Fill Out Your Goodwill donation receipt Template

When you donate items to Goodwill, you not only contribute to a worthy cause but also have the opportunity to receive a donation receipt, which can be beneficial for tax purposes. This receipt serves as proof of your charitable contribution and typically includes essential details such as the date of the donation, a description of the items donated, and the estimated value of those items. While the form may not specify an exact dollar amount, it encourages donors to assess the fair market value of their contributions. Additionally, Goodwill often provides guidance on what types of items are eligible for donation, helping you to make informed decisions about what to give. Understanding the importance of this receipt can enhance your charitable experience and ensure that you are making the most of your generosity while adhering to IRS guidelines for tax deductions.

Similar forms

The Goodwill donation receipt form shares similarities with the charitable contribution receipt. Both documents serve as proof of a donation made to a nonprofit organization. A charitable contribution receipt typically includes the donor's name, the date of the donation, a description of the donated items, and the organization's information. This document is essential for tax purposes, allowing donors to claim deductions for their contributions. Just like the Goodwill receipt, it verifies that a donation has been made and helps ensure transparency in charitable giving.

Another document that resembles the Goodwill donation receipt is the IRS Form 8283, which is used for noncash charitable contributions. This form is required when the total value of donated items exceeds a certain threshold. Similar to the Goodwill receipt, Form 8283 provides a detailed description of the donated items, their fair market value, and the date of the donation. Both documents are crucial for taxpayers who wish to claim deductions for their donations, ensuring that they comply with IRS regulations.

When it comes to documenting vehicle transactions in Colorado, individuals may also want to consider relevant resources such as the Motor Vehicle Bill of Sale. This essential form captures key transaction details to ensure compliance. For those looking for more templates or forms to assist with various documentation needs, check out Colorado PDF Forms, which offers helpful options to simplify your paperwork.

The donor acknowledgment letter is also akin to the Goodwill donation receipt. Nonprofits often send this letter to donors as a formal thank-you for their contributions. It includes essential details such as the donor's name, the donation amount, and a description of the items donated. Like the Goodwill receipt, this letter serves as documentation for tax purposes, allowing donors to substantiate their charitable contributions when filing their taxes.

Lastly, the donation confirmation email functions similarly to the Goodwill donation receipt. Many organizations send an email to confirm the receipt of a donation. This email typically includes information such as the donor's name, the date of the donation, and a brief description of the items donated. While it may not have the same formal structure as a printed receipt, it still serves as proof of the donation and can be used for tax deduction purposes, just like the Goodwill receipt.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Goodwill donation receipt form serves as proof of a charitable contribution for tax purposes. |

| Tax Deductibility | Donations made to Goodwill are generally tax-deductible if the donor itemizes deductions on their tax return. |

| Fair Market Value | Donors must determine the fair market value of the donated items for accurate tax reporting. |

| Record Keeping | Donors should keep the receipt for their records, especially if the total value exceeds $250. |

| State-Specific Forms | Some states may require specific forms or additional documentation for charitable donations. |

| Governing Laws | IRS guidelines under Section 170 govern the tax deductibility of charitable donations. |

| Itemization Requirement | To claim a deduction, taxpayers must itemize their deductions on Schedule A of Form 1040. |

| Limitations | There are limits on the amount that can be deducted based on the donor's adjusted gross income. |

| Non-Cash Donations | For non-cash donations over $500, additional forms such as IRS Form 8283 may be required. |

Different PDF Templates

Dd 214 - This document is issued upon discharge, reflecting the type and reason for separation.

Corporate Stock Ledger Example - A well-structured ledger promotes confidence among current and prospective shareholders.

A Quitclaim Deed is a legal document used in Illinois to transfer ownership of property from one person to another without any warranties. This form is often used in situations like transferring property between family members or clearing up title issues. For those seeking a simple solution to this process, you can find a helpful template at quitclaimdeedtemplate.com/illinois-quitclaim-deed-template. Ready to fill out the form? Click the button below!

How to Write a Contract for Rental Property - Tenant is responsible for ensuring that all occupants are aware of the lease rules.

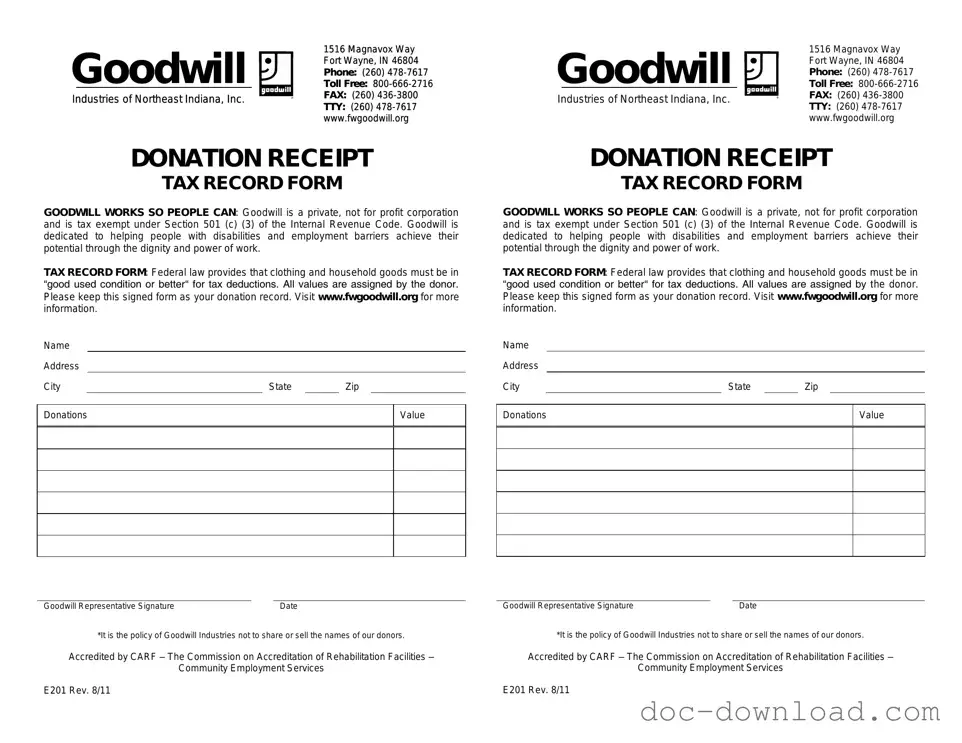

Sample - Goodwill donation receipt Form

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11