Printable Employee Loan Agreement Template

When employees find themselves in need of financial assistance, an Employee Loan Agreement can serve as a valuable resource. This document outlines the terms under which an employer provides a loan to an employee, fostering a supportive workplace environment. Key aspects of the agreement include the loan amount, repayment schedule, interest rates, and any applicable fees. Furthermore, it addresses the consequences of defaulting on the loan, ensuring both parties understand their obligations and rights. By clearly defining these elements, the Employee Loan Agreement not only protects the employer’s interests but also offers employees a structured way to manage their financial needs. This agreement can help build trust and loyalty, as it demonstrates the employer's commitment to the well-being of their staff. In this article, we will explore the essential components of the Employee Loan Agreement form and the benefits it can provide to both employers and employees alike.

Similar forms

The Employee Loan Agreement is similar to a Promissory Note. A Promissory Note is a written promise to pay a specified amount of money to a certain individual or entity at a defined time. Like the Employee Loan Agreement, it outlines the terms of repayment, including interest rates and due dates. Both documents serve to protect the lender’s interests and clarify the borrower’s obligations.

Another document that resembles the Employee Loan Agreement is the Loan Application. This form collects information from the borrower to assess their creditworthiness. While the Employee Loan Agreement outlines the terms after approval, the Loan Application serves as the first step in the lending process. Both documents are crucial in establishing a formal borrowing relationship.

The Employment Contract is also similar. This document outlines the terms of employment, including salary and benefits. While it primarily focuses on the employment relationship, it may include clauses regarding loans or advances. Both documents help define the expectations and responsibilities of both parties involved.

A Credit Agreement shares similarities with the Employee Loan Agreement as well. This document details the terms of a loan between a borrower and a lender, often a bank or financial institution. Like the Employee Loan Agreement, it specifies the amount borrowed, interest rates, and repayment terms. Both agreements aim to protect the interests of the lender while providing clear guidelines for the borrower.

The Loan Disclosure Statement is another document that parallels the Employee Loan Agreement. This statement provides borrowers with essential information about the loan, including fees and terms. It ensures transparency, much like the Employee Loan Agreement, which also aims to inform the borrower about their responsibilities and the costs associated with the loan.

A Personal Loan Agreement is similar as well. This document outlines the terms of a loan between individuals, often friends or family members. Just like the Employee Loan Agreement, it includes repayment terms, interest rates, and the total amount borrowed. Both documents serve to formalize the lending arrangement and protect the interests of both parties.

The Loan Repayment Schedule is another related document. This schedule breaks down the repayment plan into manageable installments, showing when payments are due. Similar to the Employee Loan Agreement, it helps both parties understand the timeline and amounts involved in repayment, promoting accountability and clarity.

For those looking to establish clear expectations and responsibilities in their lending processes, utilizing a formal document is essential. To achieve this, a variety of agreement forms exist, including the Employee Loan Agreement, which closely parallels Personal Loan Agreements and others. To find a suitable template for your needs, you can explore legaldocumentstemplates.com/fillable-loan-agreement-form/, which offers customizable options to help facilitate transparent borrowing agreements.

A Secured Loan Agreement is also comparable. This type of agreement involves collateral to secure the loan. Like the Employee Loan Agreement, it details the terms of the loan, including what happens if the borrower defaults. Both documents aim to protect the lender while providing the borrower with clear expectations.

Lastly, a Mortgage Agreement is similar in that it involves borrowing money, typically for purchasing property. This agreement specifies the loan amount, interest rate, and repayment terms. While the Employee Loan Agreement is often between an employer and employee, both documents serve to establish the conditions of borrowing and repayment.

Document Overview

| Fact Name | Description |

|---|---|

| Purpose | An Employee Loan Agreement form outlines the terms under which an employer provides a loan to an employee. |

| Loan Amount | The form specifies the exact amount of money being loaned to the employee. |

| Repayment Terms | It details the repayment schedule, including the frequency and duration of payments. |

| Interest Rate | The agreement may include an interest rate, which can affect the total repayment amount. |

| Governing Law | The form should specify the state laws that govern the agreement, which can vary by state. |

| Default Terms | It outlines the consequences if the employee fails to repay the loan as agreed. |

| Confidentiality | The agreement may include clauses regarding the confidentiality of the loan terms. |

| Signatures | Both the employer and employee must sign the agreement to make it legally binding. |

Sample - Employee Loan Agreement Form

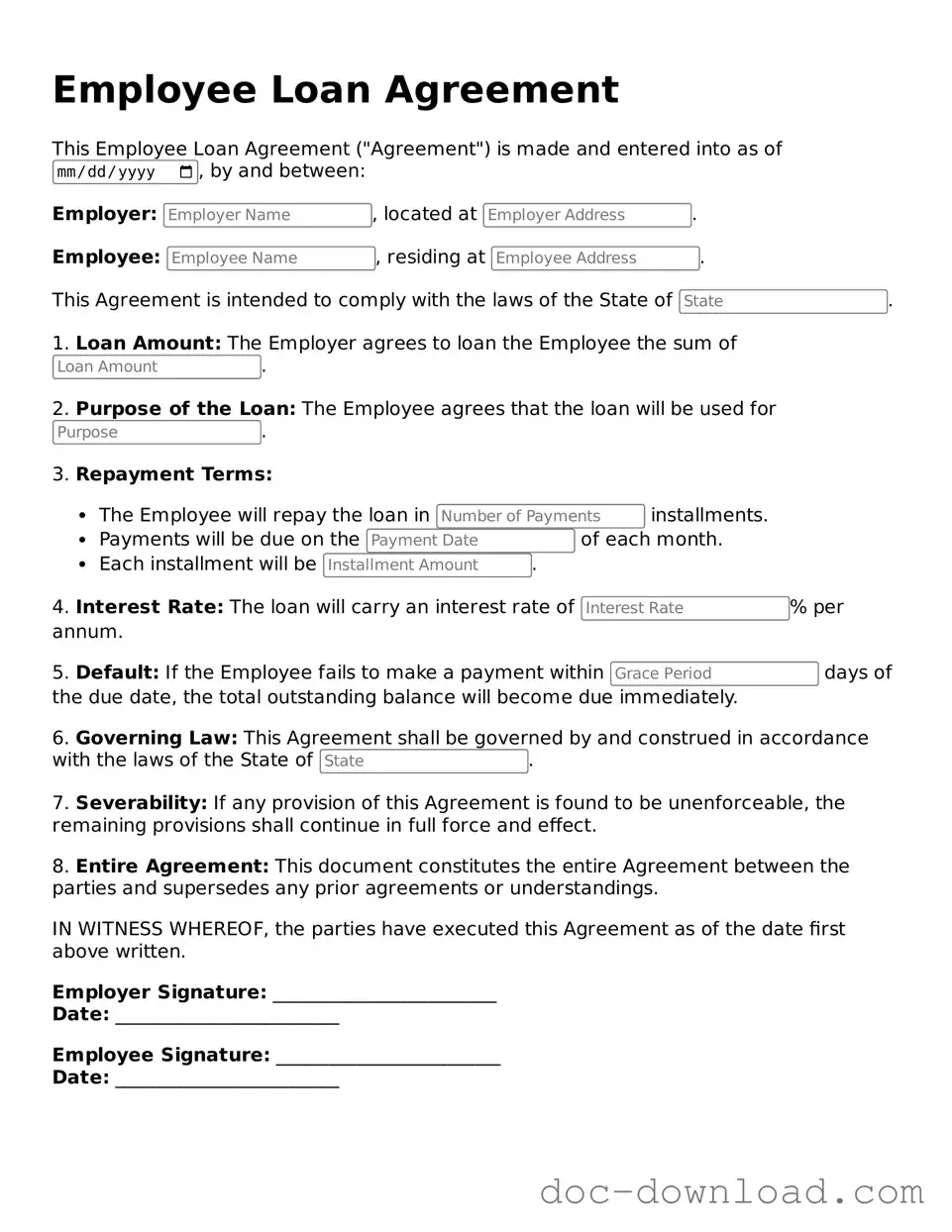

Employee Loan Agreement

This Employee Loan Agreement ("Agreement") is made and entered into as of , by and between:

Employer: , located at .

Employee: , residing at .

This Agreement is intended to comply with the laws of the State of .

1. Loan Amount: The Employer agrees to loan the Employee the sum of .

2. Purpose of the Loan: The Employee agrees that the loan will be used for .

3. Repayment Terms:

- The Employee will repay the loan in installments.

- Payments will be due on the of each month.

- Each installment will be .

4. Interest Rate: The loan will carry an interest rate of % per annum.

5. Default: If the Employee fails to make a payment within days of the due date, the total outstanding balance will become due immediately.

6. Governing Law: This Agreement shall be governed by and construed in accordance with the laws of the State of .

7. Severability: If any provision of this Agreement is found to be unenforceable, the remaining provisions shall continue in full force and effect.

8. Entire Agreement: This document constitutes the entire Agreement between the parties and supersedes any prior agreements or understandings.

IN WITNESS WHEREOF, the parties have executed this Agreement as of the date first above written.

Employer Signature: ________________________

Date: ________________________

Employee Signature: ________________________

Date: ________________________