Printable Deed in Lieu of Foreclosure Template

A Deed in Lieu of Foreclosure can be a valuable option for homeowners facing financial difficulties and potential foreclosure. This legal document allows a homeowner to voluntarily transfer ownership of their property to the lender in exchange for the cancellation of the mortgage debt. It serves as an alternative to the lengthy and often stressful foreclosure process. By choosing this route, homeowners may avoid some of the negative impacts associated with foreclosure, such as damage to their credit score and the emotional toll of losing their home. The Deed in Lieu form typically includes essential information, such as the property description, the parties involved, and any agreements regarding the condition of the property. It’s important for homeowners to understand the implications of this decision, including potential tax consequences and the lender's willingness to accept the deed. Overall, this option can provide a more amicable solution for both parties, allowing for a smoother transition away from a burdensome mortgage obligation.

State-specific Guidelines for Deed in Lieu of Foreclosure Forms

Similar forms

A mortgage release is a document that signifies the end of a mortgage agreement between a borrower and a lender. Similar to a Deed in Lieu of Foreclosure, a mortgage release allows a borrower to transfer their property back to the lender, effectively canceling the mortgage obligation. This document is typically used when the borrower can no longer make payments and seeks to avoid the lengthy foreclosure process. By executing a mortgage release, the borrower can often avoid the negative impacts of foreclosure on their credit report.

For those exploring their options in potentially distressed situations, understanding the various legal documents is essential. Among them, a Colorado Non-disclosure Agreement form can play a significant role in safeguarding sensitive information shared during negotiations or transactions. By utilizing resources such as Colorado PDF Forms, parties can ensure they are protected while navigating the complexities of financial agreements and property transfers.

A short sale agreement is another document that bears similarities to a Deed in Lieu of Foreclosure. In a short sale, the lender agrees to accept less than the full amount owed on the mortgage when the borrower sells the property. Like the Deed in Lieu, this option allows the borrower to relinquish ownership of the property to mitigate financial loss. Both documents aim to provide a more amicable solution to the financial difficulties faced by the borrower, allowing them to exit their mortgage obligations without undergoing foreclosure.

A loan modification agreement is also comparable to a Deed in Lieu of Foreclosure. This document alters the terms of an existing mortgage to make it more manageable for the borrower. While a Deed in Lieu involves giving up the property, a loan modification keeps the borrower in their home but adjusts payment terms. Both documents serve to address the borrower's financial challenges, but they do so in different ways—one by relinquishing the property and the other by restructuring the loan.

A foreclosure notice is a document that formally initiates the foreclosure process. Although it represents a more adversarial approach compared to a Deed in Lieu of Foreclosure, both documents deal with the same underlying issue: the borrower's inability to meet mortgage obligations. A foreclosure notice alerts the borrower that their property is at risk of being taken by the lender, while a Deed in Lieu offers a voluntary alternative to avoid the negative consequences of foreclosure.

An assumption agreement is another document that shares similarities with a Deed in Lieu of Foreclosure. In an assumption agreement, a new buyer takes over the existing mortgage from the original borrower. This process allows the original borrower to transfer their financial responsibility to another party, similar to how a Deed in Lieu allows the borrower to transfer ownership back to the lender. Both documents facilitate a change in ownership and responsibility, providing alternatives to foreclosure for those unable to maintain their mortgage payments.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal agreement where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Purpose | This process helps borrowers eliminate their mortgage debt and allows lenders to take possession of the property without the lengthy foreclosure process. |

| Eligibility | Homeowners must typically be facing financial hardship and unable to keep up with mortgage payments to qualify for this option. |

| State-Specific Forms | Each state may have its own specific form and requirements for a deed in lieu of foreclosure. For example, in California, the relevant law is governed by California Civil Code Section 2924. |

| Impact on Credit | While a deed in lieu of foreclosure is less damaging than a foreclosure, it may still negatively affect the borrower's credit score. |

| Tax Implications | Borrowers should be aware that they may face tax consequences, as forgiven mortgage debt can be considered taxable income under certain circumstances. |

| Legal Assistance | It is often advisable for homeowners to seek legal counsel before proceeding with a deed in lieu of foreclosure to understand their rights and obligations. |

Other Deed in Lieu of Foreclosure Templates:

How to File a Lady Bird Deed in Michigan - This deed is especially beneficial for aging homeowners planning for their end-of-life arrangements.

When dealing with property transfers in Colorado, understanding the importance of a Colorado Quitclaim Deed is essential, especially since this document facilitates the transfer of real estate with no guarantees on the title. It is commonly used among individuals who are familiar with one another, making it suitable for family transactions or divorce situations. To ensure a smooth process, you can begin by filling out the necessary form available at https://quitclaimdocs.com/fillable-colorado-quitclaim-deed/, which is an important first step in the deed execution process.

How to File a Quitclaim Deed in California - This form can help streamline property transfers during life changes.

Sample - Deed in Lieu of Foreclosure Form

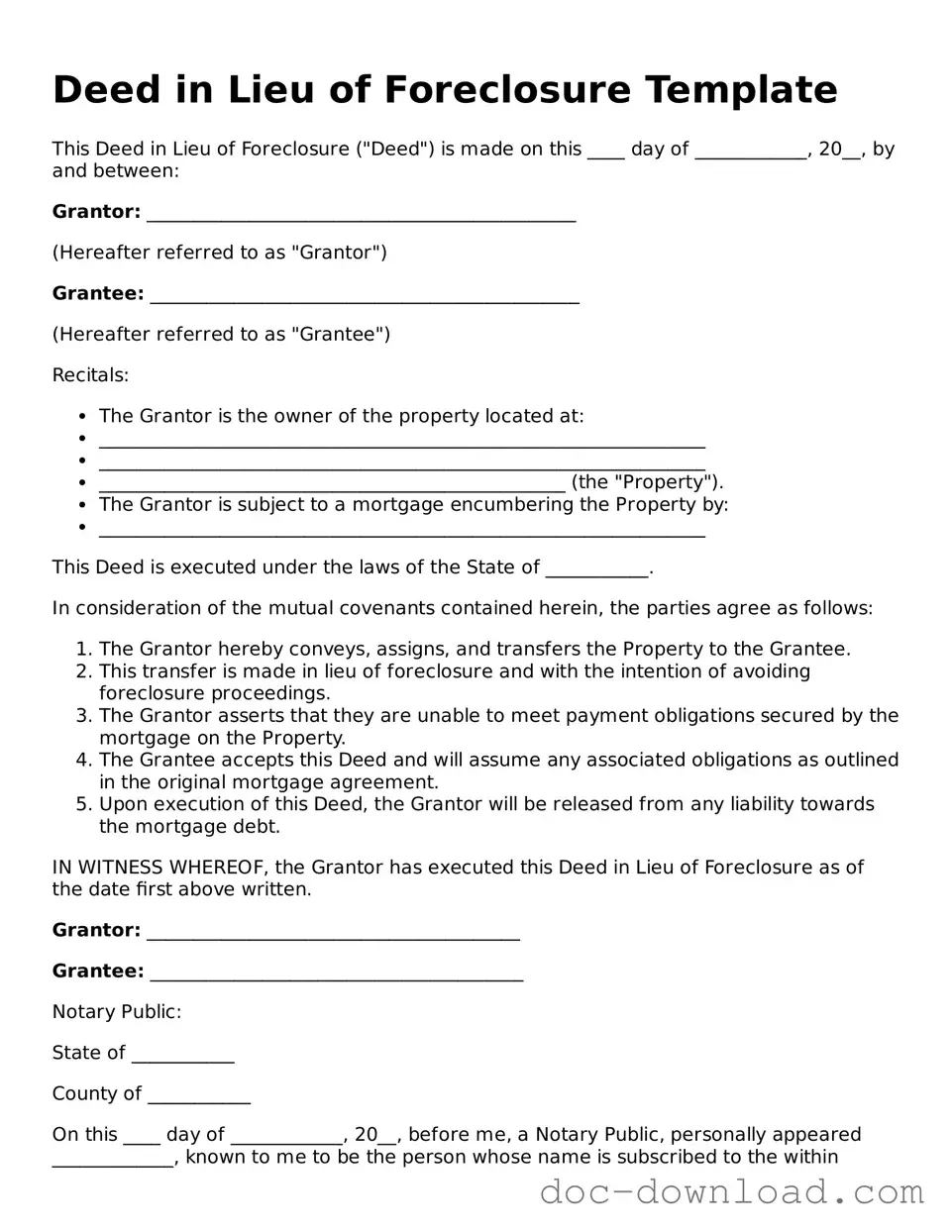

Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure ("Deed") is made on this ____ day of ____________, 20__, by and between:

Grantor: ______________________________________________

(Hereafter referred to as "Grantor")

Grantee: ______________________________________________

(Hereafter referred to as "Grantee")

Recitals:

- The Grantor is the owner of the property located at:

- _________________________________________________________________

- _________________________________________________________________

- __________________________________________________ (the "Property").

- The Grantor is subject to a mortgage encumbering the Property by:

- _________________________________________________________________

This Deed is executed under the laws of the State of ___________.

In consideration of the mutual covenants contained herein, the parties agree as follows:

- The Grantor hereby conveys, assigns, and transfers the Property to the Grantee.

- This transfer is made in lieu of foreclosure and with the intention of avoiding foreclosure proceedings.

- The Grantor asserts that they are unable to meet payment obligations secured by the mortgage on the Property.

- The Grantee accepts this Deed and will assume any associated obligations as outlined in the original mortgage agreement.

- Upon execution of this Deed, the Grantor will be released from any liability towards the mortgage debt.

IN WITNESS WHEREOF, the Grantor has executed this Deed in Lieu of Foreclosure as of the date first above written.

Grantor: ________________________________________

Grantee: ________________________________________

Notary Public:

State of ___________

County of ___________

On this ____ day of ____________, 20__, before me, a Notary Public, personally appeared _____________, known to me to be the person whose name is subscribed to the within instrument, and acknowledged that he/she executed the same for the purposes therein contained.

Witness my hand and official seal.

_____________________________________ (Seal)

Notary Public

My Commission Expires: _____________