Fill Out Your Cash Receipt Template

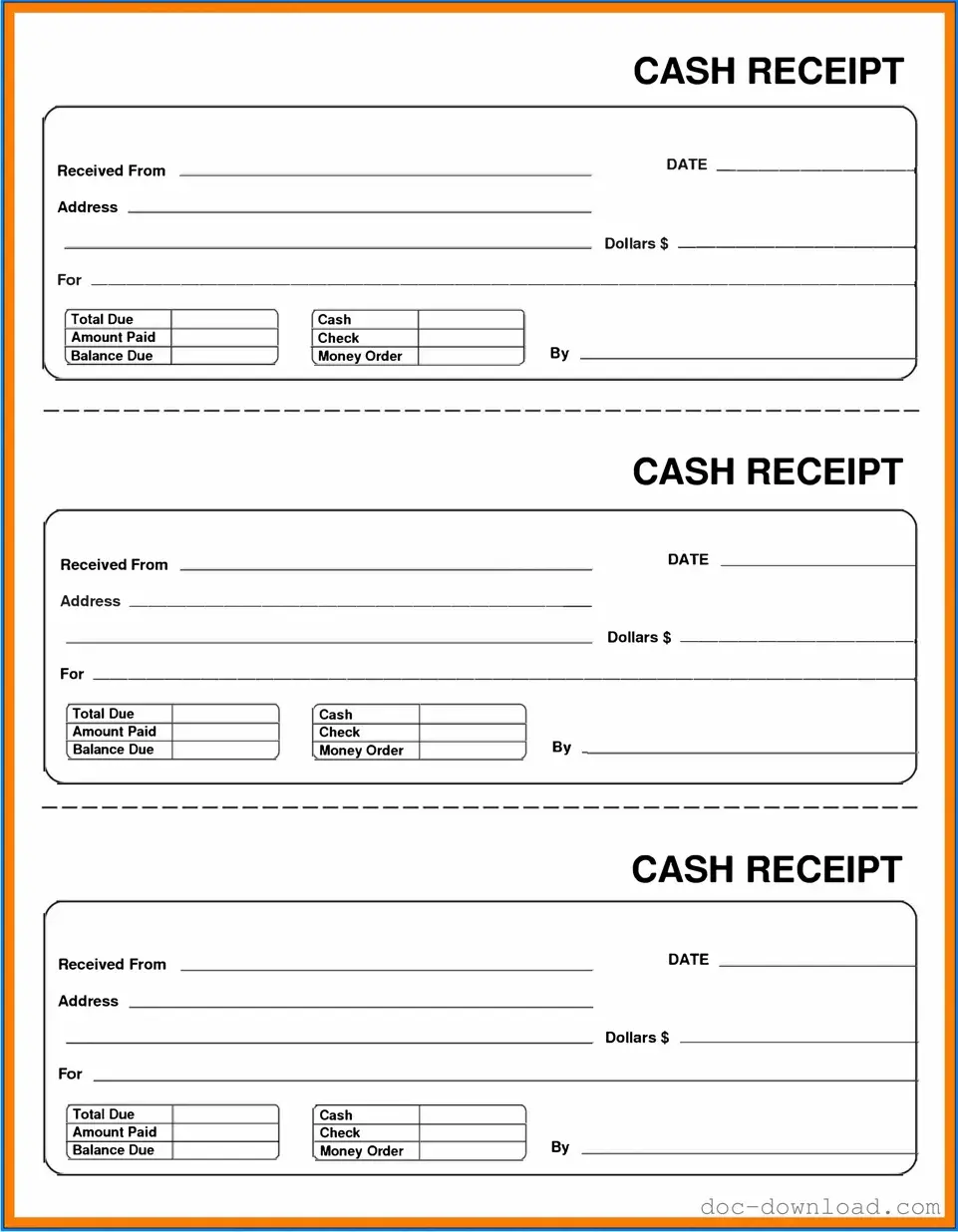

The Cash Receipt form is an essential document for businesses that handle cash transactions. This form serves multiple purposes, acting as a record of payment received from customers, providing proof of transaction for both parties involved, and aiding in accurate financial reporting. Typically, the form includes key information such as the date of the transaction, the amount received, the method of payment—whether cash, check, or credit—and details about the payer. Additionally, it often features a unique receipt number for tracking and auditing purposes. By maintaining clear and organized records through the Cash Receipt form, businesses can ensure transparency in their financial dealings, streamline their accounting processes, and enhance customer trust. Understanding how to effectively utilize this form can significantly improve cash flow management and overall operational efficiency.

Similar forms

The Invoice is a document that requests payment for goods or services provided. Similar to the Cash Receipt form, it contains details about the transaction, including the date, amount due, and a description of the items or services rendered. While the Cash Receipt confirms that payment has been received, the Invoice serves as a request for payment before the transaction is completed.

The Payment Voucher is another document that functions similarly to the Cash Receipt form. It serves as a record of payments made by a business to its vendors or suppliers. Like the Cash Receipt, it includes details such as the date, amount paid, and the purpose of the payment. However, the Payment Voucher is typically used in the context of accounts payable, while the Cash Receipt focuses on incoming cash transactions.

A Deposit Slip is a document used to deposit cash or checks into a bank account. This document is similar to the Cash Receipt form in that it records the amount of money being handled. Both documents serve as proof of a financial transaction. However, the Deposit Slip is specifically used for bank deposits, while the Cash Receipt confirms the receipt of payment from a customer.

The Sales Receipt is issued to customers at the point of sale. It provides proof of purchase and details about the transaction, such as items bought, prices, and payment method. Like the Cash Receipt form, it serves as evidence of a financial transaction. The key difference is that the Sales Receipt is generated at the time of sale, while the Cash Receipt can be issued after payment has been received.

The Credit Memo is a document that reduces the amount owed by a customer. It is similar to the Cash Receipt form in that both documents deal with financial transactions. The Credit Memo is issued when a customer returns goods or when there is an adjustment to the original invoice. In contrast, the Cash Receipt confirms that payment has been made, rather than adjusting amounts owed.

When purchasing a motorcycle, it's essential to use the appropriate documentation to ensure a smooth transaction. The Alabama Motorcycle Bill of Sale not only acts as proof of sale but also encompasses vital details about the motorcycle and the parties involved in the transaction. For those looking to avoid any ambiguities in their motorcycle purchase, it's helpful to refer to the necessary resources, such as https://motorcyclebillofsale.com/free-alabama-motorcycle-bill-of-sale, to obtain a proper bill of sale template.

The Purchase Order is a document that authorizes a purchase transaction. It outlines the items or services requested and serves as a formal agreement between the buyer and seller. While it does not confirm payment like the Cash Receipt form, it is similar in that it records transaction details. Both documents help maintain accurate financial records for businesses.

The Expense Report is used by employees to request reimbursement for business-related expenses. It includes information about the expenses incurred, similar to how the Cash Receipt form details the payment received. Both documents require supporting documentation, such as receipts, to validate the transactions. However, the Expense Report focuses on outgoing funds, while the Cash Receipt deals with incoming funds.

The Statement of Account is a summary of all transactions between a business and its customers over a specific period. It includes details of payments received and amounts owed. Like the Cash Receipt form, it provides a record of financial activity. However, the Statement of Account encompasses a broader range of transactions, including both incoming and outgoing payments.

The Receipt Acknowledgment is a document that confirms the receipt of goods or services. It serves a similar purpose to the Cash Receipt form by providing proof that a transaction has occurred. While the Cash Receipt focuses on the payment aspect, the Receipt Acknowledgment emphasizes the delivery of goods or services, making it a complementary document in the transaction process.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document cash transactions received by a business or organization. It serves as a record of payment and can be used for accounting purposes. |

| Components | This form typically includes details such as the date of the transaction, the amount received, the payer's information, and the purpose of the payment. |

| Legal Requirements | In many states, businesses must maintain accurate records of cash transactions for tax reporting purposes. This may be governed by state tax laws and regulations. |

| Retention Period | Organizations are generally advised to keep cash receipt forms for a minimum of three to seven years, depending on state laws and auditing requirements. |

Different PDF Templates

How to Get Acord Insurance Certificate - The Acord 50 WM form is used for workers' compensation insurance applications.

In the process of buying or selling property in Colorado, it's vital to utilize the right documentation to safeguard your interests. The Colorado Real Estate Purchase Agreement form serves as the cornerstone of this transaction, detailing every crucial element to avoid misunderstandings. To further assist you in this matter, you can access resources such as Colorado PDF Forms to ensure you have the most up-to-date and accurate information at your fingertips.

Fedex Freight Truck - It also allows for tracking of hazardous materials through appropriate designations on the form.

Sample - Cash Receipt Form

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By