. A Personal Guarantee is a promise made by an individual to repay a loan if the business fails to do so. Similar to a Promissory Note, it formalizes the borrower's commitment to repay the debt. However, a Personal Guarantee often adds a layer of personal accountability, meaning the lender can pursue the individual's assets if the business defaults. This document emphasizes the personal stakes involved in business financing, making it a critical tool for lenders seeking additional security.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | An Indiana Promissory Note is a written promise to pay a specific amount of money at a designated time. |

| Governing Law | The Indiana Uniform Commercial Code (UCC) governs promissory notes in the state. |

| Parties Involved | The note involves two primary parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, and it should be clearly stated in the document. |

| Payment Terms | Payment terms must be specified, including the due date and any late fees applicable. |

| Enforceability | To be enforceable, the note must be signed by the borrower and may require witnesses or notarization. |

Additional State-specific Promissory Note Forms

Should a Promissory Note Be Notarized - Signatures from both parties are required for the note to be enforceable.

When dealing with real estate transactions in Georgia, utilizing a Georgia Deed form is vital to facilitate the legal transfer of property ownership. This form not only serves as a formal agreement but also helps prevent any future disputes regarding ownership. For those needing assistance with the documentation, resources like Georgia PDF Forms can be incredibly helpful in ensuring all necessary information is accurately filled out.

Promissory Note Template California Word - A clear, concise promissory note reduces the potential for misunderstandings about repayment terms.

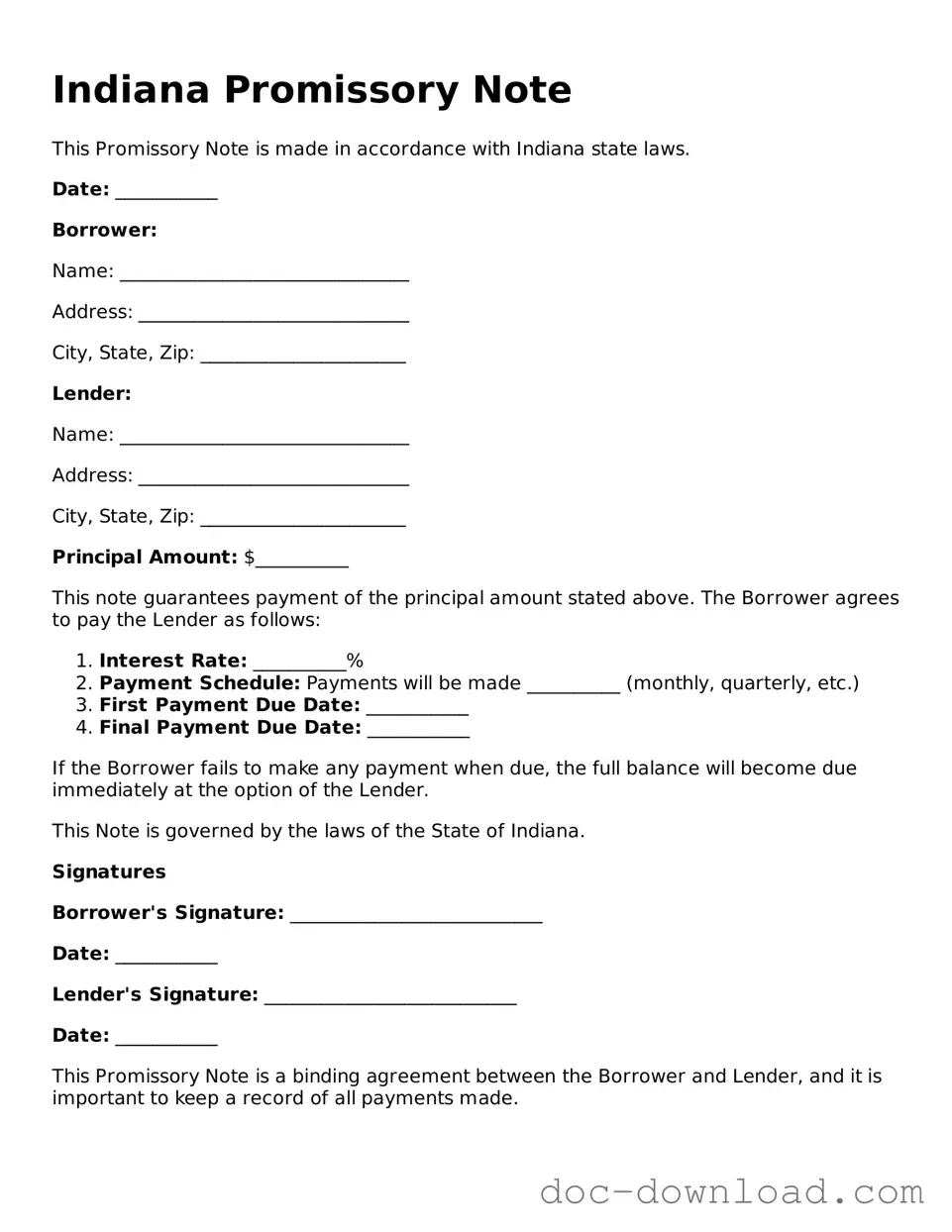

Sample - Indiana Promissory Note Form

Indiana Promissory Note

This Promissory Note is made in accordance with Indiana state laws.

Date: ___________

Borrower:

Name: _______________________________

Address: _____________________________

City, State, Zip: ______________________

Lender:

Name: _______________________________

Address: _____________________________

City, State, Zip: ______________________

Principal Amount: $__________

This note guarantees payment of the principal amount stated above. The Borrower agrees to pay the Lender as follows:

- Interest Rate: __________%

- Payment Schedule: Payments will be made __________ (monthly, quarterly, etc.)

- First Payment Due Date: ___________

- Final Payment Due Date: ___________

If the Borrower fails to make any payment when due, the full balance will become due immediately at the option of the Lender.

This Note is governed by the laws of the State of Indiana.

Signatures

Borrower's Signature: ___________________________

Date: ___________

Lender's Signature: ___________________________

Date: ___________

This Promissory Note is a binding agreement between the Borrower and Lender, and it is important to keep a record of all payments made.