Blank Deed in Lieu of Foreclosure Document for Florida

In the state of Florida, homeowners facing the distress of foreclosure often seek alternatives that can mitigate the emotional and financial toll of losing their property. One such option is the Deed in Lieu of Foreclosure, a legal process that allows a homeowner to voluntarily transfer ownership of their property to the lender in exchange for the cancellation of the mortgage debt. This form serves as a critical tool in facilitating this transfer, outlining the responsibilities and rights of both parties involved. It typically includes details such as the property description, the names of the parties, and any existing liens or encumbrances on the property. By choosing this route, homeowners can potentially avoid the lengthy and costly foreclosure process, while lenders can expedite their recovery of the property. However, it’s important to note that this option may have implications for the homeowner’s credit score and future borrowing capabilities. Understanding the nuances of the Deed in Lieu of Foreclosure form can empower homeowners to make informed decisions during challenging financial times.

Similar forms

A mortgage release is a document that frees the borrower from their mortgage obligations. Similar to a deed in lieu of foreclosure, it allows the borrower to relinquish their property to the lender, effectively canceling the mortgage. This document is often used when a homeowner can no longer afford their mortgage payments and wants to avoid the lengthy foreclosure process. By executing a mortgage release, the borrower can have peace of mind, knowing that they are no longer responsible for the debt tied to the property.

A short sale agreement involves selling a property for less than the amount owed on the mortgage, with the lender's approval. Like a deed in lieu of foreclosure, a short sale helps homeowners avoid foreclosure. In this scenario, the lender agrees to accept the sale proceeds as full satisfaction of the debt. This option can be less damaging to a homeowner's credit score compared to a foreclosure, making it an attractive alternative for those in financial distress.

A loan modification agreement changes the terms of an existing mortgage to make it more affordable for the borrower. This document can reduce monthly payments or extend the loan term. Although it differs from a deed in lieu of foreclosure, both options aim to help struggling homeowners retain their properties. A successful loan modification can prevent foreclosure and provide the homeowner with a more manageable repayment plan.

When considering the various documents related to real estate and mortgage situations, it's also essential to understand the importance of notifying relevant authorities about educational intents. For those interested in homeschooling, submitting the Colorado Homeschool Letter of Intent form is necessary, and more information can be found at Colorado PDF Forms. This ensures compliance with state regulations and supports families in their educational choices.

A forbearance agreement allows a borrower to temporarily pause or reduce their mortgage payments. This document is similar to a deed in lieu of foreclosure in that it provides relief to homeowners facing financial hardship. While a deed in lieu involves giving up the property, a forbearance keeps the homeowner in their home while they regain financial stability. This arrangement can be beneficial for those expecting a temporary setback.

A bankruptcy filing can also provide relief for homeowners facing foreclosure. While it is a more drastic measure, it shares similarities with a deed in lieu of foreclosure by allowing individuals to restructure or eliminate their debts. Depending on the type of bankruptcy filed, a homeowner may be able to keep their home or negotiate terms with their lender. Both options aim to provide a fresh start for those in financial turmoil.

An assumption agreement allows a new buyer to take over the existing mortgage from the seller. This document is similar to a deed in lieu of foreclosure because it can help the seller avoid foreclosure by transferring their mortgage obligations. In this case, the buyer assumes responsibility for the mortgage, and the seller can walk away from the property without the burden of foreclosure on their record.

A quitclaim deed is a legal document used to transfer ownership of property. This document can be similar to a deed in lieu of foreclosure when a homeowner voluntarily transfers their property to the lender. In both cases, the homeowner relinquishes their rights to the property. A quitclaim deed, however, does not involve the lender's acceptance of the property as a settlement for the mortgage debt.

A property settlement agreement is often used in divorce proceedings to divide assets, including real estate. This document can resemble a deed in lieu of foreclosure in that it may involve the transfer of property ownership. If one spouse can no longer afford the mortgage, they may agree to transfer the property to the other spouse or to the lender, similar to the process in a deed in lieu of foreclosure.

A foreclosure defense agreement is a legal document that outlines the terms under which a homeowner can contest a foreclosure. While it serves a different purpose than a deed in lieu of foreclosure, both documents are relevant in situations where a homeowner is facing financial difficulties. A foreclosure defense agreement may provide strategies to delay or prevent foreclosure, while a deed in lieu allows for a more straightforward exit from the property.

A real estate purchase agreement is a contract between a buyer and seller for the sale of property. This document is similar to a deed in lieu of foreclosure in that it involves the transfer of ownership. In a deed in lieu situation, the homeowner transfers the property back to the lender, while a purchase agreement involves a buyer acquiring the property from the seller. Both documents facilitate the change of ownership, albeit under different circumstances.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal document where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Governing Law | The process is governed by Florida Statutes, specifically Chapter 701 regarding conveyances of real property. |

| Eligibility | Homeowners facing financial difficulties and unable to keep up with mortgage payments may be eligible for this option. |

| Advantages | This process can help borrowers avoid the lengthy and costly foreclosure process, and it may have a less severe impact on credit scores. |

| Disadvantages | Borrowers may still face tax consequences, as the forgiven debt may be considered taxable income. |

| Process | The borrower must negotiate with the lender, complete the deed in lieu form, and ensure all liens on the property are addressed before the transfer. |

Additional State-specific Deed in Lieu of Foreclosure Forms

What Does an Arizona Homeowner Lose When Choosing to Use Deed in Lieu of Foreclosure? - Using this form may help homeowners alleviate burdens without enduring prolonged financial hardships.

This form is essential for ensuring a smooth transfer of property rights, especially for those who wish to understand the implications of such a transaction. For further assistance in navigating this process, you may refer to the resources available at quitclaimdeedtemplate.com/colorado-quitclaim-deed-template.

Deed in Lieu of Mortgage - The process involves an agreement between the lender and borrower regarding the property's condition and value.

Sample - Florida Deed in Lieu of Foreclosure Form

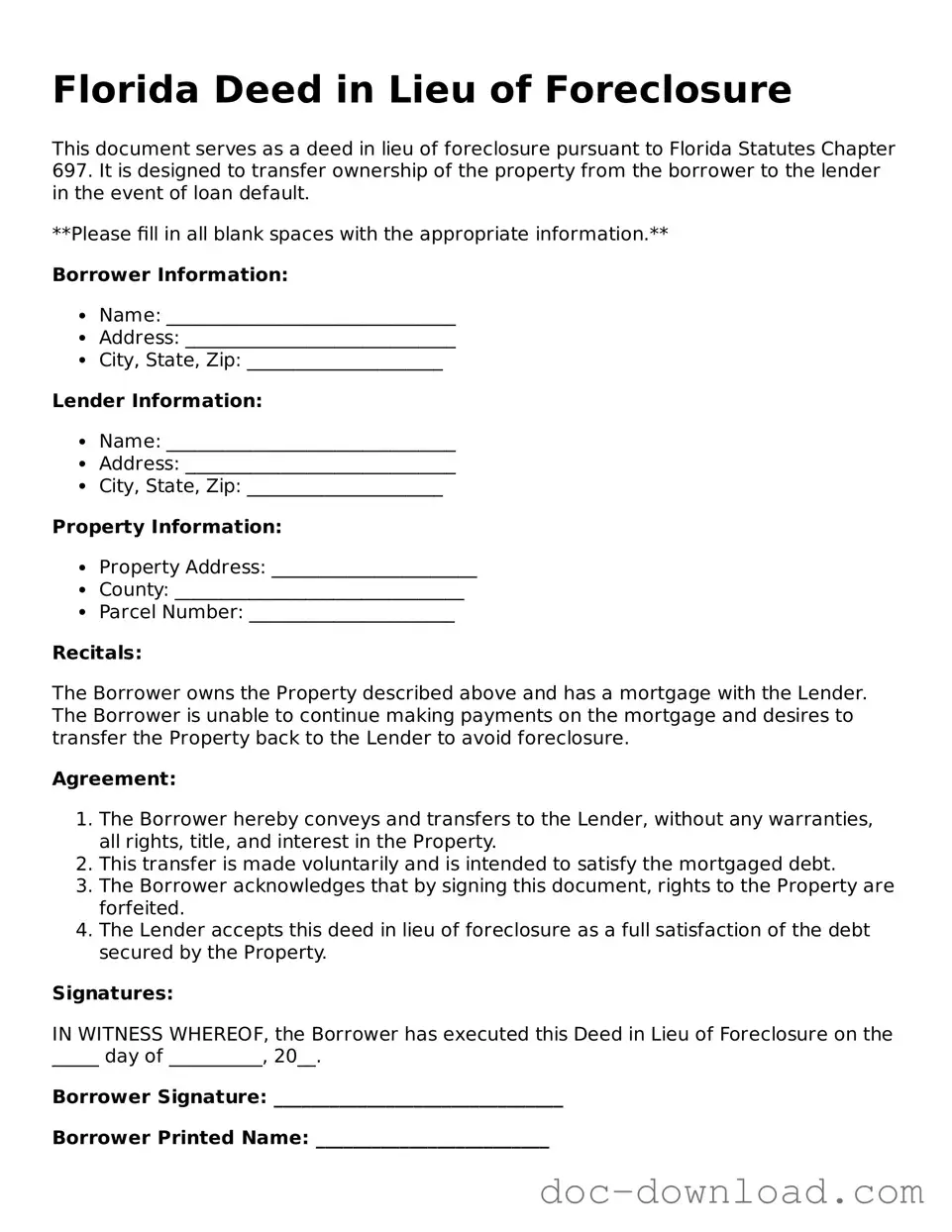

Florida Deed in Lieu of Foreclosure

This document serves as a deed in lieu of foreclosure pursuant to Florida Statutes Chapter 697. It is designed to transfer ownership of the property from the borrower to the lender in the event of loan default.

**Please fill in all blank spaces with the appropriate information.**

Borrower Information:

- Name: _______________________________

- Address: _____________________________

- City, State, Zip: _____________________

Lender Information:

- Name: _______________________________

- Address: _____________________________

- City, State, Zip: _____________________

Property Information:

- Property Address: ______________________

- County: _______________________________

- Parcel Number: ______________________

Recitals:

The Borrower owns the Property described above and has a mortgage with the Lender. The Borrower is unable to continue making payments on the mortgage and desires to transfer the Property back to the Lender to avoid foreclosure.

Agreement:

- The Borrower hereby conveys and transfers to the Lender, without any warranties, all rights, title, and interest in the Property.

- This transfer is made voluntarily and is intended to satisfy the mortgaged debt.

- The Borrower acknowledges that by signing this document, rights to the Property are forfeited.

- The Lender accepts this deed in lieu of foreclosure as a full satisfaction of the debt secured by the Property.

Signatures:

IN WITNESS WHEREOF, the Borrower has executed this Deed in Lieu of Foreclosure on the _____ day of __________, 20__.

Borrower Signature: _______________________________

Borrower Printed Name: _________________________

Lender Signature: _______________________________

Lender Printed Name: _________________________

Notary Public:

State of Florida

County of ________________________

Subscribed and sworn to before me this _____ day of __________, 20__.

Notary Signature: ___________________________

Notary Printed Name: ______________________

My commission expires: _______________________