Blank Gift Deed Document for California

In the vibrant landscape of California real estate, the Gift Deed form stands out as a vital tool for individuals looking to transfer property without the exchange of money. This legal document facilitates the gifting of real estate, allowing one person, often a family member or close friend, to convey ownership to another. By utilizing this form, the donor, or giver, can ensure that the recipient, known as the grantee, receives the property with clear title, free from any encumbrances that might complicate the transfer. Essential elements of the Gift Deed include the identification of both parties, a precise description of the property being gifted, and the intent to make a gift without expectation of compensation. Additionally, the form may require notarization to validate the transfer and ensure compliance with California laws. Understanding the nuances of this document is crucial, as it not only serves as a means of property transfer but also carries implications for taxes and future ownership rights. With the right knowledge, individuals can navigate the process smoothly, ensuring that their generous intentions are realized in a legally sound manner.

Similar forms

The California Grant Deed is similar to a Warranty Deed. Both documents transfer property ownership from one party to another. A Warranty Deed guarantees that the seller holds clear title to the property and has the right to sell it. It also protects the buyer against any claims or issues related to the property that may arise after the sale. This level of assurance is not typically offered in a Gift Deed, making the Warranty Deed a more secure option for buyers.

Another document akin to the Gift Deed is the Quitclaim Deed. A Quitclaim Deed transfers whatever interest the grantor has in a property without any guarantees. Unlike the Gift Deed, which is often used to transfer property without consideration, the Quitclaim Deed is often used among family members or in divorce settlements. It provides no warranty of title, making it a riskier option for the grantee.

The Bargain and Sale Deed shares similarities with the Gift Deed in that it conveys property ownership. However, it does not provide the same level of protection as a Warranty Deed. The Bargain and Sale Deed implies that the seller has the right to sell the property but does not guarantee that the title is free from defects. This can leave the buyer exposed to potential claims against the property.

The Special Warranty Deed is another document that resembles the Gift Deed. This type of deed provides a limited warranty, meaning the seller only guarantees the title against claims that arose during their ownership. Unlike the Gift Deed, which typically involves no consideration, the Special Warranty Deed is often used in commercial transactions where some level of assurance is still required.

The Trust Transfer Deed is also comparable to the Gift Deed. This document is used to transfer property into a trust, which can be beneficial for estate planning. While the Gift Deed transfers property outright without consideration, the Trust Transfer Deed maintains the property within the trust, allowing for continued management and control by the trustee.

When considering the various types of deeds available for property transfer, it's important to recognize the utility of the Quitclaim Deed, particularly in Florida, as described on quitclaimdeedtemplate.com/florida-quitclaim-deed-template. This legal form allows individuals to transfer property ownership efficiently, often used among family members to simplify the process without the complications that other deeds might entail. Its straightforward nature, combined with the lack of guarantees regarding the property's title, makes it an appealing choice in less formal transactions.

A Deed of Trust serves a different purpose but is related in that it involves property ownership. This document secures a loan by placing a lien on the property. While the Gift Deed transfers ownership without consideration, a Deed of Trust is used primarily for securing financing, making it a crucial document in real estate transactions.

The Reconveyance Deed is similar in that it is used to transfer property interests. This document is executed when a loan secured by a Deed of Trust has been paid off. It releases the lien on the property, effectively returning full ownership to the borrower. While it does not transfer property in the same way as a Gift Deed, it is a critical document in the lifecycle of property ownership.

Lastly, the Affidavit of Death of Joint Tenant is relevant when property is held in joint tenancy. This document is used to transfer ownership to the surviving joint tenant upon the death of one owner. While the Gift Deed involves a voluntary transfer of property without consideration, the Affidavit of Death serves to ensure the transfer of ownership in accordance with the deceased owner's wishes, making it essential in estate matters.

Document Overview

| Fact Name | Description |

|---|---|

| Definition | A California Gift Deed is a legal document used to transfer property ownership as a gift without any exchange of money. |

| Governing Law | The California Gift Deed is governed by California Civil Code Sections 11911-11923. |

| Requirements | The deed must be signed by the donor (the person giving the gift) and must be notarized. |

| Property Type | Real property, including land and buildings, can be transferred using a Gift Deed. |

| Tax Implications | Gift Deeds may have tax implications, including potential gift tax liabilities for the donor. |

| Title Transfer | Once executed, the Gift Deed must be recorded with the county recorder’s office to effectuate the transfer of title. |

| No Consideration | A Gift Deed does not involve any consideration (payment) in exchange for the property. |

| Revocation | Once a Gift Deed is executed and recorded, it generally cannot be revoked unless specific conditions are met. |

| Beneficiary Designation | The recipient of the gift is known as the grantee, who will receive ownership rights to the property. |

| Legal Advice | It is advisable to consult with a legal professional before executing a Gift Deed to understand all implications. |

Additional State-specific Gift Deed Forms

Texas Gift Deed Requirements - A Gift Deed remains effective as long as both parties agree to the terms.

When creating a legal document that dictates the distribution of your assets after death, it's vital to utilize a Last Will and Testament form, as it ensures your intentions are duly recorded and legally acknowledged. For residents of Colorado, this form is crucial, and you can find the necessary resources through Colorado PDF Forms to assist in this process.

Sample - California Gift Deed Form

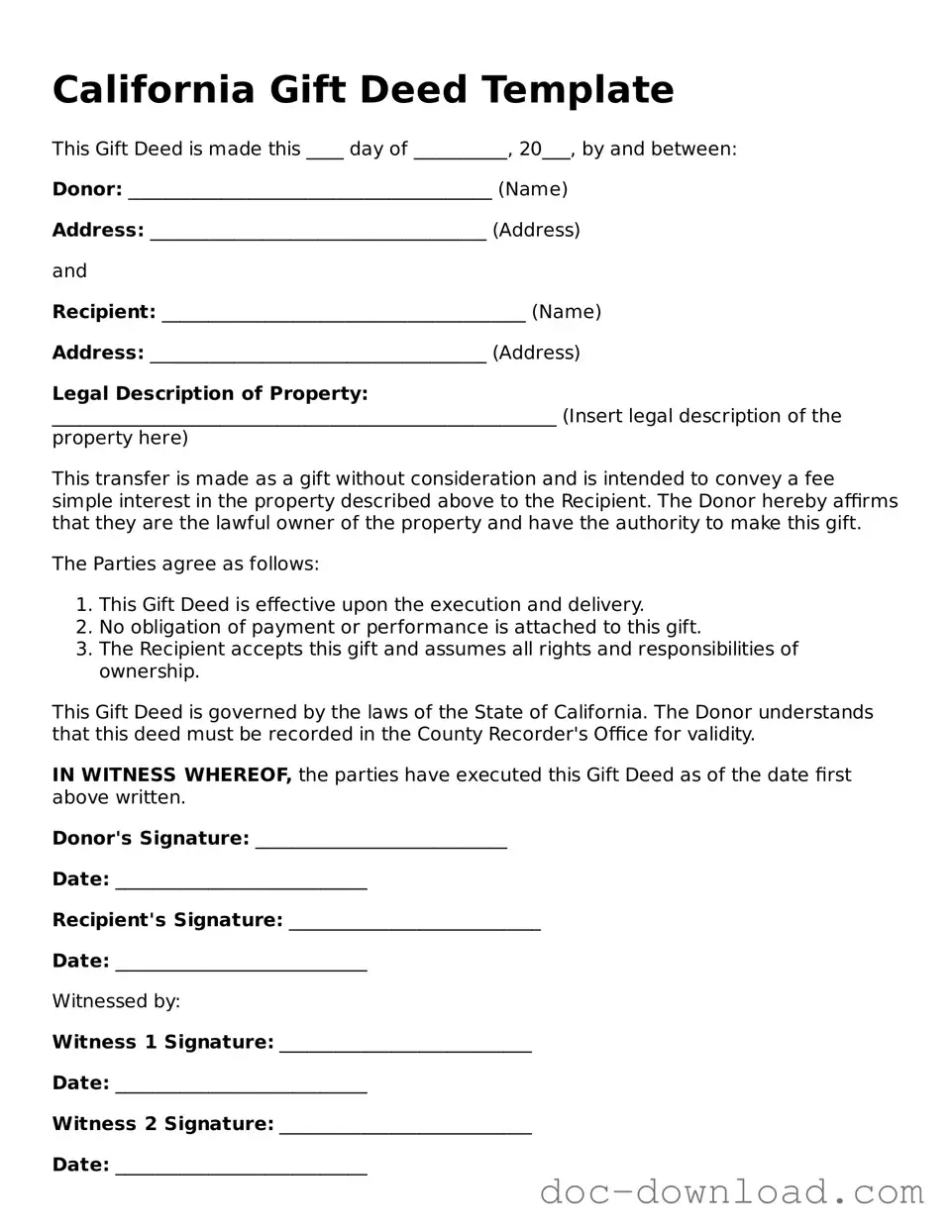

California Gift Deed Template

This Gift Deed is made this ____ day of __________, 20___, by and between:

Donor: _______________________________________ (Name)

Address: ____________________________________ (Address)

and

Recipient: _______________________________________ (Name)

Address: ____________________________________ (Address)

Legal Description of Property:

______________________________________________________ (Insert legal description of the property here)

This transfer is made as a gift without consideration and is intended to convey a fee simple interest in the property described above to the Recipient. The Donor hereby affirms that they are the lawful owner of the property and have the authority to make this gift.

The Parties agree as follows:

- This Gift Deed is effective upon the execution and delivery.

- No obligation of payment or performance is attached to this gift.

- The Recipient accepts this gift and assumes all rights and responsibilities of ownership.

This Gift Deed is governed by the laws of the State of California. The Donor understands that this deed must be recorded in the County Recorder's Office for validity.

IN WITNESS WHEREOF, the parties have executed this Gift Deed as of the date first above written.

Donor's Signature: ___________________________

Date: ___________________________

Recipient's Signature: ___________________________

Date: ___________________________

Witnessed by:

Witness 1 Signature: ___________________________

Date: ___________________________

Witness 2 Signature: ___________________________

Date: ___________________________

This template serves as a basic example of a California Gift Deed. It is recommended to consult with a legal professional before finalizing any legal documents.