Fill Out Your Citibank Direct Deposit Template

The Citibank Direct Deposit form is an essential tool for anyone looking to streamline their banking experience. This form allows individuals to have their paycheck or other recurring payments deposited directly into their Citibank account, eliminating the need for paper checks. By using this form, customers can enjoy the convenience of immediate access to their funds, often on the same day they are issued. Filling out the form involves providing personal information, such as your name, address, and account number, as well as details about your employer or the entity making the deposit. Additionally, it requires a signature to authorize the deposit, ensuring that your funds are secure and properly directed. Understanding how to complete and submit this form can significantly enhance financial management, making it a vital aspect of modern banking.

Similar forms

The W-4 form, officially known as the Employee's Withholding Certificate, is similar to the Citibank Direct Deposit form in that both documents involve the management of personal financial information. While the W-4 is used to determine the amount of federal income tax withheld from an employee's paycheck, the Direct Deposit form provides banking details for the direct transfer of funds. Both require accurate personal data, ensuring that the respective financial transactions align with the individual's preferences and obligations.

To complete your transaction with confidence, it is imperative to use the appropriate legal documents; for those dealing with mobile home sales in New York, you can download the form to ensure a clear and documented transfer of ownership.

The ACH Authorization form is another document that parallels the Citibank Direct Deposit form. This form authorizes a financial institution to initiate electronic transfers from one bank account to another. Like the Direct Deposit form, it necessitates the submission of banking details, ensuring that funds are transferred securely and efficiently. Both forms serve to streamline financial transactions, minimizing the need for paper checks and enhancing convenience for users.

Form Specifications

| Fact Name | Details |

|---|---|

| Purpose | The Citibank Direct Deposit form allows customers to set up automatic deposits into their bank accounts. |

| Eligibility | Individuals with a Citibank account can use this form to receive direct deposits from employers or government benefits. |

| Required Information | The form typically requires account number, routing number, and personal identification details. |

| Processing Time | Once submitted, it may take one to two pay cycles for the direct deposit to become effective. |

| State-Specific Forms | Some states may have additional requirements or specific forms governed by state law; check local regulations. |

| Security | Submitting the form securely is crucial, as it contains sensitive financial information. |

Different PDF Templates

Western Union Money Transfer Receipt PDF - Receive notifications to keep track of your transactions.

Download D1 Form Pdf - Providing a reliable person to sign the back of the photograph is essential.

In order to maintain clarity in employment records, it's essential to use the California Employment Verification form, which can be accessed at californiapdffoms.com, allowing employers and employees to verify and confirm employment status and history as needed.

Trader Joes - Interested in exploring innovative food concepts.

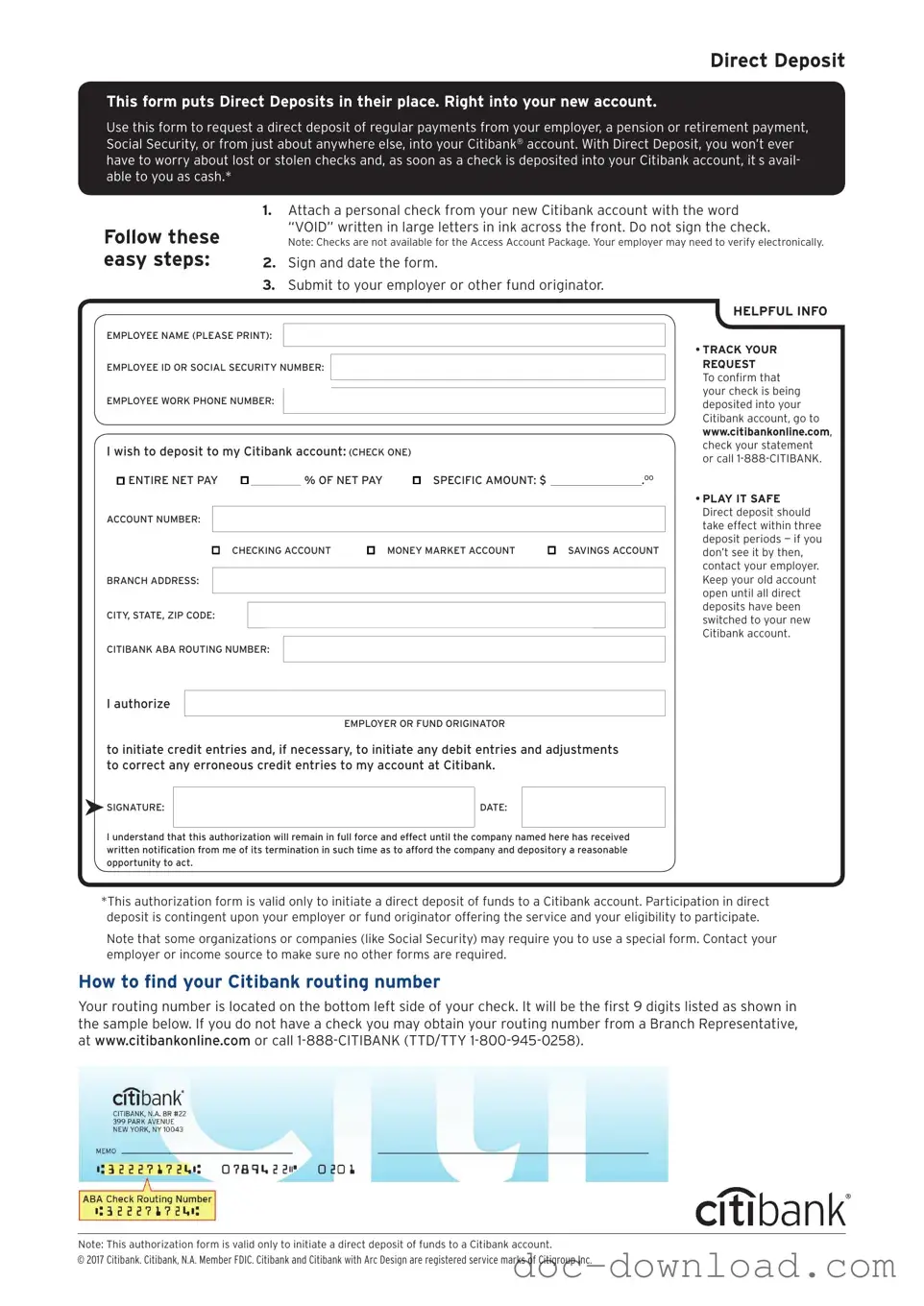

Sample - Citibank Direct Deposit Form

Direct Deposit

This form puts Direct Deposits in their place. Right into your new account.

Use this form to request a direct deposit of regular payments from your employer, a pension or retirement payment, Social Security, or from just about anywhere else, into your Citibank® account. With Direct Deposit, you won’t ever have to worry about lost or stolen checks and, as soon as a check is deposited into your Citibank account, it’s avail- able to you as cash.*

Follow these easy steps:

1.Attach a personal check from your new Citibank account with the word

“VOID” written in large letters in ink across the front. Do not sign the check.

Note: Checks are not available for the Access Account Package. Your employer may need to verify electronically.

2.Sign and date the form.

3.Submit to your employer or other fund originator.

HELPFUL INFO

EMPLOYEE NAME (PLEASE PRINT):

• TRACK YOUR

EMPLOYEE ID OR SOCIAL SECURITY NUMBER:

EMPLOYEE WORK PHONE NUMBER:

I wish to deposit to my Citibank account: (CHECK ONE)

ENTIRE NET PAY ı__________ % OF NET PAY |

ı SPECIFIC AMOUNT: $ ________________.OO |

ACCOUNT NUMBER:

ı CHECKING ACCOUNT |

ı MONEY MARKET ACCOUNT |

ı SAVINGS ACCOUNT |

BRANCH ADDRESS:

CITY, STATE, ZIP CODE:

CITIBANK ABA ROUTING NUMBER:

REQUEST

To confirm that your check is being deposited into your Citibank account, go to www.citibankonline.com, check your statement or call

•PLAY IT SAFE Direct deposit should take effect within three deposit periods — if you don’t see it by then, contact your employer. Keep your old account open until all direct deposits have been switched to your new Citibank account.

I authorize

EMPLOYER OR FUND ORIGINATOR

to initiate credit entries and, if necessary, to initiate any debit entries and adjustments to correct any erroneous credit entries to my account at Citibank.

SIGNATURE:

SIGNATURE:

DATE:

I understand that this authorization will remain in full force and effect until the company named here has received written notification from me of its termination in such time as to afford the company and depository a reasonable opportunity to act.

*This authorization form is valid only to initiate a direct deposit of funds to a Citibank account. Participation in direct deposit is contingent upon your employer or fund originator offering the service and your eligibility to participate.

Note that some organizations or companies (like Social Security) may require you to use a special form. Contact your employer or income source to make sure no other forms are required.

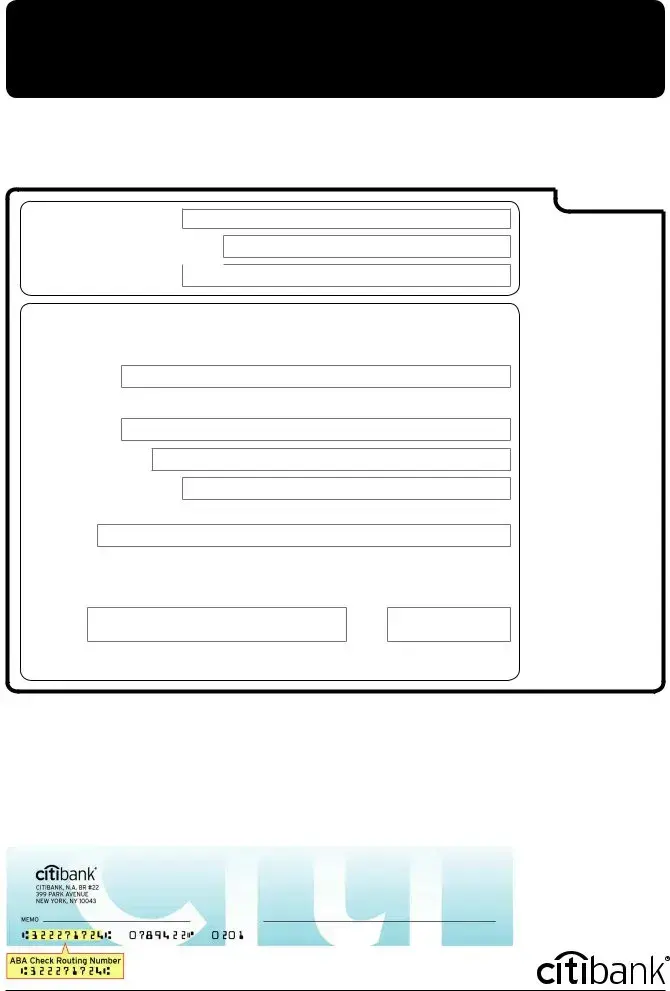

How to find your Citibank routing number

Your routing number is located on the bottom left side of your check. It will be the first 9 digits listed as shown in the sample below. If you do not have a check you may obtain your routing number from a Branch Representative, at www.citibankonline.com or call

Note: This authorization form is valid only to initiate a direct deposit of funds to a Citibank account.

© 2017 Citibank. Citibank, N.A. Member FDIC. Citibank and Citibank with Arc Design are registered service marks of Citigroup Inc.