Fill Out Your Independent Contractor Pay Stub Template

When it comes to managing payments for independent contractors, clarity and transparency are paramount. The Independent Contractor Pay Stub form serves as a vital tool for both contractors and businesses alike, providing a detailed breakdown of earnings for each pay period. This form typically includes essential information such as the contractor's name, the payment date, and a summary of the services rendered. It also outlines the gross pay, any deductions, and the net amount received, ensuring that contractors have a clear understanding of their compensation. Additionally, it may feature fields for tax identification numbers and payment methods, which further streamline the payment process. By utilizing this form, businesses can maintain accurate records while fostering trust and professionalism in their relationships with independent contractors. Understanding the components of this pay stub is key to ensuring compliance and promoting transparency in financial transactions.

Similar forms

The Independent Contractor Pay Stub form shares similarities with the Employee Pay Stub. Both documents serve to provide a detailed breakdown of earnings for work performed. They typically include information such as hours worked, pay rate, and deductions. While the employee pay stub is designed for traditional employees, it often highlights tax withholdings and benefits that independent contractors may not receive. This distinction is crucial, as it emphasizes the independent contractor's status and the nature of their compensation.

Another document akin to the Independent Contractor Pay Stub is the Invoice. Independent contractors frequently use invoices to bill clients for services rendered. Like pay stubs, invoices detail the amount owed, the services provided, and payment terms. However, invoices typically do not include deductions or tax information, as they focus solely on the transaction between the contractor and the client. Understanding both documents is essential for maintaining clear financial records.

Understanding the various documentation involved in property transactions, like the Georgia Deed form, is crucial for anyone navigating the real estate landscape. While independent contractors and employees deal with their respective pay stubs and 1099 forms, a Georgia Deed form functions within a different realm of legal documentation. It provides a definitive record of property transfer, much like how pay stubs demarcate earnings. To access important forms related to property transfers, you can visit Georgia PDF Forms, ensuring you have the necessary tools for secure and recognized transactions.

The 1099 form is also similar to the Independent Contractor Pay Stub. This tax document is issued to independent contractors by clients who have paid them $600 or more in a calendar year. While the pay stub provides a snapshot of earnings for a specific pay period, the 1099 summarizes total earnings for the year. Both documents are critical for tax reporting, but the 1099 is specifically designed for reporting income to the IRS, making it vital for compliance.

Lastly, the Payment Receipt shares characteristics with the Independent Contractor Pay Stub. A payment receipt is given to clients after payment has been made, confirming the transaction. It usually includes the amount paid, date of payment, and services rendered. While the pay stub focuses on earnings and deductions from the contractor's perspective, the payment receipt is more about acknowledging the completion of a financial obligation from the client's side. Both documents serve as essential records for financial accountability.

Form Specifications

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub is a document that outlines payments made to an independent contractor for their services. |

| Purpose | This form helps contractors keep track of their earnings and provides a record for tax purposes. |

| Legal Requirement | While not universally required, many states encourage or mandate the use of pay stubs for independent contractors. |

| Key Components | A typical pay stub includes the contractor's name, payment period, total earnings, deductions, and net pay. |

| State-Specific Forms | Some states, like California and New York, have specific regulations governing the issuance of pay stubs. |

| Governing Laws | In California, Labor Code Section 226 requires employers to provide detailed wage statements to independent contractors. |

| Tax Implications | Independent contractors are responsible for their own taxes, making accurate pay stubs essential for tax reporting. |

| Record Keeping | Contractors should keep copies of their pay stubs for at least three years for tax and legal purposes. |

| Digital Options | Many companies now offer digital pay stubs, making it easier for contractors to access and store their records. |

Different PDF Templates

How to Get Acord Insurance Certificate - This form serves as a crucial document for evaluating employee benefits.

When engaging in the sale of a motorcycle in Alabama, utilizing the Alabama Motorcycle Bill of Sale form is crucial for both buyers and sellers, as it ensures clarity and legality in the transaction. For further information and to obtain this essential document, you can visit motorcyclebillofsale.com/free-alabama-motorcycle-bill-of-sale.

Irs Form 1099 Nec - Each year, updated versions of the 1099-NEC may include revisions or new requirements from the IRS.

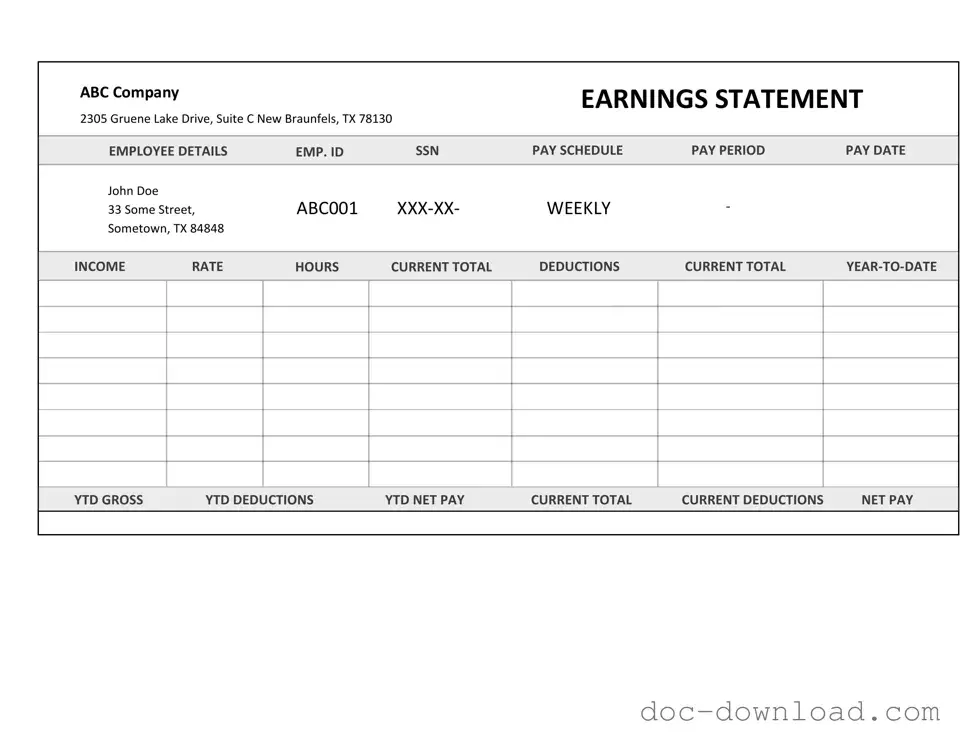

Sample - Independent Contractor Pay Stub Form

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |