Fill Out Your Cash Drawer Count Sheet Template

The Cash Drawer Count Sheet is an essential tool for businesses that manage cash transactions, providing a systematic way to track and verify the cash present in a register at the end of a shift or day. This form typically includes sections for recording the starting cash balance, cash sales, and any cash received from other sources, such as refunds or cash drops. Additionally, it allows for the documentation of cash paid out, which could include expenses or cash given to customers as change. By detailing the cash count, including denominations of bills and coins, the form helps ensure accuracy and accountability in cash handling. A well-maintained Cash Drawer Count Sheet not only aids in reconciling cash at the end of the day but also serves as a valuable record for financial audits and helps identify discrepancies that may arise during cash transactions. Overall, this form is a critical component in maintaining financial integrity and operational efficiency within a business that relies on cash sales.

Similar forms

The Cash Register Summary Report is similar to the Cash Drawer Count Sheet in that both documents provide a summary of cash transactions within a specific time frame. The Cash Register Summary Report typically includes details such as total sales, cash received, and any discrepancies. Like the Cash Drawer Count Sheet, it serves as a tool for reconciling cash at the end of a business day, ensuring that the amount of cash in the register matches sales records.

The Daily Sales Report also shares similarities with the Cash Drawer Count Sheet. This document captures daily sales figures and can include breakdowns by payment type, such as cash, credit, or debit. Both reports aim to provide an overview of financial activity for a given period. They are essential for tracking performance and identifying trends in sales and cash flow.

The Bank Deposit Slip is another document that aligns closely with the Cash Drawer Count Sheet. A bank deposit slip is used to record the amount of cash being deposited into a bank account. Both documents require accurate counting and recording of cash, ensuring that the amounts match before funds are deposited. This consistency helps prevent discrepancies and provides a clear audit trail.

For those managing employee records, a crucial document to consider is the complete Employment Verification process. This form assists in confirming employment details for various applications and inquiries, ensuring that all necessary information is properly documented and verified.

The Sales Receipt serves a similar purpose to the Cash Drawer Count Sheet in that it documents individual transactions. Each sales receipt provides proof of purchase for customers and records the cash received by the business. Both documents are vital for maintaining accurate financial records and can be used for future reference in case of disputes or returns.

The Petty Cash Log is akin to the Cash Drawer Count Sheet in that it tracks cash transactions, specifically for small, incidental expenses. This log records every petty cash disbursement and replenishment, ensuring that the total cash on hand is always accounted for. Both documents emphasize the importance of accurate cash management and accountability.

The Inventory Count Sheet is another document that parallels the Cash Drawer Count Sheet. While the Cash Drawer Count Sheet focuses on cash, the Inventory Count Sheet tracks physical stock levels. Both documents are essential for maintaining accurate records, as discrepancies in either can lead to financial losses or mismanagement of resources.

The Expense Report is similar to the Cash Drawer Count Sheet in that it documents financial transactions, but it focuses on expenses rather than income. An expense report details the costs incurred by employees or departments, providing a clear overview of spending. Both documents are critical for financial oversight and can help identify areas for cost savings.

The Profit and Loss Statement (P&L) shares a connection with the Cash Drawer Count Sheet by summarizing the financial performance of a business over a specific period. While the Cash Drawer Count Sheet focuses on cash transactions, the P&L statement provides a broader view of revenues, costs, and expenses. Both documents are essential for assessing the financial health of a business.

The Cash Flow Statement is another important document that is similar to the Cash Drawer Count Sheet. It tracks the inflow and outflow of cash within a business over a defined period. Both documents highlight the importance of cash management, ensuring that a business can meet its obligations and maintain operational efficiency.

Finally, the Credit Card Transaction Log is akin to the Cash Drawer Count Sheet in that it records payment transactions. This log details all credit card sales, including the amounts and transaction dates. Both documents are crucial for ensuring that all forms of payment are accurately accounted for and reconciled, minimizing the risk of financial discrepancies.

Form Specifications

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet form is used to document the amount of cash present in a cash drawer at the beginning or end of a business day. |

| Importance | This form helps businesses maintain accurate financial records and aids in identifying discrepancies in cash handling. |

| Usage Frequency | It is typically used daily, especially in retail environments where cash transactions are common. |

| State-Specific Regulations | In some states, businesses may be required to keep these records for a certain period for tax and auditing purposes, governed by state tax laws. |

| Record Keeping | Proper completion and retention of the Cash Drawer Count Sheet can protect businesses during audits and ensure compliance with financial regulations. |

Different PDF Templates

Navpers 1336 3 - The form serves as an essential tool for planning personnel rotations.

A Georgia Deed form is an essential document used to legally transfer property from one person to another. This form serves as evidence that the property owner has conveyed their interest in the property to the new owner. To ensure the accuracy and legality of the transfer, it is advisable to use reliable resources, such as Georgia PDF Forms, for obtaining the correct forms. Completing this form correctly ensures that the transfer is recognized by law, securing the new owner's rights to the property.

Puppy Health Record - This document serves as proof of vaccination for dogs, ensuring compliance with local regulations.

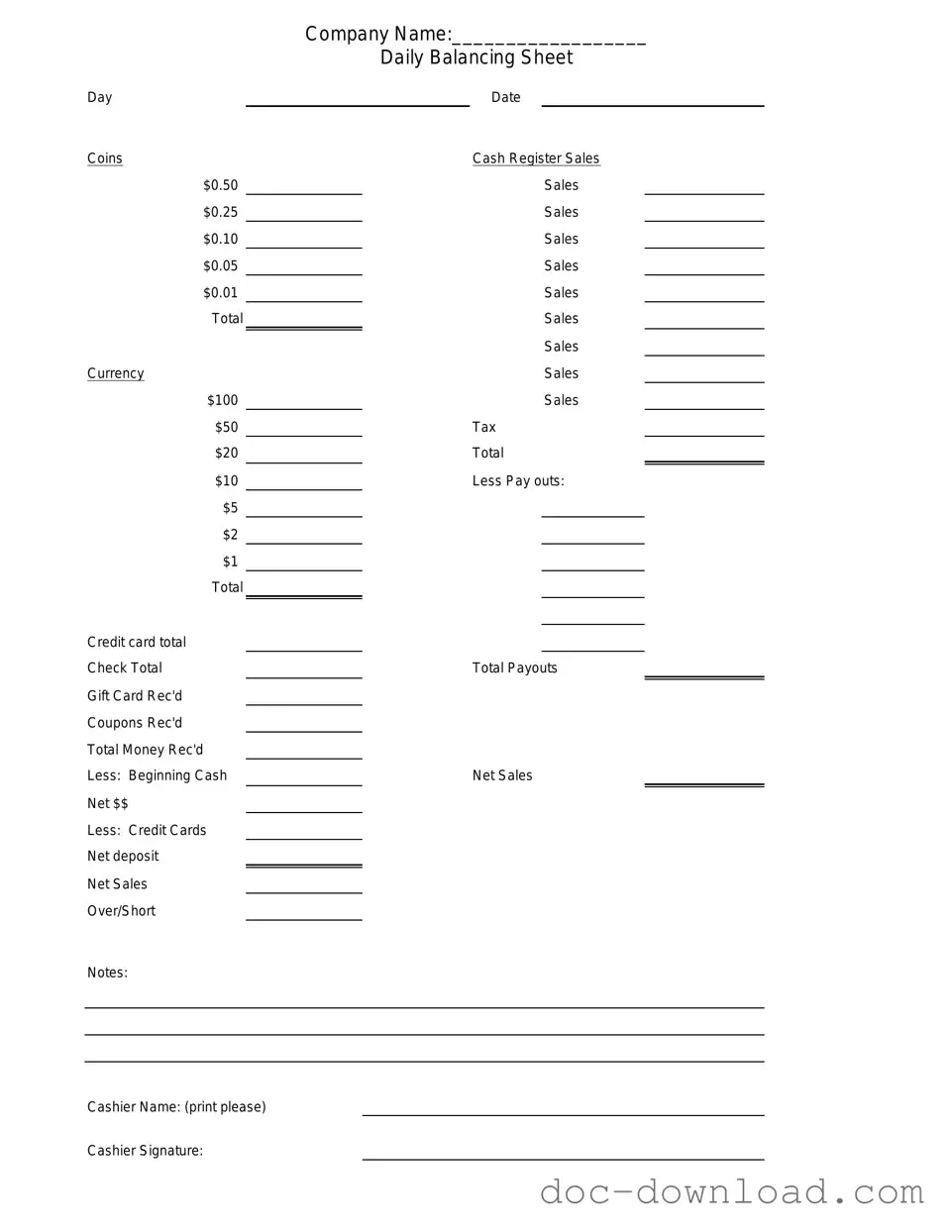

Sample - Cash Drawer Count Sheet Form

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature: