Fill Out Your Childcare Receipt Template

The Childcare Receipt form serves as an important document for parents and childcare providers alike, facilitating clear communication regarding the exchange of services. This form includes essential details such as the date of service, the total amount paid, and the name of the individual or entity that made the payment. Additionally, it requires the names of the child or children receiving care, ensuring that all parties have a record of the services rendered. The form also specifies the duration of childcare services, indicating the start and end dates, which can be crucial for both financial and scheduling purposes. Finally, a signature from the childcare provider is included, confirming the receipt of payment and the provision of services. This structured format helps maintain accurate records and provides a reliable reference for future inquiries or audits.

Similar forms

The Childcare Receipt form shares similarities with the Tuition Receipt form, which is commonly used by educational institutions. Both documents serve as proof of payment for services rendered. The Tuition Receipt outlines the date of payment, the amount, and the name of the student, mirroring the structure of the Childcare Receipt. Each form provides a clear record for parents or guardians, facilitating financial tracking for tax purposes or reimbursement requests.

Another document akin to the Childcare Receipt is the Medical Receipt. This form is issued by healthcare providers to confirm payment for medical services. Like the Childcare Receipt, it includes essential details such as the date of service, amount paid, and the recipient's name. Both receipts serve as vital documentation for insurance claims and tax deductions, ensuring that individuals can substantiate their expenses.

In the realm of property transactions, understanding the importance of documentation is crucial; for instance, when transferring ownership, a Georgia Deed form serves as an indispensable tool. It not only formalizes the transfer of property rights but also ensures legal recognition and protection for the new owner. For those interested in obtaining or filling out such documents, resources like Georgia PDF Forms provide essential guidance and templates to facilitate this process efficiently.

The Service Receipt is also comparable to the Childcare Receipt. This document is often used by various service providers, such as plumbers or electricians, to acknowledge payment for services. It typically includes the date, amount, and a description of the service rendered, similar to how the Childcare Receipt outlines the childcare services provided. Both forms help maintain transparency in financial transactions.

A Rental Receipt shares characteristics with the Childcare Receipt as well. Landlords provide rental receipts to tenants to confirm payment of rent. These receipts include the date of payment, the amount, and the tenant’s name, paralleling the information found on the Childcare Receipt. Both documents are essential for record-keeping and can be used for legal purposes if disputes arise.

Another related document is the Donation Receipt, often issued by charitable organizations. This receipt confirms a donor's contribution, detailing the date, amount, and purpose of the donation. Similar to the Childcare Receipt, it serves as proof of payment and is crucial for tax deductions. Both documents help individuals track their financial contributions for personal records and tax filings.

The Invoice is another document that bears resemblance to the Childcare Receipt. Businesses issue invoices to request payment for goods or services provided. Like the Childcare Receipt, an invoice includes the date, amount due, and details about the service or product. Both documents function as formal requests for payment and provide a record for both parties involved in the transaction.

Additionally, the Payment Confirmation Receipt is similar to the Childcare Receipt. This document is often generated by online payment systems or financial institutions to confirm a transaction. It includes the date, amount, and recipient’s information, mirroring the structure of the Childcare Receipt. Both receipts provide assurance that a payment has been successfully processed, helping individuals keep track of their financial activities.

Lastly, the Event Ticket Receipt can be compared to the Childcare Receipt. When purchasing tickets for events, attendees receive a receipt that confirms their payment. This document typically includes the date, amount paid, and the event details. Both receipts serve as proof of purchase and can be important for refunds or exchanges, ensuring that individuals have documentation of their financial commitments.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Childcare Receipt form serves as proof of payment for childcare services, helping parents keep track of expenses. |

| Information Required | Each receipt requires the date, amount paid, name of the child or children, and the childcare provider's signature. |

| Frequency of Use | Parents may need to use this form regularly, especially if they are claiming childcare expenses for tax deductions. |

| State-Specific Requirements | Some states may have specific laws governing childcare receipts, such as California's Child Care Provider Law. |

| Tax Implications | The receipt can be crucial for parents claiming the Child and Dependent Care Tax Credit on their federal tax returns. |

| Record Keeping | It is advisable for parents to keep copies of all childcare receipts for at least three years in case of an audit. |

Different PDF Templates

Indiana Odometer Statement - This document helps prevent odometer fraud during vehicle transactions.

When engaging in the sale of a motorcycle in Alabama, it is crucial to utilize the Alabama Motorcycle Bill of Sale form to ensure a smooth transaction. This legal document not only serves as proof of the transfer of ownership but also captures significant details such as the motorcycle's make, model, year, and the identities of the buyer and seller. For more information on obtaining this form, visit https://motorcyclebillofsale.com/free-alabama-motorcycle-bill-of-sale.

Broward Animal Care and Adoption - Completing the form correctly reduces the risk of administrative errors.

Florida Immunization Form 680 Pdf - It is recommended that parents keep a copy of the completed 680 form for their own records.

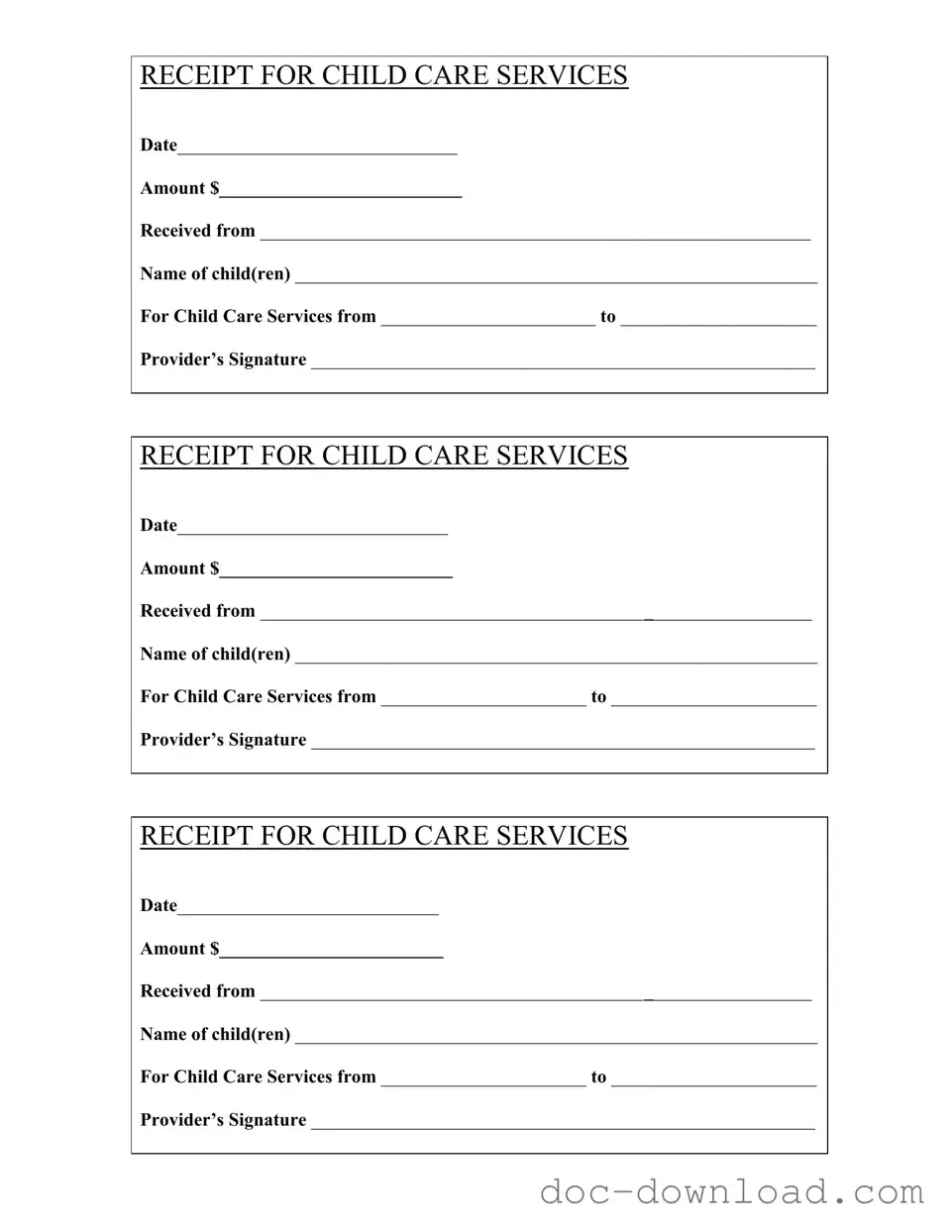

Sample - Childcare Receipt Form

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________