Blank Power of Attorney Document for Florida

In Florida, a Power of Attorney (POA) form serves as a vital legal document that allows individuals to designate someone else to act on their behalf in various matters. This form can cover a wide range of responsibilities, including financial transactions, healthcare decisions, and property management. One of the key aspects of the Florida Power of Attorney is its flexibility; it can be tailored to grant specific powers or broad authority, depending on the needs of the principal. Additionally, the form can be durable, meaning it remains effective even if the principal becomes incapacitated, or it can be limited to specific situations or timeframes. It is essential for individuals to understand the implications of granting this authority, as the chosen agent will have significant control over important decisions. Proper execution of the form, which includes signatures and notarization, is crucial to ensure its validity and enforceability. Understanding these major components can help individuals make informed choices about their legal and financial planning in Florida.

Similar forms

The Florida Power of Attorney (POA) form is similar to the Advance Healthcare Directive. Both documents allow individuals to designate someone to make decisions on their behalf. In the case of an Advance Healthcare Directive, the focus is specifically on medical decisions. This document ensures that an individual's healthcare preferences are respected when they are unable to communicate their wishes. Like a POA, it empowers a trusted person to act in the best interest of the individual, ensuring that their values and desires are honored in critical situations.

Another document comparable to the Florida Power of Attorney is the Living Will. While a Power of Attorney can cover a broad range of financial and legal matters, a Living Will specifically outlines an individual's wishes regarding end-of-life care. It provides clarity on what medical interventions should or should not be taken if the individual is terminally ill or incapacitated. This document serves to guide healthcare providers and loved ones, reducing uncertainty during emotionally challenging times.

The Healthcare Proxy is also similar to the Florida Power of Attorney. It allows individuals to appoint someone to make healthcare decisions on their behalf, particularly when they cannot do so themselves. This document focuses solely on medical decisions, ensuring that the appointed proxy can advocate for the individual's healthcare preferences. While a Power of Attorney may include financial matters, the Healthcare Proxy is dedicated to medical care, making it essential for those who want to ensure their health decisions align with their values.

The Durable Power of Attorney shares similarities with the Florida POA, particularly in its enduring nature. A Durable Power of Attorney remains effective even if the individual becomes incapacitated. This characteristic provides peace of mind, knowing that a trusted person can continue to manage financial and legal affairs without interruption. It is particularly useful for individuals who want to ensure their affairs are handled seamlessly in times of crisis.

The Financial Power of Attorney is another document that resembles the Florida Power of Attorney. This form specifically grants authority to manage financial matters, such as banking, investments, and property transactions. While the Florida POA can encompass various aspects of decision-making, the Financial Power of Attorney is tailored for those who want to focus solely on financial management. This clarity can simplify the process for both the individual and their appointed agent.

Understanding the importance of the Employment Verification form can be pivotal for both employers and job seekers. This document, which serves to validate a candidate's history, is essential during the recruitment process. For more information, you can refer to this guide on Employment Verification forms.

The Revocable Trust is also akin to the Florida Power of Attorney in that it allows individuals to designate a trustee to manage their assets. Unlike a POA, which grants authority to act on behalf of the individual, a Revocable Trust holds assets in a trust, allowing for management and distribution according to the individual's wishes. This document provides flexibility and can help avoid probate, ensuring that the individual’s assets are handled according to their desires during and after their lifetime.

Lastly, the Guardianship document is similar in that it involves appointing someone to make decisions for another person. However, unlike a Power of Attorney, which is established voluntarily, a Guardianship is often court-appointed and may be necessary when an individual is deemed unable to make decisions due to incapacity. This legal arrangement ensures that someone is available to make crucial decisions, but it typically involves more oversight and is subject to court approval, distinguishing it from the more flexible nature of a Power of Attorney.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A Florida Power of Attorney form allows an individual (the principal) to appoint someone else (the agent) to make decisions on their behalf regarding financial or legal matters. |

| Governing Law | The Florida Power of Attorney is governed by Chapter 709 of the Florida Statutes. |

| Durability | The form can be durable, meaning it remains effective even if the principal becomes incapacitated, provided it includes specific language stating this intent. |

| Revocation | The principal can revoke the Power of Attorney at any time, as long as they are mentally competent to do so. This revocation must be communicated to the agent and any relevant third parties. |

Additional State-specific Power of Attorney Forms

Printable Power of Attorney Form Tn - This form is crucial for ensuring your wishes are honored when you’re unable to communicate them directly.

In addition to understanding the California Lease Agreement form, it is beneficial to access templates that can guide you through the process, such as those available at All Templates PDF, ensuring clarity and compliance with state regulations.

Az 285 - A Power of Attorney provides the flexibility to manage your affairs effectively.

Sample - Florida Power of Attorney Form

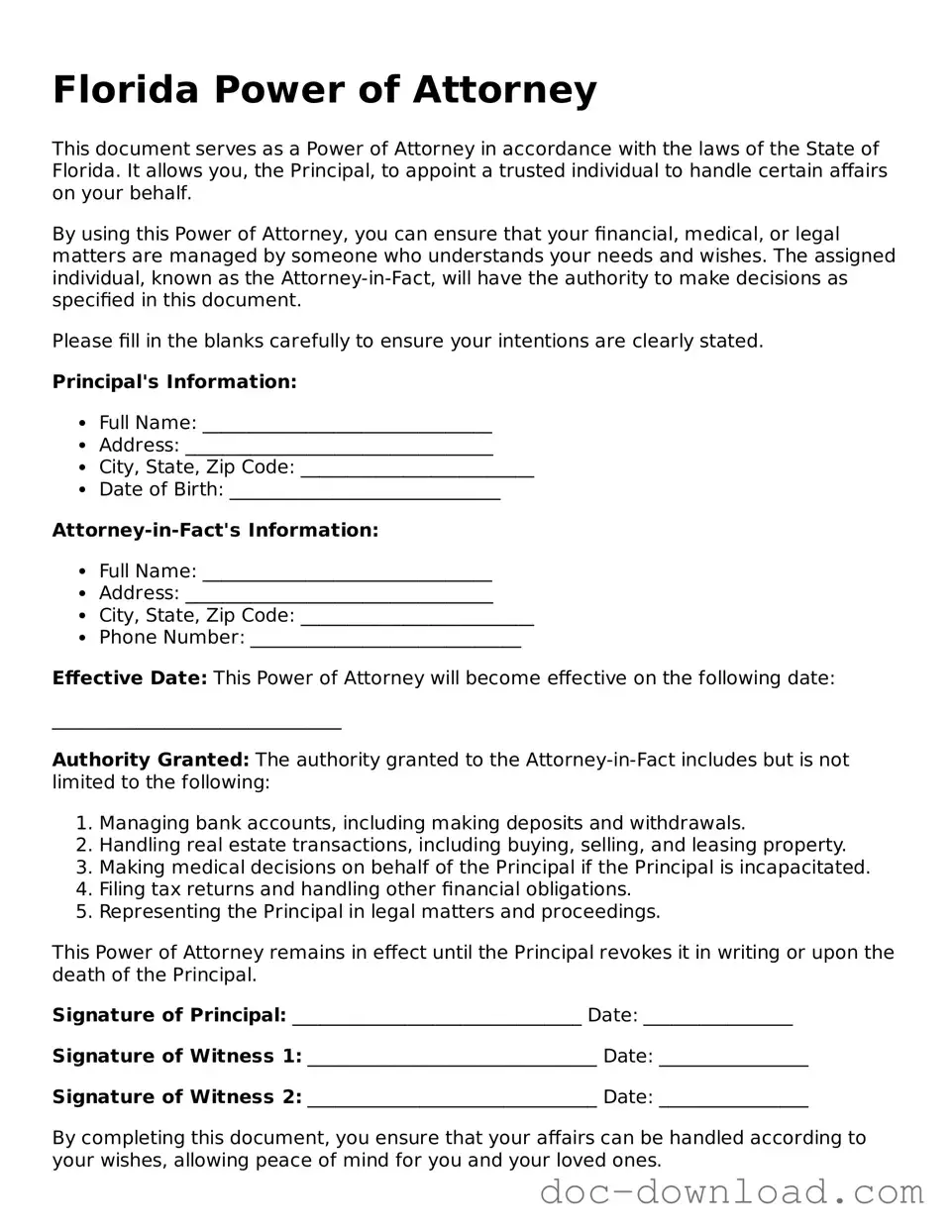

Florida Power of Attorney

This document serves as a Power of Attorney in accordance with the laws of the State of Florida. It allows you, the Principal, to appoint a trusted individual to handle certain affairs on your behalf.

By using this Power of Attorney, you can ensure that your financial, medical, or legal matters are managed by someone who understands your needs and wishes. The assigned individual, known as the Attorney-in-Fact, will have the authority to make decisions as specified in this document.

Please fill in the blanks carefully to ensure your intentions are clearly stated.

Principal's Information:

- Full Name: _______________________________

- Address: _________________________________

- City, State, Zip Code: _________________________

- Date of Birth: _____________________________

Attorney-in-Fact's Information:

- Full Name: _______________________________

- Address: _________________________________

- City, State, Zip Code: _________________________

- Phone Number: _____________________________

Effective Date: This Power of Attorney will become effective on the following date:

_______________________________

Authority Granted: The authority granted to the Attorney-in-Fact includes but is not limited to the following:

- Managing bank accounts, including making deposits and withdrawals.

- Handling real estate transactions, including buying, selling, and leasing property.

- Making medical decisions on behalf of the Principal if the Principal is incapacitated.

- Filing tax returns and handling other financial obligations.

- Representing the Principal in legal matters and proceedings.

This Power of Attorney remains in effect until the Principal revokes it in writing or upon the death of the Principal.

Signature of Principal: _______________________________ Date: ________________

Signature of Witness 1: _______________________________ Date: ________________

Signature of Witness 2: _______________________________ Date: ________________

By completing this document, you ensure that your affairs can be handled according to your wishes, allowing peace of mind for you and your loved ones.