Fill Out Your Generic Direct Deposit Template

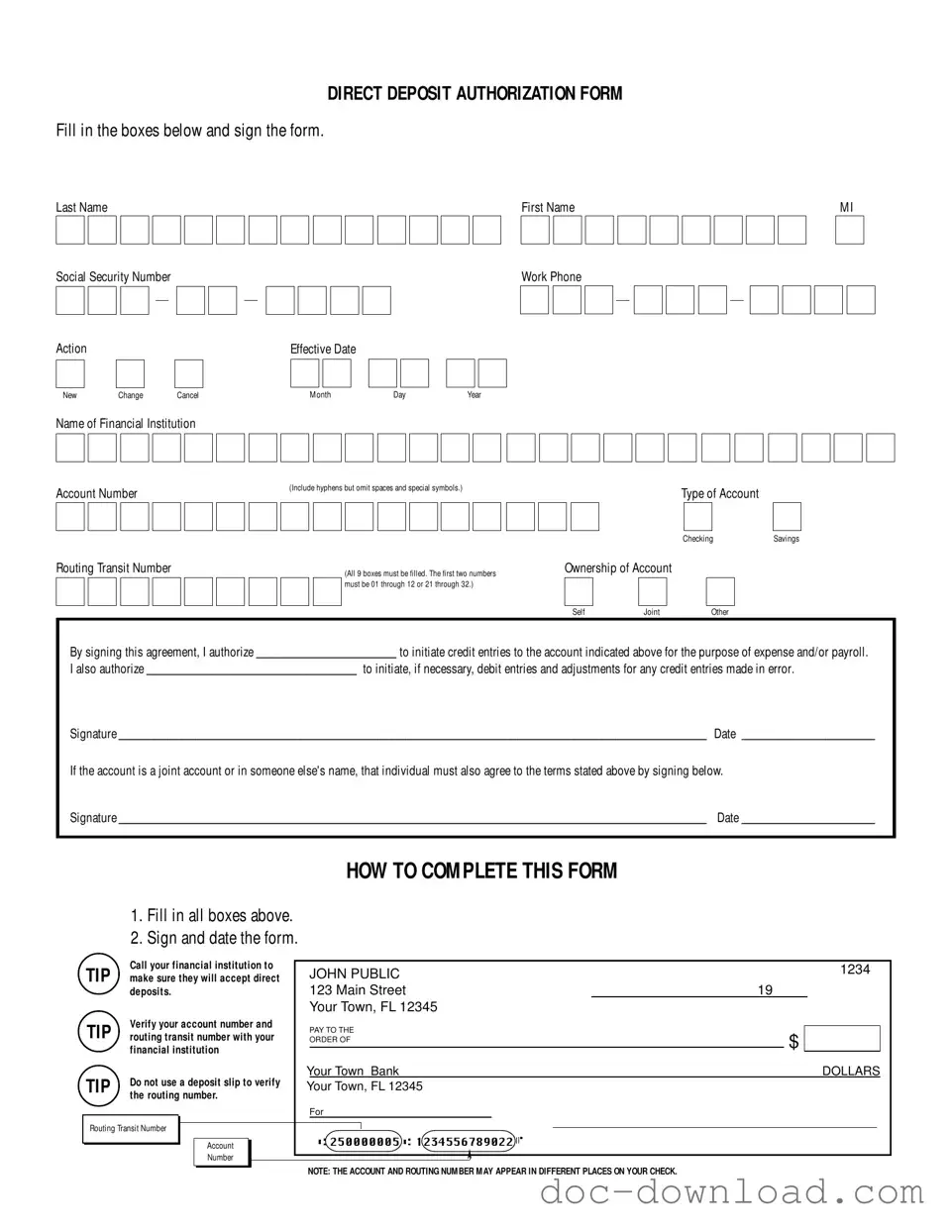

Managing finances can often feel overwhelming, but setting up direct deposit simplifies the process significantly. The Generic Direct Deposit form is a straightforward tool designed to facilitate the automatic transfer of funds into a bank account. This form requires essential information, including the account holder's name, Social Security number, and contact details. Users must indicate whether they are setting up a new direct deposit, changing an existing one, or canceling a previous authorization. Additionally, the form prompts for the name of the financial institution, the account number, and the routing transit number, all of which are crucial for ensuring that funds are directed to the correct account. It’s important to note the type of account—either checking or savings—since this affects how funds are processed. The form also includes a section for signatures, which is vital for authorizing the transaction. To ensure accuracy, users are encouraged to verify their account and routing numbers with their financial institution before submitting the form. By following these steps, individuals can enjoy the convenience of having their paychecks or other payments deposited directly into their accounts without the hassle of manual deposits.

Similar forms

The Generic Direct Deposit form shares similarities with a Payroll Authorization form. Both documents serve the purpose of allowing an employer to deposit funds directly into an employee's bank account. They require personal information, including the employee's name, Social Security number, and banking details. The Payroll Authorization form typically includes a section for the employee to indicate whether this is a new setup or a change to existing information, mirroring the options found in the Direct Deposit form.

Another document that resembles the Generic Direct Deposit form is the Automatic Payment Authorization form. This document is used to authorize recurring payments, such as utility bills or loan payments, to be deducted directly from a bank account. Like the Direct Deposit form, it requires the account holder's banking information and often includes a section for the account type. Both forms aim to streamline financial transactions by eliminating the need for manual payments.

The various forms utilized for financial transactions, such as the Generic Direct Deposit form, share commonalities in purpose and structure. Essential documentation, including a Purchase Agreement, plays a key role in formalizing the consent and authorization necessary for these automatic processes, ensuring accuracy and protection for all parties involved.

The Bank Account Information form is also quite similar. This document is often used when opening a new bank account or changing account details. It requires similar information, such as the account holder's name, Social Security number, and account numbers. The purpose of this form is to ensure that the bank has accurate information to manage the account effectively, just as the Direct Deposit form ensures that funds are deposited correctly.

A Credit Authorization form shares common ground with the Generic Direct Deposit form as well. This document allows a business to charge a customer's credit card for recurring payments or services. It requires the customer's personal information and credit card details. Both forms are designed to facilitate automatic transactions, ensuring that payments are processed without requiring additional action from the account holder.

The W-4 form, while primarily a tax document, has similarities in that it collects essential personal and financial information. Employees fill out the W-4 to inform their employer about their tax withholding preferences. Like the Direct Deposit form, it requires the employee's name, Social Security number, and may include changes to existing information. Both documents are crucial for ensuring accurate financial management in the workplace.

The Change of Address form is another document that bears resemblance to the Generic Direct Deposit form. This form is used to update personal information with various institutions, including banks and employers. It collects similar data, such as the individual's name and possibly their Social Security number, to verify identity. Both forms aim to keep records current, ensuring that important financial transactions are not disrupted.

Lastly, the Authorization to Release Information form is comparable to the Generic Direct Deposit form in that it allows for the sharing of personal information. This document is often used in various contexts, such as applying for loans or medical services. It requires the individual's consent to share their personal and financial information, similar to how the Direct Deposit form authorizes the transfer of funds into a bank account. Both forms emphasize the importance of consent in managing personal financial matters.

Form Specifications

| Fact Name | Description |

|---|---|

| Form Purpose | The Generic Direct Deposit form allows individuals to authorize direct deposits into their bank accounts. |

| Required Information | Participants must provide their name, Social Security Number, account details, and the financial institution's name. |

| Account Types | Users can select between a savings or checking account for the direct deposit. |

| Routing Number | The routing transit number must consist of 9 digits and follow specific numerical guidelines. |

| Ownership Declaration | Individuals must indicate whether the account is self-owned, joint, or other. |

| Signature Requirement | Both the account holder and any joint account holders must sign the form to authorize the transaction. |

| State-Specific Laws | In Florida, the governing law for direct deposits is outlined in Chapter 655 of the Florida Statutes. |

Different PDF Templates

How to File a Construction Lien in Florida - A certification of service at the end of the notice guarantees that the property owner is informed of the claim.

In addition to the vital role of the Georgia SOP form in real estate transactions, those looking for a range of legal documents and forms can benefit from resources like Georgia PDF Forms, which provide easy access to necessary materials for navigating the property acquisition process.

Download D1 Form Pdf - The form includes sections on health that must be filled out accurately.

Death of Joint Tenant California - Filling out the affidavit can prevent delays in property transfer following death.

Sample - Generic Direct Deposit Form

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.