Blank Promissory Note Document for Florida

The Florida Promissory Note form serves as a crucial legal document that outlines the terms of a loan agreement between a borrower and a lender. This form typically includes essential details such as the principal amount borrowed, the interest rate applicable, and the repayment schedule. It may also specify the consequences of default, including late fees or the potential for legal action. By clearly stating these terms, the Promissory Note provides both parties with a mutual understanding of their obligations. Additionally, it often requires signatures from both the borrower and lender, ensuring that both parties acknowledge and agree to the terms laid out in the document. Understanding the components of this form is vital for anyone involved in lending or borrowing money in Florida, as it helps protect the rights of both parties and facilitates smoother transactions.

Similar forms

The Florida Promissory Note is closely related to a Loan Agreement. Both documents outline the terms of a loan, including the amount borrowed, interest rates, and repayment schedules. However, a Loan Agreement often includes more detailed provisions regarding collateral, default conditions, and the responsibilities of both the lender and borrower, making it a more comprehensive document for larger loans.

A Mortgage Agreement shares similarities with a Promissory Note in that both involve borrowing money. The key difference lies in the purpose; a Mortgage Agreement secures a loan with real property as collateral. While the Promissory Note is essentially a promise to repay the borrowed amount, the Mortgage Agreement provides the lender with a legal claim to the property if the borrower defaults.

An Installment Sale Agreement is another document akin to a Promissory Note. This agreement allows the buyer to pay for a product or property in installments over time. Like a Promissory Note, it includes payment terms and conditions. However, in an Installment Sale Agreement, ownership may transfer to the buyer before the final payment, whereas the Promissory Note typically does not transfer ownership until the debt is fully paid.

A Secured Note is also similar to a Promissory Note, but it explicitly ties the loan to specific collateral. While both documents outline the borrower's promise to repay, a Secured Note gives the lender the right to claim the collateral if the borrower defaults. This added layer of security can make the loan less risky for the lender.

A Personal Guarantee is often used in conjunction with a Promissory Note, especially for business loans. This document involves an individual agreeing to be personally responsible for the debt if the borrowing entity fails to repay. It serves to provide additional assurance to the lender, similar to how a Promissory Note assures repayment from the borrower.

A Commercial Lease Agreement can resemble a Promissory Note in certain contexts, particularly when the lease includes an option to purchase the property at the end of the lease term. Both documents involve financial commitments and terms for payment, but a Commercial Lease Agreement also outlines the rights and responsibilities of the tenant and landlord during the lease period.

A Credit Agreement is another document that parallels a Promissory Note. This agreement details the terms under which a lender extends credit to a borrower. While a Promissory Note is a straightforward promise to repay a specific loan amount, a Credit Agreement can cover various types of credit facilities, repayment terms, and conditions for borrowing additional funds.

When considering financial documents, it's essential to understand the role of various agreements and how they function in the broader context of financial and legal planning. For individuals looking to manage their affairs effectively, tools like a Power of Attorney can play a crucial part. This legal document grants another person the authority to make decisions on behalf of someone, which can be particularly useful in ensuring that choices align with the individual's wishes. For those interested in obtaining necessary forms, resources such as Colorado PDF Forms can provide the required documentation for establishing a Power of Attorney.

A Loan Modification Agreement may also bear similarities to a Promissory Note. This document alters the original terms of an existing loan, often in response to the borrower’s financial difficulties. Like a Promissory Note, it requires the borrower to acknowledge their obligation to repay the modified loan amount, but it focuses on changing the terms rather than establishing them.

An Affidavit of Debt can be compared to a Promissory Note as it serves to affirm the existence of a debt. This document is often used in legal proceedings to confirm that a borrower owes money to a lender. While a Promissory Note is a contract outlining repayment terms, an Affidavit of Debt acts as a sworn statement that can be presented in court.

Finally, a Deed of Trust is related to a Promissory Note in that it secures a loan with real estate. In a Deed of Trust, the borrower conveys the property to a trustee, who holds it until the debt is repaid. This document works in conjunction with the Promissory Note, which outlines the terms of the loan, while the Deed of Trust provides security for the lender.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Florida Promissory Note is a legal document in which one party promises to pay a specific amount of money to another party under agreed-upon terms. |

| Governing Law | The Florida Promissory Note is governed by the Florida Uniform Commercial Code (UCC), specifically Chapter 673, which deals with negotiable instruments. |

| Key Components | This form typically includes the principal amount, interest rate, payment schedule, and the signatures of the involved parties. |

| Enforceability | For a promissory note to be enforceable in Florida, it must be in writing, signed by the borrower, and clearly state the terms of repayment. |

Additional State-specific Promissory Note Forms

Tennessee Promissory Note - Interest calculations should be clear, indicating how it will be applied to the outstanding balance.

To ensure a smooth transition of property ownership, it is essential to utilize the appropriate legal documentation, such as a Colorado Quitclaim Deed. This form is particularly beneficial in personal situations, like family transfers or divorce settlements, where trust is already established. For those ready to initiate this process, a helpful resource can be found at https://quitclaimdocs.com/fillable-colorado-quitclaim-deed, making it easier to fill out the necessary documents accurately.

Promissory Note Template Missouri - A promissory note can grant the lender the right to accelerate payments if certain conditions are met.

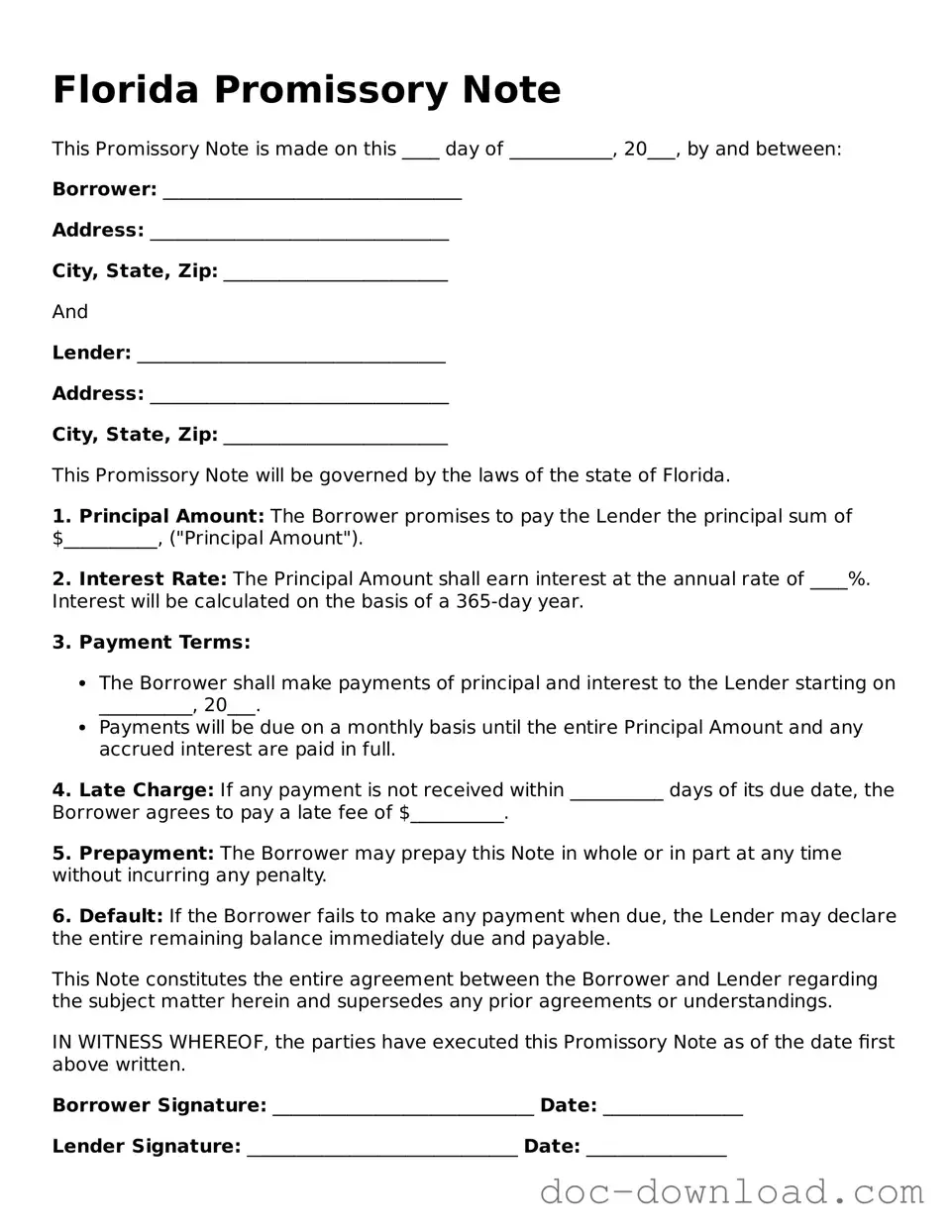

Sample - Florida Promissory Note Form

Florida Promissory Note

This Promissory Note is made on this ____ day of ___________, 20___, by and between:

Borrower: ________________________________

Address: ________________________________

City, State, Zip: ________________________

And

Lender: _________________________________

Address: ________________________________

City, State, Zip: ________________________

This Promissory Note will be governed by the laws of the state of Florida.

1. Principal Amount: The Borrower promises to pay the Lender the principal sum of $__________, ("Principal Amount").

2. Interest Rate: The Principal Amount shall earn interest at the annual rate of ____%. Interest will be calculated on the basis of a 365-day year.

3. Payment Terms:

- The Borrower shall make payments of principal and interest to the Lender starting on __________, 20___.

- Payments will be due on a monthly basis until the entire Principal Amount and any accrued interest are paid in full.

4. Late Charge: If any payment is not received within __________ days of its due date, the Borrower agrees to pay a late fee of $__________.

5. Prepayment: The Borrower may prepay this Note in whole or in part at any time without incurring any penalty.

6. Default: If the Borrower fails to make any payment when due, the Lender may declare the entire remaining balance immediately due and payable.

This Note constitutes the entire agreement between the Borrower and Lender regarding the subject matter herein and supersedes any prior agreements or understandings.

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the date first above written.

Borrower Signature: ____________________________ Date: _______________

Lender Signature: _____________________________ Date: _______________