Blank Promissory Note Document for California

In California, a Promissory Note is a crucial document that outlines a borrower's promise to repay a loan under specified terms. This form serves as a written agreement between the lender and the borrower, detailing the amount borrowed, the interest rate, repayment schedule, and any consequences for defaulting on the loan. It is important to include clear terms to avoid misunderstandings and disputes in the future. The Promissory Note may also specify whether the loan is secured or unsecured, providing additional context for both parties. Furthermore, it often includes provisions for prepayment, late fees, and the governing law, which is essential for ensuring that the agreement complies with state regulations. Understanding these elements is vital for anyone involved in lending or borrowing money in California, as it helps to protect the rights and responsibilities of both parties.

Similar forms

The California Promissory Note is similar to a Loan Agreement. Both documents outline the terms of a loan, including the amount borrowed, interest rates, and repayment schedules. A Loan Agreement may provide more detailed terms regarding collateral, default conditions, and borrower responsibilities. However, like the Promissory Note, it serves as a legally binding contract between the lender and borrower, ensuring that both parties understand their obligations.

Another document that resembles the California Promissory Note is a Secured Promissory Note. This type of note includes a security interest in specific collateral, which the lender can claim if the borrower defaults. While a standard Promissory Note may not involve collateral, a Secured Promissory Note provides additional protection for the lender. Both documents establish a clear expectation for repayment but differ in the level of security provided to the lender.

In addition to the various financial documents mentioned, individuals involved in the sale of agricultural equipment should consider the importance of having a proper legal document like the Tractor Bill of Sale form. This document not only facilitates the transfer of ownership but also protects the rights of both the buyer and seller by clearly outlining the details of the transaction.

A third similar document is the Personal Loan Agreement. This agreement details the terms under which one individual lends money to another. Like the Promissory Note, it specifies the loan amount, interest rate, and repayment terms. However, the Personal Loan Agreement often includes more personal terms, such as the relationship between the parties involved. Both documents are essential for clarifying the expectations and responsibilities of the borrower and lender.

Finally, the California Promissory Note shares similarities with a Business Loan Agreement. This document is used when a business borrows money from a lender. It outlines the terms of the loan, including repayment schedules and interest rates, much like a Promissory Note. However, a Business Loan Agreement may also include clauses specific to business operations, such as financial reporting requirements or covenants. Both documents serve to protect the interests of the lender while ensuring that the borrower understands their obligations.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A California Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The California Civil Code governs promissory notes, specifically Sections 3300 to 3345. |

| Types | There are various types of promissory notes, including secured and unsecured notes, each serving different purposes. |

| Interest Rates | California allows interest rates on promissory notes, but they must comply with state usury laws to avoid excessive charges. |

| Signatures | For a promissory note to be valid, it must be signed by the borrower, and often by the lender as well. |

| Enforceability | A properly executed promissory note can be enforced in court, making it a powerful tool for lenders. |

Additional State-specific Promissory Note Forms

Should a Promissory Note Be Notarized - Clearly defined terms can lead to better financial planning for borrowers.

Florida Promissory Note Requirements - Some promissory notes are negotiable, meaning they can be transferred to another party.

When considering property transfers in Colorado, it's important to understand the implications of using a Quitclaim Deed form. This legal document, as detailed in resources like Colorado PDF Forms, allows individuals to transfer ownership rights without guaranteeing the property's title, often making it a preferred choice for family transactions or when resolving title disputes.

Promissory Note Template Arizona - Can be invalidated if not signed by both parties in some states.

Tennessee Promissory Note - Both parties must sign the promissory note for it to be legally binding.

Sample - California Promissory Note Form

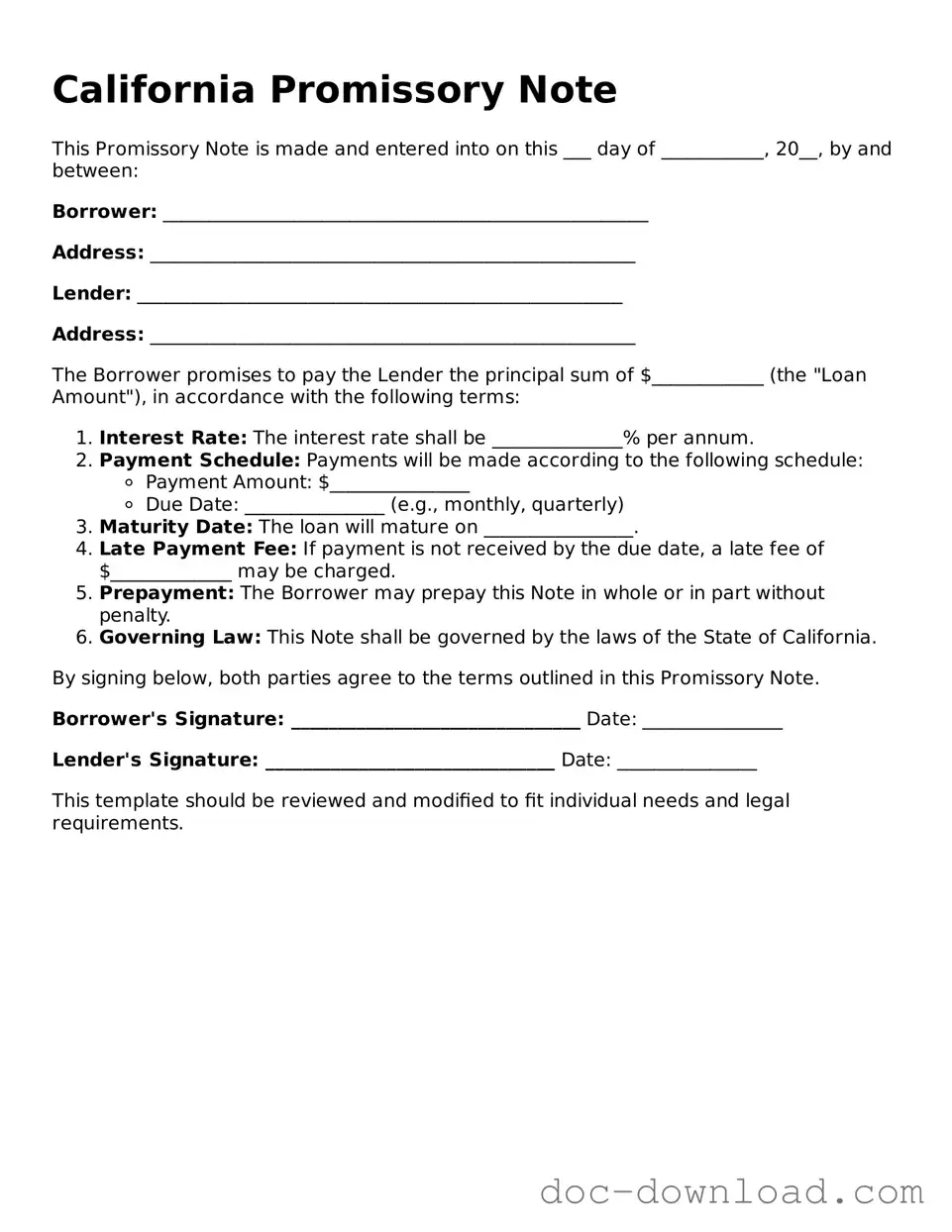

California Promissory Note

This Promissory Note is made and entered into on this ___ day of ___________, 20__, by and between:

Borrower: ____________________________________________________

Address: ____________________________________________________

Lender: ____________________________________________________

Address: ____________________________________________________

The Borrower promises to pay the Lender the principal sum of $____________ (the "Loan Amount"), in accordance with the following terms:

- Interest Rate: The interest rate shall be ______________% per annum.

- Payment Schedule: Payments will be made according to the following schedule:

- Payment Amount: $_______________

- Due Date: _______________ (e.g., monthly, quarterly)

- Maturity Date: The loan will mature on ________________.

- Late Payment Fee: If payment is not received by the due date, a late fee of $_____________ may be charged.

- Prepayment: The Borrower may prepay this Note in whole or in part without penalty.

- Governing Law: This Note shall be governed by the laws of the State of California.

By signing below, both parties agree to the terms outlined in this Promissory Note.

Borrower's Signature: _______________________________ Date: _______________

Lender's Signature: _______________________________ Date: _______________

This template should be reviewed and modified to fit individual needs and legal requirements.