Blank Loan Agreement Document for California

The California Loan Agreement form serves as a crucial document in the lending process, establishing clear terms and conditions between a borrower and a lender. This form outlines essential details such as the loan amount, interest rate, repayment schedule, and any applicable fees. It also specifies the rights and obligations of both parties, ensuring that expectations are aligned from the outset. By including provisions for default, collateral, and dispute resolution, the form helps to protect the interests of both the lender and the borrower. Additionally, it may address the governing law, which is essential for resolving any legal issues that may arise during the loan period. Understanding the components of this agreement is vital for anyone considering entering into a loan arrangement in California, as it lays the groundwork for a transparent and fair lending experience.

Similar forms

The California Promissory Note serves a similar purpose to the Loan Agreement form. Both documents outline the terms of a loan, including the amount borrowed, interest rate, and repayment schedule. A Promissory Note is often simpler and focuses primarily on the borrower's promise to repay the loan, while the Loan Agreement may include additional details such as collateral and specific conditions for default.

The Quitclaim Deed is essential for those looking to transfer property interests without the complexities of validating a title. In Indiana, property owners can utilize this straightforward legal document to convey their share to another party, often involving familial situations. To assist in this process, you can access a useful resource at https://quitclaimdeedtemplate.com/indiana-quitclaim-deed-template/ which provides templates and guidance specific to Indiana's requirements.

The Security Agreement is another document that aligns closely with the Loan Agreement. This document is used when a borrower pledges collateral to secure a loan. Like the Loan Agreement, it specifies the terms of the loan but also details the rights of the lender in case of default, providing an extra layer of protection for the lender.

A Mortgage Agreement shares similarities with the Loan Agreement, particularly in real estate transactions. Both documents outline the loan terms and conditions, but a Mortgage Agreement specifically secures the loan with the property itself. This means that if the borrower defaults, the lender can initiate foreclosure proceedings to recover the loan amount through the sale of the property.

The Deed of Trust is closely related to the Mortgage Agreement and serves a similar function. It involves three parties: the borrower, the lender, and a trustee. Like the Loan Agreement, it lays out the terms of the loan but includes provisions for the trustee to hold the title to the property until the loan is repaid. This structure can simplify the foreclosure process for lenders.

A Loan Application is another document that relates to the Loan Agreement. While the Loan Agreement details the terms of the loan after approval, the Loan Application is the initial request for funds. It collects essential information about the borrower’s financial status, credit history, and purpose of the loan, helping lenders decide whether to approve the loan.

The Loan Disclosure Statement is also similar to the Loan Agreement, as it provides crucial information about the loan’s terms. This document is typically required by law and must be provided to borrowers before they sign the Loan Agreement. It includes details about the loan amount, interest rate, fees, and other costs, ensuring borrowers understand their obligations.

The Personal Guarantee form is relevant when a business borrows money. It requires an individual, usually a business owner, to guarantee repayment of the loan personally. While the Loan Agreement outlines the loan's terms, the Personal Guarantee adds an additional layer of security for the lender by holding an individual responsible for the debt.

An Installment Agreement can also be compared to the Loan Agreement. This document outlines a payment plan for a loan, specifying how much the borrower will pay and when. While the Loan Agreement sets the overall terms of the loan, the Installment Agreement focuses on the repayment structure, often breaking down payments into manageable amounts over time.

Finally, the Forbearance Agreement is similar in that it addresses the repayment of a loan, but it is used when a borrower is struggling to make payments. This document allows for temporary relief by modifying the loan terms, such as reducing payments or extending the repayment period. Both the Forbearance Agreement and Loan Agreement are crucial in managing loan obligations, especially during financial hardship.

Document Overview

| Fact Name | Description |

|---|---|

| Purpose | The California Loan Agreement form outlines the terms and conditions for a loan between a lender and a borrower. |

| Governing Law | This agreement is governed by the laws of the State of California. |

| Parties Involved | The form requires identification of both the lender and the borrower, including their legal names and contact information. |

| Key Terms | Important details such as loan amount, interest rate, repayment schedule, and any collateral must be clearly stated. |

Additional State-specific Loan Agreement Forms

Texas Promissory Note - Having a written agreement can provide legal recourse if needed.

In today's competitive business environment, utilizing a Colorado Non-disclosure Agreement form is essential for protecting your proprietary information. By ensuring that both parties understand their obligations, this agreement helps to prevent unauthorized disclosure of sensitive data. For those looking to create or modify this critical document, resources such as Colorado PDF Forms can provide the necessary templates to meet Colorado’s legal standards.

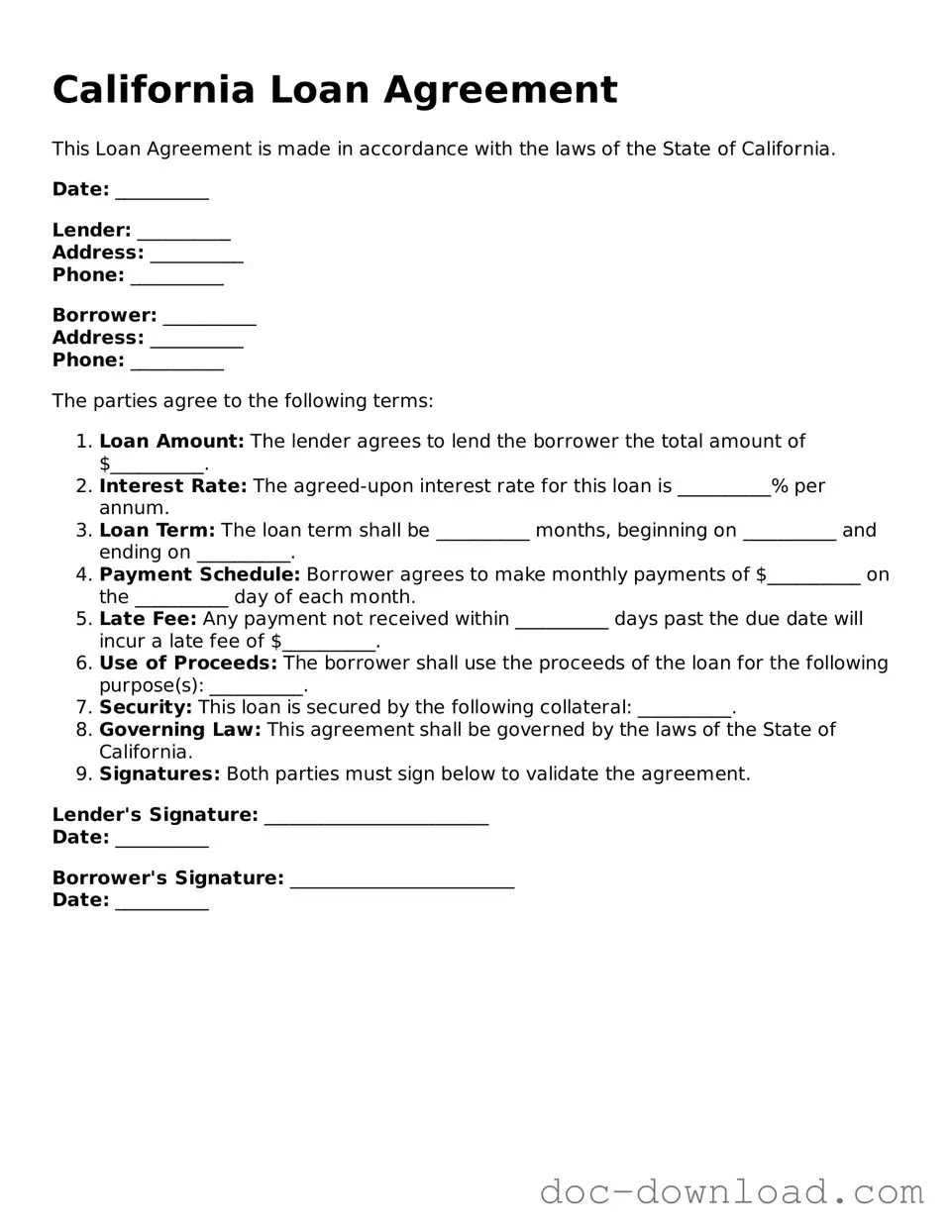

Sample - California Loan Agreement Form

California Loan Agreement

This Loan Agreement is made in accordance with the laws of the State of California.

Date: __________

Lender: __________

Address: __________

Phone: __________

Borrower: __________

Address: __________

Phone: __________

The parties agree to the following terms:

- Loan Amount: The lender agrees to lend the borrower the total amount of $__________.

- Interest Rate: The agreed-upon interest rate for this loan is __________% per annum.

- Loan Term: The loan term shall be __________ months, beginning on __________ and ending on __________.

- Payment Schedule: Borrower agrees to make monthly payments of $__________ on the __________ day of each month.

- Late Fee: Any payment not received within __________ days past the due date will incur a late fee of $__________.

- Use of Proceeds: The borrower shall use the proceeds of the loan for the following purpose(s): __________.

- Security: This loan is secured by the following collateral: __________.

- Governing Law: This agreement shall be governed by the laws of the State of California.

- Signatures: Both parties must sign below to validate the agreement.

Lender's Signature: ________________________

Date: __________

Borrower's Signature: ________________________

Date: __________