Fill Out Your Gift Letter Template

When it comes to securing a mortgage or purchasing a home, financial support from family and friends can play a crucial role in making the dream of homeownership a reality. One important document that often comes into play in these situations is the Gift Letter form. This form serves as a written declaration from the person providing the financial gift, confirming that the funds are indeed a gift and not a loan. It typically includes essential details such as the donor's name, the recipient's name, the amount of the gift, and the relationship between the two parties. By clarifying the nature of the funds, the Gift Letter helps lenders assess the borrower's financial situation more accurately. Additionally, it helps to prevent any misunderstandings or complications that might arise during the mortgage approval process. Understanding the nuances of this form can greatly enhance the home buying experience, ensuring that all parties are on the same page and that the transaction proceeds smoothly.

Similar forms

A Gift Letter is often compared to a Loan Agreement, as both documents outline the terms of financial assistance. However, while a Loan Agreement typically includes repayment terms and interest rates, a Gift Letter explicitly states that the funds are a gift and do not require repayment. This distinction is crucial, especially in real estate transactions, as lenders want to ensure that any funds provided do not create additional debt obligations for the borrower.

Another document similar to a Gift Letter is a Down Payment Assistance Agreement. This agreement may also detail financial support for a home purchase, but it often includes specific conditions or eligibility requirements tied to the assistance. Unlike a Gift Letter, which is straightforward in stating that the funds are a gift, a Down Payment Assistance Agreement might involve government programs or nonprofit organizations that have specific criteria for the recipient.

The Georgia Divorce Form serves as a crucial document in the legal landscape, ensuring that individuals looking to dissolve their marriage have the necessary paperwork in order. By providing clear and structured guidance on essential matters such as custody, property division, and other pertinent issues, the form helps streamline the process. For those needing resources related to this form, Georgia PDF Forms are an invaluable tool, offering access to all required documents and information to assist in completing the divorce proceedings efficiently.

A Promissory Note shares some similarities with a Gift Letter in that both involve the transfer of funds. However, a Promissory Note indicates a promise to repay the borrowed amount, including interest, which is the opposite of what a Gift Letter signifies. Understanding this difference is essential for both lenders and borrowers to avoid confusion regarding the nature of the financial transaction.

The Affidavit of Support is another document that parallels a Gift Letter, particularly in the context of immigration or sponsorship. This affidavit is often used to demonstrate that a sponsor has the financial means to support an immigrant. Like a Gift Letter, it confirms that the funds provided are intended to support the recipient. However, an Affidavit of Support often includes more detailed financial disclosures and obligations, emphasizing the sponsor's commitment to the recipient's welfare.

Lastly, a Financial Gift Tax Return (Form 709) is related to a Gift Letter in terms of documenting gifts for tax purposes. While a Gift Letter serves to clarify that the funds are a gift without expectation of repayment, the Financial Gift Tax Return is used to report gifts that exceed a certain value to the IRS. This document ensures compliance with tax regulations, whereas a Gift Letter is primarily focused on clarifying the intent behind the financial transaction.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose of Gift Letter | A gift letter is used to document a financial gift, often for a home purchase, ensuring that the funds are not a loan. |

| Donor and Recipient Information | The letter typically includes the names, addresses, and relationship between the donor and recipient. |

| Amount of Gift | It specifies the exact amount being gifted, which is crucial for financial records and mortgage applications. |

| No Repayment Required | The letter states that the gift does not need to be repaid, distinguishing it from a loan. |

| State-Specific Requirements | Some states may have specific laws regarding gift letters, such as California's Civil Code Section 1624. |

| Tax Implications | Donors may need to consider gift tax implications, as gifts above a certain amount may require tax filings. |

| Signature Requirement | Both the donor and recipient usually need to sign the letter to validate the transaction. |

Different PDF Templates

Is Geico Cheaper Than Progressive - Timeliness in submitting requests can aid in quicker resolutions.

Principal Immigrant Meaning - The I-864 form must be signed and dated by the sponsor for it to be valid.

To facilitate a successful lending transaction, it is advisable to utilize an efficient form, such as our thorough Loan Agreement preparation template available for your convenience. You can begin your process by visiting this Loan Agreement form guide.

Certificate of Membership - Captures information on who issued the membership interests.

Sample - Gift Letter Form

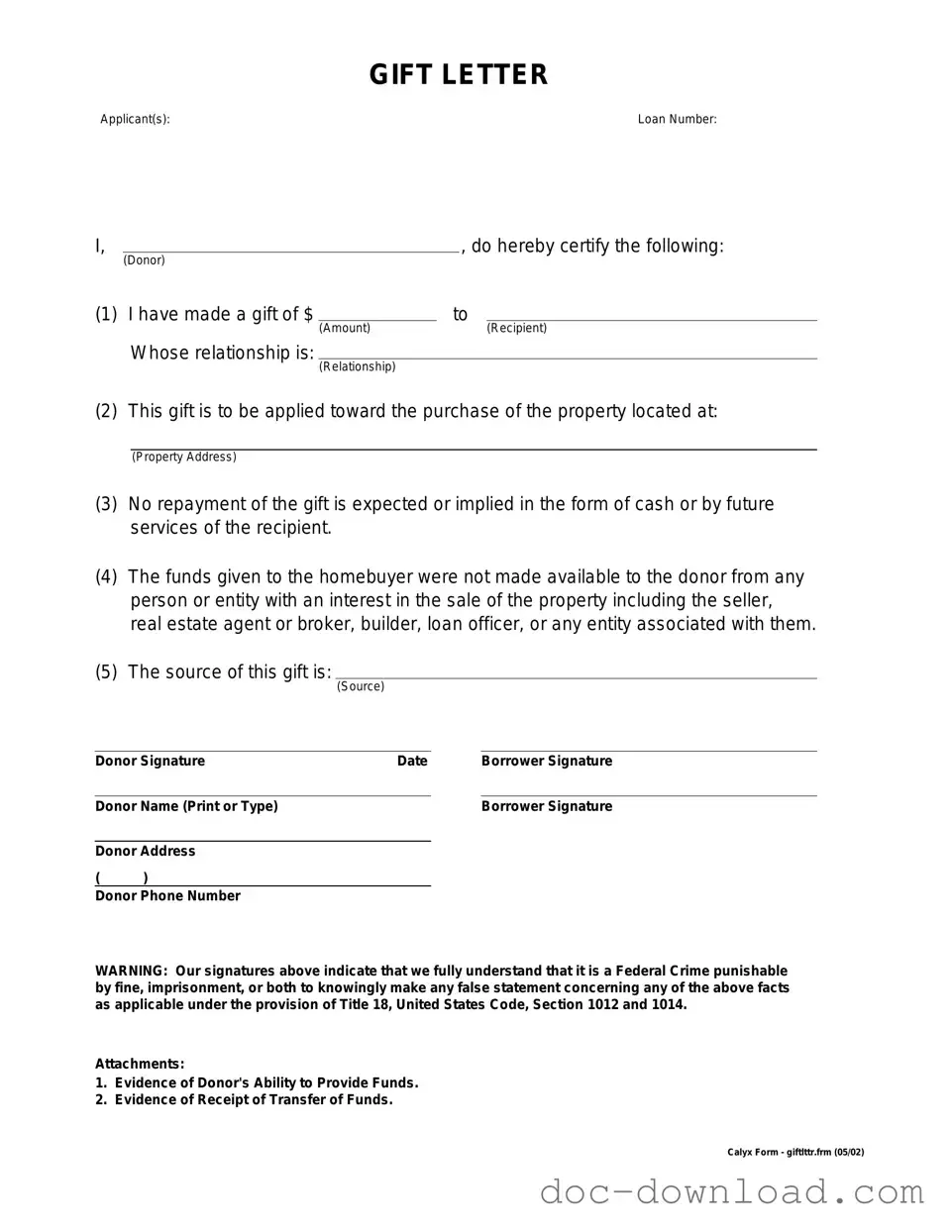

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)