Blank Loan Agreement Document for Florida

When entering into a financial arrangement, clarity and structure are crucial, and the Florida Loan Agreement form serves as a vital tool for both lenders and borrowers. This form outlines the terms of the loan, including the principal amount, interest rate, repayment schedule, and any applicable fees. It also specifies the duration of the loan and the consequences of default, ensuring that both parties understand their rights and obligations. Additionally, the agreement may include provisions for collateral, which provides security for the lender in case of non-payment. By detailing these essential elements, the Florida Loan Agreement form helps to minimize misunderstandings and disputes, fostering a transparent relationship between the lender and borrower. Understanding this form is key to navigating the lending process in Florida effectively.

Similar forms

The Florida Loan Agreement form shares similarities with a Promissory Note. Both documents outline the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. A Promissory Note serves as a promise from the borrower to repay the loan under specified conditions, while the Loan Agreement often includes additional details such as collateral and specific legal obligations of both parties. Essentially, the Promissory Note is a subset of the broader Loan Agreement, focusing primarily on the borrower's commitment to repay the loan.

Another document akin to the Florida Loan Agreement is the Mortgage Agreement. This document is particularly relevant when the loan is secured by real property. Like the Loan Agreement, the Mortgage Agreement delineates the terms of the loan, but it also specifies the rights of the lender to foreclose on the property if the borrower defaults. Both documents establish a legal framework for the borrowing relationship, but the Mortgage Agreement adds a layer of security for the lender through the collateralization of real estate.

The Florida Loan Agreement is also comparable to a Credit Agreement. Credit Agreements are typically used in business contexts, where they outline the terms under which a lender extends credit to a borrower. Similar to the Loan Agreement, it details the amount of credit, interest rates, and repayment terms. However, Credit Agreements often include covenants that require the borrower to meet certain financial metrics, thereby adding complexity to the borrowing relationship. Both documents serve to protect the interests of the lender while providing clarity to the borrower.

A Personal Loan Agreement is another document that mirrors the Florida Loan Agreement. This type of agreement is used for unsecured loans between individuals or entities. Like the Florida Loan Agreement, it specifies the loan amount, interest rate, repayment schedule, and any penalties for late payment. However, Personal Loan Agreements may lack the formalities often found in commercial loan agreements, making them more straightforward. Both documents aim to ensure mutual understanding and accountability between the borrower and lender.

The Florida Loan Agreement is also similar to a Business Loan Agreement, which is tailored for business-related borrowing. This document outlines the terms under which a lender provides funds to a business, including the purpose of the loan, repayment terms, and interest rates. Like the Florida Loan Agreement, it may also include provisions for default and remedies available to the lender. Both agreements serve to formalize the financial relationship, ensuring that both parties are aware of their rights and obligations.

The Minnesota Motor Vehicle Bill of Sale form is a crucial document used to record the transfer of ownership of a vehicle from the seller to the buyer. It serves as proof of transaction and is often required for registration and tax purposes. By clearly outlining the details of the sale, this document ensures both parties are protected and accountable. For those unfamiliar with the process, it's advisable to learn more about its importance and requirements.

Lastly, the Florida Loan Agreement can be likened to an Installment Agreement. This document is often used in scenarios where a borrower agrees to repay a debt in regular installments over a specified period. Similar to the Loan Agreement, it details the payment schedule, interest rates, and total amount owed. However, Installment Agreements may be more flexible, allowing for adjustments in payment amounts or schedules based on the borrower’s financial situation. Both documents aim to facilitate repayment while providing a clear structure for the borrower and lender.

Document Overview

| Fact Name | Details |

|---|---|

| Definition | The Florida Loan Agreement form is a legal document outlining the terms of a loan between a lender and a borrower. |

| Governing Law | The agreement is governed by the laws of the State of Florida. |

| Parties Involved | The form identifies the lender and the borrower, specifying their names and contact information. |

| Loan Amount | The specific amount of money being loaned is clearly stated in the agreement. |

| Interest Rate | The form includes the interest rate applicable to the loan, which can be fixed or variable. |

| Repayment Terms | Details regarding the repayment schedule, including due dates and payment methods, are outlined. |

| Default Conditions | The agreement specifies conditions under which the borrower may be considered in default. |

| Signatures | Both parties must sign the document to make the agreement legally binding. |

Additional State-specific Loan Agreement Forms

Texas Promissory Note - Clarity in the Loan Agreement protects the interests of both parties.

The California Form REG 262, also known as the Vehicle/Vessel Transfer and Reassignment Form, is a crucial document used during the transfer of ownership for vehicles and vessels. This form must accompany the official title or an application for a duplicate title to ensure a smooth transaction. To ensure compliance with the guidelines and protect your interests, consider filling out this important form by visiting californiapdffoms.com.

Sample Promissory Note California - Clarifies the purpose of the loan if specified.

Sample - Florida Loan Agreement Form

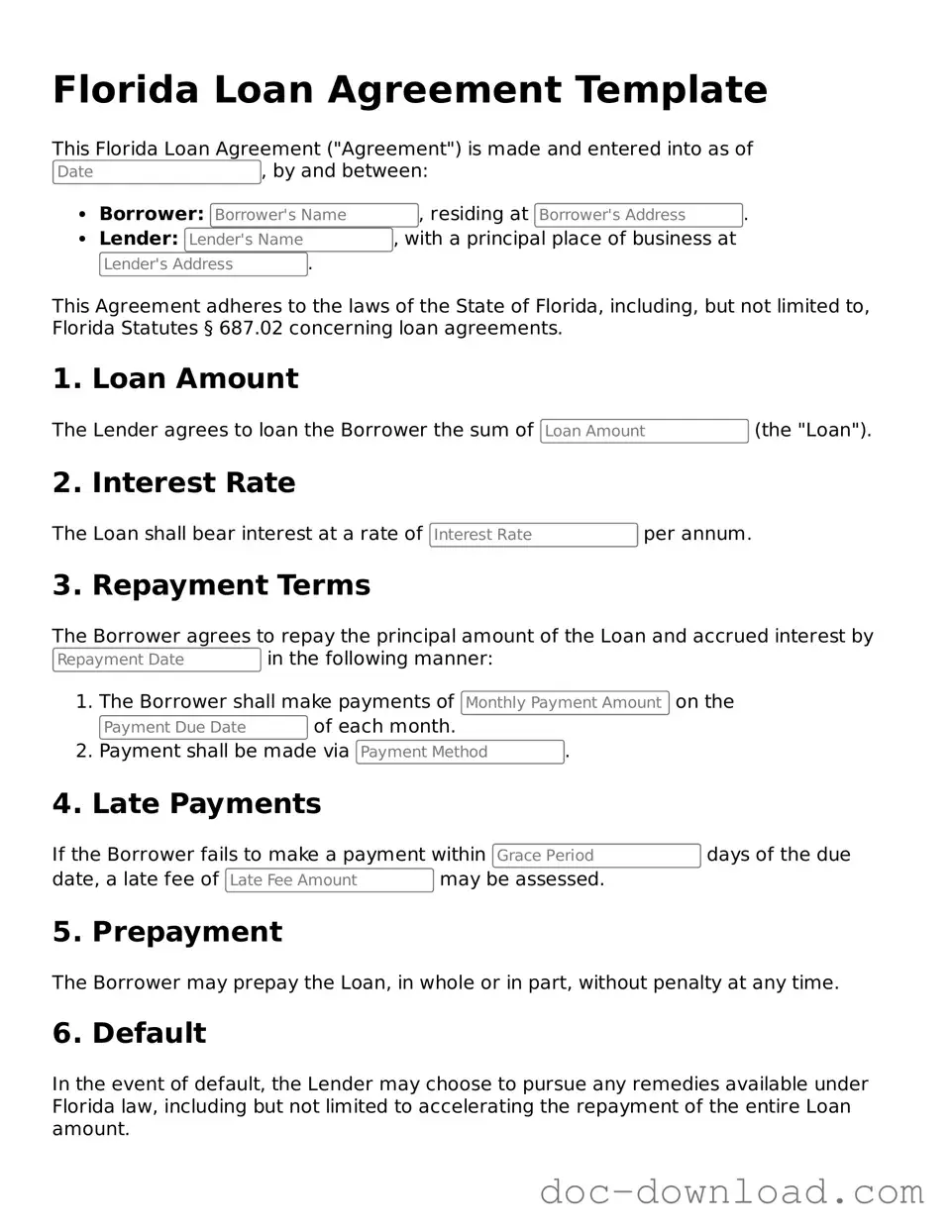

Florida Loan Agreement Template

This Florida Loan Agreement ("Agreement") is made and entered into as of , by and between:

- Borrower: , residing at .

- Lender: , with a principal place of business at .

This Agreement adheres to the laws of the State of Florida, including, but not limited to, Florida Statutes § 687.02 concerning loan agreements.

1. Loan Amount

The Lender agrees to loan the Borrower the sum of (the "Loan").

2. Interest Rate

The Loan shall bear interest at a rate of per annum.

3. Repayment Terms

The Borrower agrees to repay the principal amount of the Loan and accrued interest by in the following manner:

- The Borrower shall make payments of on the of each month.

- Payment shall be made via .

4. Late Payments

If the Borrower fails to make a payment within days of the due date, a late fee of may be assessed.

5. Prepayment

The Borrower may prepay the Loan, in whole or in part, without penalty at any time.

6. Default

In the event of default, the Lender may choose to pursue any remedies available under Florida law, including but not limited to accelerating the repayment of the entire Loan amount.

7. Signatures

By signing below, both parties agree to the terms outlined in this Loan Agreement.

- Borrower Signature: _________________________________ Date: ____________

- Lender Signature: _________________________________ Date: ____________

This Loan Agreement constitutes the entire agreement between the parties. Any amendments must be made in writing and signed by both parties.