Blank Durable Power of Attorney Document for Florida

In the vibrant state of Florida, planning for the future often involves making important decisions about who will manage your affairs if you are unable to do so yourself. A Durable Power of Attorney (DPOA) serves as a crucial legal tool in this regard, allowing you to designate a trusted individual—often referred to as an agent or attorney-in-fact—to handle your financial and legal matters on your behalf. This form remains effective even if you become incapacitated, ensuring that your wishes are respected during challenging times. The DPOA can cover a wide range of responsibilities, from managing bank accounts and real estate transactions to making healthcare decisions, depending on the specific powers granted within the document. It is essential to understand that the Durable Power of Attorney is not just a one-size-fits-all solution; it can be tailored to fit your unique needs and preferences. Additionally, Florida law outlines specific requirements for creating a valid DPOA, including the necessity for signatures and witnesses, which helps safeguard against potential misuse. By taking the time to complete this form thoughtfully, you empower yourself and your chosen representative to navigate life's uncertainties with confidence and clarity.

Similar forms

The Florida Durable Power of Attorney form is similar to the General Power of Attorney. Both documents grant an individual the authority to act on behalf of another person in legal and financial matters. However, the General Power of Attorney becomes ineffective if the principal becomes incapacitated, while the Durable Power of Attorney remains in effect under such circumstances. This distinction allows for continued management of affairs when the principal is unable to do so themselves.

For those looking to safeguard their personal or business information, understanding the various legal documents available is crucial. Just as a Durable Power of Attorney can help manage finances, a Non-disclosure Agreement form plays a vital role in protecting sensitive data from being disclosed, ensuring that trust and confidentiality are maintained in all transactions.

Another document that shares similarities is the Healthcare Power of Attorney. This document specifically allows an individual to make medical decisions on behalf of another person. Like the Durable Power of Attorney, it provides authority that persists even if the principal becomes incapacitated. However, the Healthcare Power of Attorney is focused solely on health-related decisions, whereas the Durable Power of Attorney encompasses a broader range of financial and legal matters.

The Living Will is another related document, as it outlines an individual's preferences regarding medical treatment in situations where they cannot communicate their wishes. While the Durable Power of Attorney allows someone to make decisions on behalf of the principal, the Living Will specifies the principal’s own desires regarding end-of-life care. Both documents work together to ensure that an individual’s preferences are respected during incapacitation.

The Revocable Trust is also comparable to the Durable Power of Attorney. A Revocable Trust allows a person to manage their assets during their lifetime and specify how those assets will be distributed after their death. While both documents provide mechanisms for managing financial affairs, the Revocable Trust typically avoids probate, whereas the Durable Power of Attorney does not affect the distribution of assets after death.

The Financial Power of Attorney is closely related to the Durable Power of Attorney, as both authorize an individual to handle financial matters. The key difference lies in the scope and specificity of the powers granted. A Financial Power of Attorney may focus exclusively on financial transactions, while the Durable Power of Attorney can include broader legal and financial responsibilities.

The Medical Proxy is another document that resembles the Durable Power of Attorney. A Medical Proxy allows a designated individual to make healthcare decisions for someone else. Similar to the Healthcare Power of Attorney, it becomes effective when the principal is unable to make their own medical decisions. The Durable Power of Attorney, however, covers a wider range of responsibilities beyond healthcare.

Lastly, the Guardianship document shares similarities with the Durable Power of Attorney in that both address the management of an individual’s affairs. A Guardianship is established through court proceedings and appoints someone to make decisions for a person deemed incapacitated. In contrast, the Durable Power of Attorney allows individuals to designate their own agents without court involvement, providing a more streamlined approach to managing affairs when incapacitated.

Document Overview

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney (DPOA) allows a person (the principal) to appoint someone else (the agent) to make decisions on their behalf, even if the principal becomes incapacitated. |

| Governing Law | The Florida Durable Power of Attorney is governed by Florida Statutes, Chapter 709. |

| Durability | The term "durable" means that the power of attorney remains effective even if the principal is no longer able to make decisions due to illness or injury. |

| Agent's Authority | The agent can have broad or limited authority, depending on what the principal specifies in the document. |

| Execution Requirements | To be valid, the DPOA must be signed by the principal and witnessed by two individuals or notarized. |

| Revocation | The principal can revoke the DPOA at any time, as long as they are competent to do so. |

| Agent's Duties | The agent has a fiduciary duty to act in the best interests of the principal and must keep accurate records of transactions. |

| Limitations | A DPOA cannot be used to make healthcare decisions unless it is combined with a healthcare surrogate designation. |

| Common Uses | People often use a DPOA for financial matters, such as managing bank accounts, paying bills, or handling real estate transactions. |

Additional State-specific Durable Power of Attorney Forms

Tn Power of Attorney Form - Creating this document can offer peace of mind, knowing you have a plan in place.

Indiana Durable Power of Attorney Form - This form is an essential tool for aging individuals or those facing health challenges who want control over their future.

When acquiring a new furry friend, it is essential to have the proper documentation in place, which is where the Bill of Sale for a Puppy comes into play. This form not only serves as proof of ownership but also ensures that both parties are protected during the transaction, as it outlines the details of the sale and helps avoid any misunderstandings regarding the transfer of the dog.

Massachusetts Power of Attorney Requirements - The form can be tailored to specific needs, from managing real estate transactions to dealing with banking matters and asset management.

Sample - Florida Durable Power of Attorney Form

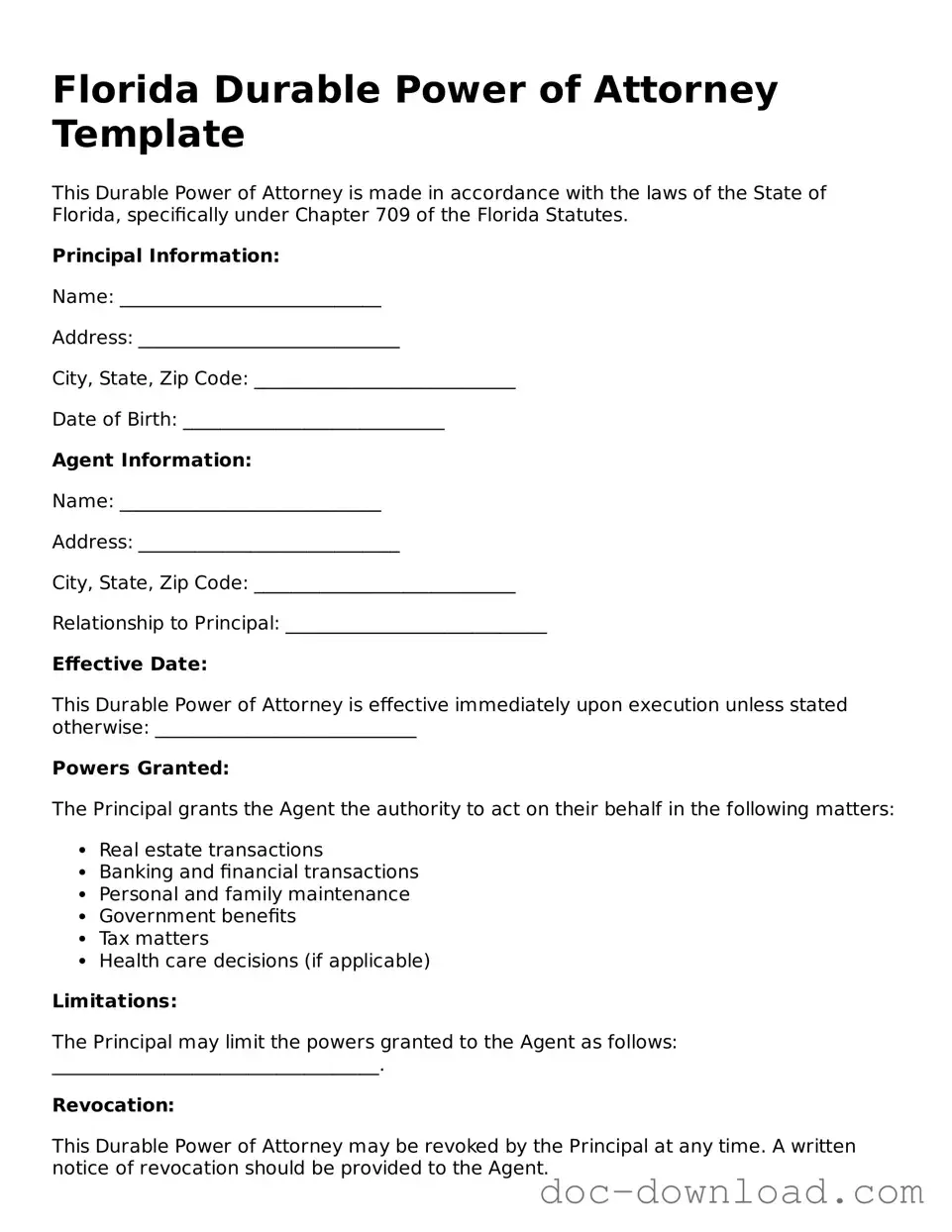

Florida Durable Power of Attorney Template

This Durable Power of Attorney is made in accordance with the laws of the State of Florida, specifically under Chapter 709 of the Florida Statutes.

Principal Information:

Name: ____________________________

Address: ____________________________

City, State, Zip Code: ____________________________

Date of Birth: ____________________________

Agent Information:

Name: ____________________________

Address: ____________________________

City, State, Zip Code: ____________________________

Relationship to Principal: ____________________________

Effective Date:

This Durable Power of Attorney is effective immediately upon execution unless stated otherwise: ____________________________

Powers Granted:

The Principal grants the Agent the authority to act on their behalf in the following matters:

- Real estate transactions

- Banking and financial transactions

- Personal and family maintenance

- Government benefits

- Tax matters

- Health care decisions (if applicable)

Limitations:

The Principal may limit the powers granted to the Agent as follows: ___________________________________.

Revocation:

This Durable Power of Attorney may be revoked by the Principal at any time. A written notice of revocation should be provided to the Agent.

Signatures:

Principal Signature: ____________________________

Date: ____________________________

Agent Signature: ____________________________

Date: ____________________________

Witnesses:

- Witness 1 Name: ____________________________

- Witness 1 Signature: ____________________________

- Witness 2 Name: ____________________________

- Witness 2 Signature: ____________________________

This Durable Power of Attorney is executed with the understanding that it will be valid in accordance with Florida law.